Capitaland Retail China Trust (CRCT) has finally made their 1st move into the acquisition plan. A few months back, they changed their investment mandate to include other asset classes such as Business Parks and Data Centres. This pointed out some hints to investors that something big could be coming soon. With the new acquisition being announced, let’s take a look at what CRCT is planning to do.

Note: Capitaland Retail China Trust has since been renamed to Capitaland China Trust

Mandate Expansion

As of 30th September 2020, Capitaland Retail China Trust announced the expansion of its investment mandate. Previously, the REIT was a China-focused Retail REIT. With the new mandate, CRCT will now also target Hong Kong and Macau assets, as well as office and industrial properties.

Key Benefits

1. Leverage On Bigger Pipeline

With Capitaland Retail China Trust now being able to acquire office and industrial assets, it definitely widens their growth prospects, and in specific, their acquisition pipeline that can be acquired from their sponsor, Capitaland.

Based on Capitaland’s current portfolio, Capitaland Retail China Trust has the potential to acquire more than 80 assets in China alone, not taking into account other assets in Macau and Hong Kong.

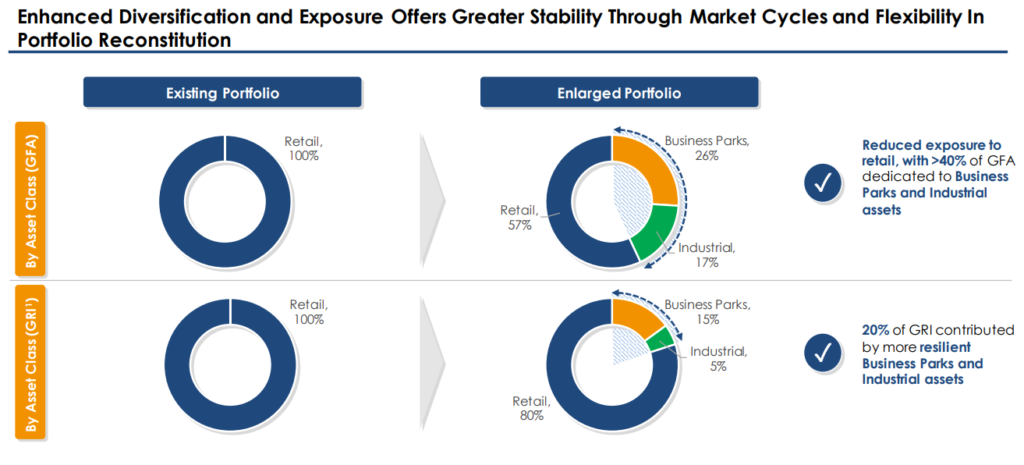

2. Diversify With Other Asset Classes

With the new mandate, it introduces a new set of asset classes into Capitaland Retail China Trust, offices, and industrial assets. With a strong mixture of all 3, it allows the REIT to diversify, minimizing risk and overexposing towards a single asset class.

3. Stronger Portfolio With More Stability

On top of the fact that they can diversify across several asset classes now, they can also acquire Data Centres and Business Parks. With the current COVID-19 pandemic situation, acquiring Data Centres and Business Parks will bring about more stability to the REIT, with a more consistent cash flow since these tenants are not impacted by the pandemic currently.

Previously, with Capitaland Retail China Trust being a pure China-focused Retail REIT, the COVID-19 pandemic brought a lot of pressure onto the REIT as its key tenants and properties were heavily affected. With the new and improved mandate, CRCT will start to see more consistency and growth as time passes with more acquisitions as they go.

Acquisition Overview

Moving onto the main topic of the article, Capitaland Retail China Trust made a huge announcement, stating an acquisition on a portfolio of assets.

The acquisition will contain 5 business parks as well as the remaining 49% of Rock Square in Guangzhou. The total acquisition cost will come up to about S$822mm, S$800mm of which will be for the purchasing of assets.

Key Acquisition Rationale

1. Leverage on The New Mandate

As mentioned in the early part of the article, Capitaland Retail China Trust has just changed its investment mandate and has shown interest in making acquisitions fast. With this new acquisition, they are acquiring Business Parks, a very resilient asset class that will bring more consistency and stability to the portfolio.

2. Portfolio Diversification

With the new addition of Business Parks, Capitaland Retail China Trust’s portfolio will not be 100% retail-focused. Post-acquisition, the retail assets will only make up 80% of CRCT’s GRI, with 15% coming from the Business Parks and the remaining 5% coming from industrial properties.

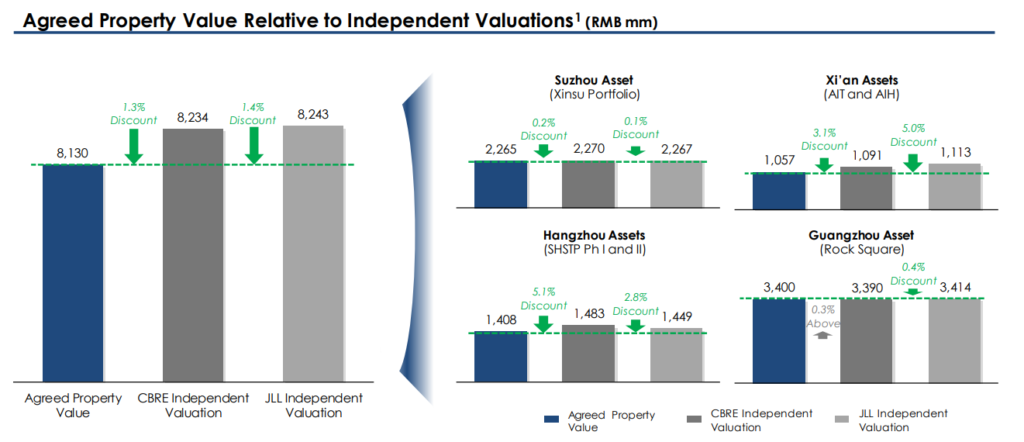

3. Attractive Entry Valuation

The acquisition is being made at a slight discount to its valuation, bringing further accretion for shareholders. With the discounted valuation, the 1H NPI Yield will go up to 5.8% as compared to 4.3% currently in 1H2020.

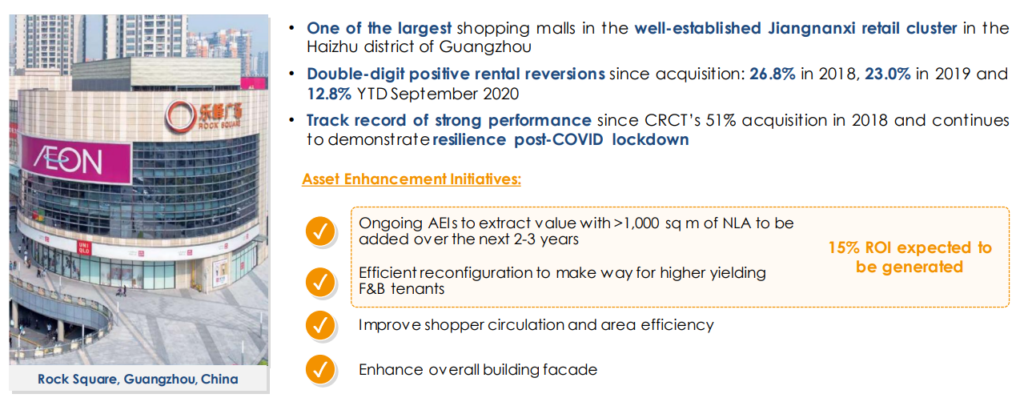

4. 100% Ownership in Rock Square

Rock Square is one of the largest shopping malls in Guangzhou, with a very strong and proven track record since Capitaland Retail China Trust’s 51% acquisition in 2018. I personally like this move by CRCT because the acquisition of the remaining 49% will give them more flexibility and allow them to do Asset Enhancement Initiatives (AEIs). The management has already planned out some AEIs which will increase the asset’s value in the next 2-3 years to come.

Not to mention the strong positive rental reversions since its acquisition, 26.8% in 2018, 23.0% in 2019, and 12.8% YTD Sept 2020. Despite the COVID-19 pandemic, the asset still maintained a positive double-digit rental reversion, proving the consistency and stability it will bring into the portfolio post-acquisition.

Pro Forma Effects

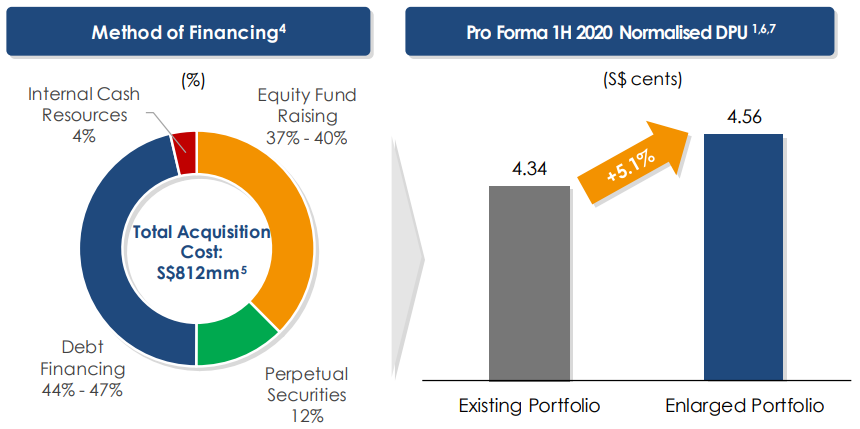

Based on the size of the acquisition, we know some sort of Equity Fund Raising (EFR) will take place but we don’t know for sure what is the plan of the management here.

Based on the presentation slides, it seems like the management wants to take on almost 50% of the acquisition cost in debt. They also recently announced the issuance of S$100m fixed-rate subordinated perpetual securities which will go into funding this acquisition as well. I personally like the management’s approach here because Capitaland Retail China Trust’s share price is trading at a huge discount to NAV. If they were to do a larger scale EFR, it could seriously dilute shareholders.

The above pro forma DPU illustration is based on a S$300m EFR. If they were to do a slightly larger EFR at S$325m, the DPU post-acquisition would be 4.51 cents, and the DPU accretion will drop to 3.9%. This is why it is so important for the REIT management to plan the acquisition funding properly to continue bringing value to shareholders.

The EFR is based on an illustrative average unit price of S$1.13, which means they would issue out 265 million new units if the EFR was S$300m or 287 million new units if the EFR was S$325m.

Based on their latest 3Q business update, the gearing stood at 34.7%, leaving them a debt headroom of S$700 million to 45% and S$1.2 billion to 50%. If they were to fund about 50% (~S$400m) of the acquisition through debt, it will most probably bring their gearing close to 40%. Assuming an EFR of S$300m and S$325m, the post-acquisition gearing would be 37.9% and 37.4% respectively.

Final Thoughts

I personally love this acquisition but the timing is important here. If they were to do the EFR now, it might not be a great idea because Capitaland Retail China Trust’s current share price is being traded at a huge discount to NAV. This makes it hard for CRCT to do any form of accretive acquisition if it involves any form of EFR. With that being said, I do like that the management has decided to take up other methods of financing the acquisition such as debt and perpetual securities.

This is just the start and Capitaland Retail China Trust has way more exciting acquisitions coming. With the inclusion of Data Centres into their mandate and with such a well-known sponsor like Capitaland, it is only a matter of time before they have DCs in their portfolio of assets. The current price of CRCT is a huge discount if you think about the long term growth prospect it has and the number of assets that can be potentially pipelined into the REIT.

As always, you can take a look at my portfolio updates to see my current positions! Also, use my referral code for an extended 3 months of premium access to StocksCafe! P.S. I’m running a telegram chat group for you guys to share and discuss investment-related topics so come on in! I’ll be there too! You can join the chat here: https://t.me/joinchat/D4iHeEVapnGC1lWcFEupVw

If you have not made an account and want to try out Tiger Brokers, feel free to use my referral code (SGSTOCKM) or sign up through this link so that you can get these rewards!

You can check out my review on them here : Start Saving Up On Commission Costs ! Use Tiger Brokers !

If you’re interested to know about my BUYs and SELLs before they appear on the site or you’re looking for someone to guide and mentor you, take a look at the Premium Subscription service I’m doing now.

Pingback: 4 Important Takeaways From Capitaland China Trust 1H FY2024 Results

Pingback: 4 Important Takeaways From The FY2023 Results of Capitaland China Trust

Pingback: My Top 5 Exciting REITs To Watch in 2022

Pingback: 4 Important Takeaways From The FY2021 Results of Capitaland China Trust