We never know when a recession may come. It can hit us when we least expect it and we wouldn’t even be prepared for it. So what can we do to protect ourselves as well as our portfolios? Buy strong recession proof companies that can consistently churn profits even in times of a recession!

Singapore Exchange (SGX:S68)

Business Model

SGX runs the entire infrastructure that allows people to buy and sell shares, REITs, ETFs, bonds, derivatives, etc. SGX has three main business divisions :

- Equities and Fixed Income

- Derivatives

- Market Data and Connectivity

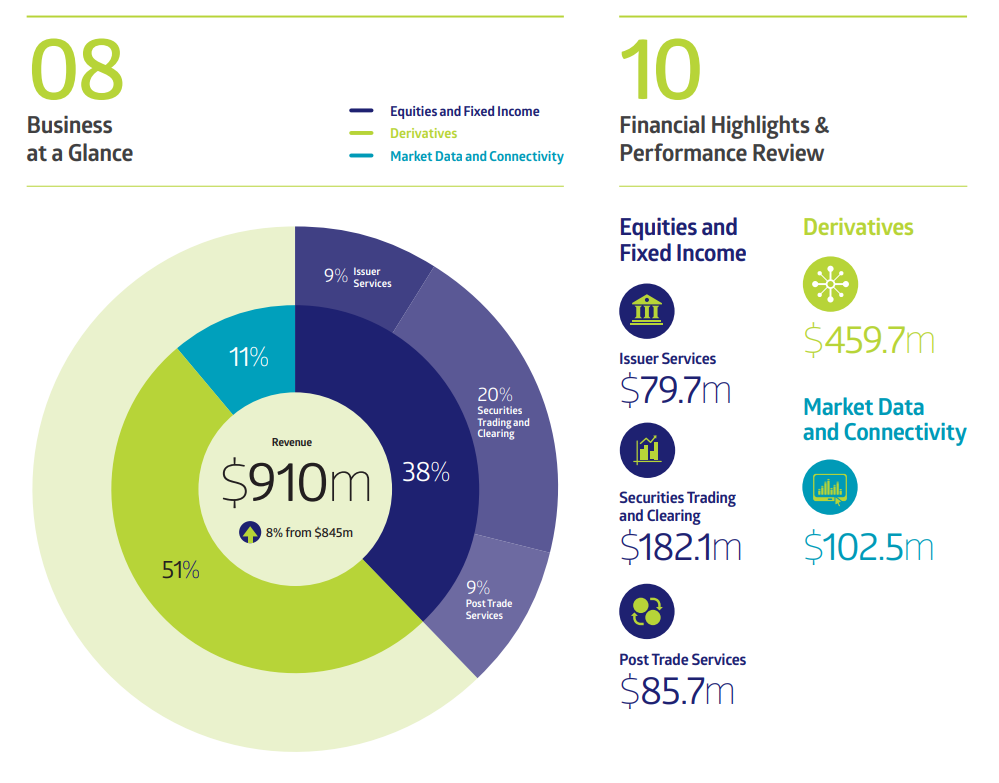

The Equities and Fixed Income division provides issuer services, securities trading and clearing as well as post-trade services. The revenue from the Derivatives segment comes from providing derivatives trading and clearing services, membership and collateral management. Lastly, the Market Data and Connectivity segment provides market data and connectivity services for end users.

It’s good to note that from their FY2019 AR, the derivatives division account for 51% of their total revenue, with equities and fixed income accounting for 38%, and with market data and connectivity accounting for the remaining 11%.

What Makes This Company Recession Proof?

Firstly, the company is a monopoly business whereby they are the only company that is offering these products and services. There is no other company or service that the public can use to buy stocks and bond off the market other than using custodian brokerage facilities.

Secondly, the company is non-cyclical. This means that they are not affected by macroeconomic or systematic changes in the overall economy. SGX’s products and services are used daily, even when in a recession. When there is more volatility in the market, SGX stands to profit more as there are more transactions being made.

Prior to this I’ve written an analysis on SGX so you can check that out here !

SBS Transit (SGX:S61)

Business Model

SBS Transit has 3 main sources of revenue :

- Bus Services

- Rail Services (North East Line, Downtown Line, Sengkang and Punggol Light Rail Transit System)

- Advertising Services (Banners and Ads on buses and at MRT platforms)

Their business model is fairly simple and easy to understand. This is great as we want a company that is easy to understand so that we can accurately predict its future cash flows.

What Makes This Company Recession Proof?

Firstly, the company is also a monopoly business as there is only one other company that is offering bus and rail services (SMRT). SBS Transit owns a large market share of the bus packages (9 out of 14) as well as almost half the rail services (4 out of 9 including LRTs). In comparison, SMRT only owns 4 out of the 14 with the exception of 1 bus route shared with SBS Transit and the other 5 rail services.

Secondly, the company is also non-cyclical. This means that they are not affected by macroeconomic or systematic changes in the overall economy. Even in times of a recession, people still need to take the public transport to travel around. This can help the company churn consistent profits even in the worst of times.

Prior to this I’ve written an analysis on SBS Transit so you can check that out here !

Final Thoughts

It’s always great to hold some recession proof companies as they help you balance out your portfolio so that you are not too heavily weighted into cyclical companies or industries. I personally like to hold some of these companies as they have the ability to provide me a consistent stream of cash flow in the form of dividends during recessions.

Thanks for your article. It is extremely unfortunate that over the last decade, the travel industry has had to deal with terrorism, SARS, tsunamis, influenza, swine flu, as well as the first ever true global downturn. Through all of it the industry has proven to be strong, resilient plus dynamic, acquiring new tips on how to deal with difficulty. There are often fresh troubles and the opportunity to which the sector must just as before adapt and react.