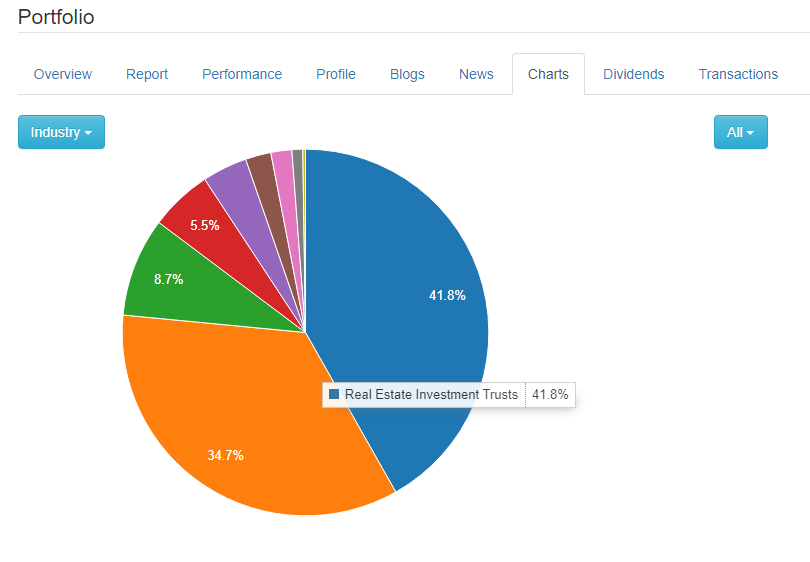

As most of you might know, I’m a huge REIT investor. I’ve written tons of analyses on REITs and I have over 40% of my portfolio in REITs alone. As such, I’m going to share with you all my ultimate guide to picking the best REITs.

With 41 REITs currently listed in the Singapore stock exchange, which ones should we buy? In this ultimate guide to picking the best REITs, we will look at the 7 steps I personally use to analyze a REIT before making that buy order. I’ll be using Frasers Centrepoint Trust (SGX: J69U) as an example.

#1 Growth in Gross Revenue and Net Property Income

Frasers Centrepoint Trust (FCT) had declining Revenue and NPI from FY2015-FY2017 but picked it back up in FY2018 and FY2019. I typically like REITs that have consistently increased their Revenue and NPI. Even though FCT had a small decrease, the overall 5-year performance is still acceptable.

Verdict : Pass

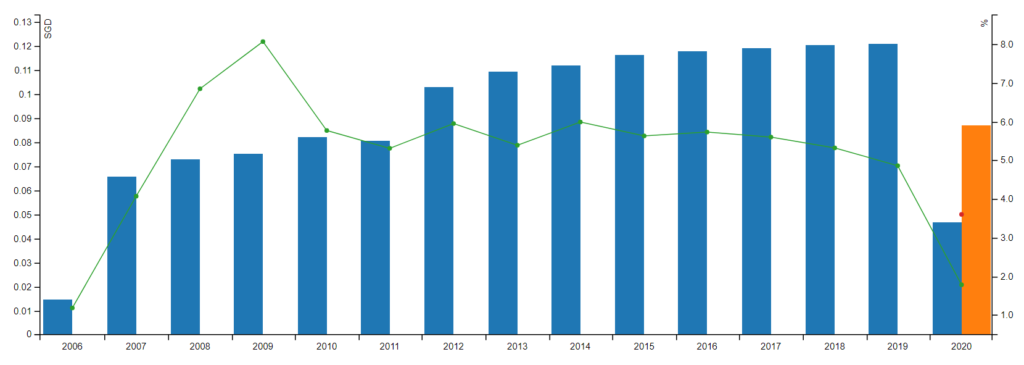

#2 Growth in Distribution Per Unit

FCT has been able to consistently increase their DPU for the past 5 years. Moreover, if we take a look at their overall track record, we can see that they have been consistently increasing their dividends every single year with the exception of FY2011.

Verdict : Pass

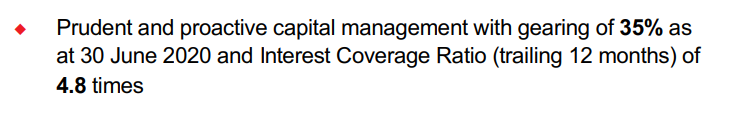

#3 Gearing Ratio Under 40%

FCT has maintained their gearing ratio under 30% for the past 5 years with the exception of FY2019.

Recently, FCT announced that they will increase their stake in PGIM ARF by another 12.07%. I’ve written an article covering it : Frasers Centrepoint Trust Increased Their Stake In PGIM ARF! What Does This Mean?. Since the acquisition is fully funded by debt, the gearing went up from 32.9% to 36.2%. Though it is a little high, it is still in an acceptable range.

From the recent 3Q result, they have managed to drop the gearing down to a conservative 35%.

Verdict : Pass

#4 Interest Coverage Ratio of Above 3x

As of 30th June 2020, from their 3Q results, we can see that FCT’s interest coverage ratio is well above 3x, at 4.8x.

Verdict : Pass

#5 Sponsor with A Good Track Record

A sponsor with a good track record can help skyrocket a REIT’s growth potential exponentially. For example, CapitaLand Retail China Trust has over 20 China shopping malls they can acquire from Capitaland. REITs like Sasseur REIT or BHG Retail REIT don’t have such a luxury to just acquire pipeline assets over from their sponsors. This is just one blocker to a REIT’s growth potential. Another would be with a sponsor like Capitaland, they can buy/acquire these assets first and then pipeline them down later on to these REITs after it has matured.

Frasers Centrepoint Trust’s sponsor is Frasers Property Limited, a well known sponsor with a few other REITs under their wing such as Frasers Logistics & Industrial Trust and Frasers Hospitality Trust. The sponsor’s track record is great and has a very healthy balance sheet with a current ratio > 1 and an ICR > 3x.

Verdict : Pass

#6 Fantastic Growth Prospects

As per mentioned earlier on with the acquisition of stake in PGIM ARF, we can see that there is a huge potential in growth for Frasers Centrepoint Trust. Post-acquisition, the REIT and its sponsor own a combined interest of 100% in PGIM ARF. This means that they can essentially buy over and acquire the entire fund including all of its assets. This will make PGIM ARF’s assets part of the pipeline assets for FCT.

With the addition of these 5 malls into the pipeline, the potential upside for FCT is increased further.

Verdict : Pass

#7 Fair Valuation

Before making any buy order, it is important to buy companies at a fair valuation. Like what Warren Buffett says, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price”. So let’s take a look at some of the valuation metrics I use when determining if a REIT is over, fair or under valued.

When valuating a fantastic REIT like FCT, I tend to give a higher allowance for what I deem as “fair valuation”. A fair valuation would be a PB ratio of under 1.2x and a Dividend Yield of above 4.5%. When valuating REITs that I deem as a “value play”, a fair valuation would be a PB ratio of under 1 and a Dividend Yield of above 6%.

Price to Book Ratio

Post-acquisition, FCT’s net asset value per share stands at $2.21. At FCT’s current share price of $2.34, the Price to book ratio is 1.06x, which is lower than 1.2x.

Dividend Yield

Post-acquisition, FCT’s projected distribution per share stands at $0.11987. At FCT’s current share price of $2.34, the Dividend Yield is 5.12%, which is higher than 4.5%.

Verdict : Pass

Final Verdict

If I were to analyze FCT, I would give it a perfect 7/7 rating. It is a must have in every REIT portfolio. Not to mention, FCT has the potential to do even better post COVID-19 when the retail and tourism sector recovers. Though the dividend yield is not factoring in any dividend cuts, which will most probably happen, FCT would still score a 6.5/7 which is still fantastic nonetheless.

Final Tips

Just because you follow this “Ultimate Guide To Picking the Best REITs”, doesn’t mean that you will automatically do well and profit in the stock market. Ultimately, it’s always important to understand what you are buying into. For example, If you are not very familiar with the industrial REIT sector, perhaps you can just buy the largest and safest one for diversification purposes. Better yet, you could just stay away from it entirely if you want to be safe. If you understand what you are buying into, you can accurately predict the REIT’s upcoming cash flow and growth potential.

Final Thoughts

I have been sharing with the members of my group to buy Retail and Hospitality REITs for the past few months. I myself have been buying up these REITs as well. My Retail and Hospitality REITs take up a whopping 63.5% of my entire REIT exposure. I understand that the coming 12-18 months will be rough for these REITs due to the COVID-19 pandemic. These REITs will most likely cut their dividends for FY2020 but it’s okay because I already expected this to happen. Coming into FY2021 and FY2022, I know that these 2 sectors will see a huge recovery when the COVID-19 pandemic starts to ease off and vaccines have been found.

I am a long term investor and I like the fact that when these sectors start to recover, my positions will yield upwards of 10% in a short span of 2-3 years. That’s something that you can only find in times of a crisis or uncertainty.