Moving into the last quarter of 2020, many investors are eager to jump in after staying on the sidelines for a while now. I’ve since decided to collate a list of my top 4 must buy REITs in the 2H2020 and moving into FY2021. These REITs are my own personal favorites and are picked based on each of their merits which I will share. Without further ado, let’s get started on this list.

Parkway Life REIT

First on my list of must buy REITs is Parkway Life REIT (SGX: C2PU), one of the largest listed healthcare REITs in Asia with an enlarged portfolio of S$1.96 billion. The REIT is defensive with its long-term lease structures which protects its downside. It also provides a stable stream of income which is supported by regular rental revisions.

As we can see from their portfolio, they are very diversified with properties across 3 key countries in Asia, Singapore, Japan and Malaysia. It’s good to note that they own a total of 49 Freehold properties and 4 Leasehold properties, 3 of which are in Singapore.

5-Year Performance

Revenue Growth

Note : Chart figures are in S$’000

As we can see, the overall 5 year trend for Parkway Life REIT is up. Just to note that Parkway Life REIT had a divestment gain of S$9.11 million in FY2015 and S$5.39 million in FY2017. These 2 are not reflected in the charts as they are one off income items and it will make Parkway Life REIT’s performance seem very inconsistent.

DPU Growth

Note : Chart figures are in S$ cents

Similarly, we can see that the overall DPU trend for Parkway Life REIT is consistently going up. The divestment gains in FY2015 and FY2017 contributed an additional 1.5cents and 0.89cents to the DPU for that year. This gain is not added in the chart as they are one off income items and does not show the real story behind Parkway Life REIT’s performance.

NAV Growth

Note : Chart figures are in S$ dollars

The 5 year trend shows that Parkway Life REIT has managed to grow its NAV/share year on year consistently by 15.4% across the 5 years. This growth comes from the aggressive acquisition and strategic divestments of the Japan assets they own over the years. There were several acquisitions and divestments made every year to help Parkway Life REIT aggressively grow its NAV/share.

It’s also good to note that despite all the acquisitions and divestments, Parkway Life REIT has managed to consistently grow its Gross Revenue, NPI and DPU, bringing consistent and increasing value to shareholders.

For a much more in-depth analysis on why I picked Parkway Life REIT as one of my must buy REITs, check out my in-depth analysis here : Parkway Life REIT, Singapore’s Most Defensive REIT

Ascendas REIT

Second on my list of must buy REITs is Ascendas REIT (SGX: A17U), Singapore’s first and largest listed business space and industrial REIT. In terms of market capitalization, Ascendas REIT is the largest listed REIT in Singapore right now with a market cap of S$11.7B. Ascendas REIT is a very well known REIT as you can see its name printed on many industrial buildings in Singapore.

As at 30 June 2020, we can see the Ascendas REIT has a huge portfolio that is very well diversified across 4 countries. They also have about 59% of the portfolio in business parks and data centres which helps the portfolio stay resilient even in times of uncertainty like the COVID-19 pandemic. Another huge benefit of their well diversified portfolio is the fact that no single property accounts for more than 4.6% of Ascendas REIT’s monthly gross revenue.

5-Year Performance

Revenue Growth

Note : Chart figures are in millions

As we can see, the overall 5 year trend for Ascendas REIT is up. Just to note that Ascendas REIT recently changed their financial year start and end dates to match with Capitaland’s. As such, the 2 years marked with the asterisk (*), represents the 9 months ending for that year. If we compare the 9 months ending for FY2018 and FY2019, we can see that there is still a strong increase year on year.

DPU

Note : Chart figures are in S$ cents

Ascendas REIT has been showing great DPU growth for the past few years taking into account that the number of shares issued is increasing year on year be it through equity fund raising or management fees being paid in units. Similar to the previous section, the 2 years marked with the asterisk (*), represents the 9 months ending for that year.

As we can see, the DPU did fall in FY2019 as compared to the year before by a small margin due to the enlarged unit base from the rights issue in December 2019. Regardless, I’m still bullish on Ascendas REIT as the acquisition was DPU and NAV accretive while at the same time, decreasing their aggregate leverage by about 1.7%.

Not to mention the acquisition was for high quality business parks, 2 of which are located in Singapore while the remaining 28 are located in US. It’s also good to note that the total portfolio in US is freehold and has a WALE of 4.2 years.

NAV Growth

Note : Chart figures are in S$ dollars

The 5 year trend shows that Ascendas REIT has managed to grow its NAV/share year on year despite the growing unit base. Not to mention the fact that Ascendas REIT is already so huge so, for them to still be growing is really a commendable feat.

For a much more in-depth analysis on why I picked Ascendas REIT as one of my must buy REITs, check out my in-depth analysis here : Is Ascendas REIT A Good Buy Now?

CDL Hospitality Trust

Third on my list of must buy REITs is CDL Hospitality Trust (SGX: J85), a well-known hospitality REIT in Singapore, owning 16 hotels and two resorts comprising a total of 5,089 rooms as well as a retail mall. This pick may come as a surprise to some as the hospitality sector has been hit pretty badly during the Covid-19 pandemic. Continue reading on to find out how CDL Hospitality Trust made it on the list.

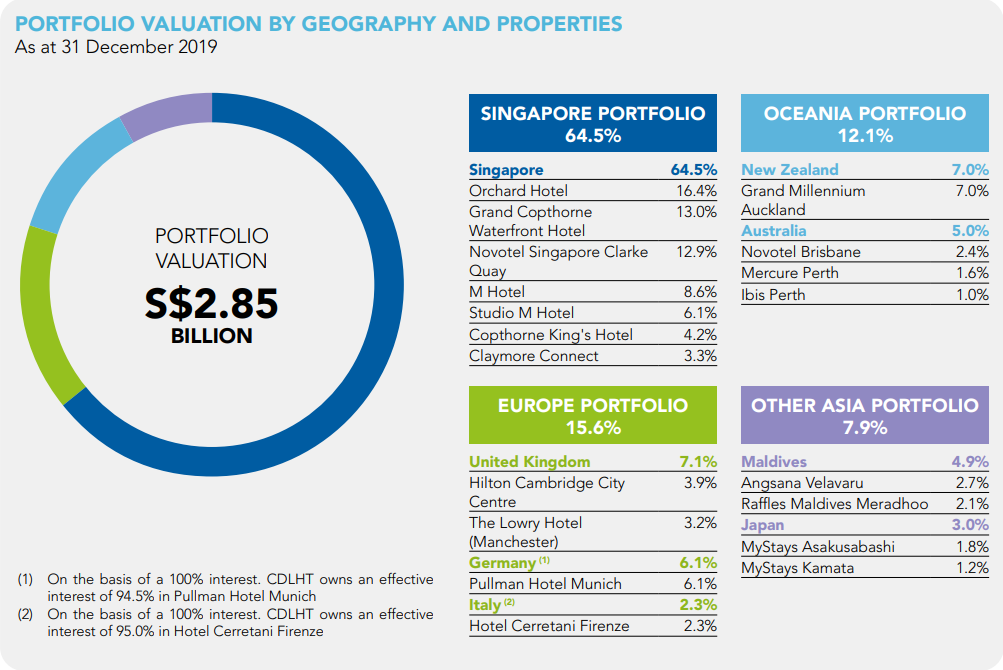

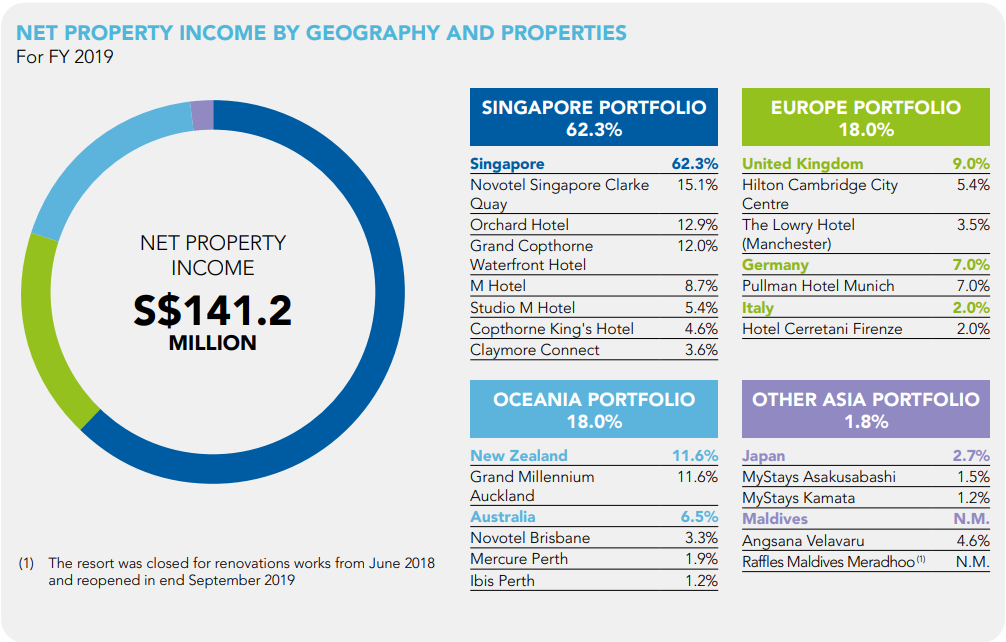

As you can see, its Singapore portfolio takes up about 64.5% of its portfolio valuation and 62.3% of its NPI. Though it is great that they have assets in other countries and regions like Europe and Oceania, the Singapore portfolio is a little too high for my liking.

5-Year Performance

Revenue Growth

Note : Chart figures are in thousands and Distributable Income is after any retention

As we can see, the overall 5 year trend for CDL Hospitality Trust is moving up but there is a pullback since FY2017 where it has hit a peak. Since then, it has been on a very slow downtrend which is worrying for some investors as this could be an indicator for its limited long term growth potential.

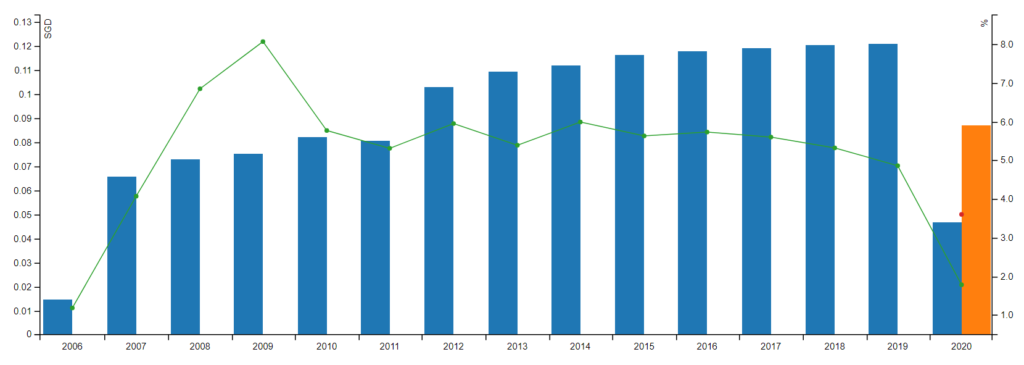

DPU

Note : Chart figures are in S$ cents and is after any retention

CDL Hospitality Trust has been consistently paying high dividends but it has been on a downward trend since FY2015. The downward trend is slow but it is definitely worrying for long term investors as the dividends can indirectly affect the stock price of CDL Hospitality Trust.

It’s good to note that even though the dividends has been dropping slowly, if you had CDLHT since the start of 2015, you would still be in the net green by the end of 2019 including dividends.

For a much more in-depth analysis on why I picked CDL Hospitality Trust as one of my must buy REITs, check out my in-depth analysis here : 4 Local Hospitality REITs! Is CDL Hospitality Trust The One For You?

Frasers Centrepoint Trust

Last but not least on my list of must buy REITs is Frasers Centrepoint Trust (SGX: J69U), another very well-known REIT amongst Singapore REIT investors. They own a portfolio of heartland retail malls in Singapore such as Causeway Point, Anchorpoint, Waterway Point, etc. They differ from Capitaland Mall Trust due to the nature of their assets. CMT owns malls that are around the town/central area as well as some heartland malls.

5-Year Performance

Revenue Growth

FCT had declining Revenue and NPI from FY2015-FY2017 but picked it back up in FY2018 and FY2019. I typically like REITs that have consistently increased their Revenue and NPI. Even though FCT had a small decrease, the overall 5 year performance is still acceptable.

DPU

FCT has been able to consistently increase their DPU for the past 5 years. Moreover, if we take a look at their overall track record, we can see that they have been consistently increasing their dividends every single year with the exception of FY2011.

For a much more in-depth analysis on why I picked Frasers Centrepoint Trust as one of my must buy REITs, check out my in-depth analysis here : My Ultimate Guide To Picking the Best REITs

Final Thoughts

All 4 REITs mentioned in this article are must buy REITs to me based on the current situation, with the covid-19 pandemic affecting the global economy. These REITs are definitely well positioned to do very well as the economy recovers post-pandemic.

If you were to invest in these 4 REITs, you are well positioned for any situation that could come, be it a second or third wave of covid-19 cases or perhaps a fast recovery on the economy.

With the stability and defensive nature of Parkway Life REIT and Ascendas REIT, you can sleep well at night, fully knowing that their overall business is not affected and they can continue to increase their DPU year on year. On top of that, with Frasers Centrepoint Trust and CDL Hospitality Trust, you can leverage on the post-pandemic recovery of the economy.