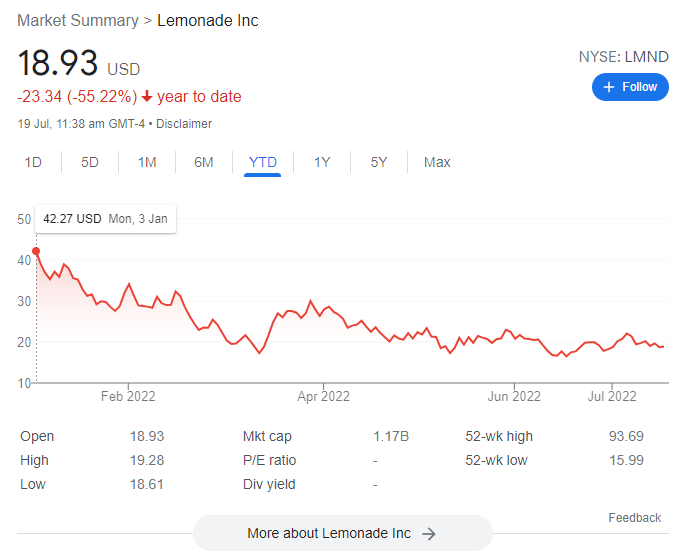

With the stock market continuing to crash as we progress into 2022, it is quite obvious that the technology sector has been hit the hardest. With most tech companies, big and small, seeing their market cap fall anywhere from 30% to even 80%, it can be quite daunting for an investor to venture into this space, especially if they are not well versed in the industry. One particular tech company that I’ve been accumulating and holding is Lemonade (NYSE: LMND).

As you can see above, the company has seen its share price fall over 55% year to date. If we compare over the past 52 weeks, Lemonade is down over 78%. Despite all this negativity, the company has continued to excel and grow rapidly. In this article, I’ll be sharing with you all you need to know about Lemonade moving into 2H 2022.

Q1 FY2022 Results

First off, let’s review Lemonade’s latest results release which was their Q1 FY2022 results.

Key Operating Metrics

| Q1 2022 | Q1 2021 | Q1 2020 | |

|---|---|---|---|

| In Force Premium (IFP) | $419 million (+66.27%) | $252 million (+89.47%) | $133 million |

| Gross Earned Premium | $96 million (+71.43%) | $56 million (+80.65%) | $31 million |

| Premium/Customer | $279 (+21.83%) | $229 (+25.14%) | $183 |

| Total Customer Count | 1,504,197 (+37.17%) | 1,096,618 (+50.36%) | 729,325 |

Looking at Lemonade’s Key Operating Metrics in Q1 FY2022, we can see that the IFP and Gross Earned Premium has grown significantly over the past 2 years by more than three-folds. The premium/customer as well as total customer count has seen a slower growth because Lemonade only served Renters, Homeowners and Pet insurance. Not to mention the fact that they were only based in the US, not even across all 50 states. If we take into account these 2 factors, the growth is actually quite strong, from a little over 700k customers to well over 1.5million now in just 2 years.

Read Also: Here Is Why Lemonade Is A 100-Bagger In The Making

Loss Ratios

As we all know, the loss ratio is a very important metric when we talk about insurance companies because we need to understand if they are actually making money. From the chart above, we can see that the loss ratios held steady in 2020. The huge spike in Q1 2021 was due to the Texas Freeze which was a black swan event. Since then, they have managed to control and reduce the loss ratios to a more comfortable range although it has risen to ~90% in this quarter.

So why did Lemonade hit a 90% loss ratio in Q1 2022? In a nutshell, loss ratios are lagging indicators and even though there are underlying improvements, it will still take time before the numbers are reflected accordingly. Not to mention the fact that across the industry, all insurers were hurt by inflation as claims are instantly adjusted for inflation while premium rates take months to adjust. Nonetheless, the management has stated that despite the 90% loss ratio, their dashboards show that the business generated in Q1 is expected to have a loss ratio comfortably within their target of 75%.

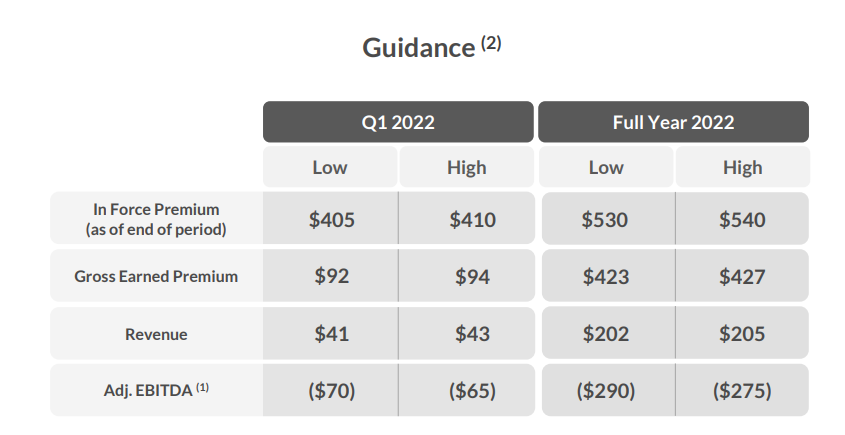

FY2022 Guidance

Based on Lemonade’s FY2022 Guidance, which was presented during their FY2021 result release, we can see that they are projecting an IFP growth of approximately 39.47% – 42.11% year over year which is rather conservative if you think about it. With Lemonade Car and Lemonade Life rolling out, we might even see Lemonade’s IFP more than double during FY2022. It is also good to note that comparing with the actual results in Q1 FY2022, we can see that the company has managed to surpass the upper end of their original guidance. This is definitely great to see as it marks a strong start for Lemonade coming into FY2022.

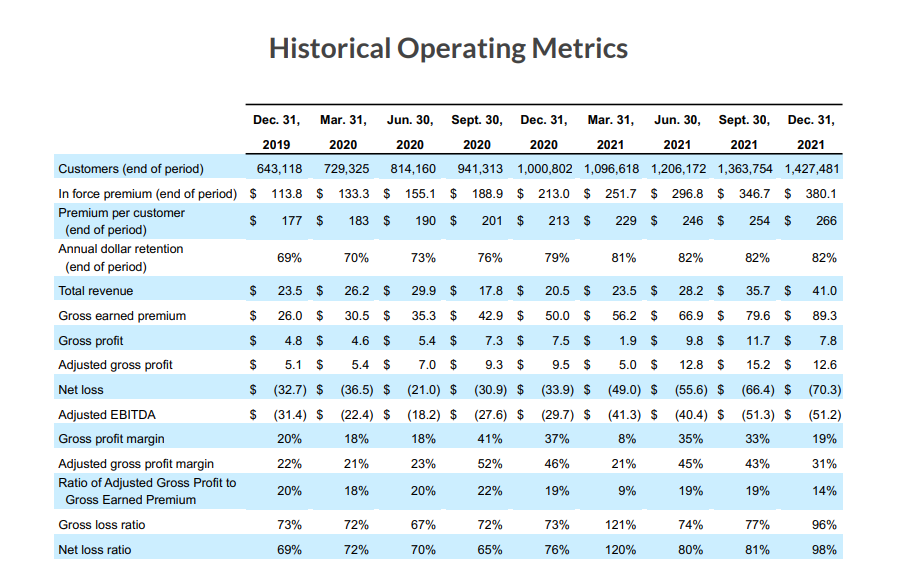

3-Year Performance

Next up, we are going to look at the historical performance for Lemonade over the past 3 years.

From a quick glance, we can see that Lemonade has definitely been growing fast over the past 3 years, starting with only 643k customers to now well over 1.5million in Q1 FY2022. The IFP has also grown steadily quarter over quarter despite the small product offering they had. One key metric to take note here is the Annual Dollar Retention which is defined as the percentage of IFP retained over a 12 month period. This includes changes in policy value, number of policies, policy type as well as churn. The key factor that’s helping the company continuously grow this metric quarter over quarter is the increasing number of customers that own multiple policies with Lemonade.

Some of the other metrics here like revenue or gross profit are not as significant for a InsurTech company like Lemonade because you have metrics like loss ratio or IFP which help provide a much clearer picture on how well the company is performing.

Bull Case

Now that we’ve looked at the financials, we need to analyze the possible outcomes that could happen to the company over the next 12 – 24 months ahead. This includes macro trends as well as understanding the business as a whole. Let’s start off with the Bull Case first.

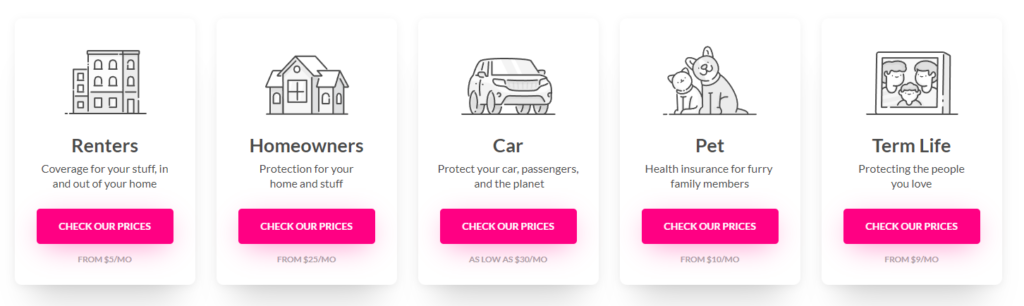

Expanding Their Product Offering

Previously, Lemonade has only served 3 key insurance products namely Renters, Homeowners and Pet insurance. As we venture into 2022, the company has grown their product offering, adding 2 major products into their overall product suite. With the release of Lemonade Car and Lemonade Life, 2 very important and high margin insurance products, Lemonade will start to see a huge growth as a whole.

With the introduction of these 2 key products, we can expect not only the total customer count to grow as they tackle a wider target audience but also, the premium/customer to grow significantly. Lemonade’s core business model is “Graduating” with their customers. Starting off with students/young adults who might own pets or are renting apartments, they have access to affordable and trustable insurance plans thanks to Lemonade. As they “graduate” in life, starting a family, buying their own home and car, it would be easier for them to get all their insurance plans from the same insurer for convenience sake. On top of that, they might even extend further and get their loved ones covered under Lemonade as well.

As such, with their well suited business model and expanding product offering, we can definitely expect Lemonade to have a record breaking year.

Geographical Expansion

When Lemonade started out, they were only based in a couple of states across the US. As time passed, they were expanding across more states in the US and even entered the European market, serving customers in Germany as well as the Netherlands. Coming towards the end of 2020, they also launched into France. This leaves a lot of room for them to grow and expand geographically as they still have the rest of the US as well as Europe.

Read Also: Lemonade (NYSE: LMND) – The Most Talked About Disruptor in 2020

Metromile Integration

In November 2021, Lemonade announced its intention to acquire Metromile in an all-stock deal which valued the company at approximately ~$500million. The company expects to close the acquisition in Q2 FY2022 and be able to offer car insurance to most Lemonade customers within 12 months of that point (Q2 FY2023). Thus, while Metromile’s existing IFP (around $117m) will be added to Lemonade’s book of business after the acquisition is closed in mid-2022, it will take another 12 months (at the earliest) until Lemonade can offer car insurance to all 50 US states.

Despite this slight setback, I think the metromile acquisition is a fantastic one for Lemonade and here’s why. With Lemonade Car just being launched recently, integrating Metromile’s assets together will help improve the product immensely. When I say assets, this not only includes physical assets such as Metromile’s 49 state licenses in the US but also their huge data sets which have been accumulating for over 10 years now.

Metromile’s car-mounted precision sensors have taken over 400 million road trips, covering billions of miles and sending real-time streams to the Metromile cloud. These proprietary data were mapped onto behaviors (how much someone drives, when, where, and how they drive) and cross-referenced with actual claims data, enabling these behaviors to be scored for risk with great granularity. These machine learning (ML) models were regularly ported onto ever more precise ‘forms and rates,’ which were approved by regulators and implemented in the Metromile product, enabling this multi-year cycle to start over.

Metromile is currently on its third generation of models, an achievement that requires not only data science and insurance excellence, but years of real-world feedback and iteration at scale. All of this combined will help Lemonade build a better product, providing them the data sets they need to accurately price risk against each customer. This not only means that Lemonade will charge a higher premium to customers who are deemed as “unsafe drivers” but, it also means that Lemonade can offer a lower premium to customers who are deemed as “safe drivers”.

Read More: Why Lemonade Is Acquiring Metromile

Bear Case

Now that we’ve discussed some of the Bull Case scenarios, we also need to look at the possible Bear Case scenarios as well to better weigh the pros v. cons for Lemonade as a company.

Unforeseen Spike in Loss Ratio

In Q4 FY2021, Lemonade reported a large spike in both gross (96%) and net loss ratios (98%) due to some unforeseen damage to insured properties. While it is common for insurance companies to have increasing loss ratios due to major natural disasters outside of the company’s control (e.g., the Texas Freeze in Q1 2021), it is a little worrying to know that Lemonade admitted to being under-reserved for the claims. The management was also quite vague when disclosing what caused this elevated loss ratio during the conference call.

Notwithstanding this blip, Lemonade again re-iterated as in previous quarters that loss ratios for each of their newer products are improving with time. However, this trend gets masked when we analyze the total loss ratios as the growth in newer products (with higher loss ratios) exceeds the growth in more mature products (e.g., renters insurance with a lower loss ratio), resulting in Lemonade’s newer products becoming a greater contributor to overall loss ratios with each successive quarter.

If Lemonade remained a sole provider of renters/pet insurance and had not expanded into other products, their loss ratios would likely be below 70% and much more stable, but their TAM would be a lot smaller as well. From a high-growth business’s point of view, I think it is a very fair trade-off, to take in short term pains for long term gains.

Plateau in Retention Rate

Ideally in a best case scenario, we’d like to see Lemonade’s Annual Dollar Retention (ADR) Rate continue to increase into the 90% region but we need to be realistic with our expectations. Lemonde closed their ADR in Q1 FY2022 at 82%, which is a plateau point since Q2 FY2021. It has been 4 quarters whereby Lemonade has stagnated their ADR growth. This could be seen as a point of concern if Lemonade continues to plateau or even see their ADR start to decline over the next few quarters.

The management has pointed out some interesting points regarding this matter. As of now, only Illinois and Tennessee were offered Lemonade’s mega-bundle (renters/home, life, pet and car). Based on the current data they have, it seems to be very promising. After only 1 complete quarter, Lemonade saw a 40% higher bundle rate in Illinois as compared to the rest of the market in the US. The average 3-product customer and 2-product customer outspect the average 1-product customer by 7x and 3x respectively. The ADR for Illinois alone rose to 90% in Q1 FY2022 as compared to Lemonade’s overall ADR of 82%.

As time progresses and Lemonade expands their mega-bundle offering to more states in the US and even expanding into Europe, we can expect to see the ADR grow rapidly in tandem with their other core metrics like IFP and Premium/Customer.

What To Look Out For In FY2022

As you may know, Lemonade does partial reinsurance so that they can lower their risk, but this in turn will also lower their potential gains in terms of income. Lemonade has been slowly reducing the amount of reinsurance they are ceding out so that they can keep more of the premiums themselves as time passes due to a more stable book with growing customers and increased diversity.

Based on the 4Q21 numbers, they have reduced the amount of insurance being ceded out by approximately ~6% which is a strong sign of confidence shown by the management. As we venture into the second half of FY2022, investors should monitor if Lemonade continues to reduce the amount of insurance being ceded out as they expand their book, which will result in higher revenues.

The management also mentioned in the Q1 earnings that their expected multi-year average loss ratio is targeted to be within 75% and want to remind shareholders that even though loss ratios will spike from time to time, the new business model (reinsurance), will help them tide through such volatile times. An interesting thing to look out for in FY2022 would be if the management decides to release the loss ratio of each product individually as they gather more data and as more time passes by so that shareholders can appropriately see and analyze which product is pulling the numbers down.

One very important key metric to watch out for is Lemonade’s IFP. Both the CEO (Daniel Schreiber) and CFO (Tim Bixby) have mentioned during various interviews that IFP is Lemonade’s core metric. As long as the IFP growth is strong and consistent, making short term operating losses is reasonable. My personal forecast for Lemonade’s FY2022 IFP is $600million and here’s why. On top of the additional $100m in IFP which will come from the Metromile acquisition, I believe with the increase in policies and customer base, Lemonade can easily more than double FY2021’s IFP ($380million).

Final Thoughts

I’ve been a very strong advocate for Lemonade since FY2020 when I first started investing in the company. The company is built to battle the struggles with traditional insurance companies. With traditional insurance companies, you pay high premiums and it takes ages to get your claims back whereas with Lemonade, you can easily get insured in just 90 seconds and receive claims in just 3 minutes. The best part is that everything can be done through their App and AI Chatbot (Maya) which is definitely a huge edge over traditional insurance companies.

Another interesting fact about Lemonade is that since they only receive a flat fee from the premiums paid by customers, whatever that is left from the premiums received will be donated back to charities chosen by the customers themselves under the Lemonade Giveback program. In 2021, the program has donated over $2.3million across 65 nonprofit organizations.

When investing, it’s not always about fundamentals and share price movements but rather, investing in a company that you are actually interested in. I started investing in Lemonade because I loved the business model, their entire approach to battling traditional insurance companies through the usage of Tech and AI, as well as how easy it is for customers to get insured under them. I’m catching this falling knife all the way down, are you?