With a high possibility of only 1 to 2 rate cuts by the end of 2024, it doesn’t look good for REITs as we enter 2H 2024. Most REITs are impacted heavily as their cost of debt has risen exponentially. This also discourages any forms of acquisition as this might mean taking on more debt than the REIT can comfortably handle. Despite being a defensive REIT by nature, Parkway Life REIT (SGX: C2PU) is also impacted. In this article, I’ll be covering Parkway Life REIT, Singapore’s most defensive REIT, and whether or not it is a good buy now at its current valuation.

Portfolio Overview

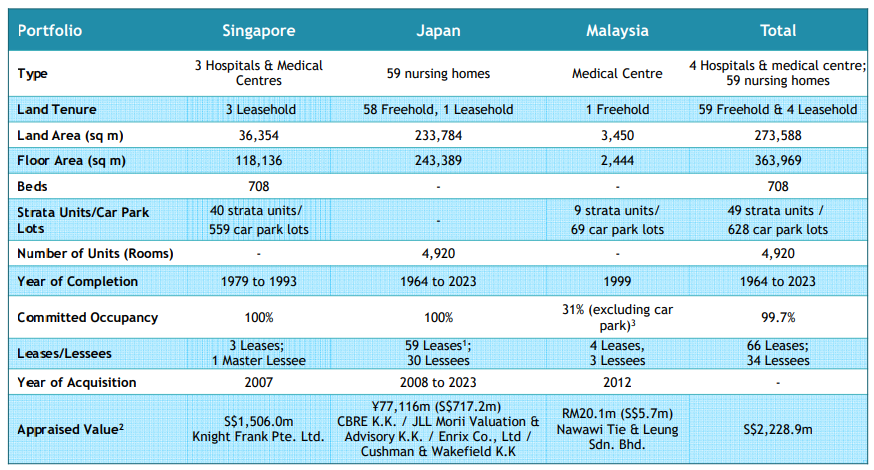

Parkway Life REIT is one of the largest listed healthcare REITs in Asia with an enlarged portfolio of S$2.2 billion. The REIT is defensive with its long-term lease structures which protect its downside. It also provides a stable stream of income which is supported by regular rental revisions.

As we can see from their portfolio as of 31 December 2023, they are very diversified with properties across 3 key countries in Asia, Singapore, Japan, and Malaysia. It’s good to note that they own a total of 59 Freehold properties and 4 Leasehold properties, 3 of which are in Singapore. The 3 Singapore hospitals are well secured by its master lessee, Parkway Hospitals Singapore which is a fully owned subsidiary of Parkway Life REIT’s sponsor, IHH Healthcare.

Many people see this as a key risk because if the master lessee decides to stop renewing their lease, Parkway Life REIT will see a huge problem with finding new tenants. For me, I view this as a sign of stability because its master lessee is its sponsor, indirectly of course. The 58 nursing homes in Japan are key assets because Japan has an aging population. These nursing homes will be a key factor for Parkway Life REIT’s strong revenue growth in Japan.

FY2023 Results

Substantial Growth In Gross Revenue and NPI

| Year on Year Difference | FY2023 | FY2022 |

|---|---|---|

| Gross Revenue | S$147.467 million (+13.5%) | S$129.972 million |

| Net Property Income (NPI) | S$139.084 million (+14.1%) | S$121.868 million |

For FY2023, Parkway Life REIT reported a robust financial performance, with significant increases in both Gross Revenue and Net Property Income (NPI). Gross Revenue for FY2023 reached S$147.48m, marking a 13.5% increase from S$129.97m in FY2022. This growth was primarily driven by the contributions from new acquisitions and higher rental income from the Singapore properties under new master lease agreements initiated in August 2022. The NPI also saw a substantial rise, amounting to S$139.08m, a 14.1% increase from the previous year’s S$121.87m.

Even without acquiring new assets, Parkway Life REIT is well positioned to see continued double-digit growth due to its lease structure with the Singapore hospitals. To further elaborate, the Singapore assets are locked in till December 2042, with steady rental escalations in place. The rental escalations set in place are guaranteed up to 2025 (~3%). From FY2026 to FY2042, the escalation will be reviewed, with the management forecasting a 24% increase in FY2026.

Weaker Growth In Distributable Income and DPU

| Year on Year Difference | FY2023 | FY2022 |

|---|---|---|

| Distributable Income | S$89.341 million (+2.7%) | S$87.004 million |

| Distribution Per Unit (DPU) | 14.77 cents (+2.7%) | 14.38 cents |

The Distributable Income for FY2023 was S$90.63m, reflecting a 2.7% increase from S$88.27m in FY2022. This increase in distributable income translated into a higher distribution per unit (DPU), which rose to 13.35 cents from 13.29 cents in the previous year. The consistent growth in DPU is a positive indicator for investors, showcasing the REIT’s ability to generate and distribute steady income.

Strong Balance Sheet

| As at 31 Dec 2023 | As at 30 Jun 2023 | As at 31 Dec 2022 | |

|---|---|---|---|

| Aggregate Leverage | 35.6% | 35.3% | 36.4% |

| Interest Coverage | 11.3x | 13.8x | 18.3x |

| Average Cost of Debt | 1.27% | 1.19% | 1.04% |

Parkway Life REIT’s balance sheet remains strong, underpinned by a strategic mix of debt financing and asset acquisitions. As of 31 December 2023, the REIT successfully put in place 6 new facilities, comprising a mix of SGD and JPY loans, with tenors ranging between 3 to 6 years. These facilities were primarily utilized for renewing capital expenditure at Mount Elizabeth Hospital and refinancing maturing loan facilities due in 2024 and 2025. This puts the REIT’s all-in cost of debt at 1.27%, a slight increase year over year.

The REIT’s gearing ratio remains conservative at 35.6%, providing ample headroom for future growth and acquisitions. With their current gearing level, they have a debt headroom of S$400.4m before reaching 45% gearing and S$673.7m before reaching 50% gearing. Additionally, the extension of JPY income hedges until 1Q 2029 enhances the stability of distributions to unitholders, mitigating foreign exchange risks and securing predictable cash flows.

5-Year Performance

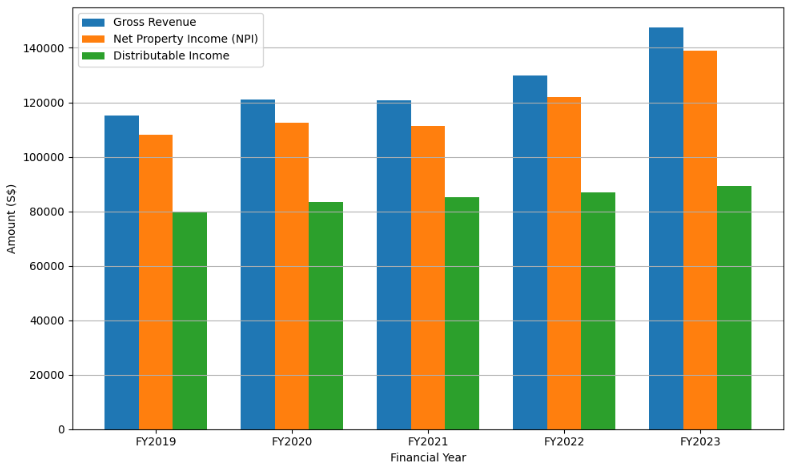

Revenue Growth

Note: Chart figures are in S$’000

As we can see, the overall 5-year trend for Parkway Life REIT is up. There is also a notable uptick in FY2022 onwards, where its Gross Revenue grew by 7.7% mainly due to higher rents from the Singapore hospitals as they just renewed the master lease.

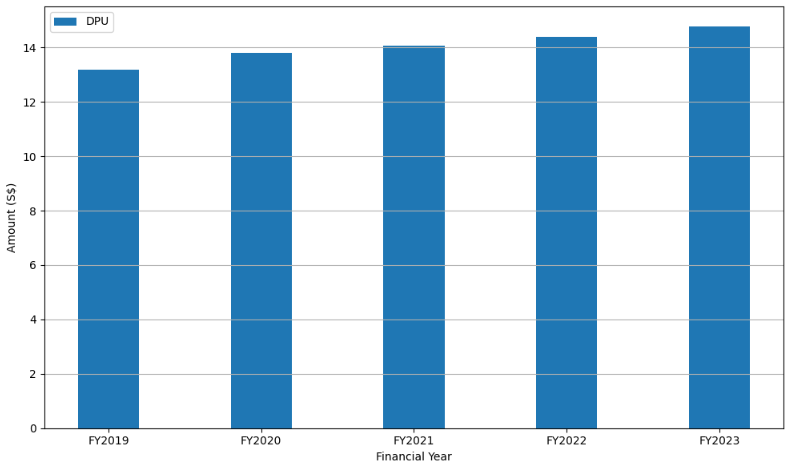

DPU Growth

Note: Chart figures are in S$ cents

Similarly, we can see that the overall DPU trend for Parkway Life REIT is consistently going up. It’s good to note that since Parkway Life REIT hasn’t done any Equity Fundraising (EFR) prior, investors won’t be diluted when the REIT is doing acquisitions. As such, the DPU can consistently climb as long as the REIT continues to grow its top and bottom line.

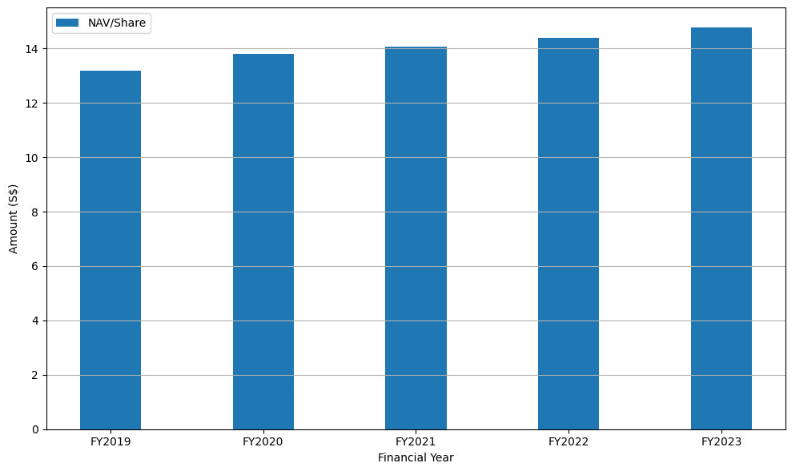

NAV Growth

Note: Chart figures are in S$ dollars

The 5-year trend shows that Parkway Life REIT has managed to grow its NAV/share year on year consistently by ~20% across the 5 years. This growth comes from the aggressive acquisition and strategic divestments of the Japan assets they own over the years. There were several acquisitions and divestments made every year to help Parkway Life REIT aggressively grow its NAV/share. The majority of the growth also came in FY2021 whereby the overall portfolio had a valuation gain of S$239.2m.

Acquisition In New Key Markets

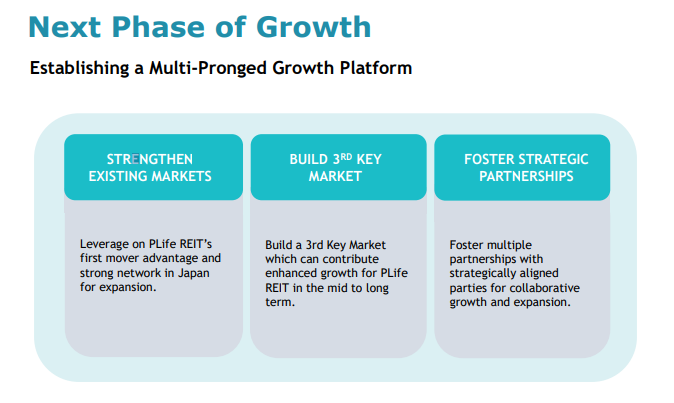

As mentioned in an older article here, I talked about the strong possibility that Parkway Life REIT will enter into a new key market. In the FY2023 earnings, the management has yet again hinted at the possibility as well.

Taking this into consideration, let’s re-look into the 2 possible markets that I think Parkway Life REIT might enter next. If Parkway Life REIT is planning to go into another Asia market, I’m guessing they will go for either Taiwan or South Korea.

Fantastic Healthcare System

Both Taiwan and South Korea have robust healthcare systems set in place. Taiwan’s healthcare system is highly ranked globally, known for its efficiency and comprehensive coverage. South Korea also boasts one of the most advanced healthcare systems in the world, with high-quality medical facilities and services. OECD Health Statistics report that South Korea has one of the highest numbers of hospital beds per capita, indicating an advanced healthcare infrastructure. Both countries also ensure that healthcare is easily accessible to all citizens, making sure there is low out-of-pocket cost and short waiting times.

Low Interest Rate

Taiwan maintains low interest rates, which means the cost of debt for acquisitions would be relatively cheap. The Central Bank of the Republic of China (Taiwan) has kept its key interest rate at historically low levels, supporting favorable borrowing conditions. South Korea’s central bank has also maintained low interest rates to stimulate economic growth. As of early 2024, the base rate is at a historically low level, facilitating affordable financing for acquisitions.

Aging Population

According to the National Development Council of Taiwan, the population is aging rapidly, with the proportion of people aged 65 and over expected to reach 20% by 2025. This demographic trend drives demand for healthcare services and facilities. Similar to Taiwan, South Korea is facing an aging population as well. The Korean Statistical Information Service (KOSIS) projects that the elderly population in South Korea will reach 20% by 2025, further increasing demand for healthcare and senior living facilities.

As such, based on the reasons stated above, Taiwan and South Korea are fantastic options for Parkway Life REIT to enter as their 3rd key market.

Current Valuation

Of course, before we invest in any company, we should always do it at the right price and valuation. Let’s take a look at Parkway Life REIT’s current valuation based on its closing price ($3.65/share) today. Based on its last closing price, Parkway Life REIT is priced with a 1.55x PB ratio and a 4.05% annualized dividend yield. It is good to note that there are no significant REITs that we can use to make comparisons other than First REIT, and as such, there will be no comparison being done as the numbers won’t be meaningful.

Based on its current valuation, we can see that Parkway Life REIT is priced at a pretty high premium and has a relatively low yield. This makes investors rethink about investing in this REIT because the return is so low but most investors fail to realize that the yield is so low because of how defensive the REIT is. Even in the worst times, with multiple macro trends and factors involved, Parkway Life REIT has managed to grow its DPU and NAV year over year.

Final Thoughts

Parkway Life REIT is a fantastic and defensive REIT to hold though the valuation might not be attractive because of the high premium you are paying but always remember that when buying high-quality assets, a premium must be paid in order to hold such assets. You won’t be able to find an A5 Wagyu steak at the same price as a normal steak cut in the supermarket. Given the strong growth potential that the REIT has, coupled with how defensive it is, seems like a no-brainer for the average dividend investor!

Pingback: 4 Key Takeaways From The FY2024 Results of Parkway Life REIT

Pingback: REIT Posts of the Week @ 15 June 2024