Insurance is one of the largest markets in the world, generating over $5 trillion in annual revenue and it’s being disrupted by Lemonade (NYSE: LMND) right now! The company is building an insurance experience that is easy, affordable, and hassle-free by injecting technology and accountability into an industry that often lacks both. Knowing all this, could Lemonade really be the next 100-bagger in the making? In this article, I will cover all the reasons, including my bull and bear thesis on how Lemonade will fare over the long term.

Business Model

Lemonade is an Insur-Tech company, focused on disrupting the insurance industry by injecting technology and AI. The company uses AI and big data to run its work processes such as allowing customers to purchase insurance or making claims. On the backend, the company uses AI to manage workflows and predict possible frauds. On the frontend, they utilize AI chatbots to interact with customers, underwrite policies, and pay claims. This allows Lemonade to provide a high-quality user experience at a lower cost than traditional insurers.

Read Also: Lemonade (NYSE: LMND) – The Most Talked About Disruptor in 2020

How Does Lemonade Make Money

Lemonade has a fixed-fee business model based on proportional reinsurance, which is essentially insurance for insurance companies.

Here’s how it works: When Lemonade receives premiums from customers, it keeps a flat fee (25%) and pays or “cedes” the remaining 75% to reinsurance companies. In exchange, the reinsurance companies take responsibility for 75% of claims. They also pay Lemonade a commission (25% of 75% = 18.75%) for bringing them business.

This makes the overall balance sheet capital-light since they do not bear a big chunk of the claims made as it is ceded out to other insurance companies. In Q1 2021, this proved to be a very good model since it protected them from the major impact that was caused by the Texas Freeze, limiting their downside to just 25%.

As the business grows and diversifies more for Lemonade, thus lowering its book’s volatility, the management intends to gradually reduce the portion of premium that they cede out over time. When Lemonade first entered the quota share reinsurance program in July 2020, they secured 55 of the 75 points on a 3-year term, while the remaining 20 points were up for renewal annually. Since then, Lemonade has managed to step down from ceding 75% of their premiums to 70%, which means they only renewed 15 of the 20 points that were in the agreement.

Q2 FY2021 Performance

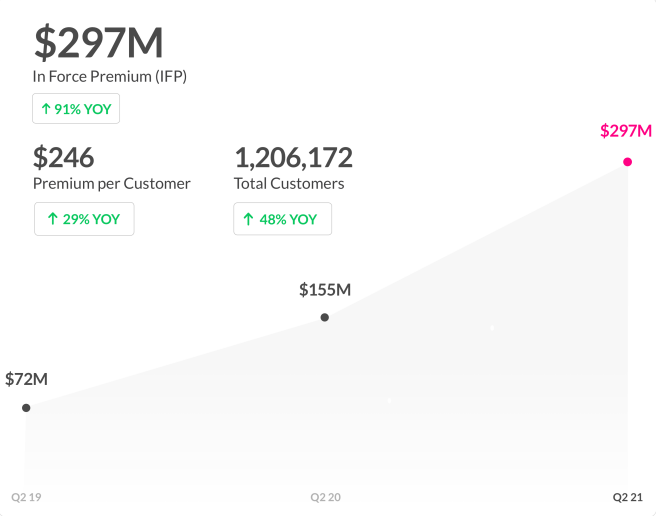

From the first glance, we can see that everything is up and up. The premium per customer rose 29% year over year to $246 and the total customer count has grown by 48% year over year to over 1.2 million. The most important metric for Lemonade is actually the In Force Premium (IFP), which has grown 91% year over year to $297 million.

IFP is defined as the aggregate annualized premium for customers as of the period end date. IFP is calculated using in force written premium, which is the annualized premium of in-force policies underwritten by Lemonade, and in force placed premium, which is the annualized premium of in force policies placed with third party insurance companies for which Lemonade earns a recurring commission payment.

As we can see, Lemonade has managed to reduce its gross loss and net loss ratio since Q1 2019 with a minor setback in Q1 2021 with the Texas Freeze which was a black swan event. Lemonade recovered beautifully in Q2, bringing the numbers right back down. Ideally, we would want both the loss ratios to be lower than 56.25% for Lemonade to start being profitable.

Guidance

Lemonade has a fantastic set of guidances set for the upcoming quarter and FY2021 as a whole. To meet their expected Q3 guidance numbers, they will need to achieve a quarter on quarter IFP growth of 13.2%-14.2%. They also need to grow their gross earned premium quarter on quarter by 14.3%-15.8%.

As for their expected FY2021 guidance numbers, they will have another 6 months to achieve these numbers. To hit their FY2021 guidance numbers, they will need to reach a half on half IFP growth of 28.0%-29.4%. They will also need to grow their gross earned premium by a whopping 132.3%-134.0% over the next 6 months.

That being said, I do believe that the numbers are definitely realistic and can be met due to 2 key factors which I will be explaining in my “Bull Thesis” in the next segment. Let’s dive right into my bull thesis for lemonade and why I think it will become the next 100 bagger.

Bull Thesis

Huge Room For IFP Growth

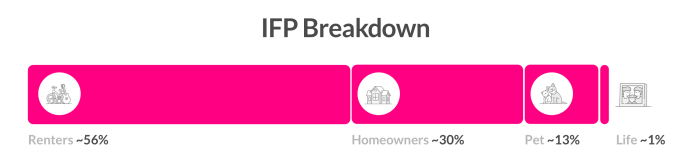

As of Q2 2021, the IFP breakdown comes up to, 56% coming from renters insurance, 30% from homeowners insurance, 13% from pet insurance, and 1% from life insurance. With the Term Life policies newly introduced into their product offerings, only being offered to some of their customers, there is plenty of room for it to grow be it within Lemonade’s current customer base as well as new customers out in the market as well. As of now, Lemonade offers term life insurance policies for as little as $9 per month. No medical exams are required and coverage can be purchased in just five minutes. Lemonade sells policies with term lengths from 5 to 30 years with up to a death benefit of $1.5 million.

With their Term Life policies going for $9/month, it is bound to attract plenty of new customers and especially youths who are fresh out of university or college and are moving into the next stage in their lives. With the seamless signing up process and very user-friendly chatbot which helps you get on board almost instantly, there is plenty of untapped potential for Lemonade.

Expanding Product Offering

As mentioned, Lemonade introduced Term Life policies earlier this quarter to only a select number of customers. As such, there is a ton of untapped potential for Lemonade in terms of growing the number of customers with a Term Life policy. On top of this, Lemonade is actually planning on releasing another high-earning policy which was first announced in an interview with CNBC. This is none other than Lemonade Car which is also Auto insurance. Other than the short interview, there was also an email sent to Lemonade users with regards to Lemonade Car which was shared on Reddit.

With these 2 key insurance policies being newly introduced for Lemonade, there is a huge Total Addressable Market (TAM) being unlocked for them. Having only started with smaller insurance policies such as Pets, Renters, and Homeowners, we can definitely expect a wider range of customers for Lemonade ranging from fresh graduates to families that want to opt for a cheaper insurance policy for the whole family to be covered and insured.

It is pretty much self-explanatory as to why Term Life policies are very welcomed with a huge demand for it but for Auto insurance, it might not come as obvious. With a huge number of car owners in the US as well as Europe that is still ever-growing day by day, the demand for Auto insurance is bound to grow. In the US and Europe, it is mandatory for every car owner to buy insurance coverage to not only protect themselves but other motorists as well. This helps create a “forced” pressure to buy Auto insurance if you want to own a car in these 2 regions.

Bear Thesis

Of course with the bull thesis will come a bear thesis or rather, what if everything good doesn’t happen and everything bad continues to go worse? Well here is my bear thesis which mainly revolves around 2 key points.

Slowdown In Customer Growth

First off, the slowdown in customer growth, which is pretty much expected as Lemonade grows bigger in size. As such, this isn’t a very huge concern for me but I realized that many investors are very fixated on this metric even though the CFO has mentioned previously that the IFP is the key metric they are monitoring. Regardless, even if the business is doing well, the market could think otherwise and misprice Lemonade due to a slowdown in customer growth.

Loss Ratio Maintains

The second point is more important which revolves around the loss ratio of Lemonade. If the loss ratio maintains at a high number or even goes up due to more black swan events, Lemonade could take a longer time to reach profitability. I don’t expect Lemonade to put profitability as a number 1 priority as I much prefer them to grow the business organically before worrying about making profits. That being said, the market does like to see companies go from loss-making to profit-making as it indicates that the company is supposedly “doing good”. This could be misleading and can result in a huge misprice for the stock over the short term.

Final Thoughts

So what is my Target Price (TP) for Lemonade? Based on its current share price of $68 or a market cap of $4.2B, my TP is as expected, definitely 100x from here or rather a market cap of over $420B. Of course, I don’t expect Lemonade to achieve such a feat over the next year or so but rather over a longer period of time, perhaps 20 years, which is the average amount of time needed to grow a 100 bagger. Why am I so bullish and pricing Lemonade with such a huge upside?

In 2020, the insurance industry in the U.S. alone had a total of $1.28 trillion in net premiums written. For P/C insurance which mainly consists of auto, homeowners, and commercial, had a total of $652.8 billion in net premiums written. As for Life/annuity insurance which consists of annuities, accident, health, and life, had a total of $624 billion in net premiums written. This already gives Lemonade a ton of room to grow already just in the US. Not to mention their expansion into Europe, Lemonade has plenty of areas to grow as they expand not just their product offerings but also expand geographically into more regions.

It is also forecasted that the global insurance market will grow to $6.39 trillion in 2025, marking a conservative CAGR of 7.39%. Using the same CAGR, we can expect the global insurance market to grow to upwards of $18 trillion in 2040. The number may seem insane for now but remember that years ago, no one would expect a company to reach a market cap of $1 trillion but then Apple came to break that record. Shortly after, Apple hit its 2nd trillion in terms of market cap. Many estimates seem far-fetched for now but with some foresight, I believe that it can happen. The industry isn’t going to be obsolete as time passes and it can only grow bigger over time due to factors like inflation and just overall demand as there is a growing population globally.

Personally, I have accumulated a growing position in Lemonade, entering my first tranche since 24th December 2020 at $127. Since then, I’ve entered several positions along the way with my highest tranche being $150 a share and my lowest being $61.9 a share earlier this month. I believe in the long-term potential for Lemonade and it is definitely one to stay as a huge disruptor to this 3000-year-old industry that has yet to see Technology being injected into it meaningfully like how Lemonade is doing so.

Pingback: Lemonade (NYSE: LMND) is Down Over 56% YTD in 2022! Should You Catch This Falling Knife?