This is the third part to a 4 part series where I share my insights and analysis on the 4 local hospitality REITs listed on the SGX. If you haven’t seen the previous 2 check them out here, Ascott Residence Trust and CDL Hospitality Trust. In this article, I’ll be sharing all you need to know about Far East Hospitality Trust.

Far East Hospitality Trust (SGX:Q5T)

Property Overview

As at Q1 FY2020, Far East Hospitality Trust owns a total of 13 properties, 11 of which are located in the central area of Singapore. Of its 13 properties 9 of which are hotels which the remaining 4 are serviced apartments.

It is also good to note that all its assets are in Singapore meaning that its business will be seriously impacted by the lock down situation right now.

Financial Ratios

The aggregate leverage of Far East Hospitality Trust is standing at 39.5%. This is a little too high for my liking as I typically prefer REITs with leverage less than 35% since this gives them ample space to grow, be it through acquisitions or AEIs.

On a good note, it is good to see that they only have a small portion of their debt maturing in FY2020. This will help them tide through the year and conserve some capital in the process.

Similarly to its peers in the hospitality sector, Far East Hospitality Trust has been hit pretty hard due to the declining demand for travel and tourism. It is good to note that due to its master lease structure, it will not be hit as hard as its peers. I’ll be explaining that in the next section.

Potential Upsides

All assets are under a Master Lease Agreement

What is a master lease agreement? Essentially, it is an agreement whereby the rental will comprise of a fixed rent and a variable rent.

Currently, FEHT’s fixed rent accounts for 58% of its FY2019 gross revenue. With the master lease agreement, there is downside protection for FEHT since there is a recurring and predictable stream of income from its tenants.

Planned Asset Enhancement Initiatives (AEIs)

It’s great to see that the REIT manager is actively improving its assets through Asset Enhancement Initiatives (AEIs). Taking advantage of the declining demand, it’s a great chance for hospitality REITs to do AEIs and improve the quality of their assets.

From the Q1 FY2020 business update, we can see that there will be AEIs done on The Elizabeth Hotel, Orchard Rendezvous Hotel as well as Rendezvous Hotel Singapore.

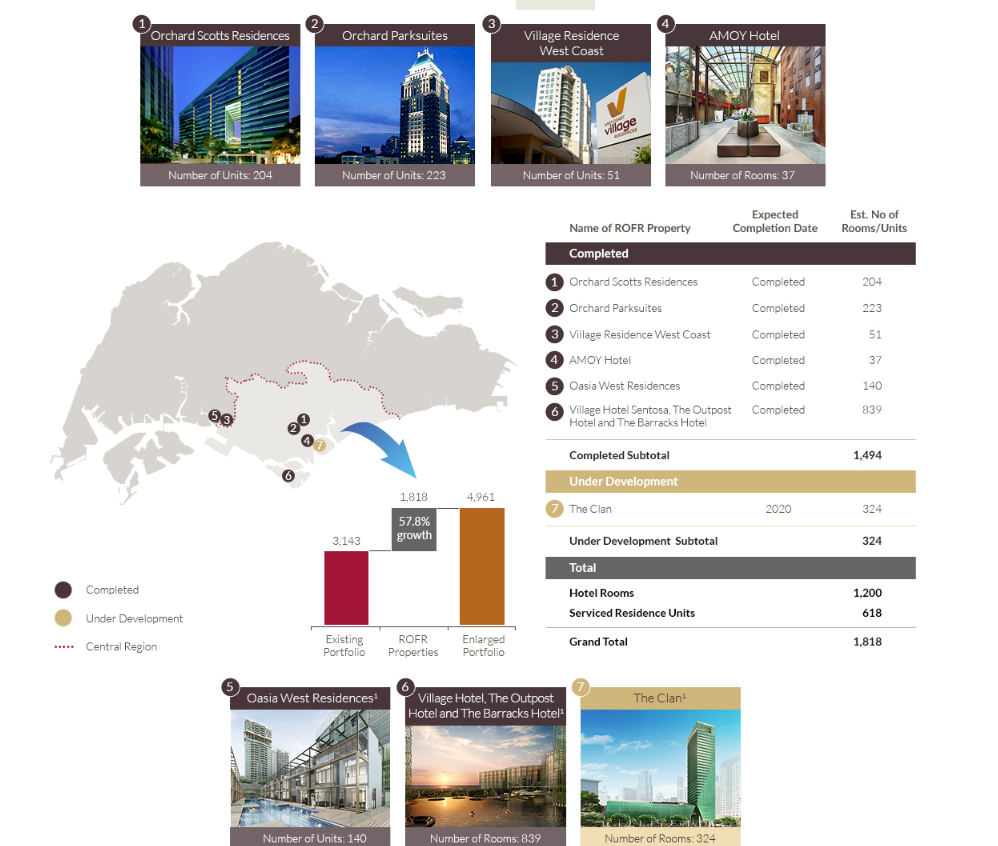

Strong Sponsor Pipeline with 7 ROFR Assets

Far East Hospitality Trust has 7 ROFR assets that can be acquired from its sponsor. This is fantastic as compared to CDL Hospitality Trust which I mentioned in the last article, who does not have any ROFR assets from its sponsor.

Potential Downsides

High Gearing

With its aggregate leverage standing at 39.5%, an acquisition would be very unlikely. Even if an acquisition is being made, it will most probably be done through a combination of debt and equity, maybe in the proportion of 30:70. This will cause dilution for current shareholders if they choose not to participate in the preferential offering or rights issue being made by the REIT.

If the REIT does decide to draw on more debt than equity, it will put them in a very unfavorable position with leverage crossing well over 40%. I believe with a higher proportion towards equity will help the REIT in maintaining their aggregate leverage under 40%.

Declining DPU

As you can see from the chart above, Far East Hospitality Trust’s DPU has been declining since 2013 and this is not a very good sign to see as a dividend investor. In addition with the declining demand for tourism and travel, the DPU will be hit even further.

Assuming a conservative 35% decrease in DPU due to the hit in revenue would be pretty reasonable due to a large portion of its forward earnings coming from fixed rents. I am also bullish on the sector’s recovery in 2H of FY21 so my forecast for FY21’s DPU is an increase of 15% from the year prior.

| @ $0.48/share | FY19 | Realistic FY20 Forecast | Realistic FY21 Forecast |

| DPU | 0.0381 | 0.024765 | 0.02847975 |

| Yield | 7.94% | 5.16% | 5.93% |

Final Thoughts

It is great to see that the REIT is making changes to its management fees to help retain capital. I do want to point out that the manager’s performance fee is paid with regards to the net property income or the annual distributed amount, whichever is lower.

This is a fantastic change as this will motivate the REIT manager to actually help bring more value to shareholders through DPU accretive initiatives be it AEIs or acquisitions. Previously, the fees were paid based on the NPI which is not very aligned with investors’ interests. A REIT manager could do DPU dilutive acquisitions and still get a higher performance fee due to the increase in NPI from the acquisition. Now that this has changed, I have a new found interest in Far East Hospitality Trust.

I’m personally looking to get a position in Far East Hospitality Trust soon when the price is right! I believe that it has limited downside here on out and has great potential upside for investors who are willing to take the risk.