Capitaland China Trust (SGX: AU8U) has seen its share price tumble by over 24% year to date and it doesn’t look good for investors. The recent FY2023 results were relatively weak, with a disappointing set of results coupled with a weak balance sheet amidst the high interest rate environment. Capitaland China Trust (CCT) has just released its 1H FY2024 results, so let’s see if there are any signs of recovery shown for FY2024 or if it will continue to do poorly. Could this be a falling knife or a good buy for investors now?

1. Disappointing Drop in Gross Revenue and NPI

| Year on Year Difference | 1H FY2024 | 1H FY2023 |

|---|---|---|

| Gross Revenue | RMB 925.929 million (-2.3%) | RMB 947.781 million |

| Net Property Income (NPI) | RMB 631.328 million (-4.9%) | RMB 663.709 million |

Capitaland China Trust (CCT) saw a slight drop in its Gross Revenue and NPI YoY on an RMB basis by 2.3% and 4.9% respectively. If we were to compare on an SGD basis, the gap would be widened to 6.3% and 8.7% due to the FX impact from a stronger SGD/RMB (4.2% change in FX).

The weak set of results was due to 2 key factors, namely the divestment of 2 retail assets as well as tenant issues in Shanghai Fengxian Logistics Park. If we were to do a meaningful comparison with the remaining 9 retail malls in the portfolio, we actually see a net 4% growth in Gross Revenue as well as a 6.1% growth in NPI on a YoY basis. This shows that the retail portfolio is still doing well and improving.

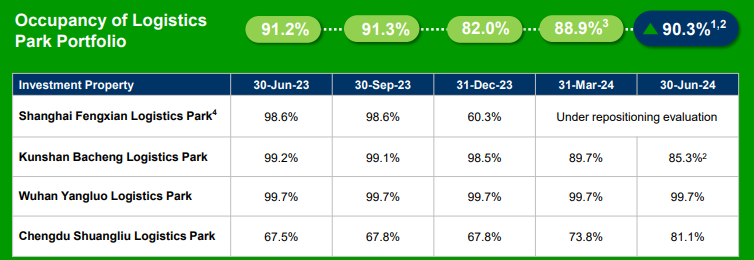

As for the Logistics Park, as you can see above, the occupancy has been fluctuating a lot over the past few quarters. The Chengdu Shuangliu Logistics Park (CSLP) has been improving over the past few quarters. The Wuhan Yangluo Logistics Park (WYLP) has been rather consistent with a 99.7% occupancy rate, while the Kunshan Bacheng Logistics Park (KBLP) has been rather inconsistent with a steady decline in its occupancy in the last 3 quarters. On a brighter note, there have been new tenants secured, which will boost KBLP’s occupancy to a stable 99% by the end of July 2024.

The Shanghai Fengxian Logistics Park (SFLP) is the biggest concern as the management is still finding tenants to replace the former tenants who vacated due to business closure. The 90.3% occupancy excludes SFLP because if we include it in, the occupancy would drop to a low of 70.4%. Thankfully, the logistics park segment only contributes to 2.9% of CCT’s overall portfolio Gross Rental Income (GRI) so this isn’t a huge laggard on the overall results.

2. Weaker Distributable Income and DPU

| Year on Year Difference | 1H FY2024 | 1H FY2023 |

|---|---|---|

| Distributable Income | S$51.302 million (-18.7%) | S$63.128 million |

| Distribution Per Unit (DPU) | 3.01 cents (-19.5%) | 3.74 cents |

Similarly, the Distributable Income and DPU took a hit as a result of the Gross Revenue and NPI being down on an RMB and SGD basis. On top of the weaker FX rate, CCT also had a higher withholding tax paid for the repatriation of dividends. Thankfully, despite all this, CCT managed to decrease its overall cost of debt, which resulted in a S$1.833m decrease in net finance costs to S$31.534m in 1H FY2024.

3. Balance Sheet Slowly Improving

| As at 30 Jun 2024 | As at 31 Mar 2024 | As at 31 Dec 2023 | |

|---|---|---|---|

| Aggregate Leverage | 40.8% | 40.8% | 41.5% |

| Interest Coverage | 3.2x | 3.2x | 3.1x |

| Average Cost of Debt | 3.49% | 3.47% | 3.57% |

Diving into CCT’s balance sheet, we can see that its aggregate leverage has decreased slightly since FY2023, falling from 41.5% to 40.8% across the last 2 quarters. The high leverage will hinder growth opportunities for CCT as this limits the debt headroom available. This also means that if CCT does make any large acquisitions, it will likely be funded through a mixture of debt and Equity Fundraising (EFR).

We can also see that the interest coverage ratio has improved slightly from 3.1x to 3.2x, which is weak but it is still above the minimum of 2.5x should a REIT choose to leverage up to 50%. CCT has also managed to reduce its cost of debt slightly from 3.57% to 3.49% as it rebalances its % of fixed-rate debts from 82% to 87% (including onshore loans).

As a result of this allocation, CCT’s Distributable Income stands to see a net increase of S$1.2m or a reduction of S$1m p.a. from the impact on interest expense, assuming a 0.5% increase/decrease in the variable rate. It is good to note that there is a variance in the net gain/reduction as there is a mixture of SGD and RMB debt (73% – 27%) in CCT’s portfolio.

4. Growth Potential

As mentioned above, the logistics park segment is a burden on CCT’s overall portfolio. It would be beneficial if the management handled this either by placing more emphasis on business parks and retail assets or by improving the tenancy and occupancy rate in the logistic parks. On top of this, with the updated investment mandate since FY2021, they can acquire not just retail malls but also, office and industrial properties. Not to mention, they can also acquire across Hong Kong and Macau as well, not restricted to just China assets. This huge change widens CCT’s range of possible acquisitions, especially from their sponsor, Capitaland.

Read Also: Capitaland Retail China Trust Has Finally Made Their 1st Acquisition After Expanding Their Mandate

Capitaland China Trust can leverage a much bigger pipeline from its Sponsor, with more than 80 assets that could be pipelined into CCT just in China alone, not adding in assets that are in Macau and Hong Kong. This definitely presents a huge upside for CCT but given its current high aggregate leverage, investors might need to get their pockets ready in the case of an EFR.

Final Thoughts

As we can see from the 1H FY2024 Results of Capitaland China Trust, it was a very mixed set of results. The Gross Revenue and NPI showed an initial drop but upon closer inspection, we can see that the retail portfolio is actually performing better than the year prior. The logistics park segment is still a laggard. Given more time, CCT should be able to normalize its earnings and show more meaningful growth.

Although factors such as foreign exchange rates or interest rates cannot be controlled by the REIT, it is important that the management proactively improves the REIT. One good note is that the REIT has a high % of fixed-rate debts which means that moving forward, the finance expense will be more predictable. As we can see, the net finance cost has actually started to reduce since 6 months ago.

Based on its last close of S$0.70, Capitaland China Trust is currently valued at a 0.588 Price/Book ratio with a Trailing Twelve Month (TTM) yield of 8.59%. This is pretty attractive and the yield does offer a big margin of safety for investors while waiting for the REIT to recover. Despite this, I think investors should steer clear and wait on the sidelines first if they are not yet invested. It would be wise to simply wait for some signs of recovery before starting a position in CCT. If you are an existing shareholder, you should consider waiting first before DCA-ing down because there might be more downside that cannot be predicted moving forward.