As inflation has slowed down and stabilized over the past few months, the first forecasted rate cut will come in September during the next FOMC meeting. The market is still conflicted on how much the estimated cut will be, with forecasts leaning towards a 50bps cut (52.5%) instead of a 25bps cut (47.5%). With rate cuts, this means the risk-free rate will be impacted as well, which will impact fixed-income investments as they are linked. As such, risk-averse investors should start capitalizing on high-yield fixed-income investment alternatives before the yield drops further. In Singapore, apart from the traditional Fixed Deposits offered by banks, we have government bonds such as the Singapore Savings Bond (SSB) and Treasury Bills (T-Bills). We also have money market funds that are offered by brokers but we will be taking that out of the comparison as the returns are not guaranteed. Without further delay, let’s dive in and find out which fixed-income investment is generating the best yield in Singapore.

Singapore Savings Bond (SSB)

As we all know, there is a new SSB issued every month which has a maturity tenor of 10 years. This month, the SSB issued is yielding an average of 3.1% p.a. across 10 years. The interest rate per year is as follows:

We can see that the yield is relatively stable for the first 6 years at a slightly lower 3.06%. The yield then gradually increases upwards from the 7th year mark to 3.09%, 3.17% in the 8th year, and finally plateauing at 3.21% for the 9th and 10th year respectively. It is important to note that this month’s issuance is a slight step down from last month’s.

If you have bought older SSBs that are lower yielding, fret not because here is what you can do! You can simply apply for this month’s SSB with the amount you have in the older SSBs, and then redeem (which means to withdraw) your old SSBs. This will allow you to “effectively transfer” your investment to a higher-yielding SSB, for a low cost of $4 ($2 transaction fee * 2 transactions). The only downside to this strategy is that you must have available funds to buy the current SSB since the redemption of your older SSBs will take approximately 1 month (2nd business day of the following month) to reach your bank account. Another thing to note is the redemption period for SSBs is only open from 6 pm on the 1st business day of the month, to 9 pm on the 4th last business day of the month so make sure you submit your redemption requests during this period.

The benefit of investing in SSBs is that you can freely redeem your investment at any point in time for a small fee of $2. The interest gained will be paid out every 6 months. This provides investors flexibility in the case of an emergency where they need the money urgently, which makes SSBs a great investment vehicle for emergency funds as well. There is also a much smaller barrier to entry for SSBs with just a minimum of $500 per tranche.

Treasury Bills (T-Bills)

Moving on, we have T-bills. In Singapore, there are currently 2 types of T-Bills being issued, namely the 6-month and 1-year T-Bills. The 6-month T-Bills are usually issued twice a month whereas the 1-year T-Bills are less frequent. The interesting thing about T-Bills is that the interest rate is determined after the auction period has ended. As such, investors usually look at past issuances as a guideline.

| T-Bill Information (Auction Date – Code) | Cut-off Yield |

| 04 Jul 2024 6-month T-bill (BS24113N) | 3.7% |

| 18 Jul 2024 6-month T-bill (BS24114V) | 3.64% |

| 01 Aug 2024 6-month T-bill (BS24115A) | 3.4% |

| 25 Jan 2024 1-year T-bill (BY24100T) | 3.45% |

| 18 Apr 2024 1-year T-bill (BY24101X) | 3.58% |

| 25 Jul 2024 1-year T-bill (BY24102W) | 3.38% |

The latest 01 Aug 2024 6-month T-bill (BS24115A) had a cut-off yield of 3.4% p.a., which is a drastic decrease from the past few issuances as seen in the table above. In 2024, there have been 3 new 1-year T-Bills were issued, the first was auctioned on 25th January 2024 with a cut-off yield of 3.45%, the second was auctioned on 18th April 2024 with a cut-off yield of 3.58%, and the third was recently auctioned on 25th July 2024 with a cut-off yield of 3.38%

In the month of August, we have 2 6-month T-bills being issued, of which 1 was already issued on the 6th of August. The other one has already been announced on the 7th of August and will close on the 15th of August. You can find the full issuance calendar here.

Unlike SSBs, T-Bills do not pay coupons or interest. Instead, you buy T-bills at a discount to the face (par) value and are given the full value at maturity. In other words, if you were to buy $1,000 worth of the 6-month T-bill with a yield of 3% p.a., you would only need to pay $985 upfront. This is calculated by taking the yield earned ($1,000 * 3% * 0.5) deducted from the amount bought ($1,000). When the T-Bill matures, you will receive the full $1,000 back and earn $15. Do note that there is a slightly higher barrier to entry for T-Bills with a minimum of $1,000 per tranche.

Another difference between SSBs and T-Bills is that you cannot redeem it early. However, you can sell your T-Bills on the secondary market but do note that because the trading volume is relatively low, this makes T-Bills very illiquid on the market.

Fixed Deposits

Last but not least, we have the traditional Fixed Deposits offered by banks. Unlike SSBs and T-Bills which need to be issued, banks are always offering Fixed Deposits but the interest rate offered will vary. This month’s Fixed Deposit rates are as follows:

As we can see, Bank of China (BOC) is currently offering the highest interest rate at 3.45% while Citibank is offering the lowest at only 2.65%. Each bank also has differing tenures ranging from 3 months to 15 months as well as different requirements such as minimum deposits of $500 to $50,000.

StashAway Simple Guaranteed

StashAway’s Simple Guaranteed is a cash management portfolio that places your funds into a fixed deposit. Instead of placing your fixed deposit with a bank directly, with StashAway’s Simple Guaranteed, StashAway will help you place the funds with a partner bank. Don’t worry because not only is StashAway licensed by MAS, but they also only partner with MAS-regulated banks as well.

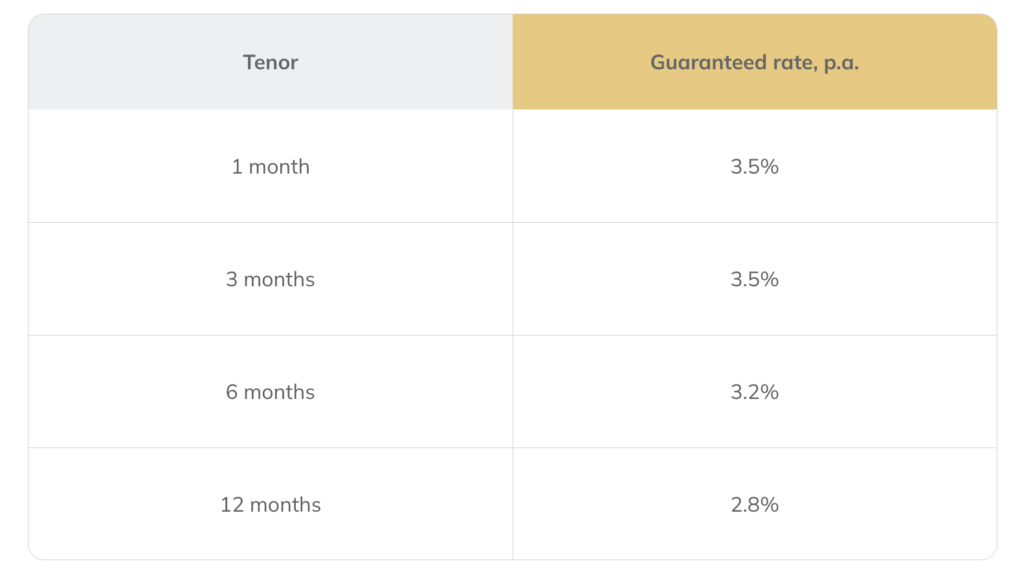

Similarly, the lock-in periods range from 1/3/6/12 months. An added flexibility to this in comparison to other banks is the very low minimum deposit of $1. This allows you to spread your funds across different lock-in periods based on your needs. The rates are updated daily between Monday to Friday but once you lock in your rate, which means to put your funds into the fixed deposit, you won’t be affected by the change in rates. Currently, the rates range between 2.8% to 3.5% depending on the tenor, which is much lower than last month’s rates.

Syfe Cash+ Guaranteed

Syfe’s Cash+ Guaranteed is a cash management portfolio that is similar to StashAway’s Simple Guaranteed as it also places your funds into a fixed deposit. Similarly, Syfe is also licensed by MAS.

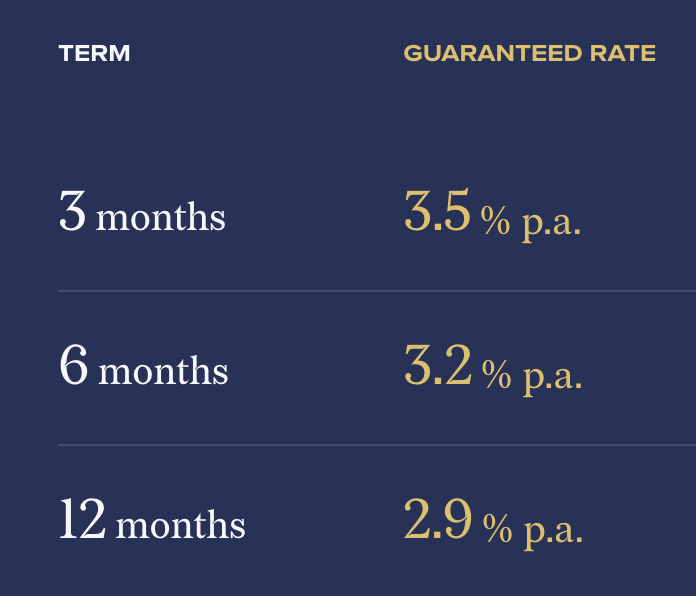

The lock-in periods differ from StashAway’s as it only offers a 3/6/12 month term. Like StashAway, Syfe’s Cash+ Guaranteed also has no minimum or maximum deposit. This allows you to spread your funds across different lock-in periods based on your needs. The rates are updated daily at around 2 pm but once you lock in your rate, which means to put your funds into the fixed deposit, you won’t be affected by the change in rates. Currently, the rates range between 2.9% to 3.83.5 depending on the tenor, which is more attractive than StashAway, but a step down from its rates offered last month. On top of that, if you sign up with my affiliate code: SGSMI, or sign up using this link, you will be entitled to sign-up rewards such as fee waivers across all Syfe’s products and many more!

Read also: Syfe – The All-In-One Investment Platform That Is Suited For All Types Of Investors

Final Thoughts

As investors, we can compare these 3 fixed income investments on 3 key factors:

- Yield

- Flexibility

- Barrier to Entry

Firstly, when we compare yield, we can see that Syfe’s Cash+ Guaranteed and StashAway’s Simple Guaranteed come in first, with T-Bill in a close second, with Fixed Deposits coming in third, and SSBs ranking last. It is important to note that for Fixed Deposits, if we were to take the average across all banks, it would give you an average of 3.11% which is the second lowest among all 5 investments.

Secondly, when we compare the flexibility, SSBs will clearly rank first as you can withdraw at any time. Fixed Deposits will rank second as most banks will allow you to withdraw without any penalty but you won’t be able to get any interest earned up to the date of withdrawal. Third would be T-Bills as you cannot redeem them early. You can only sell them via the secondary market would is a hassle on its own. The last would be StashAway’s Simple Guaranteed and Syfe’s Cash+ Guaranteed which does not allow you to withdraw during the lock-in period.

Last but not least, when we compare barriers to entry, StashAway’s Simple Guaranteed and Syfe’s Cash+ Guaranteed will rank first with a minimum deposit of only $1, with SSBs ranking second with a minimum of $500 per tranche. T-Bills will rank third with a minimum of $1,000 per tranche and Fixed Deposits rank last as they vary across banks, with some requiring you to deposit fresh funds which is quite troublesome.

Overall we can see that for the month of August, Simple Guaranteed and Syfe’s Cash+ Guaranteed come in at first place with the lowest score, with SSBs ranking second, T-Bills ranking third, and Fixed Deposits ranking last. Of course, it is important for investors to understand each product and find the perfect fit for you based on your investment needs. If you are looking for fixed-income investments, you should act fast before the rate cuts come, or else the yield will just keep dropping moving forward.

Thank you for the helpful analysis of fixed income revenue sources. I was particularly interested in StashAway Simple Guaranteed. However I was not able to understand if 1 month lock-in involves 30days from lock-in or if it was by other means. Another thing I was unsure of was how funds parked in StashAway is withdrawn and time taken to withdraw funds to my account. I checked StashedAway website but there are no answers (in the FAQ). Again thank you for the write-up.

Based on my understanding, 1 month is 30 days.

As for withdrawal, from my own experience, it usually takes 3 – 5 business days on average. It will take slightly longer if you are withdrawing your entire portfolio value out as compared to just partial withdrawal.