Tiger Brokers is back with their new feature, Fund Mall. Fund Mall is Tiger Brokers’ brand new feature, introducing a wide variety of mutual funds for investors to invest in. These funds are unique and harder to access if you have smaller capital to invest with.

This brand new feature allows investors to use Tiger Trade’s all-in-one account, adding easy and instant diversification to their portfolios without having to open a separate, non-linked account. Without further delay, let me show you what you can do with the platform.

Disclaimer : Information written in this article is based on my own research and opinions.

Note : This is a sponsored post

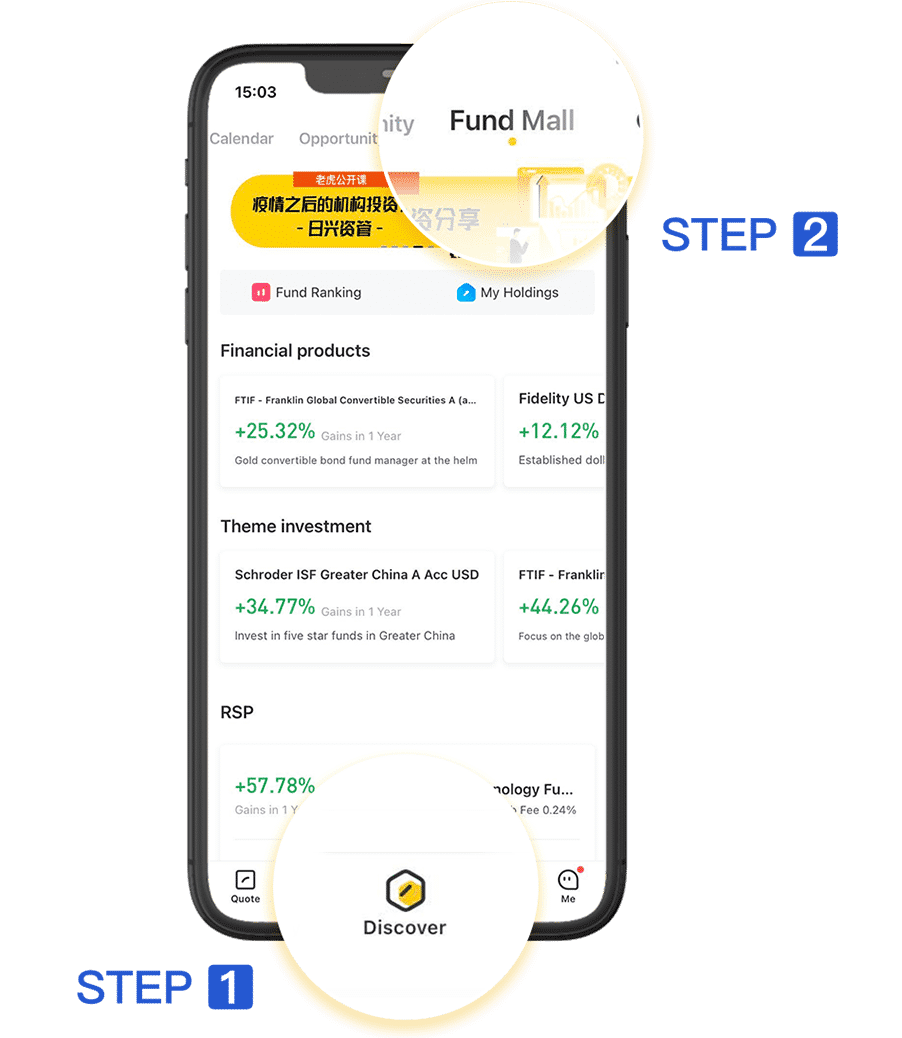

Where To Find Fund Mall?

Firstly, you will need to know where and how to locate it in the mobile app.

Fund Mall can be easily found on the mobile app under Discover > Fund Mall.

Platform Features

Let’s jump right into the platform and take a look into the features that the platform offers.

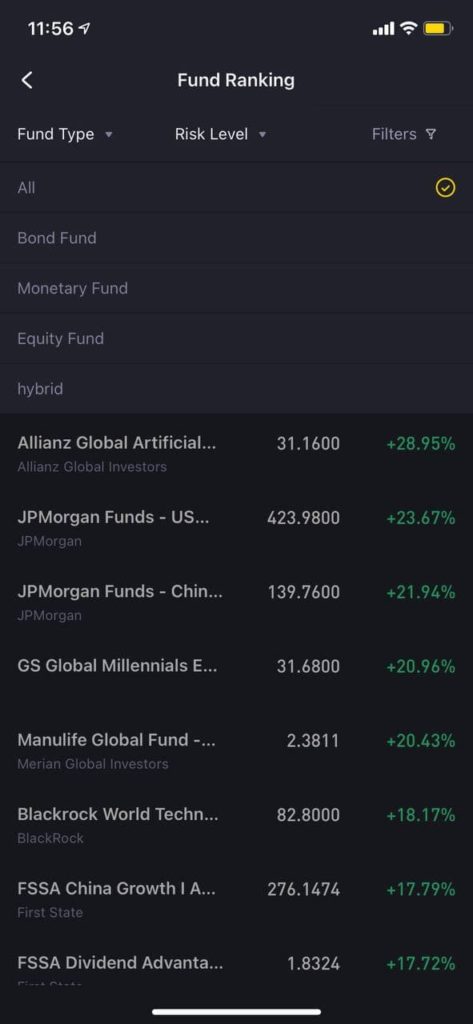

Types Of Funds

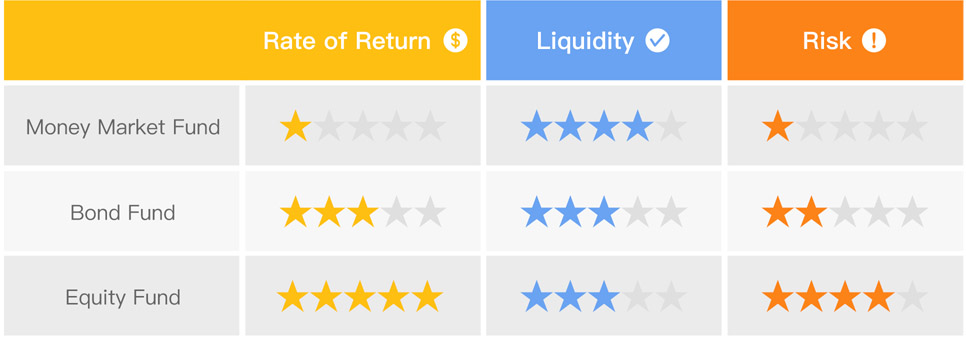

Firstly, Tiger Brokers’ Fund Mall offers investors the ability to invest in 3 different types of funds, Equity Funds, Bond Funds, and Money Market Funds.

Equity Funds: Focuses on investing in stocks in the U.S. as well as Asia including but not limited to large-cap stocks, small-/middle-cap stocks, technology stocks, emerging market equity, and other stocks/ETFs.

Bond Funds: Focuses on investing in bonds, including but not limited to investment-grade bonds, emerging market bonds, high-yield bonds as well as a combination of different strategies.

Money Market Funds: Focuses on investing in monetary instruments denominated in U.S. Dollars, including but not limited to fixed-term deposit, cash equivalent, short-term bonds.

You can also see the different Rate of Return, Liquidity as well as Risk across the different funds. Money Market Funds and Bond Funds might be more suitable for investors who are more risk-averse and seeking capital preservation. Investors who are more aggressive and have a longer holding horizon might consider investing in Equity Funds for higher rate of return.

The above shows the performance of the various funds. For example, we can see that the Equity Fund has performed very well with a 10-20% rate of return over the past 1 year and a 5-13% rate of return over the past 3-5 years.

Multiple Risk Levels

The filtering option also allows you to look for funds based on your risk appetite, ranging from Low to High. This feature allows investors to quickly seek out funds that suit their risk profile instead of spending previous time looking through every fund.

It is also important for investors who are looking for higher returns, to know that they might need to stomach a much higher volatility in return. Of course, for long term investors, short term volatility should be taken advantage of as you can buy more at a lower price.

Fund Information

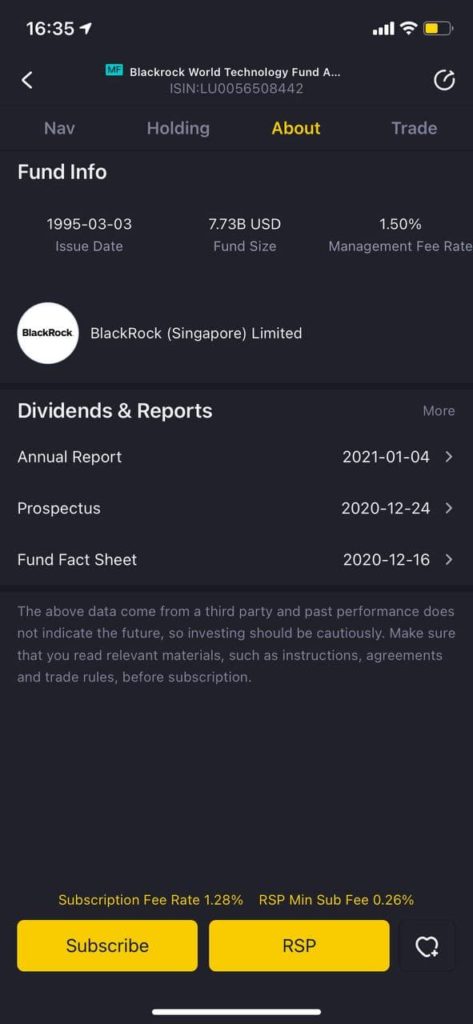

The platform also provides information regarding each fund such as NAV, NAV trends as well as historical performance.

You can also check out the fund’s performance over the past few months and even years.

Under the “Holding” page, you can also find out the assets or equities being held under the fund, the distribution of asset classes, geographical location as well as industries.

There is also an about page in which you can look at their prospectus, annual reports, fund fact sheets, and past dividend distributions. You can also see the fund size, issue date as well as management fees that you will be paying.

Why Choose Fund Mall?

There are various well-known platforms that allow investors to invest in funds but why should you choose fund mall? Here are a couple of reasons why you might favor Tiger Brokers’ Fund Mall over the other platforms.

Low Barrier to Entry

Starting off, as per all of these platforms, that will always be a minimum sum that you need to invest. This typically ranges from $100 to even $1000, depending on what fund you want to invest in.

With Tiger Brokers’ Fund Mall, you can invest in any Fund on the platform with as low as US$100. This allows you to adopt the Dollar Cost Average approach and invest over a long period of time without much hassle and penalty.

0% Fees

To help investors kick start their wealth building journey, Tiger Brokers is having a 0% transaction and platform fee promotion for all Funds! As many investors should know by now, one of the biggest problems that an investor face is high fees and costs when investing. These fees and costs can easily eat up all your profits and leave you dry with nothing. Thanks to Tiger Brokers’ 0% fees, all the profits are yours to keep.

Single Account Access

With some of these platforms, your normal brokerage trading account might be separated from your fund buying account. With Tiger Brokers, you won’t have that problem because everything will be aggregated into 1 single account. This way, you won’t have to log into multiple platforms just to check your overall portfolio performance.

Frequently Asked Questions

As this feature is still relatively new, there are many questions being asked about how it works, what will happen to my dividends and is my money safe. Let’s jump right into the FAQ and answer some of these doubts.

How Does Buying and Selling Work?

The buying and selling of funds are relatively straight forward as you can buy and sell at any time during the trading day. It is good to note that the currency used to buy funds is denoted in USD so if you have the cash in other currencies, you will need to perform a currency exchange first before you can buy funds.

Fund Buying Rules

If the fund “buy” order is made at 11 am or before (Singapore time) on day T, the order will be accepted on day T, the confirmation of day T’s net buying value and shares will be made on T+1, and the order will be completed on T+4.

If the fund “buy” order is made after 11 am (Singapore time) on day T+1, the order will be accepted on day T+1, the confirmation of day T+1’s net buying value and shares will be made on T+2, and the order will be completed on T+5.

(Note: The above is the usual situation. The confirmation and order completion time may be different for a few funds.)

Fund Selling Rules

If the fund “sell” order is made at 11 am or before (Singapore time) on day T, the order will be accepted on day T, the confirmation of day T’s net selling value and shares will be made on T+1, and the order will be completed during T+4 to T+10, at which time the funds will automatically reach the client’s Tiger account.

If the fund “sell” order is made at 11 am or before (Singapore time) on day T, the order will be accepted on day T+1, the confirmation of day T+1’s net selling value and shares will be made on T+2, and the order will be completed during T+5 to T+11, at which time the funds will automatically reach the client’s Tiger account.

(Note: The above is the usual situation. The confirmation and order completion time may be different for a few funds.)

A fund selling must be made after the status of the first fund buy order is “Buy Completed” (T+4 or T+5).

Regular Savings Plan (RSP)

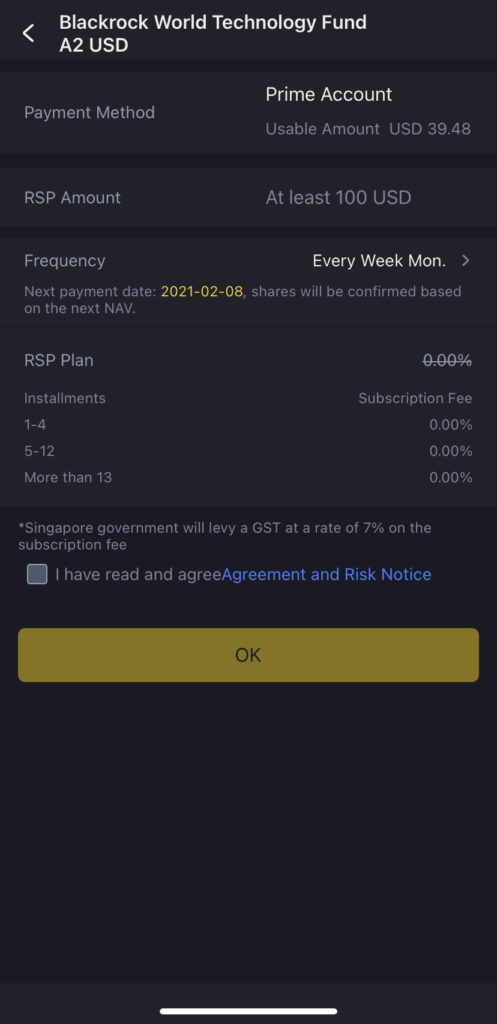

Tiger Brokers’ Fund Mall also helps investors who want to adopt the DCA approach by allowing investors to automatically buy funds over a set period of time. For example, a client may set his/her RSP to automatically invest 100 USD in a particular fund once per week. A client has the option to automate this process every week, every 2 weeks or every month and you can even set which day of the week you want it to start.

Earnings and Dividends?

As you start investing in funds using Fund Mall, you will see a few terms that might be vague. Here is what they represent:

Yesterday’s Return: The return earned by the fund held during the most recent trading day

Holding Return: The cumulative return earned during the fund’s holding period

Cumulative Return: The total cumulative return earned since the fund mall account opening.

Also, if the fund held has dividends, the distribution method may include monthly dividends, quarterly dividends, annual dividends, etc. Normally, the dividend share of a fund will reach the fund mall account within T+4 days after the dividend distribution date.

Additionally, Fund Mall helps users reinvest (also known as fund switch) their dividends back into the fund, thus increasing the power of compounding for investors.

Funds Security

Many investors are curious and worried about where the funds go, is this safe and will their hard earned money go missing one day if something bad happens. Fret not because your funds are safely secured and well taken care of.

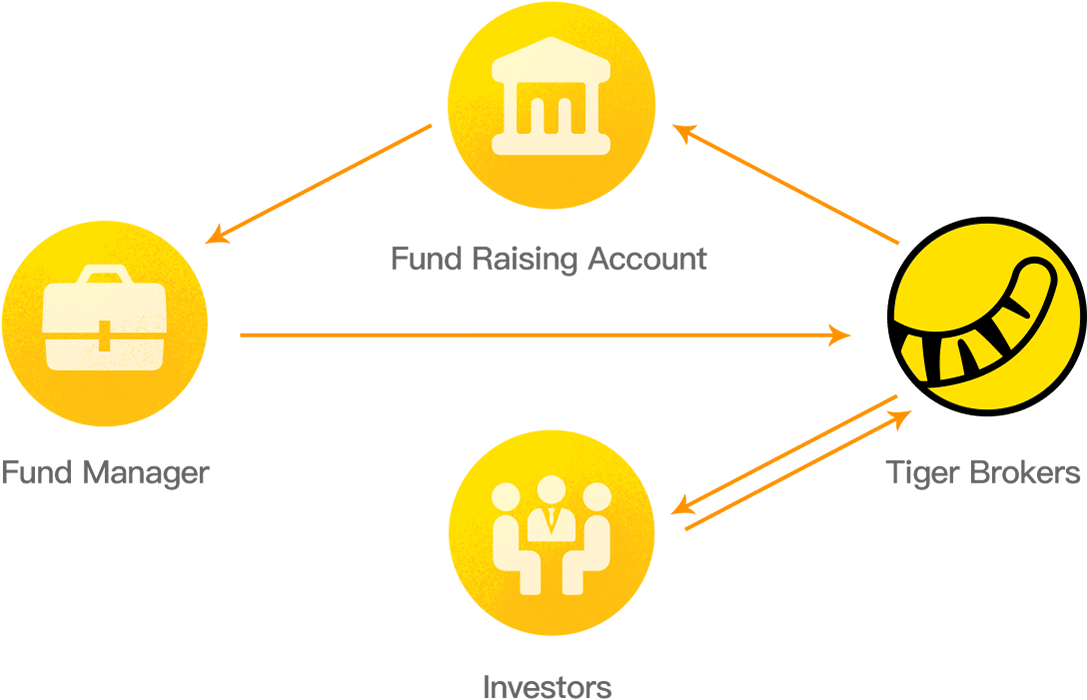

After the investor subscribes for a fund in Tiger Brokers’ Fund Mall account, the money for subscription will be transferred from his/her Tiger account to the fund company’s bank account, after which the funds will be invested.

Investors’ money in the funds are strictly supervised by financial regulators of the country where the fund is registered or where the fund manager is (e.g. U.S. Securities and Exchange Commission (SEC), Monetary Authority of Singapore (MAS)) to ensure the safety of investors’ assets.

Final Thoughts

I’ve always wanted to invest in global mutual funds, seeing as many of them manage to outperform the market over the past 5 years or so but I’ve never had the chance to because of several reasons such as:

- No access to these funds

- Limited capital to invest with

- Commission fees are way too high

Thanks to Tiger Brokers’ Fund Mall, I have a platform that I can invest in funds without worrying about losing all my profits to high commission fees. I will definitely be on the lookout for funds to invest in that I feel have a great growth trajectory over the next 5-10 years and has proven itself to do well over the past 5 years.