With more and more investment platforms entering the Singapore market, investors might need to spread their investments across multiple platforms, with the possibility of having one for investing in equities, one for investing in Robo-advisors, and perhaps one in a high-yield savings account (HYSA), making it a hassle if they want to move funds across different investments. Well, look no further because Syfe can do it all! Syfe was established in July 2019, making it relatively newer compared to its peers in the robo-advisory space. Despite this, Syfe has evolved rapidly, from just being a Robo-advisor to now offering cash management solutions as well as a brokerage for investors to maximize their funds and grow to its full potential. In this article, we’ll discuss all the features and products Syfe has to offer and why it is suited for all types of investors.

Who is Syfe?

Syfe is an online wealth manager that launched in Singapore in July 2019 after raising $5.2 million in seed funding, led by UK-based venture capital fund Unbound. In September 2020, the company raised another US$18.6 million for its Series A round and an additional US$ 30 million in July 2021. This takes Syfe’s total funding to about US$53 million to date. They also hold a capital markets services (CMS) license from the MAS.

The company was founded by Dhruv Arora, who was previously a Portfolio Trader at UBS Hong Kong and went on to become a Director and lead UBS’s ETF efforts in the region. Since 2018, Syfe has been building a platform that will appeal to passive investors, enabling their customers to grow their savings through an automated platform that is both easy to use and affordable.

Robo-Advisor

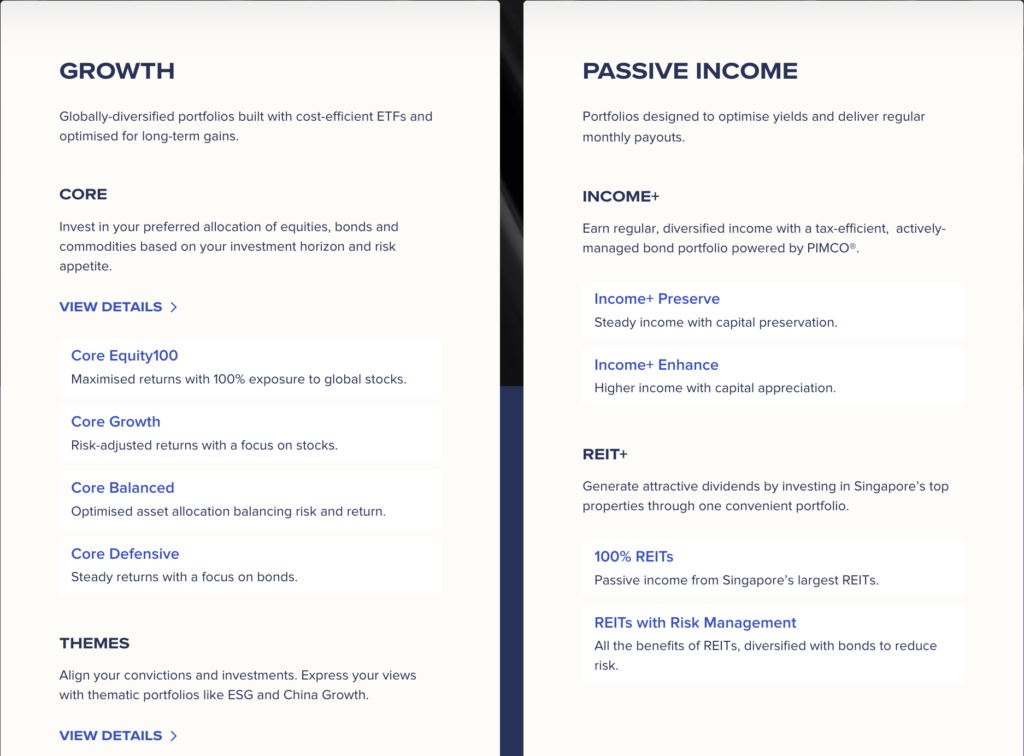

Syfe’s core product is its robo-advisor, which has been well-received by investors in Singapore. The great thing about Syfe’s robo-advisor is how customizable it is. You can choose a portfolio that is best suited for your investment goals, such as passive income or simply long-term capital appreciation. They offer many interesting portfolios but one that caught my eye would be the REIT+ which allows investors to invest in REITs which helps to generate dividends as a form of passive income. They offer 2 different types of REIT portfolios, with the “REITs with Risk Management” portfolio being more suitable for risk-averse investors as the portfolio is diversified with bonds to help reduce risk but still provide an attractive dividend, whereas the “100% REITs” portfolio is more suited for investors that can take on more risk.

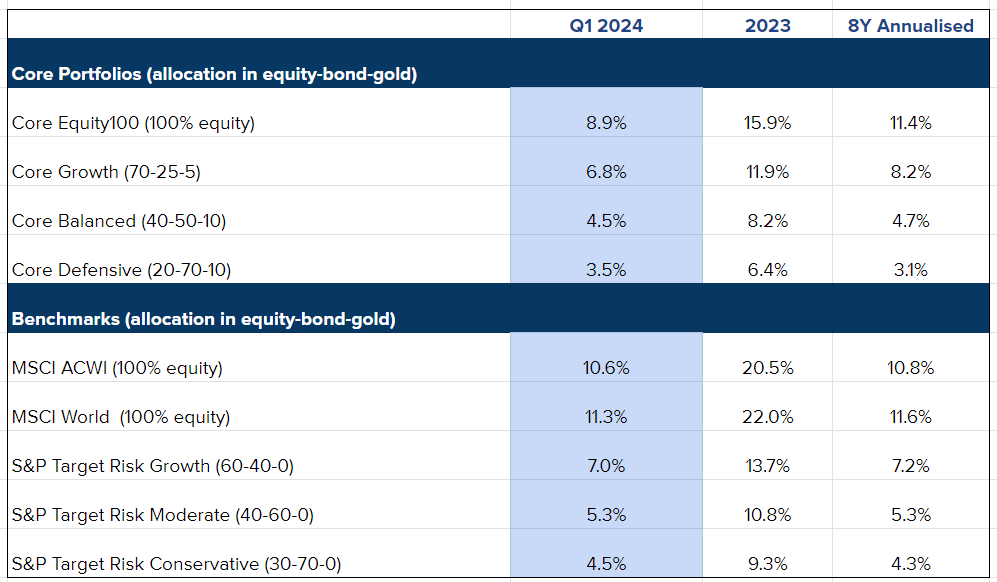

Syfe has recently reported its Q1 2024 portfolio update, showing strong returns for investors. One thing investors can appreciate is the transparency from Syfe, showing the performance across all portfolios they have. It is good to note that Syfe not only releases the performance of its portfolios but also does an in-depth explanation of why certain portfolios are performing better. This can be seen from the Q1 Performance Review, which is something investors can expect every quarter. This also helps investors understand their investments better and provides more conviction to continue Dollar Cost Averaging (DCA) into the robo-advisor.

Cash Management

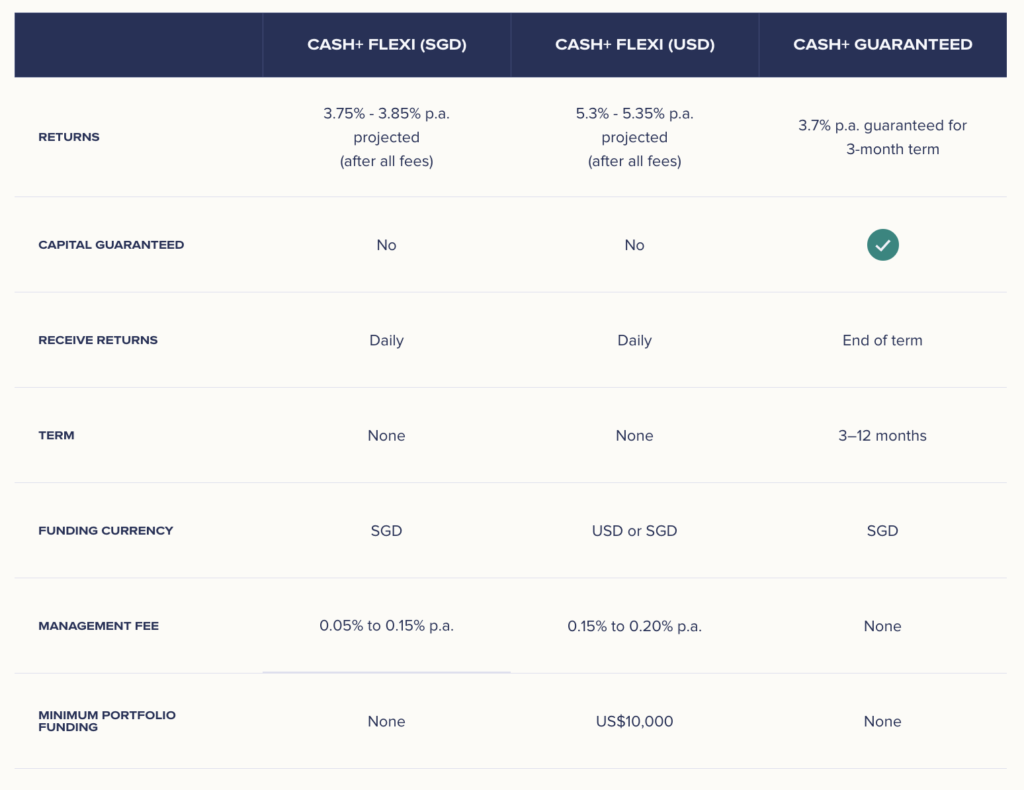

The next product that Syfe offers is its cash management, which consists of 2 key products, a like-money market fund (MMF) product as well as a like-fixed deposit (FD). Currently, not only banks are offering this, but many brokerages are also offering similar products as well, making the overall market very competitive. Syfe currently offers very attractive rates in comparison to its competitors in the market, with its Cash+ Flexi (MMF) offering 3.75% – 3.85% p.a. returns, with interest earned daily. Its Cash+ Guaranteed (FD) also offers a very attractive rate of 3.7% p.a. for a 3 month-term. You can also invest for longer time periods, up to 12 months but the rates will differ across the different investment periods.

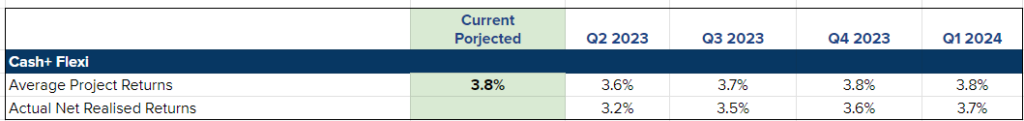

The Cash+ Flexi’s performance for the past 4 quarters has been near its projection of 3.8%, with some fluctuations in Q2 and Q3 of 2023, but has remained constant at 3.8% over the past 2 quarters.

Brokerage

Last but not least is Syfe’s newest product, its brokerage, which allows investors to invest in equities like any other brokerage. With so many brokerages in the Singapore market, what makes Syfe attractive?

Attractive Fee Structure

As we can see, Syfe offers monthly free trades for the US market regardless of AUM, with unlimited free trades for the first 3 months, which allows you to do monthly DCA free of fee. Its fees for trading in the Singapore and Hong Kong markets are comparable to other online brokerages in Singapore.

Flexibility

With Syfe’s brokerage, investors are given more flexibility, as you can invest with any amount with fractional shares. This gives you granular control over your investments as you can allocate specific dollar amounts instead of buying whole shares. There are also unlimited transfers and withdrawals with 0 fees.

Sign Up Rewards

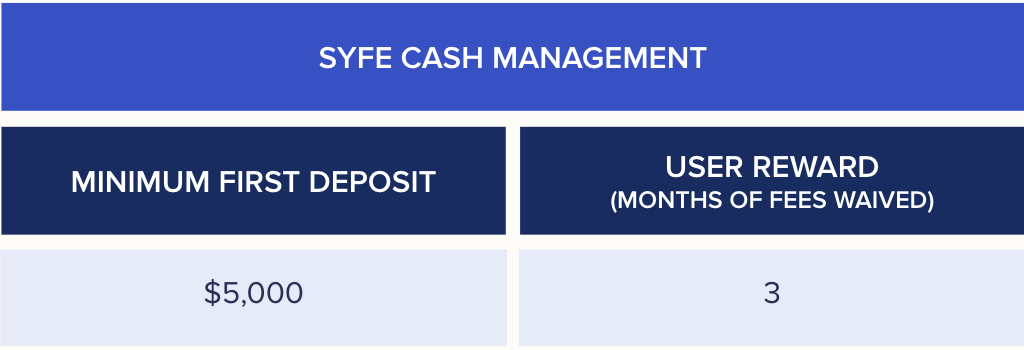

If you’re a new user who has yet to open a Syfe account, you’re in luck because there are sign-up rewards for you! Simply use my affiliate code: SGSMI or sign up using this link. So what will you be getting? You will be enjoying rewards across all 3 products in Syfe, starting with fee waivers on Syfe’s Robo-advisor, with a minimum first deposit of $2,000, which gives you 3 months of fee waivers. For Syfe’s Brokerage, with a minimum first deposit of $2,000, you will receive $10 worth of cash credits. In addition to this, with every successful first deposit into Syfe’s brokerage, you will be entitled to a 1-month free subscription to my Premium Subscription (worth ~$22.67). Contact me here once you have successfully deposited to redeem your free subscription!

Last but not least, with a minimum first deposit of $5,000, users can enjoy 3 months of fee waiver to Syfe’s cash management.

Final Thoughts

So how is Syfe suitable for all types of investors? For the risk-averse investor who only wants to invest in MMFs or FDs, Syfe’s cash management offers attractive rates with no strings attached such as a high minimum deposit. For long-term investors, you can go for the robo-advisor which offers you the option to focus on passive income in the form of dividends or simply long-term capital appreciation. For the DIY investor, there is Syfe’s brokerage which offers at least 2 free trades in the US market every month, which gives you a lot of opportunities to DCA free of cost. This truly makes Syfe a fantastic one-stop-shop for all types of investors.

Pingback: Which Fixed Income Investment Is The Best In Singapore? (Mar 2025)

Pingback: Which Fixed Income Investment Is The Best In Singapore? (Feb 2025)

Pingback: Which Fixed Income Investment Is The Best In Singapore? (Nov 2024)

Pingback: Which Fixed Income Investment Is The Best In Singapore? (Oct 2024)

Pingback: Which Fixed Income Investment Is The Best In Singapore? (Sep 2024)

Pingback: Which Fixed Income Investment Is The Best In Singapore? (Aug 2024)