Due to the recent increase in volatility in the US market coupled with the possible hiking of interest rates, investors are now more cautious with their investments. It will soon be hard to beat the risk-free rate if the interest rate continues to trend higher. In Singapore, the risk-free rate is 2.5% (CPF OA) and 4% (CPF SA). As such, dividend investors are always looking for investments that can yield higher than that. One particular investment would be the 3 US REITs listed in the Singapore market which yields an average of 7.84%. Let’s dive into these 3 US REITs and see if they are a worthy investment.

Portfolio Overview

Let’s start off our in-depth analysis with an overview of each of the 3 US REITs’ portfolios.

KORE

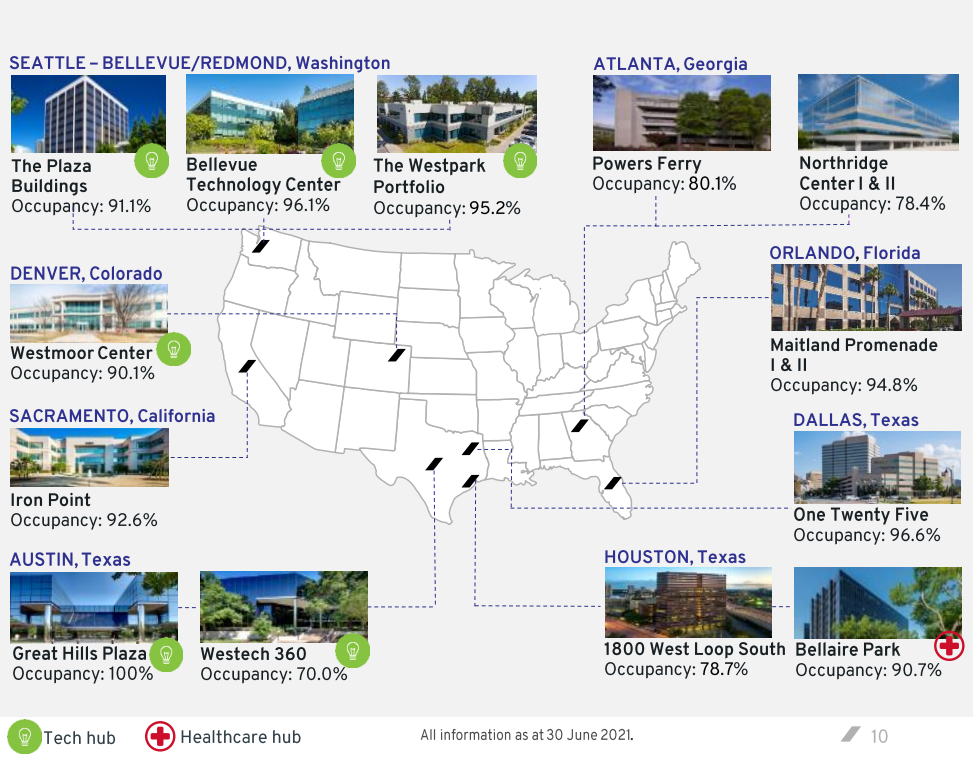

Keppel Pacific Oak US REIT (KORE) holds a portfolio of 13 freehold assets, 6 of which are tech hubs while 1 is a healthcare hub. KORE emphasizes the growth potential in tech and innovation which is why they are increasing their exposure to tech in terms of tenant composition and overall industry exposure.

MUST

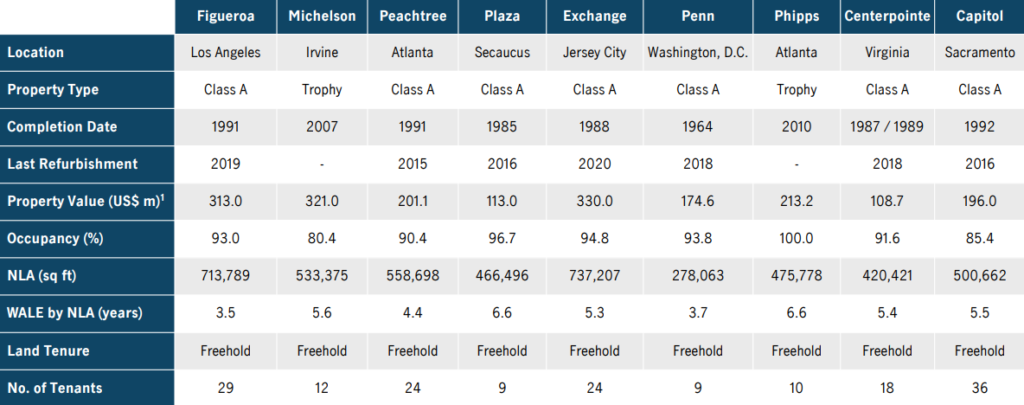

Manulife US REIT (MUST) has a superior portfolio, with properties strategically located in prime areas of key US cities. MUST holds a strong portfolio of 9 high-quality freehold assets that are either Class A or Trophy assets.

PRIME

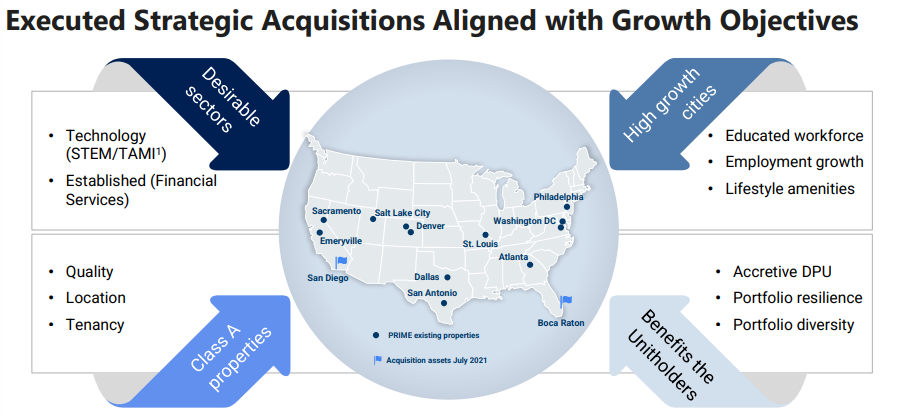

PRIME US REIT (PRIME) holds a high-quality portfolio of prime office properties, diversified across key U.S. office markets. With a total of 12 freehold Class A assets, PRIME REIT is targetting tech as well as established sectors such as financial services.

1H 2021 Results

Gross Revenue and NPI

| Year on Year Difference | KORE | MUST | PRIME |

|---|---|---|---|

| Gross Revenue | $68.383 million (-3.0%) | $90.799 million (-7.9%) | $72.069 million (+1.2%) |

| Net Property Income (NPI) | $40.587 million (-3.1%) | $56.069 million (-9.8%) | $46.34 million (-2.3%) |

Firstly, when comparing the recent 1H 2021 results across the 3 US REITs, we can see that PRIME REIT did the best with the only positive growth in Gross Revenue by 1.2% and the smallest dip in NPI by 2.3%. KORE performed 2nd while MUST fell behind significantly with its Gross Revenue falling by 7.9% and NPI by 9.8% respectively.

Distributable Income and DPU

| Year on Year Difference | KORE | MUST | PRIME |

|---|---|---|---|

| Distributable Income | $29.937 million (+2.8%) | $42.99 million (-10.4%) | $35.425 million (-1.3%) |

| Distribution Per Unit (DPU) | 3.16 cents (+1.9%) | 2.70 cents (-11.5%) | 3.33 cents (-5.4%) |

As we compare the Distributable Income and DPU segment, we can see that KORE actually did the best here with positive growth in its Distributable Income by 2.8% and DPU by 1.9%. PRIME REIT performed 2nd with a slight drop in its Distributable Income by 1.3% and DPU by 5.4%. Similarly, MUST performed the worst amongst the 3 US REITs with its Distributable Income falling by 10.4% and DPU by 11.5% year over year.

Balance Sheet Stability

| As at 30 June 2021 | KORE | MUST | PRIME |

|---|---|---|---|

| Aggregate Leverage | 37.1% | 41.6% | 34.4% |

| Interest Coverage | 4.9x | 3.3x | 5.8x |

| Average Cost of Debt | 2.82% | 2.99% | 2.7% |

Lastly, when comparing the 3 US REITs’ balance sheets, we can see that PRIME REIT has the strongest balance sheet with the lowest aggregate leverage at 34.4%, the highest interest coverage ratio of 5.8x, and the lowest average cost of debt at 2.7%. Placing close behind in 2nd place would be KORE with aggregate leverage of 37.1%, an interest coverage ratio of 4.9x, and an average cost of debt at 2.82%. MUST is placed last here with a very worrying aggregate leverage of 41.6%, a lower than average interest coverage ratio of 3.3x. Its only saving grace would be its low average cost of debt at 2.99%.

Summary

Across the board, PRIME and KORE REIT are neck and neck in terms of year over year growth with MUST trailing far behind its peers. All 3 US REITs did face some dips in terms of performance year over year due to the lower occupancies across all commercial assets. Despite the drop in occupancy, the 3 US REITs managed a positive rental reversion for 1H 2021 which helped offset some of the missing income.

3-Year Performance

Just to note, PRIME REIT had its IPO on 19th July 2019 so the numbers for FY2019 to FY2020 would appear to be a big jump but it only accounted for 6 months worth.

Gross Revenue

Looking at the 3-year performance for the 3 US REITS, we can see that there has been consistent growth throughout the period. Among the 3 US REITS, PRIME REIT grew the most within this period, boosting its Gross Revenue by 56.6%, with KORE trailing behind at 49.25%, and MUST following closely at 34.42%. Although from a glance, PRIME REIT looks like the best pick here, it is good to note that there is only 2 years worth of data for PRIME REIT as compared to its peers with 3 years worth of data to compare with.

Net Property Income

Similarly for NPI, PRIME REIT showed the largest growth, more than doubling its FY2019 NPI in FY2020. This is due to its smaller size, allowing it to grow more significantly in its early stages. KORE placed 2nd in terms of NPI growth with a 46.3% growth from FY2018-FY2020 with MUST trailing behind at only 27.76% growth within the same period.

Distributable Income

Similarly, the Distributable Income is in tandem with the NPI, showing consistent growth across the 3-year period.

Distribution Per Unit (DPU)

Last but not least, the most important factor when it comes to investing in REITs for income or dividends, the DPU. As we can see PRIME REIT showed strong growth as well due to its smaller base and shorter time period of just 1.5 years. KORE showed consistent growth across the 3 years while MUST lagged behind, showing a consistent decline in its DPU. This can be very worrying for investors as a declining DPU is often an indicator that something is going wrong with the portfolio’s assets and overall management.

Potential Growth Catalysts

As long-term investors, it’s important to identify long-term potential growth catalysts that can help skyrocket the REIT’s value in the future, either through its share price or in terms of DPU. Let’s dive into each of the 3 US REITs to see what potential growth catalysts each of them have for the long term.

KORE

In the 1H 2021 results release, KORE showed bleak prospects, with committed occupancy of its portfolio standing at a low 90.5% with a positive rental reversion of 5.4%. Additionally, it is recognized that its tenant concentration risk remains low, with the top 10 tenants accounting for only 20.2% of its cash rental income.

However, KORE has acknowledged such declines and is rather optimistic about the prospects of its REITs as its suburban office buildings and business campuses are purportedly well-positioned to benefit from the potential shift away from downtown and central business district locations especially during the pandemic period and thus this would generate revenues in the long run. Additionally, the REIT’s investment in tech hubs would prove beneficial in the long term as many gain greater interest in technological transformations.

However, it is evident that the 2022 renewed leases of KORE points towards a wait and see attitude, with leases signed recently spreading over 2022 and 2024. The graph above further shows that the rental growth projection worsens. Thus, it is really uncertain how KORE would fare in the upcoming 12 months which would ultimately reveal the strength of the KORE’s leasing team. The only saving grace is that KORE’s average in-place rents are ~8% below asking rents, allowing some room for organic growth in the near term.

MUST

MUST has proven resilient amidst the pandemic, reporting higher NPI and DI for FY 2020, increasing to US$115.8 million and US$89.0 million respectively during FY 2020 due mainly to acquisitions made in 2019. Although there was a dip in the DPU in 2020, it was largely attributed to lower rental income due to higher vacancies and lower car park income.

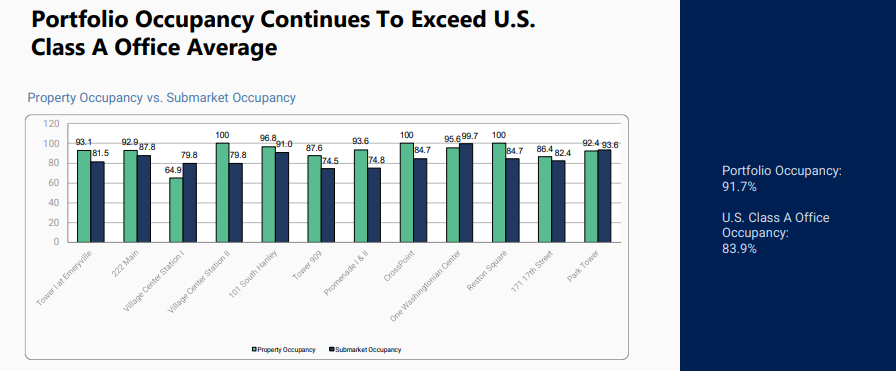

Occupancy rates have been on the decline since 2020, declining further in 1H 2021 to 91.7%. However, this is understandably still a good result relative to the US market occupancy rate which fell from an average of 88% at the start of 2020 to 84% by the end of 2020. Moreover, MUST’s WALE stands at a high 5.3 years, with its top 10 rentals largely from publicly listed companies or government agencies and thus brings about stability. Occupancy for the properties have been well above the US Class A average for the past 5 years and this good track record further establishes MUST’s stable portfolio.

The CEO said that MUST’s diversified tenant strategy which comprises 16 trade sectors is paying off. Its top 10 tenants mainly consist of headquarters, government, and listed entities. The CEO shared that despite a difficult patch for one of MUST’s children’s wear retailers, the rest of the tenants have stood strong during COVID-19, highlighting Amazon and Quest Diagnostics as companies that have massively outperformed.

However, it is noted that while the traditional sectors of legal, government, finance and insurance protected the REIT’s portfolio in 2020, MUST will be changing up a gear and concentrating on attracting tenants from higher-grade sectors to drive returns.

It is important to note that looking at the REIT’s asset under management, it is noticeable that MUST has placed emphasis, with 52% of MUST’s AUM includes technology, entertainment, and cloud security services. The underlying quality of MUST’s nine Class A office buildings in the U.S. has enabled the REIT to weather the impact of the pandemic. With the long-term positive expectations for the U.S. economy, and the REIT’s positioning to capitalize on post-pandemic themes for future acquisitions, this could lead to growth in new frontiers to rejuvenate MUST’s prospects moving forward.

PRIME REIT

In 1H 2021, PRIME REIT has already made 2 acquisitions, Sorrento Towers and One Town Center. Both acquisitions are freehold assets with a long wale of 6.6 years and 6.2 years. These 2 strong acquisitions will only meaningfully help contribute in 2H 2021 and fully contribute in FY2022. As such, investors have more to look forward to as we can expect a much stronger growth for PRIME REIT in 2H 2021 and FY2022.

Additionally, the REIT’s management has been strategic with its portfolio of assets, factoring in desirable sectors, high-quality properties in active and high-growth cities to help bring continued value to shareholders.

From the graph above, we can see that PRIME REIT’s management has been doing a great job maintaining a strong occupancy rate of 91.7% across its portfolio as compared to the overall U.S. Class A office average of 83.9%. Coupled with the in-place rents ~6.4% below asking rents, we can expect continued organic growth for PRIME REIT even without any more acquisitions for the year.

Valuation

| PB Ratio | Annualized Dividend Yield | |

|---|---|---|

| KORE ($0.76) | 0.96x | 8.316% |

| MUST ($0.70) | 1.03x | 7.714% |

| PRIME REIT ($0.84) | 0.98x | 7.929% |

As we dive into the valuation segment, we can see that despite MUST being the weakest amongst the 3 US REITs, it is being priced with the highest premium with a PB ratio > 1 coupled with the lowest annualized dividend yield of 7.714%. KORE takes the lead when it comes to valuation, with the lowest PB ratio of 0.96x and the highest annualized dividend yield of 8.316%. PRIME REIT comes in close behind in 2nd place with a PB ratio of 0.98x, also below 1 with a near 8% annualized dividend yield.

Final Thoughts

Overall, the 3 US REITs offer a very attractive dividend yield at the moment, far surpassing the risk-free rate in Singapore. There is also some considerable upside for the 3 US REITs in terms of growth prospects in the long-term as investors adopt a buy and hold strategy to these 3 US REITs. Additionally, I feel that both KORE and PRIME REIT are fundamentally strong REITs with an attractive valuation based on their last closing price. For those who like to invest in US properties without buying US REIT, KORE would be the best option here.

Pingback: REIT Posts of the Week @ 9 October 2021 | TheFinance.sg