As you might have heard, Sembcorp Industries(SCI) and Sembcorp Marine(SCM) has proposed a S$2.1 Billion Recapitalisation of Sembcorp Marine, as well as a De-merger so that both Companies can focus on their Growth Segments. So what should current shareholders do? Let’s take a look at what this announcement is about and what should investors do about it.

Announcement Details

So the announcement is split into 2 parts, the first being the S$2.1 Billion Recapitalisation of Sembcorp Marine and, the second being the De-merger of both companies.

The S$2.1 Billion Recapitalisation

The S$2.1 billion renounce-able Rights Issue by Sembcorp Marine will help strengthen its cash position and balance sheet. SCM will undertake a 5-for-1 Rights Issue (5 Rights Shares for every 1 SCM share held) at a Rights Issue Price of S$0.20 per share.

The proposed rights price represents a

- 31.0% discount to the Theoretical ex-rights price (TERP) of $0.29, based on 5 day VWAP of $0.74.

- 35.1% discount to the Theoretical ex-rights price (TERP) of $0.308, based on last close price of $0.85.

- 76.5% discount last close price of $0.85.

It is also good to note that Sembcorp Industries has undertaken, meaning it has given its promise, to subscribe for up to S$1.5 billion of Rights Shares by setting off the S$1.5 billion outstanding under its Subordinated Loan extended to Sembcorp Marine. Temasek has also agreed to sub underwrite the remaining S$0.6 billion.

The De-merger

Sembcorp Industries and Sembcorp Marine is looking to do a de-merger, whereby they will split both companies into 2 separate entities rather than having a parent-child relationship.

This will be done by having Sembcorp Industries sell its existing stake in Sembcorp Marine to its shareholders. Therefore, this means that current shareholders of Sembcorp Industries will have shares in both Sembcorp Industries and Sembcorp Marine.

The distribution will be done on a pro rata basis whereby fractional entitlements to be disregarded. Following completion of the Proposed Distribution, any resultant fractional SCM Shares will be aggregated and held by SCI for future disposal.

SCI shareholders would receive between 427 and 491 SCM Shares for every 100 shares owned.

Sembcorp Industries’ Stake In Sembcorp Marine

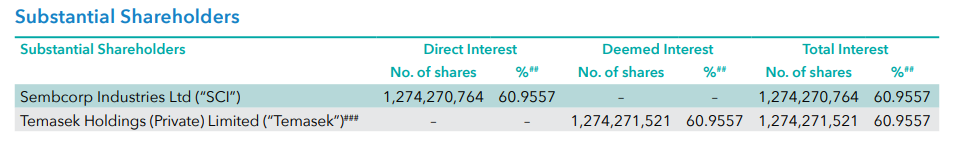

Currently as at 9th March 2020, SCI’s stake in SCM stands at 60.9557% or 1.27 billion shares. Based on the information we can get from Sembcorp Industries’ Annual Report, we can see that their Net Asset Value per share is $3.85.

If we work backwards and subtract the portion that comes from Sembcorp Marine at its share price at that point of time ($1.32), we can see that the NAV/share will equate to roughly $3.088/share.

How Is The Distribution Per Share Calculated

As for how they arrive 427-491 SCM shares for every 100 SCI shares owned, you take their current stake in Sembcorp Marine multiplied by 6 and then divided by the total number of shares issued for Sembcorp Industries and you will end up with 4.277 per share.

Also it’s good to note that if they subscribe a full S$1.5 billion worth of rights shares, each SCI shareholder will get 5.2 SCM shares for each share they own.

What Should Current Shareholders Do?

Sembcorp Industries

There are 2 options right now for current SCI shareholders.

1. Sell when the market rallies and take any loss/profit you can get

If i was a shareholder,I would be very happy to hear that SCI is selling their stake in SCM and using the proceeds to actually focus on their main business’s growth and development.

2. Buy and Hold for long term and see what happens post De-merger

Another option would be for shareholders to hold their stakes in SCI and watch the company grow. Though looking at the company’s current outlook and the industry’s downturn, it could take a while before Sembcorp Industries is back on track.

Sembcorp Marine

I would recommend shareholders to subscribe to the rights in excess and take advantage of the huge discount to TERP. It wouldn’t make sense for shareholders to sell right now with the share price plummeting at the moment, you are essentially locking in your losses without trying to fight the battle.

Of course, if you would like to just sell your stake and reinvest into other assets, that is fine as well but most shareholders do not have the mental strength to cut loss and turn the paper losses into actual ones.

What Can Non-Holding Investors Do?

Non-holding SCI and SCM investors can take this opportunity to either, re-evaluate the 2 companies and see if there is an opportunity to invest in either of them taking into account that both companies’s share price has fallen quite a bit, or to use this opportunity and subscribe in excess to the SCM rights issue and hope to flip for a quick profit on the day the rights shares commence trading.

I would personally not recommend the 2nd option unless you have some spare capital to play with and don’t mind risking your capital for a quick profit.

Final Thoughts

I personally feel that this is a great step moving forward as both companies will be separate entities and can focus on growing their businesses individually. Though this is a great step moving forward, I am still not looking to invest in either of these companies as the industry’s current outlook is not looking very well.