Over the past two years, the Federal Reserve has undertaken one of the most aggressive rate-hiking cycles in decades. The Fed raised rates at the fastest pace since the early 1980s to combat a sharp surge in inflation. This inflation spike was driven by a range of factors, including post-pandemic demand surges, global supply chain disruptions, and rising commodity prices. With inflation consistently surpassing the Fed’s 2% target, the central bank had to act decisively. As a result, borrowing costs for consumers and businesses surged, mortgage rates climbed, and market liquidity tightened. These measures helped temper inflation but also slowed economic activity. Now, with inflation easing significantly, the Fed has started executing rate cuts, starting with a 50bps cut last night. In this article, we’ll cover the potential impacts of the Fed’s cutting rates and possible sectors that might thrive/suffer from them.

Why The Fed Is Cutting Rates Now

After two years of aggressive rate hikes, inflation is stabilizing. In mid-2022, inflation peaked at over 9%, but recent data shows it has fallen closer to the Fed’s 2% target. This reduction is largely due to easing supply chains, falling energy prices, and the dampening effect of high rates on consumer demand.

Despite these improvements, the economy faces new challenges. The rapid rate hikes necessary to control inflation have started to slow economic growth. Key indicators such as consumer spending, business investments, and housing market activity are showing signs of fatigue. The labor market, while still strong, is cooling, with slower job creation and moderated wage growth.

The Fed’s goal is to balance price stability with sustainable economic growth. With inflation now under control and economic risks increasing, rate cuts may be necessary to prevent a recession. The Fed must balance its approach—acting too slowly could lead to a deeper contraction while acting too quickly could undermine its inflation-fighting progress. The shift to rate cuts reflects a move from inflation control to economic stabilization.

What This Means for the Economy

The potential Fed rate cuts signal an acknowledgment of the fragile economic environment. Here’s how these cuts could affect the economy:

- Easing Financial Conditions: Lower rates reduce borrowing costs for businesses and consumers. This could boost spending in areas like housing, where high mortgage rates had previously stifled activity, and in business investments, where high financing costs had led to postponed projects.

- Stimulating Investment and Spending: Cheaper credit encourages business expansion and new projects. Consumers might also increase spending on major purchases, such as cars and homes, as loan costs decrease. Lower rates typically boost the stock market, as equities become more attractive compared to bonds and other fixed-income investments.

- Labor Market Implications: Lower rates could stimulate job creation, benefiting sectors like construction, technology, and consumer services that have been sluggish due to high borrowing costs. However, the Fed must be cautious, as excessive stimulation could reignite inflationary pressures, especially in a still-tight labor market.

- Risk of Reigniting Inflation: Although inflation has decreased, the Fed’s long-term credibility depends on keeping inflation near its 2% target. Aggressive or premature rate cuts could trigger renewed inflation, undoing recent progress. The challenge is to provide relief without overheating the economy.

Impact of Rate Cuts

The extent of the rate cut will be closely monitored. Before the official announcement of the 50bps rate cut, there was a 65% forecast for a 50bps cut and a 35% forecast for a 25bps cut. Here’s how different scenarios could impact the economy and markets:

- 50 Basis Points (bps) Cut: A larger cut would signal the Fed’s deep concern about economic slowing and its willingness to act aggressively. This could boost market confidence, with equities likely to rally as expectations of supportive monetary policy rise. However, it might also raise fears of potential inflationary pressures and introduce market volatility.

- 25 Basis Points (bps) Cut: A smaller cut would reflect a more cautious approach, suggesting that the Fed sees a need for easing but remains wary of inflation. This would likely lead to a more measured market reaction, with a moderate boost to consumer spending and business investment. The impact on the economy may be slower and less pronounced compared to a larger cut.

Fed’s Decision Moving Forward

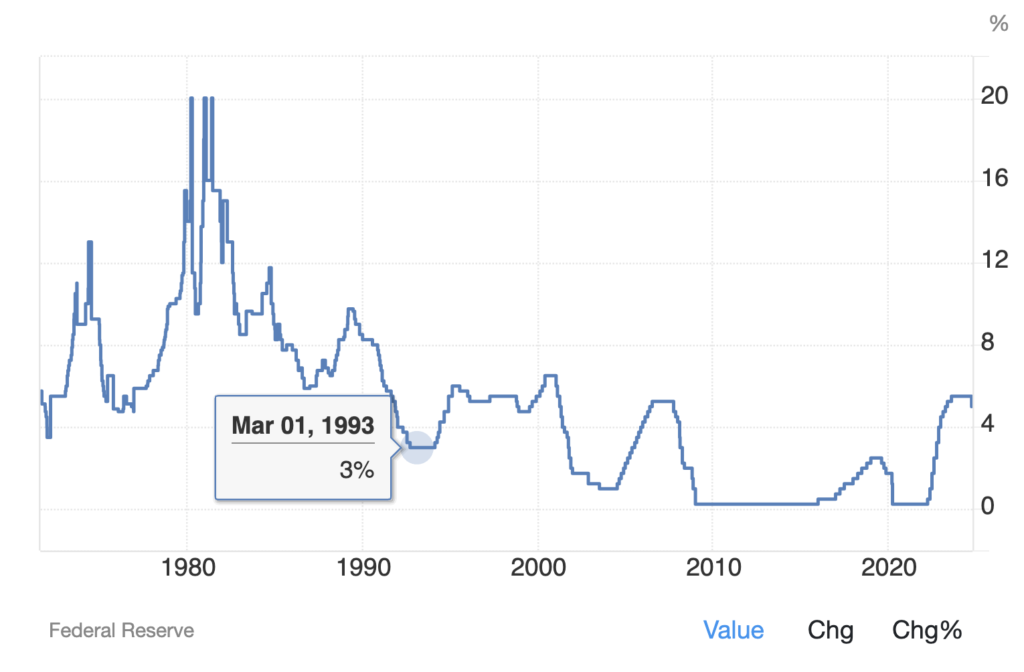

The Feds have also signaled the possibility of 2 more rate cuts (25bps each) in 2024, along with a 100bps cut in 2025 and a 50 bps cut in 2026. This will leave us at a terminal rate of 2.75% to 3% by the end of 2026. For further context, the US Federal Reserve last stabilized rates at this level was back in 1992 for approximately 15 months before rates started hiking again. Despite rates being cut so aggressively in the next 2 years, we are nowhere near the previous level of near 0% back in 2009 to 2015. This new terminal rate might be the new norm moving forward, so it might be wise for investors to stop hoping for near 0% interest rates again as that is very unlikely to happen.

Industries Poised to Win and Lose

Historically, there are proven winners and losers whenever there are rate cuts. Some industries will be impacted more than others. Here’s a look at potential winners and losers:

Winners

- REITs (Real Estate Investment Trusts): REITs are likely to benefit from lower rates, as cheaper borrowing costs can drive up property values. Additionally, lower rates make dividend-paying stocks like REITs more attractive to income-seeking investors.

Read Also: My Top 5 Exciting REITs To Watch in 2024

- Technology: Technology companies, particularly those focused on growth, depend on low borrowing costs to fund expansion and innovation. Lower rates could improve profitability and spur investment in research and development. Historically, tech stocks perform well in low-rate environments.

Losers

- Banks: Banks might face challenges as lower rates compress the margins on loans. Although rate cuts can stimulate loan demand, the profitability of those loans may decrease. Banks reliant on net interest income could see diminished earnings.

- Energy: The energy sector may struggle. Energy companies, particularly those involved in fossil fuels, tend to perform better with high inflation and elevated energy prices. Lower rates might signal weaker demand, potentially leading to softer energy prices and reduced profitability.

Conclusion

As the Fed prepares to cut rates aggressively, the market watches closely. A rate cut could provide much-needed relief to a slowing economy, but it carries the risk of reigniting inflation. The Fed faces a critical challenge: Can it navigate a “soft landing,” managing inflation while avoiding a recession? Or is a recession inevitable, with rate cuts only delaying the inevitable downturn? The coming months will reveal whether the Fed can effectively balance these competing priorities.