When it comes to investing, there is no one right way that can make you money, it all comes down to what strategy works best for you. There is a huge range of investing strategies from the well known growth and value investing to the newer strategies like quantitative investing.

For investors who are more focused on the number crunching, quantitative part of investing, PyInvesting is here to help make your life easier. In this article, I’ll be sharing on this new and powerful tool for quantitative investing.

Note : This is a sponsored post

Introduction

PyInvesting was founded by Ivan who worked as a software developer at a hedge fund, responsible for building the fund’s trading system. PyInvesting was initially built to manage his own portfolio using a data driven approach to investing. After a few months, he decided to open up the platform to the community so that other investors could try out and create their own quantitative investment strategies.

PyInvesting.com is still in its early stages and has 3 main sections as of now, the screener, backtester as well as the live section which allows users to go live with their strategy. Let’s take a look at the key features and what they can do.

Key Features

1. Backtest

The backtest feature is the main focus of the platform. It is essentially a simulation of an investment strategy using historical prices. The best part is, PyInvesting already has a few backtest strategies that you can use and test out on the platform.

For example, the Relative Strength Backtest selects the top few stocks with the strongest signals among all stocks to form a portfolio. You can then set benchmarks which you want to compare your strategy’s performance against. By default, it’ll be set to SPDR’s S&P 500 Index (SPY) but you can add additional ones such as Vanguard’s Total U.S. Stock Market (VTI).

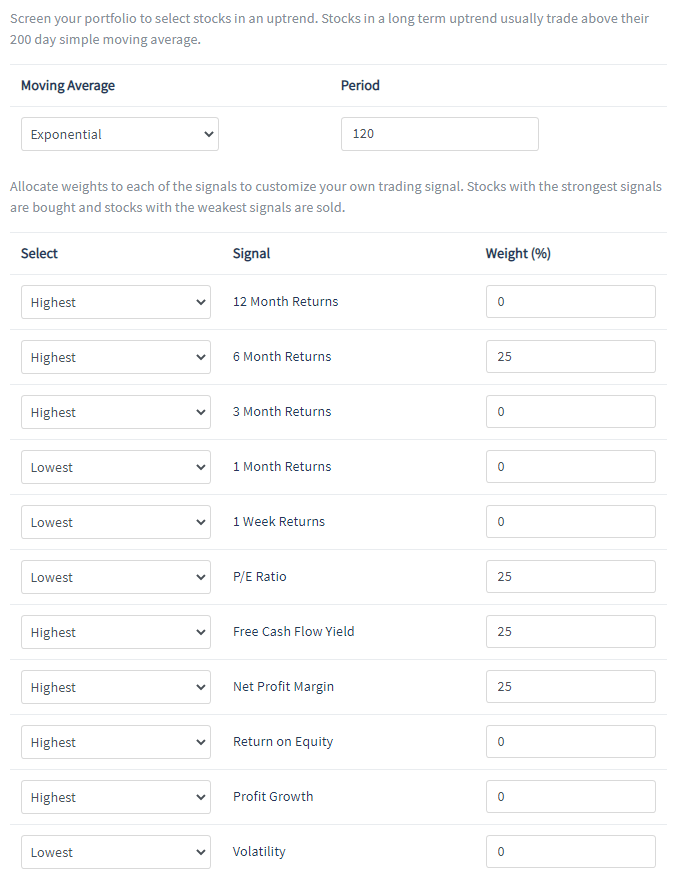

You can also customize the weightage of certain signals based on the strategy you are trying to test out. For the Relative Strength Backtest, these are the default weightages being set.

Once you are done with the weightage, you can select the number of stocks you want to put into your simulated portfolio. You can also choose how often you want the portfolio to be rebalanced, going weekly to monthly to yearly.

Another cool feature about this backtester is that you can choose to use PyInvesting’s risk management system to adjust cash allocation based on market sentiment. Once you’re done, you can run the backtest, which will take about 3-5 minutes.

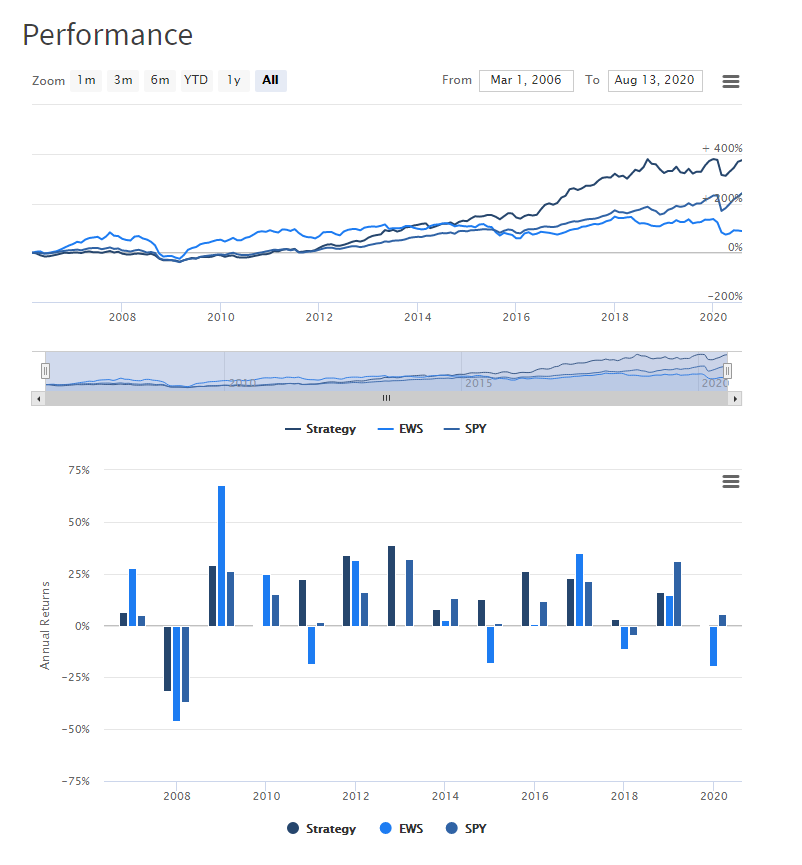

Once the backtest is done, it will display the backtest’s performance and relevant data.

Note : This strategy is based on choosing the top 10 stocks from their default S&P 500 portfolio and is rebalanced weekly.

Performance Against Benchmarks

To start off, they will show you across the board, the performance of the strategy against the benchmarks you’ve set. As we can see, this strategy outperformed the SPDR S&P500 Index as well as iShares MSCI Singapore ETF by a great margin. It also achieved the lowest volatility with the highest annualized return as well as the lowest maximum drawdown.

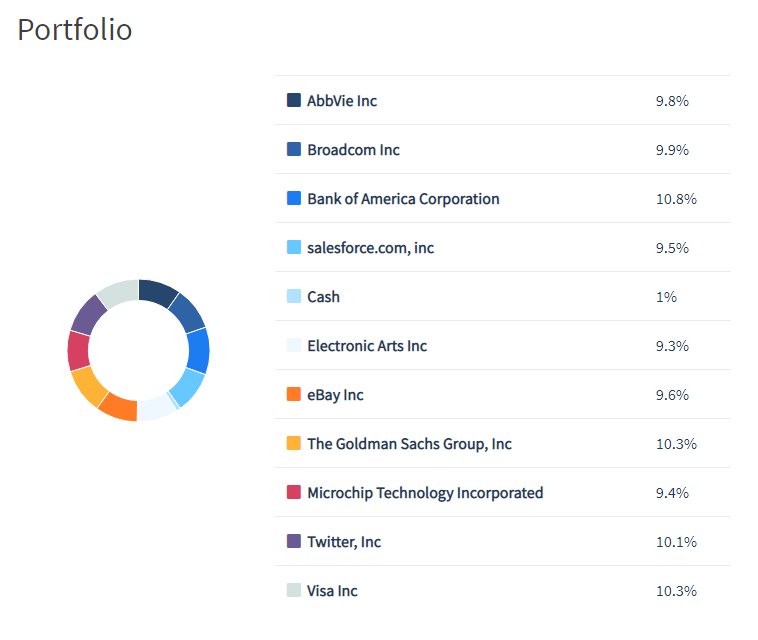

Portfolio Weightage

Next, you can see the end portfolio weightage and components you will have.

Changes in Portfolio Allocation

You can also see the changes in portfolio allocation as time passes.

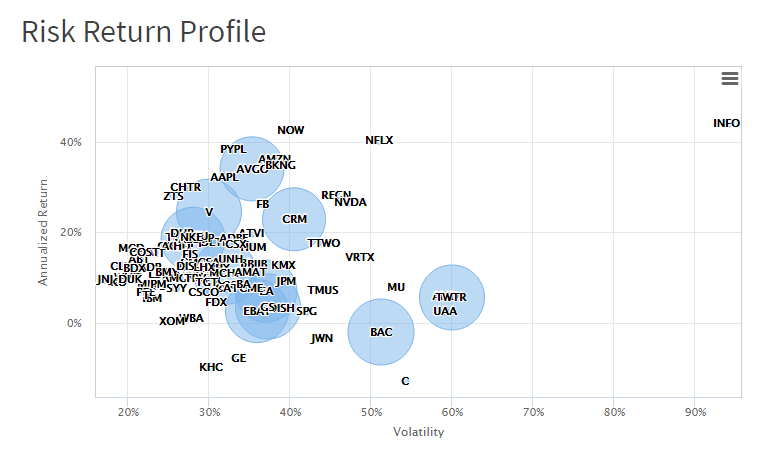

Risk Return Profile

They also add in a risk return profile for every stock that you have chosen in the portfolio, which is the default S&P 500 portfolio in my case.

2. Going Live

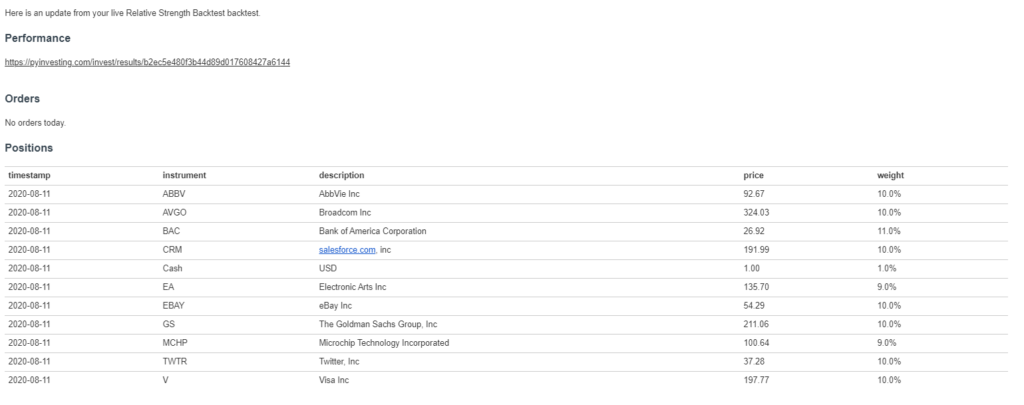

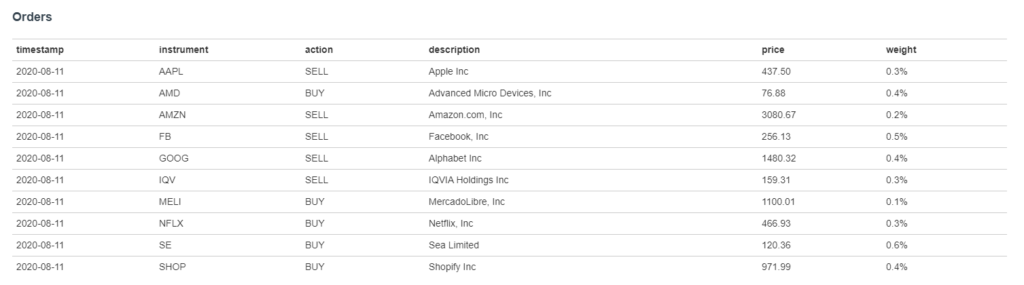

After you have finished analyzing the backtest, you can actually have it running live, which means you can start having PyInvesting actively inform you how you should allocate your portfolio according to this strategy. Once you start running it live, you will receive email updates every weekday on your portfolio allocation as well as the performance of the portfolio.

Based on your portfolio rebalancing frequency, you will receive orders, which are essentially changes you should make to your portfolio based on the back test you have used.

| Rebalance Frequency | Weekly | Monthly | Yearly |

|---|---|---|---|

| When It Comes | Every Wednesday | Every First Day of The Month | Every First Day of The Year |

You can see a sample of how it would look like below.

3. Screener

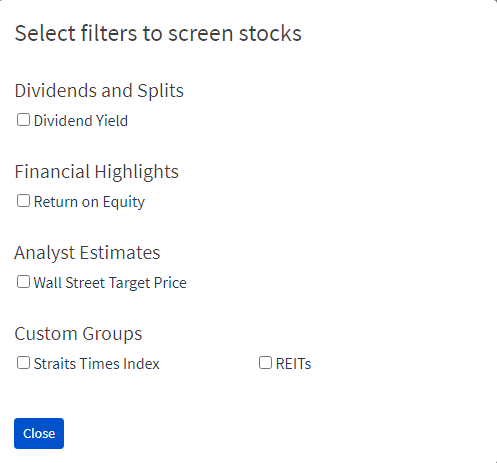

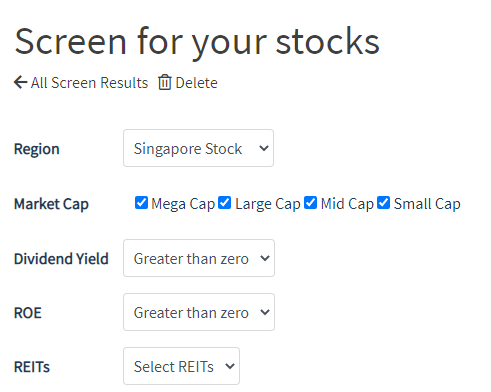

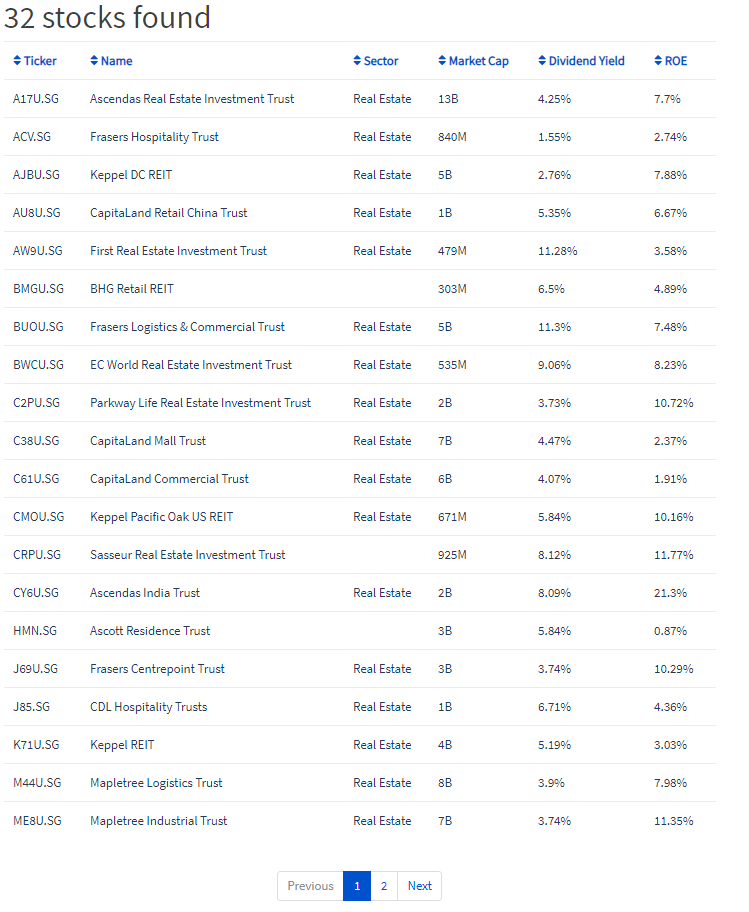

PyInvesting also has a screener which you can use. As of now, there are other 5 filters you can use other than the default one which is “Market Cap”.

Sample Screen

To showcase the screener, I’ve decided to run a simple one as you can see below.

From this screen, I managed to screen out 32 REITs out of the 42 REITs in Singapore, including stapled and property trusts.

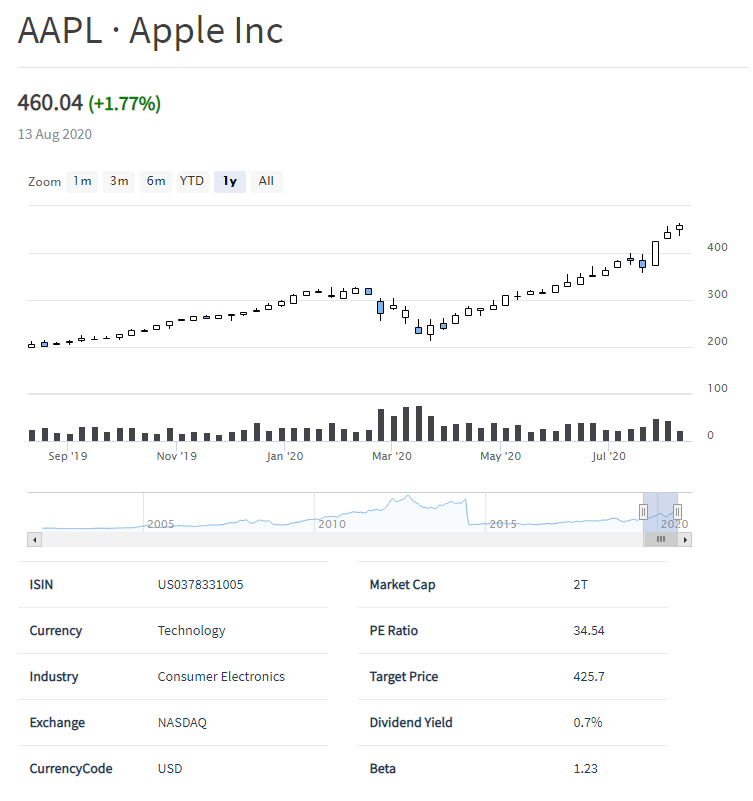

4. Stock Information

On PyInvesting, you can search for stocks and do your research on the platform as well. I’ll be using Apple (AAPL) as an example here. Right off the bat, you can see the basic information of the company such as its market cap, PE ratio, dividend yield, industry as well as a chart showing its performance.

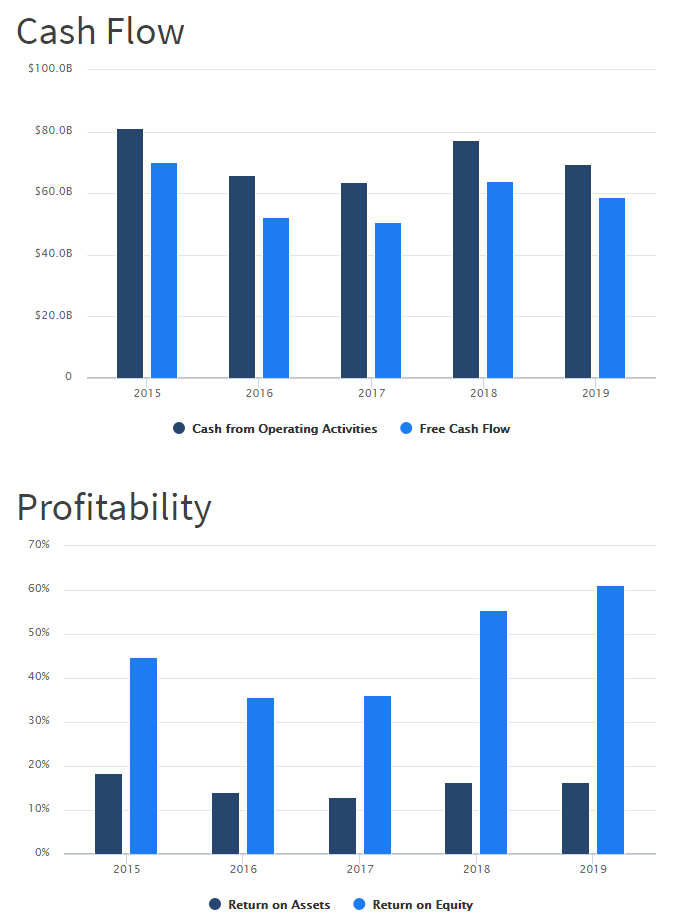

As you scroll down, you will find information such as the earnings as well as the valuation of the company. I personally find the PE ratio valuation chart pretty useful as you can clearly see the historical trend of the PE ratio for the company as time passes.

As you scroll further, you will find information such as cash flow and profitability of the company. What’s really cool is the fact that it not only shows the net cash from operating activities but also the free cash flow, which is very a important number to use when assessing a company’s financial health.

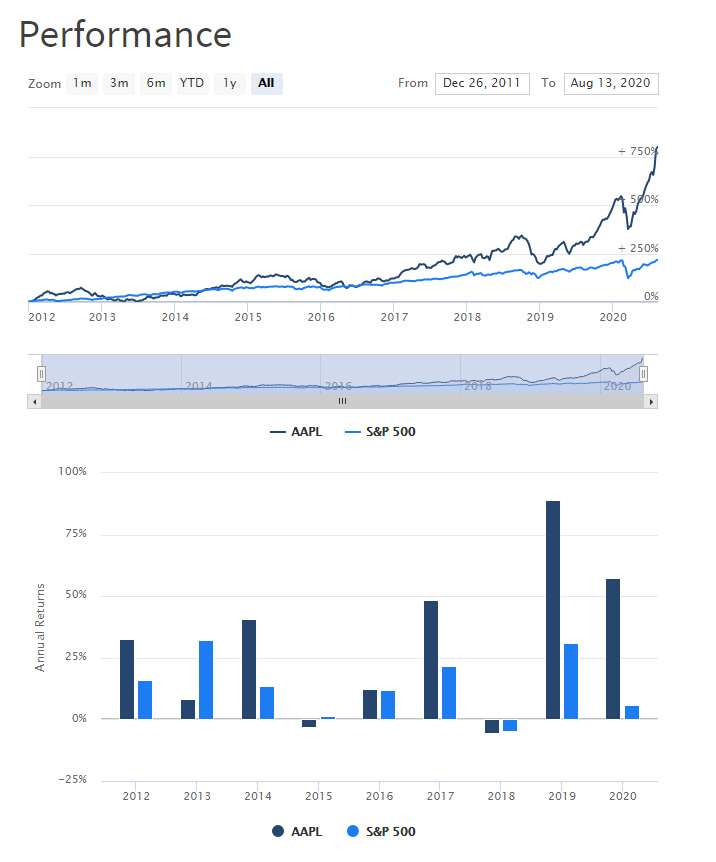

Towards the end, you can find the stock’s performance compared to its market index. So for example, AAPL’s benchmark comparison it will be the S&P 500 Index and for Ascendas REIT it will be the Straits Times Index.

Final Thoughts

Personally, even though I’m more of a fundamental investor, looking at the business as a whole, I feel that PyInvesting has many use cases other than for quantitative investing. For example, I could integrate it into my research process, using it as a screener as well as a a back tester. Another use case would be to use the back tester to test certain theories or approaches such as investing in companies that historically had a low PB ratio, or companies that historically had a high PE ratio, etc.

I’m happy to announce that sgstockmarketinvestor is collaborating with PyInvesting. As such, if you sign up using my sign up link, you are entitled to a free 1 month trial of the premium features. The main differences between the free and premium version is as such :

Of course, if you love the platform and the tools, the premium version is a huge must and it isn’t gonna cost you an arm and a leg as well. On top of the free 1 month trial, if you sign up with my sign up link and you decide to subscribe to the premium version, you will get a 20% discount for life. This means, for only $16/month, you will get all the premium features of PyInvesting. As for myself, I will get a 20% cut of the net proceeds from each subscription.