Most of my readers should know by now that I’ve been actively talking about Tiger Brokers as well as been using the platform myself for the past few months. If you haven’t seen the previous review I’ve written, check out 4 Reasons Why I Love Tiger Brokers !

I’m sure there are many investors that are considering whether or not to use the platform for trading/investing but find the process challenging as they are new to it. Today I will be sharing my own personal experience with Tiger Brokers as well as some of the new features they have on the platform.

Note : This is a sponsored post

Setting Up The Account

Setting up the account was a very fast and simple process which you can easily do on the mobile app. When setting it up on the mobile app, you’ll be given 2 options, to manually key in all your information such as name, DOB, address, or to set up the account with Singpass. The former method takes about 5-10 minutes while the latter only takes a minute.

Funding Process

Once the setting up was done, you will be prompted to deposit some funds to start trading with the account. If you use a local bank such as DBS, POSB, UOB or OCBC, the process is very simple as you just do a normal bank transfer to their designated bank account. Once the transaction is done, just screenshot the successful transaction and submit it to the app.

The entire process was done pretty quickly. I got my account set up and funded within an hour. My subsequent deposits were processed just as fast with one of them being processed within a minute. Talk about speed and efficiency.

After The Account Is Set Up

After the account is set up, you can access all the features and functionalities within the app which I will be going through in the next few points.

Finding Freebies

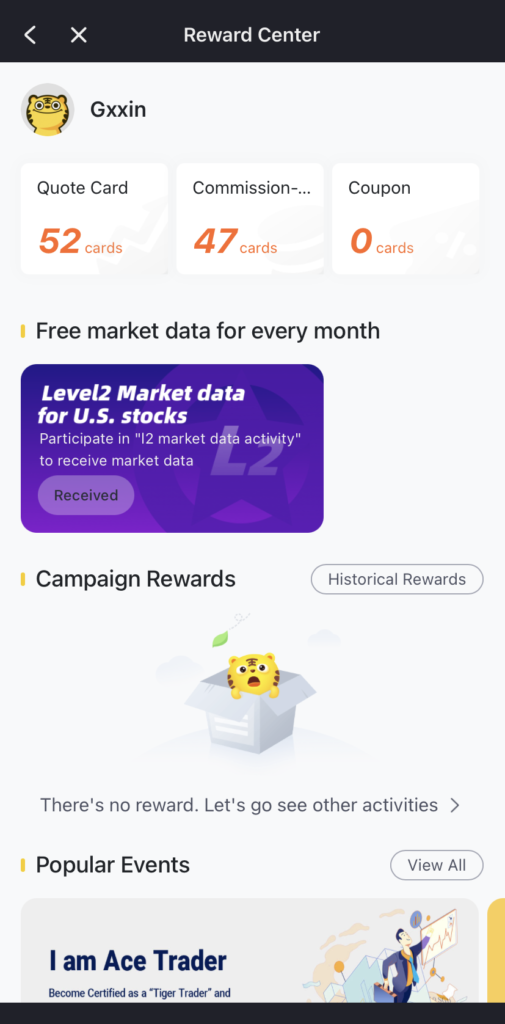

When you sign up with a referral code, you will be entitled to various freebies such as free commission trades and access to level 2 data which is market depth. In the Me Page, under “Promotions & Rewards”, you can find all the free commission cards as well as quote cards that you have entitled to your account.

Don’t forget that you can get free level 2 market data every month for U.S. stocks so make sure you redeem it every month. Also, make sure you redeem your rewards as soon as you get them because they will expire within a certain time period if they are not redeemed.

Do note that the number you see are cards that are not yet used. Those that have been used can be found under the expired coupons link at the bottom.

Currency Exchange

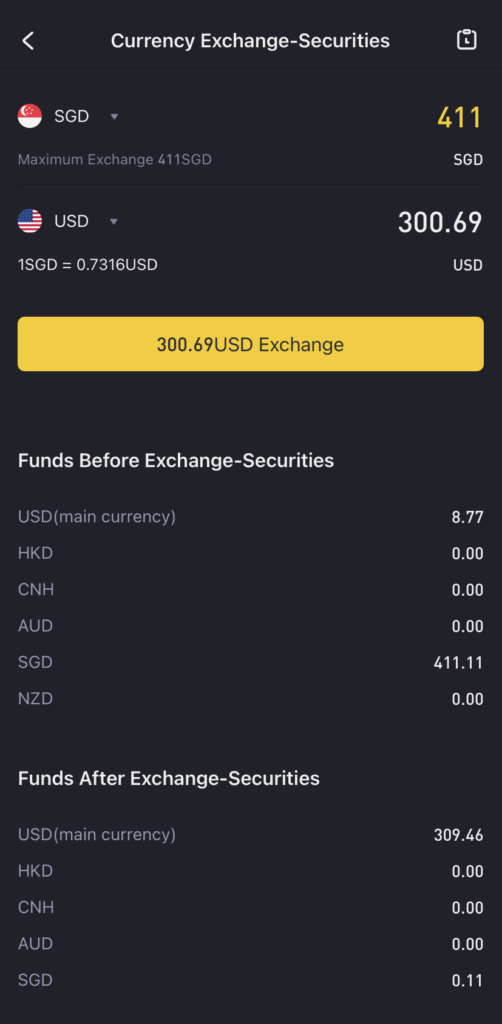

In the app, there is also a currency exchange if you want to use different currencies. This comes in handy for me as I deposit SGD into the account but I also buy some U.S. stocks as well. The exchange rate is based on real time rates which are more attractive than that of banks. There are no extra fees or charges when changing to different currencies.

Using another broker as an example, if you use Interactive Brokers to convert SGD to USD, you will be charged a small fee of around SGD$2. This might be a small sum but if you choose to convert to many other currencies in the future, these small fees are going to be a big issue.

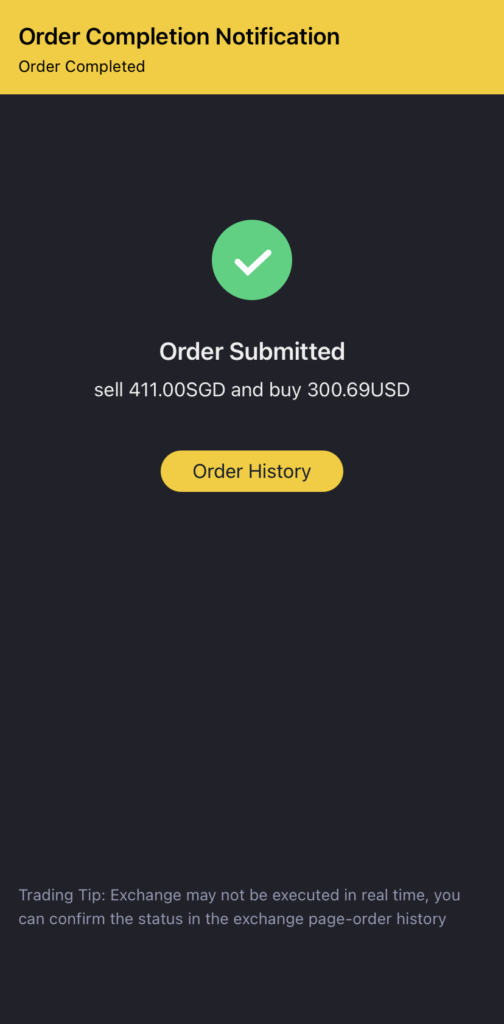

Once you confirm your order, you will come to the order submitted page. The currency exchange order fills immediately and you can use the funds right after. If you use Interactive Brokers, after you are done with the currency exchange, you have to wait for 2 days before you can use the funds which is very inconvenient.

Withdrawal Process

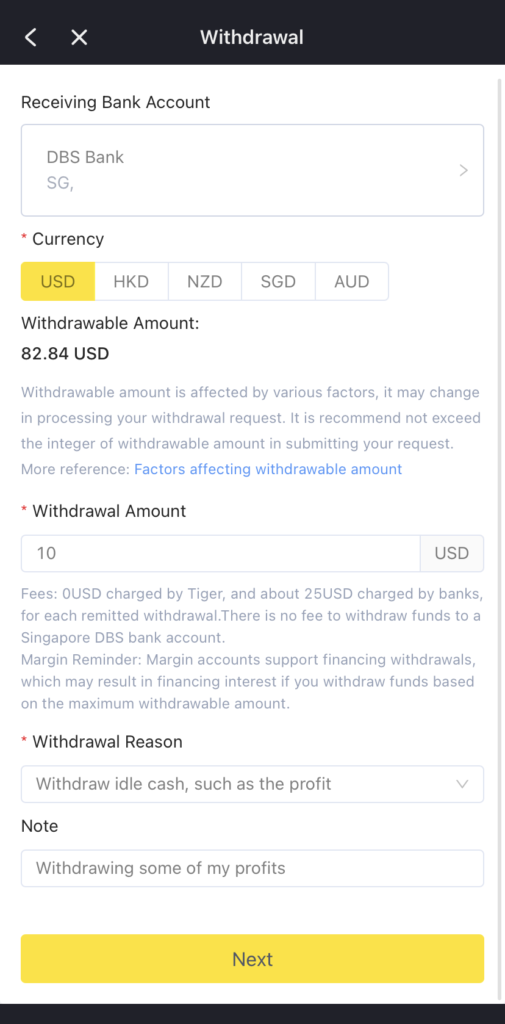

The withdrawal process is fairly simple and straightforward for Tiger Brokers. You add in the bank account you want to withdraw funds to, the currency, amount and the reason. The withdrawal usually takes 1-2 business days but it can be as fast as a few hours.

It is good to take note that when withdrawing different currencies, there might be additional charges from the receiving banks. If you were to withdraw SGD to a local bank, there are no charges from both Tiger Brokers and the receiving bank. If you were to withdraw USD to a local bank, there are no charges from Tiger Brokers but there could be additional charges charged by the receiving bank.

Making My First Transaction

In this section, I’ll be taking you through my process when making my first buy order.

Search Function

Before I made the order, I needed to find the stock. With Tiger Brokers’ search feature, I can easily find the stock I want by either searching the name or symbol.

Making The Order

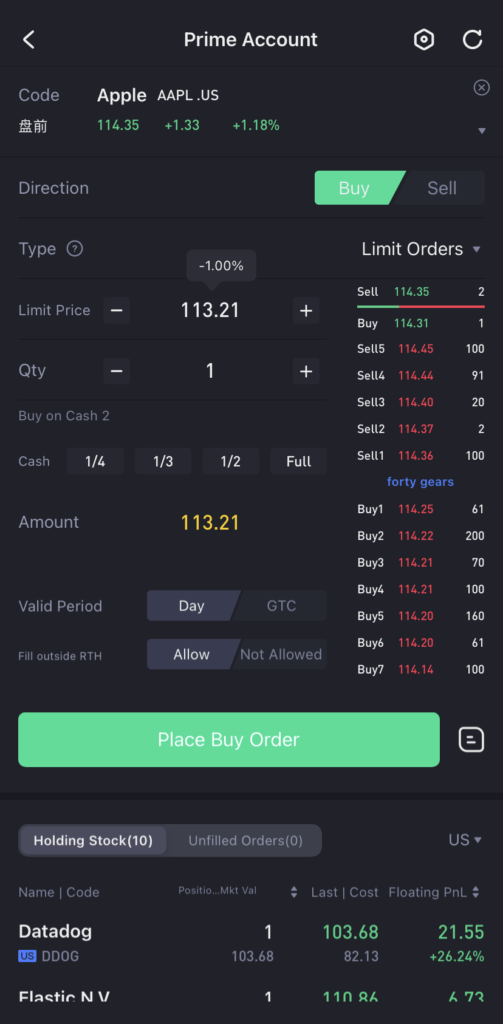

Once I’ve found my stock, I’m presented with a very intuitive UI that shows all the key information I need such as the current bid and ask price, the intraday price change as well as the market depth if you have access to it. You can also find a summarized list of information with regards to the stock such as the 52 week high and lows, current PE ratio, dividend yield and many more.

You are also given the option to see the intraday chart, daily chart, weekly chart and hourly chart and many more.

When making an order, all the relevant information is laid out in a nice and neat manner so that you can make the best informed choice. There is a small bubble above the price you set, letting you know how much does the price need to change in order to reach the set price. It also lets you know under Qty, the amount of shares you can buy based on the amount of buying power you have and the limit price you set. With Tiger Brokers, you get many options when making a trade from the type of order all the way down to how long you want the order to run.

Types of Orders

There are 4 types of orders you can make with Tiger Brokers. The traditional Market and Limit orders are known to all. They also have a Stop-Loss as well as Stop-Limit order. The Stop-Loss order is well known amongst traders as a way to create a safety net should a stock see a sudden plunge in price.

The Stop-Limit order is something unique which I’ve never seen before. The Stop-Limit order essentially allows you to set a trigger price. When the stock hits the preset trigger price, the order then becomes executable and enters the market in the form of a limit order.

Order Validity

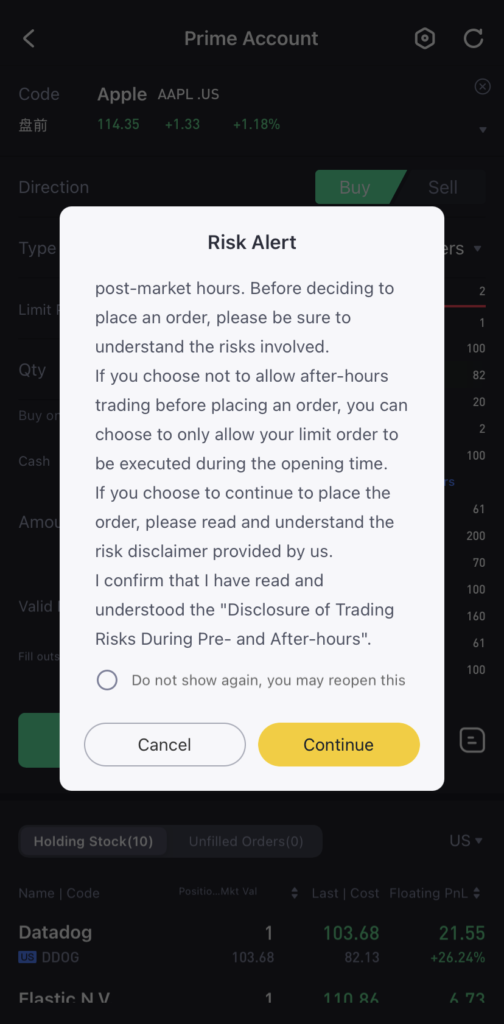

On Tiger Brokers, you can set the order to be valid until the end of the day or until the order is completely filled. You can also choose the option to have the order fill outside normal trading hours.

Order Completed

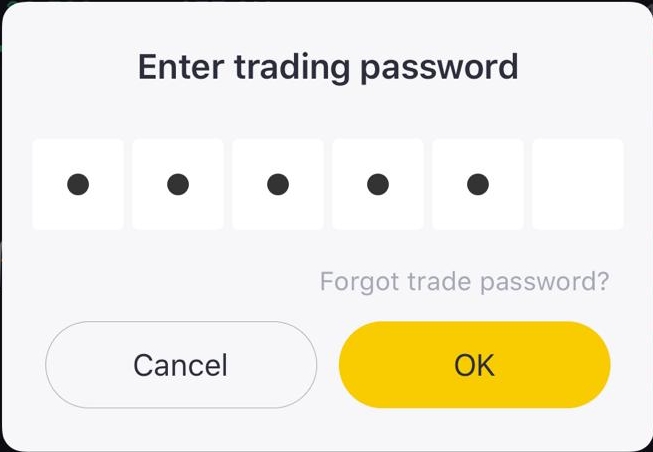

After you click onto continue you will be prompted to key in your trading password. If you log into the Tiger Brokers mobile app using face or fingerprint verification, you might not be prompted with this.

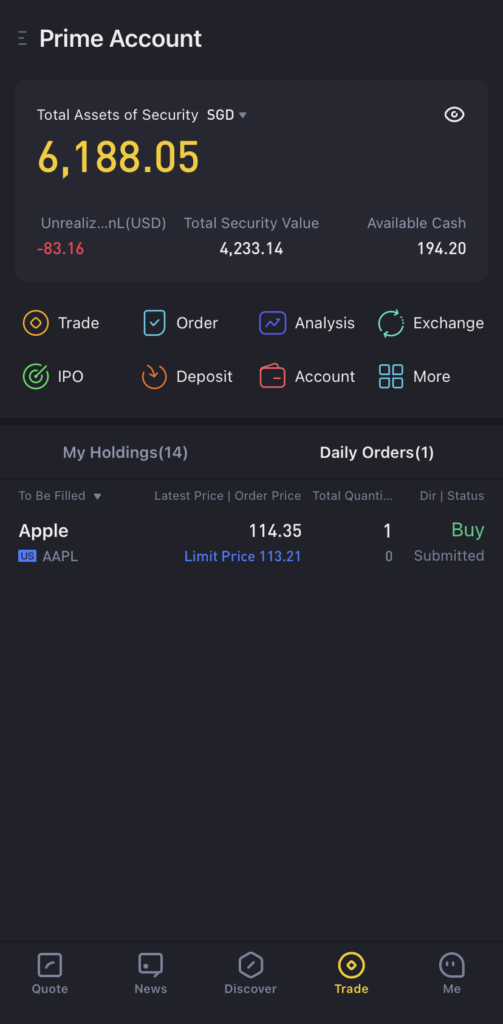

Once the order is done, you can find it under Trade in the “Daily Orders” tab.

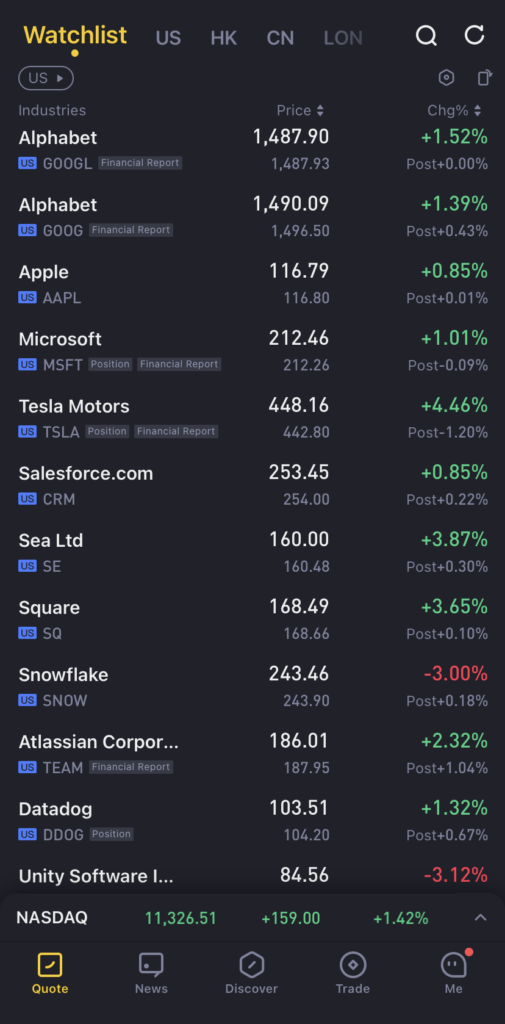

Watchlist

The watchlist feature is a very important one to have for me as I like to set all the stocks I’m watching with the brokerage. This way, I can monitor all the price changes. You can add all the stocks you want in your watchlist and then further filter them based on the exchange they are on like Singapore or US.

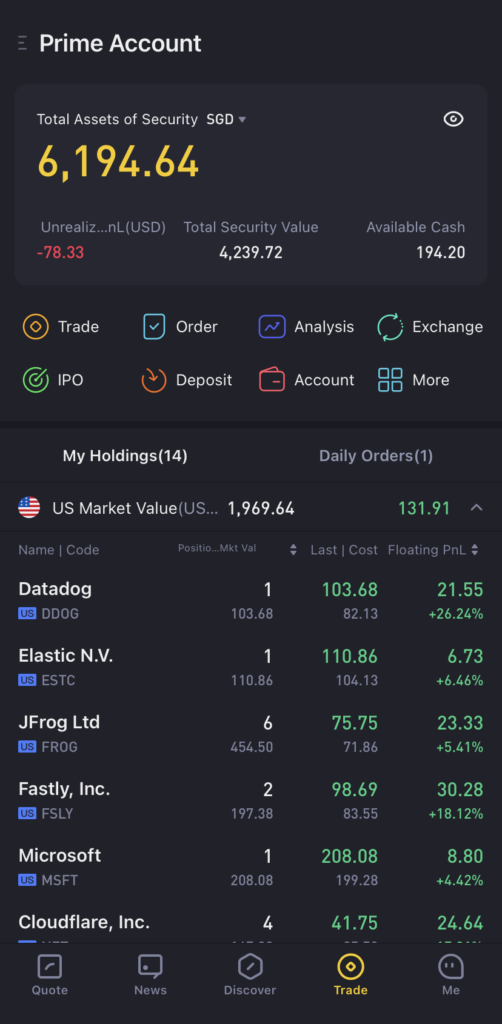

Portfolio Overview

One of the key features I really like about Tiger Brokers is the portfolio overview. With one look, you can see your entire portfolio with all the needed information in there. You can see what’s your cost price, quantity, overall unrealized gains/losses with each of your positions. They also separate out your portfolio based on the exchanges each stock is in which is pretty neat.

The Tiger Brokers Community

Something that sets Tiger Brokers apart from the other traditional brokers we have in Singapore is that they have a few social media accounts to better interact with the community and its users. This is a definite plus point because they are more connected with their user and the community as compared to the other brokers. This gives us users a chance to provide feedback or give our input on future features that can improve our overall user experience.

Currently, they are on 3 different social media platforms namely Facebook, Instagram and Telegram. In the Facebook group, the admin as well as other users regularly share the latest and trending news topics that are related to the stock market. As for the Instagram, it is still fairly new so they are only updating the account with new features and promotions.

The really interesting one is the Telegram group chat. There are a couple of Tiger Broker admins that regularly communicate with the users in the group. It creates a nice community of users that often share and help each other be it when navigating through the app or when they face certain issues. It warms the cockles of my heart to see that all the users in the group are actively helping one another.

Final Thoughts

Overall, I am very satisfied with Tiger Brokers with the very low commission costs and easy to use user interface. The broker is still relatively new which is a good thing as they are actively creating new features to help improve the platform for users.

Tiger Brokers can also be used for Dollar-cost averaging (DCA) because of their very low commission costs. With their on going promotion for Singapore stocks, there is no minimum commission being charged. This will allow you to buy as many or as little as you want without paying a minimum commission.

I lost heavily vested in s-chip and so i am skeptical of chinese company. I am sorry if that turn u off, hope your reader dont take me seriously, Currently i am using iocbc. the comm is quite exp, but the dealer is OK.

I want to know who are the custodian of your share? What happen if Tiger go bust> what will happen to my share?

And also ,i know they are cheap, fundsupermart is also cheap, but their US stock price are delay,is tiger stock price real time at the buy/sell format.. Thank you

You can find it under this article I wrote previously : https://sgstockmarketinvestor.com/4-reasons-why-i-love-tiger-brokers/

“It is good to note that when buying Singapore shares, these shares will be custodized with DBS while foreign shares will be custodized with other reputable brokers. The funds that are in your Tiger Brokers account is also with DBS. Being a Capital Markets Licensee under MAS, clients’ funds and assets will have to be segregated from Tiger Brokers.”

As for your second question, for US stocks, Tiger Brokers will indicate real time buy/sell if you have access to L2 data which is given free every month currently!