Mapletree North Asia Commercial Trust (MNACT) has just changed their mandate and immediately announced a new acquisition. This is a very good piece of news for shareholders as this allows MNACT to acquire assets from a wider range of countries. In this article, I’ll be talking about the new mandate change and the proposed acquisition.

What’s The New Mandate?

On the 25th of September, MNACT announced to shareholders that they have expanded their investment mandate to include South Korea.

The new mandate will now allow MNACT to invest, directly or indirectly, in a diversified portfolio of income-producing real estate in the Greater China region, Japan and now, South Korea. These properties will be primarily for commercial purposes (including real estate used predominantly for retail and/or office purposes).

Why Does It Matter?

The expansion of the mandate is in line with the Manager’s key financial objectives to provide shareholders an attractive rate of return on their investment through regular and stable distributions as well as to achieve long-term growth in distribution per unit and net asset value per unit whilst maintaining an appropriate capital structure fore MNACT.

South Korea is a well established country with fantastic investment opportunities for MNACT. The Manager is of the view that the broadening of the mandate into South Korea will help widen MNACT’s access into another scalable new market with quality commercial assets and freehold land tenure, and will further accelerate the diversification of MNACT’s portfolio

The Acquisition That Followed

1 minute and 37 seconds later, an acquisition was announced.

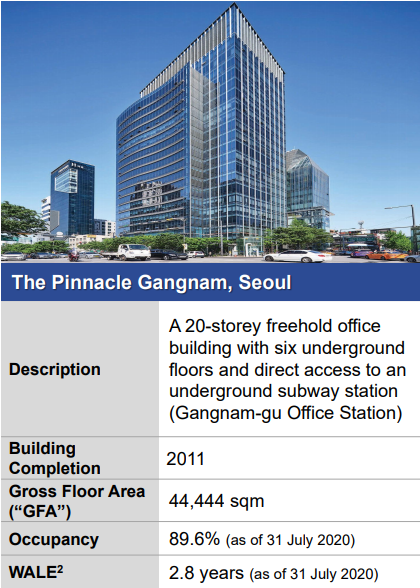

Acquisition Details

MNACT has entered into a unit sale and purchase agreement to acquire 50% interest in “The Pinnacle Gangnam”. Of the remaining 50% interest, 49.95% is held by Gangnam Asset Pte. Ltd., an indirect wholly-owned subsidiary of Mapletree Investments Pte. Ltd. The remaining 0.05% is held by an unrelated 3rd party investor.

The independent valuation of the property stands at KRW458.8 billion (S$536.4 million). The agreed property value is slightly lower at KRW452.0 billion (S$528.4 million) and the agreed value that MNACT has to pay for 50% interest in the property amounts to KRW226.0 billion (S$264.2 million). The estimated total acquisition cost including professional fees and fees payable to the manager amounts to KRW228.9 billion (S$267.6 million).

Waiver of Performance Fees

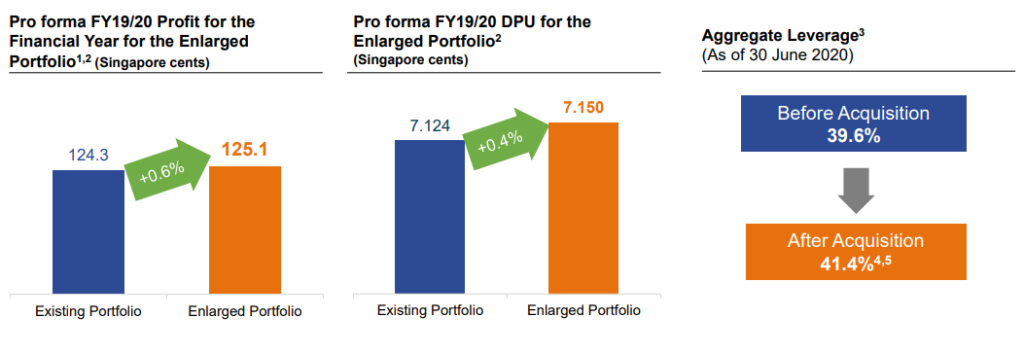

In view of the impact of COVID-19 on MNACT’s distribution to shareholders, MNACT’s Manager has also taken a positive step forward in bringing value to shareholders by waiving the entitlement of performance fees.

The performance fees will be waived until such time whereby the DPU exceeds the threshold DPU of 7.124cents, which was the DPU achieved in FY19/20. prior to the full year impact of COVID-19. This means that for the manager to be entitled to the performance fees, the 2nd year’s DPU has to not only exceed the 1st year’s DPU but it also has to exceed the threshold DPU.

It is good to note that once this threshold has been exceeded, it will not longer be applicable in the following years to come and the Manger will continue to be entitled to receive the Performance Fees.

Pro-Forma Impacts

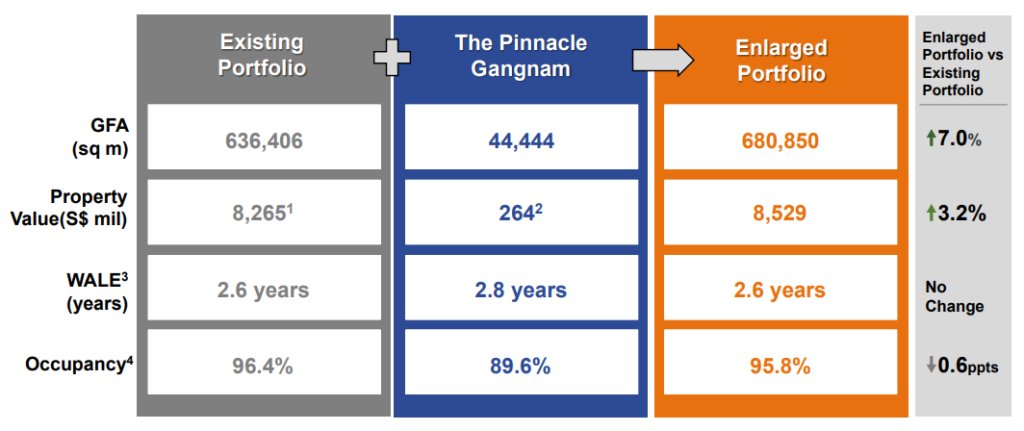

Portfolio

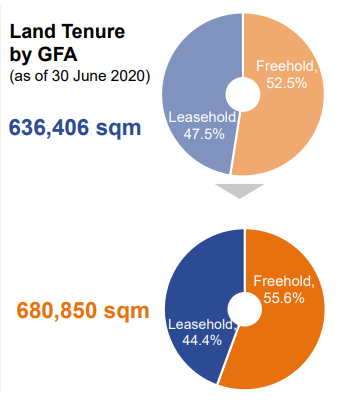

The pro-forma portfolio has an increased GFA of 7% and an increased property value of 3.2%. The WALE was unchanged while the occupancy rate will fall by 0.6ppts to 95.8%.

Financials

The pro-forma financials look pretty good with the FY19/20 profit to increase by 0.6% and the FY19/20 DPU to increase by 0.4%. The aggregate leverage jumped up to a high 41.4% from 39.6% prior. The leverage is definitely worrying as it limits MNACT’s potential to grow further.

My take is that MNACT will probably try to pay down its debt for the next 2 quarters before acquiring the remaining 50% of the South Korean asset. I highly doubt that MNACT will go for any form of Equity Fundraising (EFR) to acquire the remaining 50% interest as it will most probably be highly dilutive. Although, if MNACT acquires more than just the remaining 50% interest in the South Korean asset, an EFR might not be the worst option around.

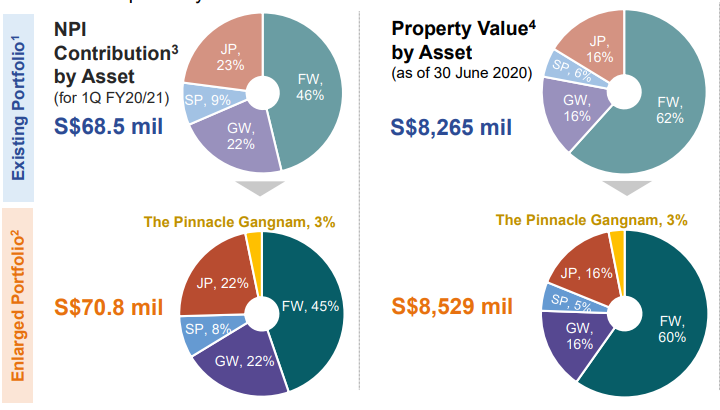

Reduced Income Contribution From Any Single Property

This is my favorite part of the acquisition. With the new acquisition, Festive Walk’s income contribution to MNACT’s total portfolio will be reduced to less than 50%. This is a very big change as Festive Walk was MNACT’s prized asset but has since become a slightly underperforming asset due to the situation in Hong Kong. With Festive Walk now accounting for less than 50% of MNACT’s income contribution, MNACT’s NPI and DPU will become more stable moving forward.

Increased Percentage of Freehold Assets

Another key thing to note about the acquisition is that because it is a freehold asset, MNACT’s percentage of freehold assets has since increased from 52.5% to 55.6%.

Key Benefits Of The Acquisition

Fantastic Location with Grade-A Building Specifications

The property is a quality Grade A building with accessibility to food options and public transport making it a fantastic choice for tenants to go for.

Not to mention its close proximity to a diverse range of other amenities and 5 star hotels.

Leverage on Sponsor’s Resources

MNACT’s sponsor, Mapletree Investments Pte. Ltd., has a total of S$490 million in assets under management in South Korea including the 49.95% interest in the proposed acquired asset which is also subject to a ROFR granted by the sponsor to MNACT.

MNACT can leverage on the sponsor’s brand to grow aggressively in South Korea in the future. For example, the sponsor can start looking out for and acquire high quality assets in South Korea that can be pipelined into MNACT in the future when the asset has matured.

Final Thoughts

I personally own a very small position in MNACT from a very long while ago. I have always loved MNACT because of its high quality assets and the fact that the REIT manager’s fee structure is very aligned with shareholders’ interests. The manager is only rewarded with a performance fee if MNACT manages to increase its DPU year on year. This is very aligned with my investment strategy which is to invest in REITs and companies that are able to consistently grow their DPU and/or dividends year on year.

Moving forward, MNACT has been put back onto my watchlist and I will look to accumulate a bigger position when the price is more attractive. With its current valuation at $0.935/share, it is still very attractive with a PB ratio of 0.66x and a yield on cost of 7.65%.

Heya i’m for the first time here. I came across this board and I find It really helpful & it helped me out much. I am hoping to present something again and aid others such as you helped me.

I really like what you guys are usually up too. This sort of clever work and exposure! Keep up the fantastic works guys I’ve incorporated you guys to my blogroll.

My brother recommended I might like this website. He used to be entirely right. This post actually made my day. You can not believe just how much time I had spent for this information! Thanks!

Thank you for the kind words! Cheers!

Hmm is anyone else experiencing problems with the pictures on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any feedback would be greatly appreciated.

An impressive share, I simply given this onto a colleague who was doing somewhat analysis on this. And he in truth bought me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the deal with! However yeah Thnkx for spending the time to debate this, I feel strongly about it and love studying extra on this topic. If attainable, as you turn out to be expertise, would you mind updating your blog with extra details? It is extremely helpful for me. Massive thumb up for this weblog post!

I will definitey try to imprive the content here but thanks for the great and kind words!

thank you heart

cheers!