The recently proposed merger between Mapletree Commercial Trust (SGX: N2IU) And Mapletree North Asia Commercial Trust (SGX: RW0U) has sparked a lot of interest and negative sentiment with investors. From discussions across forums and chat groups, the general consensus is that this merger is fantastic for MNACT but horrible for MCT but is that really true? Let’s take a deeper dive into the merger details and take an alternate view on the merger itself.

Proposed Merger Details

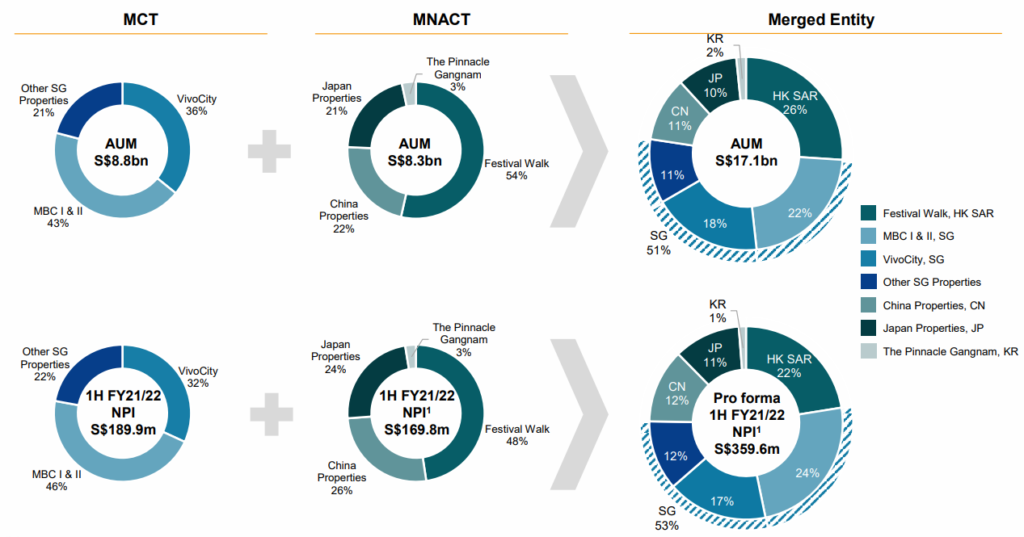

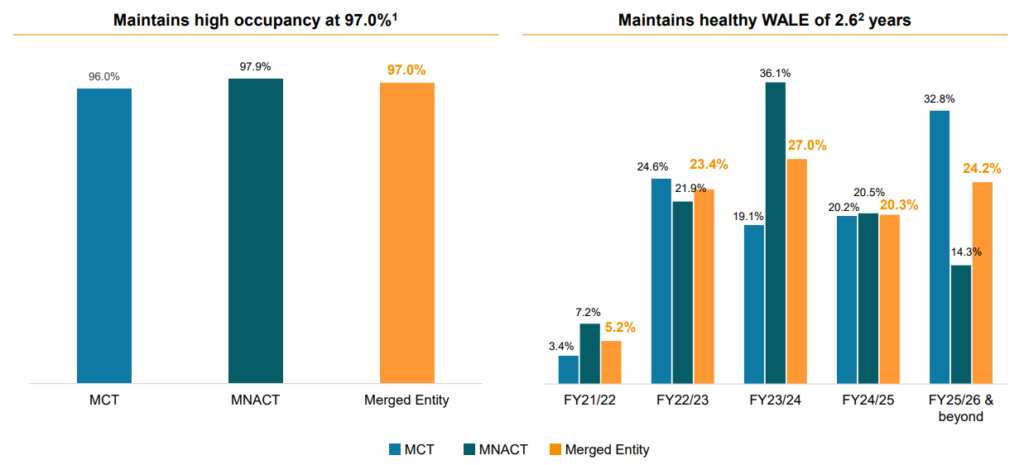

Post-merger, the transaction will create a merged entity which will be named Mapletree Pan Asia Commercial Trust (“MPACT”) with its investment mandate encompassing key gateway markets of Asia. MPACT will have a total of S$17.1B assets under management with a strong portfolio occupancy of 97% and a relatively long WALE of 2.6 years.

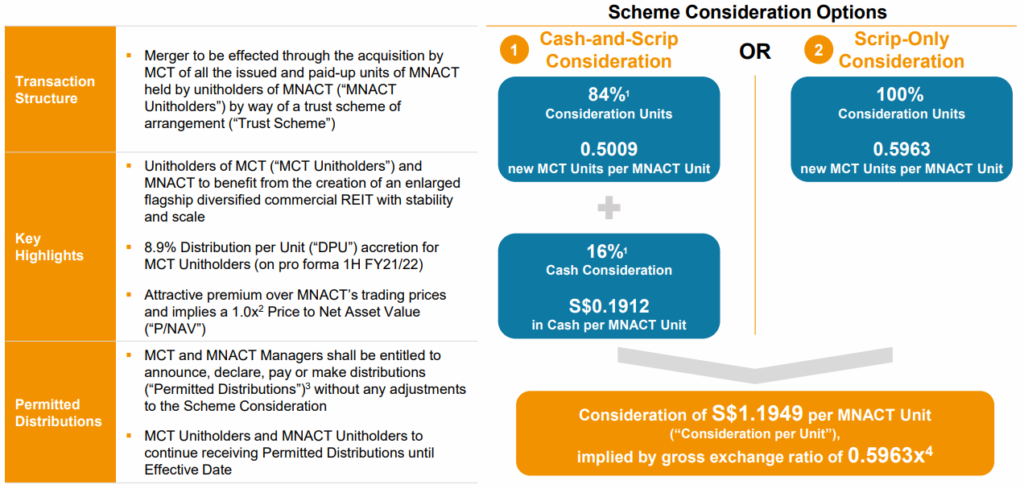

Scheme Consideration

The scheme consideration for MNACT unitholders will be either to opt for 100% shares or 84% in shares and 16% in cash. MNACT shares are priced at 1x Price to Net Asset Value (P/NAV), also known as Price to Book (P/B). This is a huge upsell for MNACT as its shares were being priced at a range between $0.94 to $1.07 in the weeks prior to the merger. Meanwhile, MCT is being priced at S$2.0039 (the “Scheme Issue Price”), which is determined by reference to the 1-day Volume-weighted Average Price (“VWAP”) of MCT Units on 27 December 2021.

Updated Management Fee Structure

MPACT’s management fee structure will be adopted from MNACT’s structure which is more aligned with investors’ interests since the performance fee is based on DPU growth rather than NPI, which is MCT’s previous structure. Dividend investors will be very happy with this fee structure as it incentivizes the management to grow the REIT’s DPU year over year. This will also keep the management on its toes, making sure they only make DPU accretive acquisitions that will positively impact investors.

Timeline

The timeline is still tentative but here is the rough flow for the events leading up to the merger. There will be an EGM for both REITs and investors will have to vote if they want the merger or not. If everything goes through smoothly, we can expect the cash and shares to be paid out to MNACT investors by early June and MNACT to delist in the same month as well.

Benefits of the Merger

As with mergers and acquisitions, not every transaction will be a beneficial one for both parties. Let’s take a look at the key benefits of the merger for both MCT and MNACT.

Enlarged Investment Mandate

As mentioned above, MPACT will have an enlarged investment mandate, combining both MCT’s and MNACT’s investment mandates. The expanded geographic scope to key gateway markets of Asia includes but is not limited to Singapore, China, Hong Kong SAR, Japan as well as South Korea. With a strong sponsor such as Mapletree, MPACT can only stand to benefit from such a large investment mandate, allowing a much bigger potential pipeline from its sponsor.

Enhanced Portfolio Diversification

Post-merger, MPACT will be very diversified thanks to both MNACT and MCT having relatively big portfolios. It is good to note that the existing issue with MNACT’s portfolio, Festive Walk contributing a huge portion to the REIT’s NPI, will now be resolved post-merger as the contribution coming from Festive Walk will be reduced significantly from 48% to 22%. Vivocity’s heavy contribution in MCT will also be reduced from 32% to 17% as well as MBC I & II’s contribution, reducing from 46% to 24%.

The merger does help improve MCT’s occupancy rate slightly from 96% to 97% and the WALE is still at a healthy 2.6 years which is good for a commercial REIT.

Enlarged Size Allows For Bigger Acquisitions

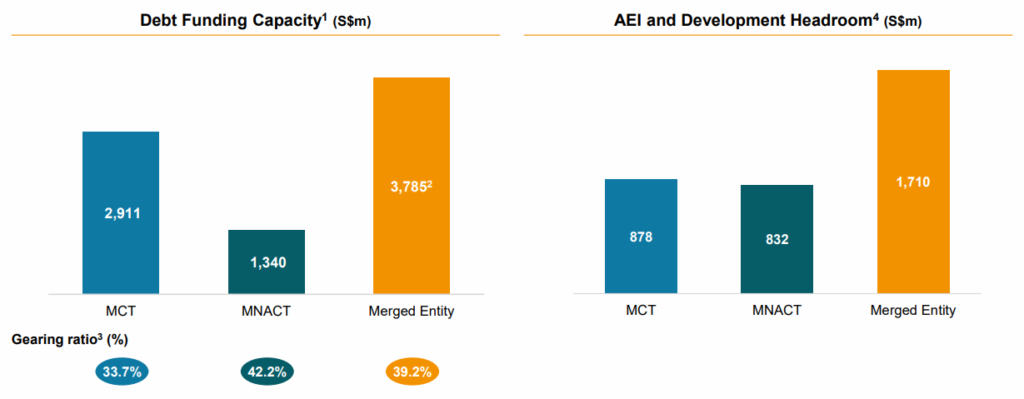

A clear negative to the merger will be the REIT’s balance sheet post-merger. MCT’s gearing will go from a low of 33.7% to a high of 39.2% due to MNACT’s high gearing. Although this could be worrying to investors at first, it is good to note that with a much larger portfolio now, MPACT has a much larger debt headroom for potential growth opportunities.

Even though its gearing is at a high of 39.2%, it still has a S$3.785B debt headroom before reaching the gearing cap of 50%. Not to mention an AEI and Development headroom of S$1.71B as well. Despite the higher gearing ratio, investors should be more objective when analyzing if this is truly a negative point or a positive one.

DPU and NAV Accretive

Last but not least, post-merger, the DPU and NAV per share are expected to grow depending on how many MNACT investors opt for Cash and Shares or Shares only. We can expect the DPU to grow from 7.5% to 8.9%. Based on MCT’s last close at $1.82, this will represent a forward yield of 5.19% to 5.25%. The yield looks pretty attractive considering the size of the REIT and its potential growth opportunities post-merger.

Risks of the Merger

Now let’s dive into the possible risks of the merger. The most obvious one will be if there are new covid-19 variants that continue to increase which will, in turn, delay the reopening of the economy. Although this is a major risk for investors, it is something out of control and can only be viewed as a near-term risk because eventually, the world will move towards a post-covid state and we will learn to live with the virus just like the common cold.

The other risk would be MNACT’s assets, most importantly Festive Walk, failing to perform over FY2022. Festive Walk has definitely been a huge worry for investors but as of 24th November 2021, MNACT has already provided an update on the settlement agreement with the insurers. Claims were made for property damage and revenue loss due to business interruption amounting to approximately HK$334.4m or S$58.3m. Although this does not help Festive Walk from a business standpoint, it does help soften the blow.

There is nothing much to worry about on MCT’s portfolio because it has been performing remarkably ever since its acquisition of MBC II in FY2021. The REIT has performed very well despite the pandemic badly impacting Vivocity as well as its overall portfolio.

Offering an Alternate View

After reading through most of the discussions across forums and chat groups online, the general consensus is that this is bad for MCT but fantastic for MNACT. Now let’s try to view the merger from an alternate standpoint and figure out if the merger is truly a good one or not.

Overpricing MNACT but Underpricing MCT?

As stated above, MCT is being priced at its last closing market price before the halt and merger announcement while MNACT is priced at book value. This valuation greatly benefits MNACT unitholders who have been holding a REIT that has been severely underpriced by the market for a very long time now, and for a good reason too. This is a huge win for MNACT as its shares were being priced at a range between $0.94 to $1.07 in the weeks prior to the merger. Meanwhile, MCT is being priced at S$2.0039 (the “Scheme Issue Price”), which is determined by reference to the 1-day Volume-weighted Average Price (“VWAP”) of MCT Units on 27 December 2021.

Although MCT is being priced at a premium to its NAV ($1.68), I feel that pricing MNACT at 1x PB is a little too high. MNACT has been underperforming severely for FY2021 and it looks like it will carry on for FY2022 as well. On the flip side, MCT has been posting strong numbers for FY2021 and is poised to bounce back stronger in FY2022. No doubt, the acquisition is a good one for MCT over the long run but perhaps the pricing could have been fairer for MCT shareholders. I believe pricing MNACT using a 60-day or even 90-day VWAP would have been a better approach rather than giving it a flat 1x PB valuation.

Expect Huge Growth in 2-3 Years

With such a huge debt headroom and big investment mandate, coupled with such a strong sponsor like Mapletree, MPACT is poised to grow to greater heights in FY2022. With interest rates now slowly increasing, expecting 3 hikes in FY2022 alone as mentioned by the feds, MPACT might try to accelerate its plans to grow and acquire while debt is still cheap. We can definitely expect to see huge acquisitions coming in within its first year and it will most certainly be DPU accretive thanks to the new management fee structure.

It is quite possible for investors to see MPACT grow 2x in possibly 5 years if they keep on aggressively growing and acquiring assets. They could even explore the idea of acquiring other REITs in Singapore as well given their huge debt headroom. With S$3.785B, they could easily acquire OUE Commercial REIT or Lendlease REIT. This statement is not to say that they will acquire or that these are great acquisition opportunities but rather, the fact that MPACT has the ability to acquire at such a big scale.

Final Thoughts

Prior to this merger, I’ve had MCT coming in and out of my portfolio several times now and it has been a great performer in my portfolio. Meanwhile, I’ve always held a very small position in MNACT since I started investing. I’ve already sold my small MNACT position at $1.13 during the run-up after the trading halt has ended. I will be monitoring the situation closely and, should an opportunity to accumulate MCT at an attractive price present itself, I will be ready to accumulate and hold for the long term. I suggest a buying price of around $1.82 to my premium group which will represent a yield of 5.19% to 5.25%, much higher than CPF SA’s 4%.