Lendlease REIT (SGX: JYEU) just announced a lease restructuring with Sky Italia, the current tenant of Lendlease REIT’s Sky Complex right before FY2023 closes. This sudden lease restructuring has definitely surprised investors but in a good way. Let’s dive into the details and analyze if this is a good time to invest in Lendlease REIT.

Original Lease

Lendlease Global Commercial Italy Fund, a wholly-owned fund of Lendlease REIT, is the landlord of Sky Complex. The original lease with Sky Italia was due to expire in May 2032 with an option held by the tenant to terminate its lease early in 2026. Of course, it is unlikely that the tenant will terminate the lease early, but there is still some uncertainty lingering around. On top of this, the annual rental was reviewed based on 75% of the ISTAT (Italian National Institute of Statistics) consumer price index variation. It is also important to note that Sky Complex contains 3 office buildings, which are all 100% freehold and fully leased by Sky Italia.

Restructured Lease

So what changed in the restructured lease? Firstly, the lease has been restructured to commence on 15th December 2023 and will be leased for an initial term of 9 years + 1 month, with an option given to the tenant to renew for an additional term of 6 years. Compared to the original lease, the tenant now doesn’t have an early lease termination option which provides more stability and predictability for Lendlease REIT.

Secondly, the starting annual rent for Buildings 1 and 2 will be approximately 1.5% higher than the original lease, in addition to the recent 5.9% rental reversion in May 2023. The New Lease includes a tenant incentive in line with market standards.

Lastly, Building 3 will be returned to the landlord in Q1 FY2024 upon the completion of reinstatement works and Sky Italia will provide a consideration to Lendlease REIT of an amount equivalent to approximately 2 years of existing annual rent of Building 3.

Key Benefits

Now that we’ve covered the initial and restructured leases, let’s cover the key benefits of this change for Lendlease REIT.

#1 Reduced Tenant Concentration Risk

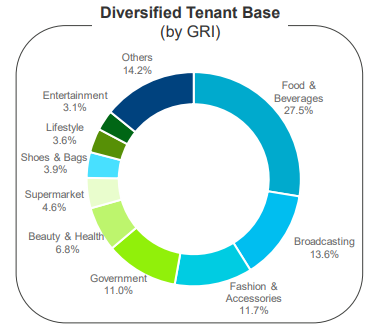

The biggest change would be the tenant concentration towards Sky Italia as Building 3 is returned to Lendlease REIT. The landlord plans to redesign Building 3 for multi-tenancy use, which will help diversify Lendlease REIT’s tenant base. Post restructuring, the percentage of Lendlease REIT’s portfolio tenant base in the broadcasting sector by monthly gross rental income (GRI) will be reduced on a pro forma basis as of 30th September 2023 from 13.6% to approximately 10.2%.

#2 No Material Impact on Lendlease REIT

Although Lendlease REIT has reduced its GRI coming from Sky Italia, there is little to no material impact on Lendlease REIT’s distribution per unit (DPU) or net asset value (NAV). The supplementary rent coming from Sky Italia for Building 3 will help to supplement the asset’s total revenue while Building 3 is slowly being leased out to new tenants. As of 30th September 2023, Building 3 alone accounts for approximately 3.9% of Lendlease REIT’s monthly GRI.

#3 Positive Expected Rental Growth

With the new lease set in place, there will be annual rental updates for Buildings 1 and 2 based on the ISTAT consumer price index, which will likely be revised upwards. In addition, Sky Italia will be bearing most of the property’s operating expenses in Buildings 1 and 2. This means that Lendlease REIT will only stand to benefit from this new lease restructuring. Not forgetting the fact that as Building 3 is slowly being leased out, new tenants secured will help contribute towards Lendlease REIT’s overall revenue on top of the supplementary rent already received from Sky Italia.

Read Also: 5 Key Takeaways From Lendlease REIT’s FY2023 Results

Final Thoughts

In summary, a good and strategic move to reduce tenant concentration risk. Sky Italia’s initial contract was due to expire in May 2032 with an option to terminate early in 2026. With the restructured lease, Lendlease REIT has found more stability in this Grade A asset. Not forgetting the most important fact that after this lease restructuring, Lendlease REIT will be able to organically grow its revenue further with new tenants being leased with Building 3.

It has definitely been a rough year for Lendlease REIT but things are slowly turning up. With interest rates forecasted to see some cuts in FY2024, REITs will stand to benefit from this as the cost of borrowing lowers and opens up more doors for acquisitions and other growth opportunities.

Pingback: My Top 5 Exciting REITs To Watch in 2024

Pingback: REIT Posts of the Week @ 23 December 2023