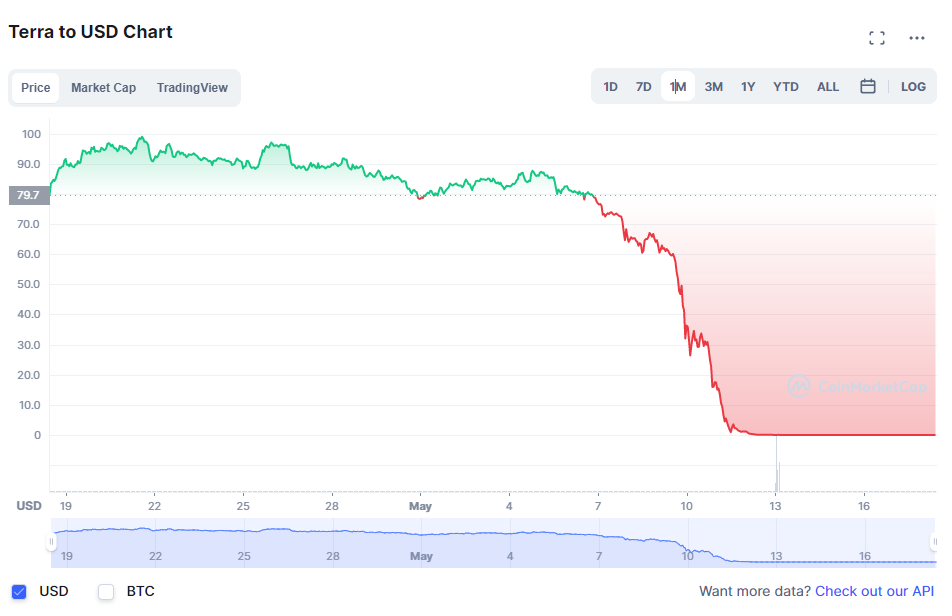

With Terra (LUNA) causing a huge shockwave across the Crypto market, speculations are growing faster than ever about whether or not LUNA will ever recover back to its all-time highs. Technically if we look at it from a mathematical standpoint, it’s almost improbable, not impossible, for LUNA to recover back to its all-time highs of approximately ~$116 about 1.5 months ago. In this article, let’s dig deeper into what exactly happened to LUNA, what is going to happen moving forward, and what investors/traders can learn from this incident.

What Exactly Happened to LUNA?

Before we talk about what exactly happened to LUNA, let’s first understand how LUNA started and how it got so well known across the entire Crypto market.

The Beginning of LUNA

Terra (LUNA) was founded by Do Kwon and Daniel Shin of Terraform labs in 2018 and uses a Tendermint-based Delegated-Proof-of-Stake (DPoS) as its consensus mechanism. According to its whitepaper, the founders’ goal was to fulfill what Bitcoin originally set out to be: a peer-to-peer electronic cash system. At its core, LUNA provides smart contract capabilities for the creation of algorithmic stablecoins. Rather than using fiat currency or over-collateralized crypto as reserves, each Terra stablecoin is convertible into the network’s own native token, LUNA.

As of 4th March 2022, the Terra ecosystem contains over 100 of these natively built projects including non-fungible token (NFT) collections, decentralized finance (DeFi) platforms, and Web3 applications. This definitely shows the amount of interest as well as deep investments Terra has gathered over the past 4 years within the Crypto community. Across its ecosystem of stablecoins, UST is by far the most popular, which tracks the price of the US dollar closely. This is achieved through its peg to the dollar using the ecosystem’s other token, LUNA.

UST, LUNA and Anchor Protocol

To create UST, you need to burn LUNA. So for example, if LUNA is worth $100 per token, you could trade that for 100 UST but the LUNA token would result in being destroyed/burnt. This deflationary protocol was meant to ensure luna’s long-term growth. As more people buy into UST, more LUNA would be burnt, making the remaining luna supply more valuable.

So how does UST maintain its peg? 1 UST can always be exchanged for $1 worth of LUNA. If UST slips to 99 cents, traders could arbitrage the difference by buying UST and exchanging it back for LUNA, earning 1 cent per token. People buying UST drives the price up, and UST being burnt during its exchange to LUNA deflates the supply.

On top of that, Do Kwon also created the Luna Foundation Guard (LFG) which is built to protect the peg of UST. The LFG had about $2.3B in Bitcoin reserves, with plans to expand that to $10B worth of Bitcoin and other crypto assets. If UST dipped below $1, Bitcoin reserves would be sold and UST bought with the proceeds. If UST goes above $1, creators would sell UST until it goes back to $1, with the profit being used to buy more Bitcoin to pad out the reserves.

To further incentivize investors/traders to burn LUNA to create UST, creators are offered an insanely high 19.5% yield on staking through Anchor Protocol, which is a savings, lending, and borrowing platform built on the Terra Blockchain. The Anchor Protocol was what attracted everyone towards Terra simply because of the high yield which appeared to be “risk-free”.

What Triggered The Explosion?

Coming to the main topic at hand here, what exactly happened to LUNA that caused the coin to drop by over 99%? It all started on 7th May when over $2B worth of UST was unstaked from Anchor Protocol and hundreds of millions of that were immediately sold. This huge sale pushed the price down to 91 cents. Traders then came in and tried to arbitrage the difference, exchanging 90 cents worth of UST for $1 worth of LUNA but there was 1 issue that came up. Only $100m worth of UST can be burnt for LUNA per day.

Investors, already anxious and nervous due to the current gloomy market situation, flocked to sell their UST once the stablecoin failed to retain its peg. It bounced between 30 cents and 50 cents in the week following the initial depeg. Due to this, the LUNA token has also lost all its value and saw its token price fall from $80 to less than $0.00001 in less than a week.

Due to the value of UST falling way below its peg, UST holders are trying to cash out through LUNA, which will result in more LUNA being minted in response to the amount of UST being burnt. With LUNA’s current price being much lower than it used to be, large holders are trying to cash out whatever that is left of their original investment, causing a huge spike in LUNA’s supply. As of 18th May 2022, LUNA’s supply has drastically increased from 386m to well over 6.5T.

There have been speculations on the matter, hinting at the possibility that large organizations or institutions orchestrated this by unstaking all their UST all at once and selling it into the market, causing the entire thing to crash. Again, this is still speculation and it is unknown what or who really caused the whole crash to occur.

What’s The Plan for LUNA Moving Forward?

So what is going to happen to the shareholders who have suffered in the process? Firstly, from a mathematical standpoint, it’s impossible for LUNA’s token price to recover back to its all-time highs of approximately ~$116. If it did, its market cap would come up to approximately ~$7.54 quadrillion which is quite a ridiculous number to even begin with. At its current token price of $0.0001837, its market cap is approximately ~$1.2B as compared to its market cap 1.5 months ago at its all-time highs, which was approximately ~$41B.

Do Kwon & Luna Foundation Guard’s Plan

A few days after the entire crash, Do Kwon has resurfaced on Twitter, tweeting 2 huge threads on what is the plan moving forward for LUNA. The first thread has Do Kwon explaining what happened and what the LFG has done during the de-pegging. The second thread comes with a plan whereby Do Kwon plans to fork the Terra chain into a new chain without algorithmic stablecoins called Terra (LUNA) and change the old chain to be called Terra Classic (LUNC).

The new LUNA token will be airdropped to current LUNC token stakers, holders, residual UST holders as well as essential app developers. The new Terra 2.0 will be focused on developers, with developers getting an immediate emergency allocation of LUNA tokens to fund the runway, as well as a pool of tokens earmarked to align the interests of the base layer with its builders. The governance proposal, if passed, will coordinate the fork with validators on the 27th of May.

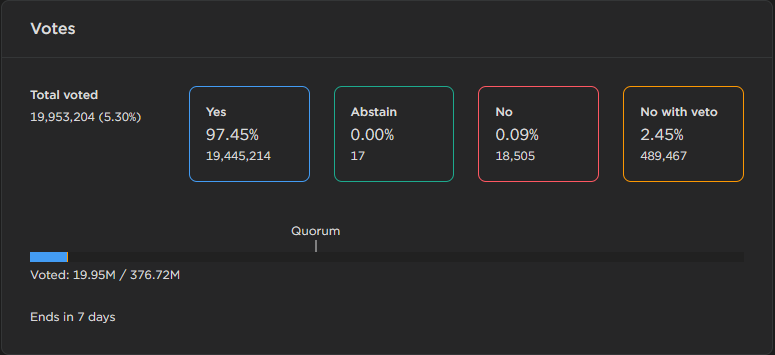

As of 18th May at 8:10 pm, the current show of voters (5.3%) have voted Yes (97.45%) to Do Kwon’s plan for a hard fork. This definitely seems like a bad move because hard forking the chain and creating a new one will not help solve anything. The new fork will not suddenly gain value and rise back to how it used to be. On top of that, you cannot void all past transactions made after an old snapshot, both on-chain and off-chain.

As of 18th May, the LFG currently holds the assets shown above. The LFG is also looking to use its remaining assets to compensate the remaining users of UST. Holders and stakers will be paid out, starting from the smallest wallets first. This means that if you are a retail investor, you can expect to receive some of your money back.

Learning Takeaways

Moving on from this, what are some of the key learning takeaways we can gather and apply to our own investment strategy in the future so that we can avoid such losses?

#1 Always Do Your Own Due Diligence

The biggest and most important one would be to always do your own due diligence and research what you are investing in. During the hype of Anchor Protocol and LUNA, I have avoided it extensively simply because of 2 key reasons: #1 95% of investors don’t even understand it and #2 If it was really “risk-free”, why aren’t big institutions going in on this opportunity?

Firstly, how do I know that 95% of investors don’t even understand how LUNA and Anchor Protocol worked? After scouring through the internet, various forums, chat groups, and Reddit threads, it’s not hard to see that majority of commenters don’t understand what LUNA is and how Anchor Protocol works. Most can’t even explain the relation between LUNA and UST and others couldn’t explain why Anchor Protocol could payout 19.5% yield so easily. This was the first big red flag that I realized.

Secondly, if you think about it logically, if there was a “risk-free” investment that yielded way higher than AAA or government bonds, why aren’t the big banks and institutions jumping right into this investment opportunity? Even if the risk to reward ratio was 1:5 or even 1:3, I’m sure they would have still dabbled some funds into it because it would be an attractive risk to reward ratio. So why didn’t they? In reality, if you look at the entire thing objectively, you will realize that technically, you stand to gain approximately 19.5% yield while risking 100% of your capital because LUNA can go to 0 in an instant. Of course, I never forecasted or predicted that it will go to $0 so soon but it was a ticking timebomb waiting to blow up.

#2 Leverage is a Double-Edged Sword

The second key learning takeaway would be to understand that leverage is a double-edged sword. Leverage can not only amplify gains but also your losses as well. I’ve always stayed clear away from investing with leverage because there is no investment that is 100% risk-free and can yield you higher than your interest cost. Bonds don’t work because the yield is far too low as compared to what you pay on your interest costs. Many investors, especially newer and younger ones, thought that they were geniuses, making 10x or even 100x in the Crypto market over the past 2 years, over-leveraged, and invested more than they can afford to lose. As a result, we now see many cases across the internet whereby investors lose more than half their portfolio, and some even lose their homes.

#3 Diversify, Diversify and Diversify

The last key learning takeaway would be to always Diversify, Diversify and Diversify. As I mentioned, there is no 100% risk-free investment that is guaranteed to make you money. No matter how much conviction and research you have, there are many things that cannot be predicted, that could happen. One simple example would be the covid pandemic which was a black swan event. No one expected it to happen and no one expected it to last over 2 years since its first recorded outbreak. This is why it is important to always diversify according to your own risk appetite and what you are comfortable with.

A general rule of thumb given by many great and famous investors like Warren Buffett and Peter Lynch would be to never invest more than 5% into any single company. No matter how great and how well you understand a company, keeping yourself diversified will help you avoid black swan events that could burn your entire investment portfolio in an instant.

Final Thoughts

As a whole, we as investors or even traders must always understand that all forms of investments carry risk. Even now, there are still many platforms that offer high yields for staking stablecoins like USDC or USDT. It might seem enticing and in theory, “risk-free”, but it is important that you do your own due diligence and research all the possible risks and outcomes that could happen, both good and bad. On an interesting side note, I made a bold prediction in my premium group regarding my thoughts and insights on the Crypto market almost a year ago and this is what I wrote. If you want to hear more of such insights, check out my premium subscription here.

Very well-written article. Indeed for Terra to recover back to its all-time highs, the market cap will be ridiculous!