As oil prices continue to surge, investors are curious if there are any good oil companies left to invest in, to leverage on this opportunity. The most talked-about one in the Singapore market would be Rex International (SGX: 5WH) and for good reason as well. With a strong track record and fantastic growth potential, it is not surprising to see why investors are accumulating as much as they can to ride on the current oil craze.

Based on its 52-week share price low of $0.13 to its last close price of $0.36, that represents a 177% growth in just 1 year. Is there any more upside left for investors to capitalize on or is it time to take profits off the table and move on?

Rex International

The company’s main activities are in offshore oil exploration in assets located in Oman and Norway.

The company owns Rex Virtual Drilling, which is developed by its Swedish founders. Rex Virtual Drilling is a liquid hydrocarbon indicator that studies resonance information in seismic data to locate hydrocarbons directly. The company believes that Rex Virtual Drilling substantially increases the chance of success of finding oil in exploration drilling and is offering the technology as a de-risking tool to other oil exploration companies.

Rex International Holding has achieved three offshore oil discoveries since its listing in July 2013; one in Oman and two in Norway. The company is also expanding its business with research into sustainable energy solutions. The company’s proposed new business in Sustainable Solutions for Materials takes inspiration from Sweden, a country that practices a circular economy or a cradle-to-cradle approach, that involves using products that can be reused completely.

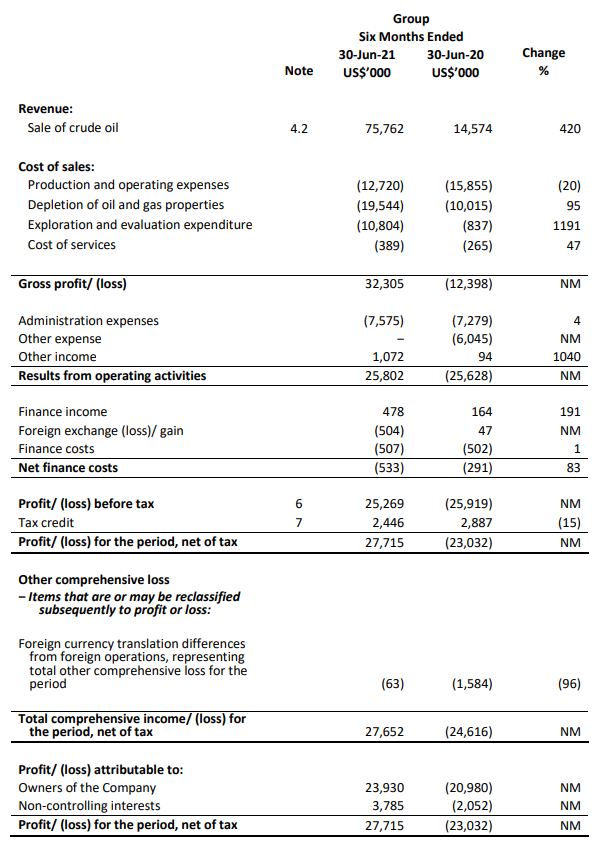

1H 2021 Results

Jumping right into Rex International’s 1H 2021 results, we can see that the sale of crude oil has jumped significantly due increase in barrels sold as well as the average price the oil barrels are sold at. The average realized oil price sold in 1H 2020 was US$23 per barrel as compared to 1H 2021 which was US$62 per barrel, representing an approximate ~170% growth in just 1 year. As a result, not only did the sale of crude oil grow by 420% year over year, the company is now profitable as well.

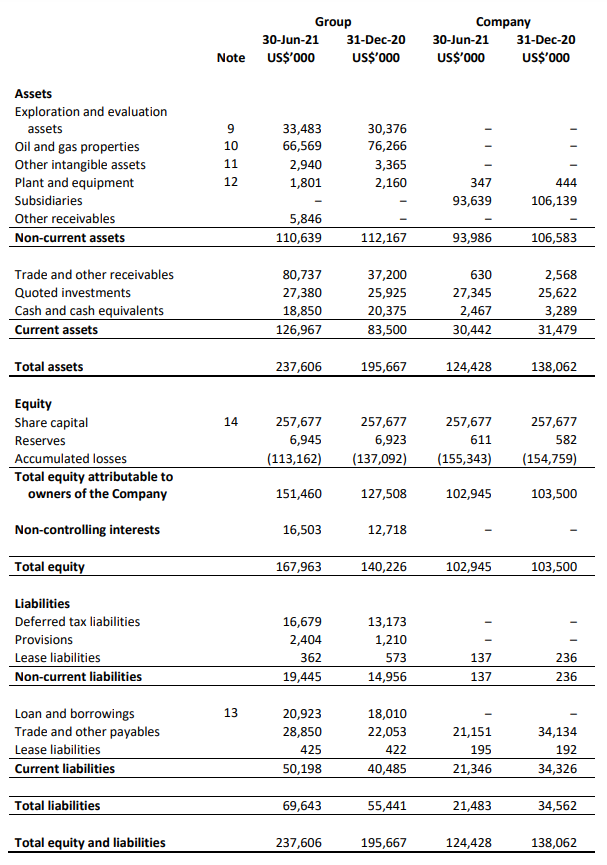

Looking at their balance sheet, we can see that Rex International has a very solid balance sheet with a Current Ratio of 2.53x with a net cash position. With the overall business operation now turning profitable, we can expect to see Rex International grow its cash pile significantly which can be used to fund future investments and projects.

Previous Predictions Made

This is not the first time I made an analysis on Rex International. Since my first investment in Rex International back in 2020, I have written quite a few analyses as well as made some predictions as to how the company will perform over the next few years. Let’s review how my predictions have done so far.

Read Also: Rex International Completes Drilling in Oman! Should You Invest in This Small-Cap Gem in 2021?

FY2021 Revenue from Sale of Oil

Based on the 1H 2021 numbers, we can see that my prediction for the government’s entitlement for the sale of crude oil in Oman, was accurately estimated at 40%. Based on the current performance and the number of oil barrels being produced monthly, despite the higher brent oil prices right now, we can expect Rex International to underperform my previous prediction.

I estimated the FY2021 revenue from the sale of oil to be within the range of US$191m-US$239m. This prediction was made using a few assumptions namely being that the daily production rate was 20,000, the average realized oil price was $62 and that the operating costs will continue to remain at $80,000. With the most recent daily production rate released for the past few months averaging around 10,000 and the current price of Brent oil at $85, the expected daily revenue will come up to $850,000. After netting off the operating costs and the government’s entitlement, we can expect a daily net profit of $462,000 or a monthly net profit of $13.86m. With only 3 more months to go before the year ends and a target of $115m for 2H 2021, I expect Rex International to fall short of my prediction by a small margin.

The prediction was made with a high daily production rate because the estimated production rate after the completion of Yumna Well 2 and 3 were seen to grow from 9,000 stb/day to 30,000 stb/day. As of 5th April, the 3 wells were tested steadily over a week at rates of 20,000 stb/day and have since been optimized to maximize recovery from the Yumna field. To my surprise, they trimmed down the production rate significantly to an average of 10,000 stb/day over the past few months.

Dividend Policy

As predicted a few months ago as well, with the huge surplus in cash holdings from the sale of oil barrels, Rex International will need to start thinking of other methods to continue bringing shareholders value other than acquiring more contracts and projects.

Over the past few months, they have already acquired 2 production sharing contracts by Petronas in Malaysia, a 40% investment in a commercial drone company as well as participation in the Norwegian Sea exploration well. Despite all this, Rex International still has a huge excess of cash leftover which does not have any use. The introduced dividend policy will definitely make shareholders happy as Rex International continues to pile up on its cash holdings.

Based on their current cash positions, it is likely for Rex International’s management to offer a small dividend payout coupled with a one-time special dividend payout over the next few years. Based on an FY2021 revenue from the sale of oil of US$250m and a net profit margin of 50%, investors can expect a dividend payout of US$25m (~20% of net profits) coupled with a US$25m (~20% of net profits) as a one-time special dividend. The remaining funds could be kept in the war chest should better opportunities come or use it to pay out dividends in the coming next years. Based on the above assumption of a dividend payout coupled with a one-time special dividend, this comes up to a dividend payout of US$0.0384 per share or a dividend yield of 14.4%. Even without the special dividend payout, the dividend yield is still an attractive 7.22%.

Is There Any Upside Left?

Based on its 52-week share price low of $0.13 to its last close price of $0.36, that represents a 177% growth in just 1 year. Is there any more upside left for investors to capitalize on or is it time to take profits off the table and move on?

Newly Introduced Dividend Policy

Being in the Singapore market, which is mainly occupied by dividend and income investors, this move could prove to be great for Rex International since it provides some stability as investors start pegging the share price to its dividend yield. As long as they can offer an attractive yield, perhaps more than 4%, and can sustain it over the next few years, we can definitely expect the share price to hover around that price range or even go up if they choose to grow the dividend payout.

Oil Prices At Dangerous Highs

As everyone knows, oil prices have surged to a high of $85 which was last seen in Oct 2018, and before that, Nov 2014. Can these prices sustain for the rest of the year or will we start to see a healthy pullback in oil prices? There have been some strong catalysts coming into play and pushing the oil price up over the span of 2021 but investors need to take note that oil is a very volatile commodity and can be easily impacted by politics globally.

As Rex International’s main source of income comes from Oman, which is through the sale of oil barrels, this can heavily impact Rex’s current and future revenue growth.

UOB Analyst Report

Whenever investors see or hear about analyst reports, they will definitely read about it as analyst reports are always held in high regard when it comes to retail investing. With UOB’s most recent analyst report, investors can cheer for joy as it is a very bullish one.

With a revised Target Price of S$0.46 based on their conservative assumptions, the share price definitely benefited from this. Based on their report, they find Rex International cheap, trading at only 4.8x 2021F PE. With positive industry tailwinds and a robust 1H 2021 earnings, investors can expect a much better set of earnings in 2H 2021as well as strong growth moving into FY2022. Based on its last close price, there is still a 27.8% upside left before Rex International hits UOB’s target price.

Final Thoughts

As an early investor of Rex International, buying my first tranche near the $0.10-$0.11 range, I have always been bullish about the company. Of course, as a value investor, it is only natural to realize profits once your investments have reached near their fair value or even become overvalued. I have since realized my profits for Rex International at $0.30 per share, enjoying gains of more than 200% in just 1.5 years.

So comes the question, do I think there is still any upside left for Rex International? In short, I think there is still some upside potential for the company and investors but the downside risk is too large for me to invest in. With oil prices being at such a high, a healthy correction or pullback could be on the horizon. This could definitely impact Rex International negatively as the year comes to an end. If Rex International announces a very attractive dividend payout next year during their AGM, we could see the share price surge once more if the overall business is growing well.