Palantir (NYSE: PLTR), the big data analytics company known for its work for the US defense and national security establishment as well as several other government agencies, has been in the market for over a year now since its IPO. They just released their Q3 FY2021 results which caused a huge spike in interest around the company but a huge dip in the stock price. In this article, I’ll be sharing with you everything you need to know about Palantir and whether or not it is a good buy right now in 2021.

Business Overview

Palantir, at its core, is a big data analytics company that started with mainly federal agencies for its customer base. As time passed, they expanded their customer base to serve state and local governments as well as private companies in the financial and healthcare industry. As such, the company has been pretty secretive about its operations and products.

To find out more on what Palantir does as well as find answers to some of your questions regarding the company, read this: After Palantir’s Exciting Inaugural Demo Day 2021, I Held An AMA

Let’s hop onto the next part and look into the management that has been running Palantir for the past 17 years.

CEO & Management

Alex Karp joined as Palantir’s CEO in 2004, famous for being an unusual leader, even by Silicon Valley standards. He became successful by investing in startups and stocks after receiving an inheritance from his grandfather. He even founded the London-based money management firm Caedmon Group.

Shyam Sankar joined Palantir as their COO in 2006 after hearing about the company from a friend. He was introduced to one of the founders and after seeing version 0.7 of the app, meeting a bunch of brilliant people, and hearing about their mission, he knew where he had to go. In less than 2 weeks, he joined as employee #13. Find out more here.

Peter Thiel is very well known today as one of the co-founders of PayPal. Back in 2004, he had sold the company off to eBay for $1.5 billion and decided to launch Palantir together with his Stanford computer science graduates Joe Lonsdale and Stephen Cohen together with Nathan Gettings, a PayPal engineer.

FY2021 Q3 Update

Let’s start off with taking a deep dive into the recent FY2021 Q3 results release for Palantir as they share many exciting news and numbers for investors.

Revenue and Free Cash Flow Growth

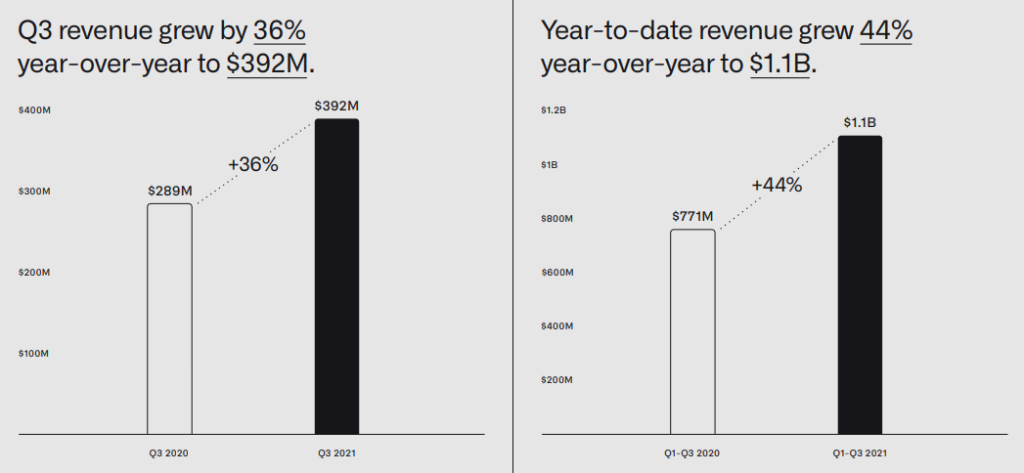

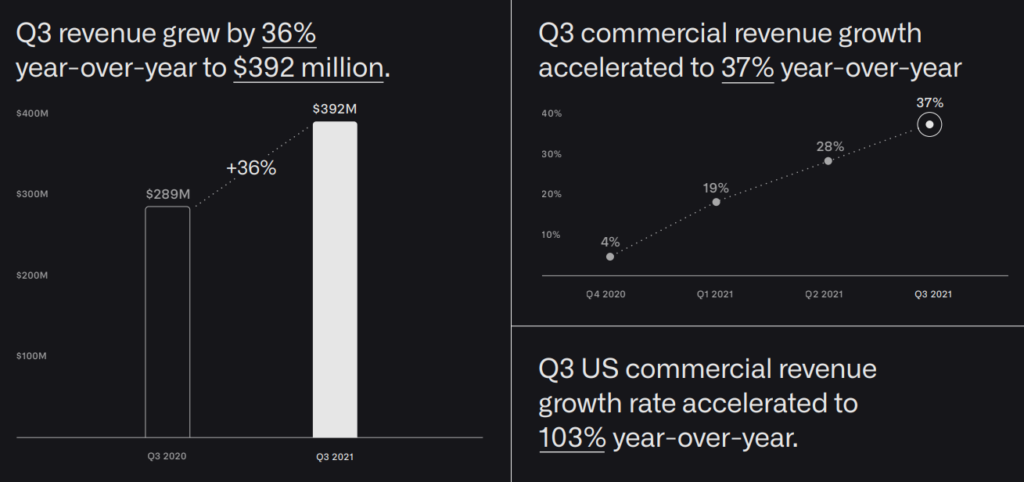

Starting off, we can see Palantir has done fantastic in Q3, growing its revenue by 36% year over year to $392m. On top of that, the year-to-date (9 months) revenue has grown 44% year over year to over $1.1b.

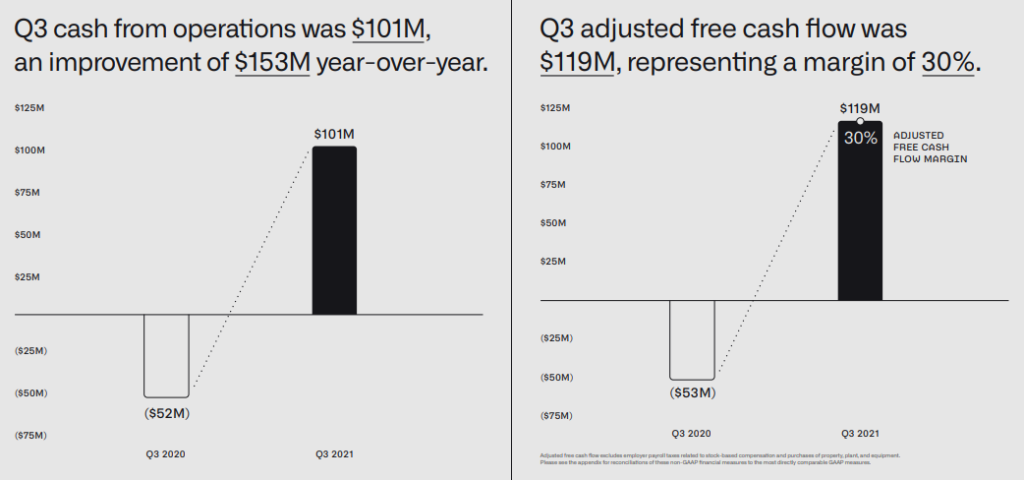

Looking at the cash from operations, it has improved significantly from a negative $52m last year to a positive $101m this year. On top of that, the company has significantly improved its free cash flow from a negative $53m last year to a positive $119m this year, also representing a 30% adjusted free cash flow margin. The year-to-date adjusted free cash flow stands at a positive $320m, representing an adjusted free cash flow margin of 29%, as compared to last year’s negative $285m.

For a Software as a Service (SaaS) company like Palantir, Free Cash Flow (FCF) is the best indicator to judge if the business operations are truly profitable as compared to looking at the net profits in the income statement. Looking at how much Palantir’s FCF has grown over the past 1 year, in addition to the increased full-year adjusted free cash flow guidance to $400m+ as compared to $300m+ previously, investors can be more confident in the company as it is now profitable when looking at the business operations.

New Deals & Revenue Diversification

After looking at the numbers side of the business, let’s take a closer look at the key drivers for this quarter.

As most investors know, Palantir started off primarily as a government-focused SaaS company. As time passed, they have decided to branch out and start offering their product suite to commercial clients as well to help diversify their revenue streams and scale up as a business. In Q3, Palantir saw its commercial revenue growth of 37% year over year with its Q3 commercial revenue coming from the US alone, having grown by over 103% year over year.

In Q3, Palantir has added 34 net new customers, now having their total customer count at a peak of 203. Within that, the average revenue per top 20 customer grew by 35% to $41m. They have also grown their overall commercial customer count by 46% quarter on quarter and since 31st December 2020, they have grown their customer count by a phenomenal 135%. Although the customer count at the start of the period was low, it is still huge growth in less than a year.

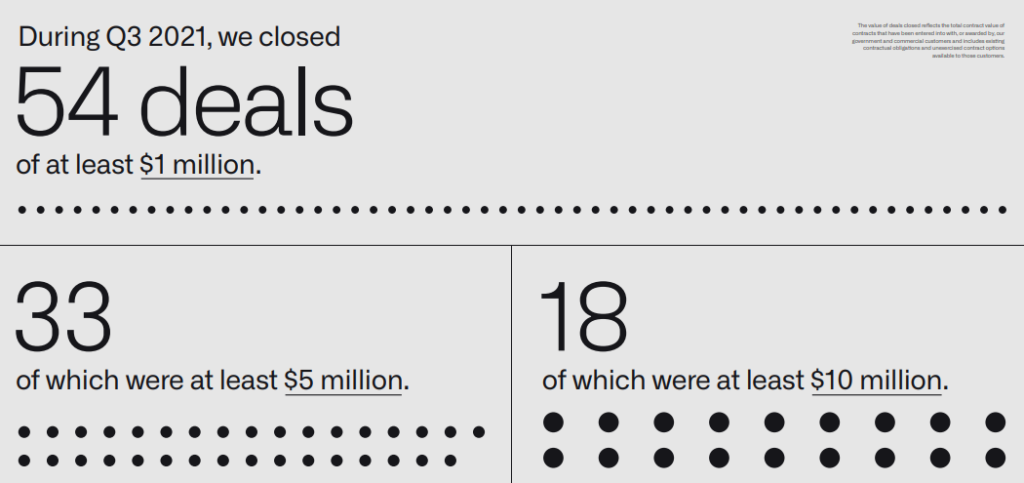

In total, Palantir secured 54 deals that are worth at least $1m in Q3, 33 of which are worth at least $5m and within that, 18 are worth at least $10m. This is huge for Palantir because that translates to over $276m in contract value in just Q3 alone.

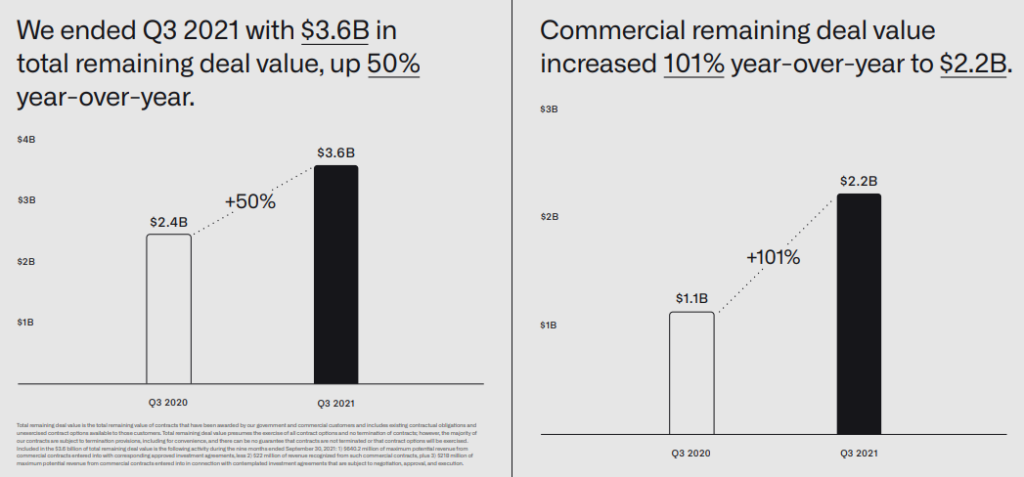

The billings for Q3 grew by 56% year over year to $347m with the Remaining Performance Obligations (RPO) growing by 172% year over year to $874m. Palantir ended Q3 with $3.6b in total remaining deal value, growing by 50% year over year with its commercial remaining deal value growing by 101% year over year to $2.2b.

Product Developments

Next up, let’s look at Palantir’s newest product developments over Q3.

Foundry for Builders

Starting off, Palantir has leveraged Foundry and built a solution specifically for Entrepreneurs, also known as Builders. It is designed to help Builders 10x and even 100x their processes and overall product in terms of speed. Big Data solutions shouldn’t be designed only for big companies but also for startups as well. Foundry for Builders puts the power of Palantir into the hands of startups to help accelerate their growth. With this, Palantir is allowing Builders to leverage onto Foundry’s core platform for combining disparate data, harmonizing it, and building applications faster and more sustainably than before.

Foundry at its core is a highly available, continuously updated, fully managed SaaS platform that spans from cloud hosting and data integration to flexible analytics, visualization, model-building, operational decision-making, and decision capture.

Builders can leverage Foundry’s platform through 5 key processes. Data Integration, Model Integration, Ontology, Workflows, and Decision Orchestration. In summary, the platform allows a Builder to connect, scale, and transform all forms of data (structured, unstructured, streaming, IoT, geospatial, etc.) securely through all data sources. From there, Builders can build and train models in any industry-standard toolset using their integrated workbench. Foundry’s native no/low-code application builder can also help you manage workflows similar to what JIRA can do. On top of all this, Foundry can help Builders make better decisions through scenario simulations based on “what-if” conditions as well as chaining multiple models together.

Foundry for Crypto

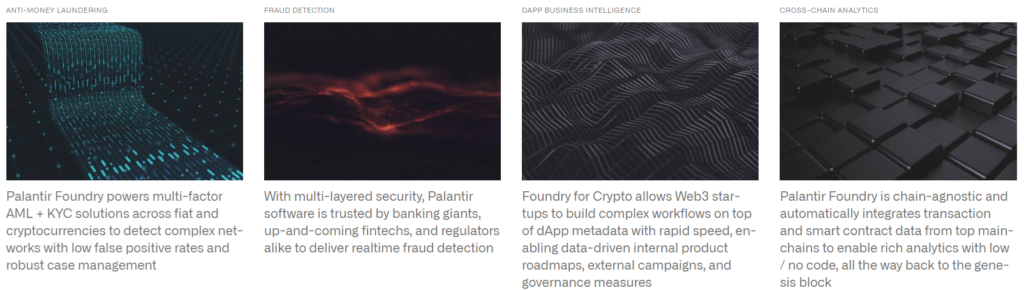

The next product development is also related to Foundry but now, leveraging the platform for Crypto. Using next-generation software for next-generation finance, Palantir is now letting companies leverage Foundry’s cutting-edge technology to grow their customer base securely. Foundry for Crypto achieves this in 4 key ways. Anti-Money Laundering, Fraud Detection, DAPP Business Intelligence, and Cross-Chain Analytics.

*As of the time of writing, there has only been more information given for Anti-Money Laundering

Under Anti-Money Laundering (AML), Palantir Foundry powers multi-factor AML + Know Your Customer (KYC) solutions across fiat and cryptocurrencies to detect complex networks with low false-positive rates and robust case management. Thus far, Foundry for AML has allowed global financial organizations to lower their costs by 90% and improve their true positive rate by 45X. With this solution, it provides banks with the flexibility to deliver 70+ use cases on a single platform. Foundry also cuts investigative time in half while improving risk posture and relationships with the regulators

So what makes Palantir different? Firstly, Palantir’s Machine Learning (ML) based entity resolution and advanced network-based risk models enable easy and accurate linking of customers, networks, and unknown counterparties. This empowers the bank with a solid, future-proofed foundation, and a central client file that can be updated dynamically across AML functions.

Secondly, the solution takes a hybrid approach, providing comprehensive out-of-the-box modules, scenarios, and models, while offering the flexibility needed to meet regulatory demands based on the bank’s customer base and risk tolerance. Ultimately, this improves alert accuracy and efficiency while providing more high-quality, automated SARs and reports for regulators.

On top of all this, Foundry was initially built for use by government intelligence and defense agencies. With privacy concerns being the #1 priority, Foundry was built to include unparalleled, granular security controls. All data is encrypted both in transit and at rest, and Palantir offers high auditability and role-based access control frameworks so that all teams can access and share the necessary data without compromising security.

Summing it up, Palantir has optimized Foundry’s platform to suit the needs of Crypto companies, ensuring the highest level of security as well as allowing companies to leverage on the platform to build complex workflows on top of dApp metadata with rapid speed, enabling data-driven internal product roadmaps, external campaigns, and governance measures. On top of that, the platform is chain-agnostic and automatically integrates transaction and smart contract data from top mainchains to enable rich analytics with low / no code, all the way back to the genesis block.

Cloud 2.0 with Apollo

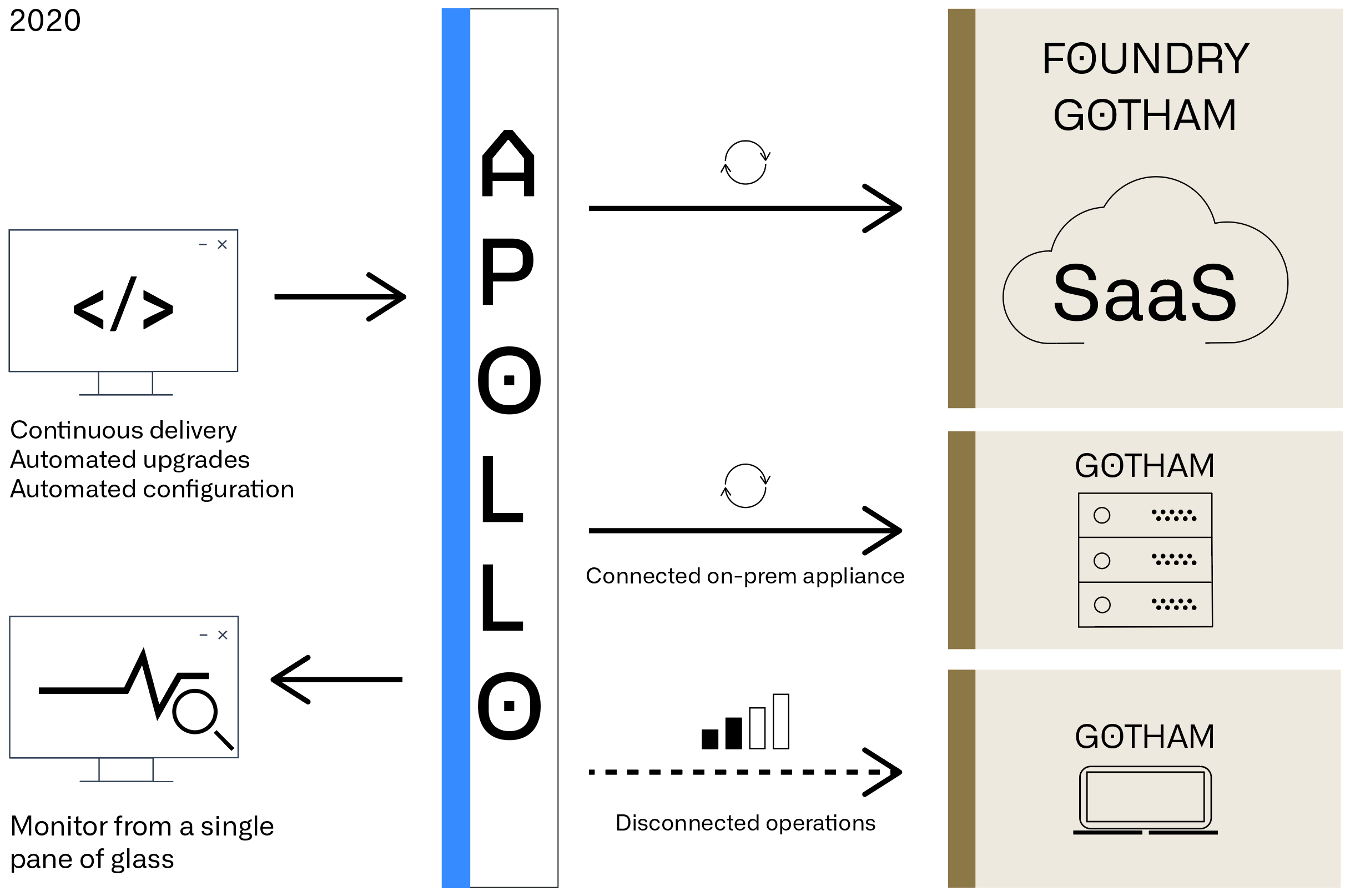

The last development update to Palantir’s product suite is Apollo. In essence, Palantir has enhanced Apollo, enabling companies to dynamically deploy it anywhere whether it be on the cloud, across different regions, or spanning on-premise environments. From autonomous management of edge devices to fleet-wide integration of AI models, Apollo’s auto-scaling infrastructure powers workflows beyond traditional SaaS architectures. From FedRAMP to GxP, Apollo’s compliance-aware change management supports the secure management of software across the most protected, regulated environments.

This is very crucial because Apollo is used by Palantir to provide continuous integration (CI) and continuous delivery (CD), also known as CI/CD, across all its products. It is essentially Palantir’s in-house DevOps platform that allows Palantir to continue growing and improving its product suite whilst making sure safety and security are never compromised in the process.

Read Also: Palantir (NYSE: PLTR) – The Most Mysterious And Intriguing Tech IPO in 2020

Valuation

Moving into valuation, Palantir has been going through a rough patch as you can see from the chart below.

After its peak at $45 in late January 2021, Palantir has seen some sideways movement despite the business growing faster and bigger quarter after quarter. As we can see, Palantir has been ranging between $20.55 to $29.10 over the past few months, respecting a few key support and resistances marked at $23 and $27.50 respectively. The RSI looks weak at the moment and could signal a good opportunity to accumulate now as it reverts back to the mean. With such a fantastic set of results, the market will soon start turning upwards and price Palantir more fairly.

On a fundamental basis, when I analyze high-growth SaaS companies, I stay far away from the traditional PE or PS ratios because those metrics are unable to properly valuate SaaS companies. To properly valuate a high-growth SaaS company such as Palantir, I use 11 key metrics such as Net Recurring Revenue (NRR), Growth Rate, Annual Recurring Revenue (ARR), Total Addressable Market (TAM), Rule of 40, and many more to price the company’s future value based its the current performance.

Using this calculator, with reference to FY2021’s guidance numbers, Palantir’s fair value over the long term stands at ~$165.6b in terms of market cap or ~$88.75 in terms of share price, assuming no dilution in shares outstanding.

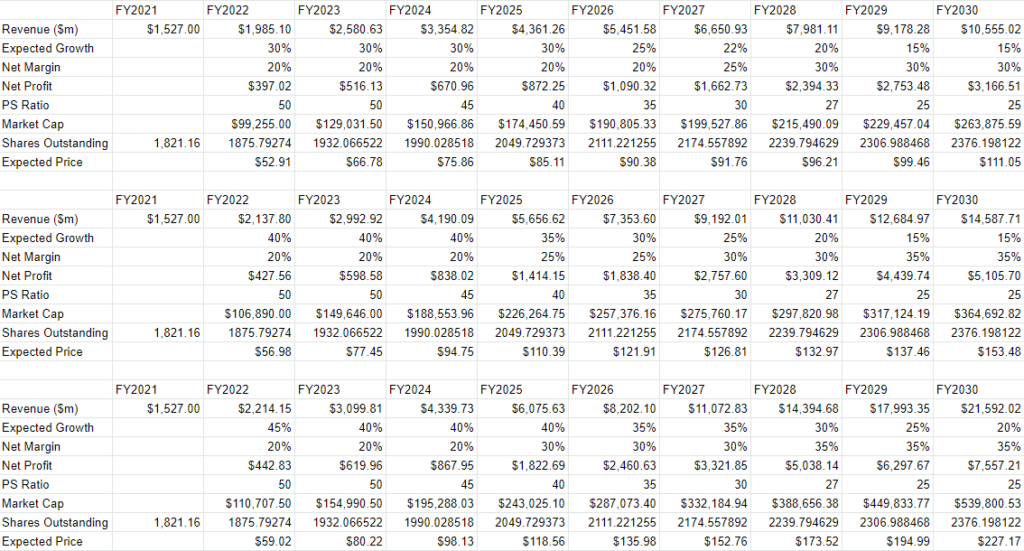

Now that we have Palantir’s expected fair value over the long term, how do we know if it is realistic? We can backtest it using a few values such as expected growth rate, net profit margin as well as using a traditional PS ratio to give an estimated value to Palantir at any given year.

Note that the shares outstanding in all the assumptions are diluted by 3% yearly because the management has indicated that they will slow down share dilution significantly starting FY2022. Although 3% might not be the case for the first few years, I use it as an average across a 10-year span. We are also using the same PS ratio across all 3 cases across the 10-year period to be consistent in our comparison.

The first table assumes a very conservative case whereby Palantir grows by 30% until FY2025, as stated in their guidance, and thereafter, the growth rate will fall off to a floor at 15% in FY2029. It also assumes a low net margin of 20% until FY2026 which will then start to grow to 25% in FY2027 and 30% in FY2028 and onwards, indicating that the company has matured as the growth rate slows down and profitability increases. Based on this assumption and the fair value above, it will take Palantir nearly 5 years to achieve this.

The second table assumes a base case whereby Palantir exceeds its expected growth rate, starting at 40% until FY2024 as it starts to fall off, reaching a floor of 15% in FY2029. It also assumes a more optimistic case whereby Palantir achieves a higher net profit margin starting FY2025 at 25% and growing it to a high of 35% in FY2029 and onwards. Based on this, Palantir is expected to reach the above-mentioned fair value by FY2024.

The last table assumes a very bullish case whereby Palantir does extremely well in FY2022 with an expected growth rate of 45% which then falls off to 40% in FY2023 until FY2025. From there on, it will start to slowly fall off, reaching a floor of 20% in FY2030. It also assumes a very bullish case for Palantir’s profitability which is starting to look very realistic as the company is generating an increasing amount of free cash flow. Based on this, Palantir is expected to reach the above-mentioned fair value by FY2024 as well.

Final Thoughts

Although these numbers and tables should not be followed religiously, it provides some insight and clarity as to whether or not my valuation is realistic based on the expected growth rate, net profit margin, and a traditional PS ratio that the market uses to value high-growth SaaS companies as they start to mature and grow larger in size.

Palantir is definitely a company to watch as it is a huge player in the up-and-coming trend of SaaS and big data tech companies. There is a misconception on what Palantir does exactly. Many think that it mines, collects, and aggregates data, while others view it as a data analytics company. For one, Palantir does not mine or collect any data from their clients. As for the second misconception, Palantir is much more than just your average data analytics company like Datadog. You can see from the product offerings that Palantir is very customizable and is very well built for government agencies as well as commercial companies that want to ramp up their operations.

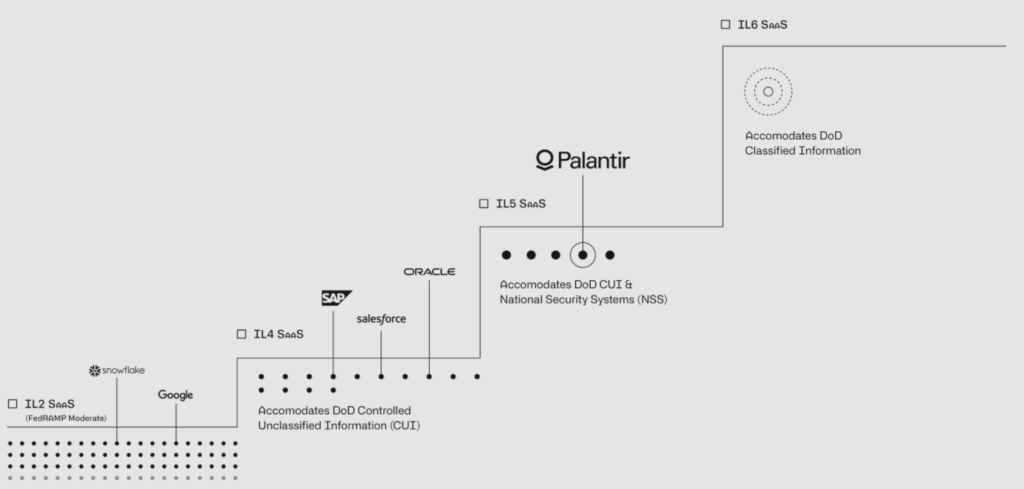

Another misconception that many investors have on Palantir is that its competitors are the likes of Snowflake, Splunk, Salesforce, and Datadog. This misconception stems from investors not fully understanding what Palantir does as a company and how huge its moat is. With so many government entities in their clientele list, Palantir is required to have a very high clearance level in terms of security in their overall product suite.

Palantir is one of 5 SaaS offerings that are authorized for Mission Critical National Security Systems (IL5) by the U.S. Department of Defense. Other names mentioned such as Salesforce and Snowflake are of a much lower clearance level as compared to Palantir.

Overall, Palantir has been on my watchlist since day 1 and I will continue to monitor its progress as time goes on, accumulating more as it dips. I’ve also talked about it with the members of my Premium Subscription for quite some time now since its IPO. Most of them accumulated with me ever since the IPO and even during the dip over the past few months.

Pingback: How My Portfolio Has Performed in 2024 - sgstockmarketinvestor