Lendlease REIT (SGX: JYEU) is no longer a stranger to the Singapore market, having been around for a few years. Since its IPO, Lendlease REIT has made 1 huge improvement to strengthen its overall portfolio, which is the acquisition of JEM. As Singapore continues to ease restrictions set in place due to the COVID-19 pandemic, making masks optional on public transport starting on Feb 13th, retail REITs could stand to gain from this as retail footfall will likely see an increase after this announcement. In this article, we will dive deep and analyze how well it has performed in FY2022 as well as in its recent 1H FY2023 results, and discuss if Lendlease REIT is still a good buy in 2023.

Portfolio Overview

Lendlease REIT has a total of 3 assets in its portfolio, two in Singapore, namely 313@somerset and JEM, as well as one in Milan as of 31st December 2022.

Lendlease REIT’s recent acquisition, JEM, is a very well-known shopping mall, located on the west side of Singapore. The asset is a 99-year leasehold and has a decent valuation cap rate of 4.5% for retail and 3.5% for office. Its occupancy rate has remained very strong throughout FY2022, holding at 100%. On top of this, the asset has a very long WALE of 9.2 years (by NLA) and 5.9 years (by GRI). Overall, this acquisition will prove to be a very good one for Lendlease REIT as it boosts the overall portfolio’s stability.

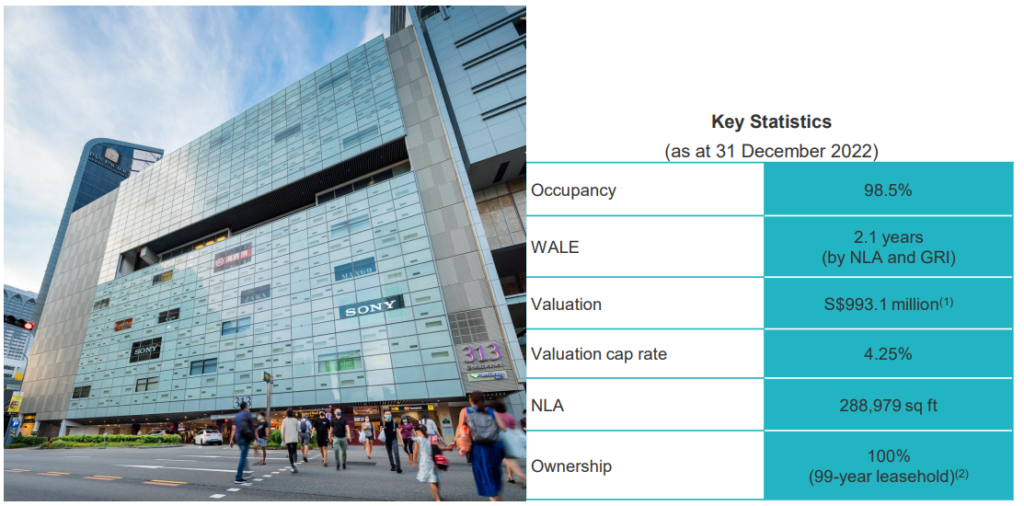

Lendlease REIT’s 1st Singapore asset, 313@somerset, is also a very well-known shopping mall, located in the heart of Singapore. The asset is a 99-year leasehold and has a decent valuation cap rate of 4.25%. Its occupancy rate has fallen during the height of the COVID-19 pandemic, to a low of 95.6% in September 2020. Soon after, thanks to the proactive management as well as the recovering situation of the economy, the occupancy rate has since improved gradually to 99.7% in 1H FY2022. As of 31 Dec 2022, the occupancy did fall slightly to 98.5%. The overall WALE of the asset, 2.1 years, is on par with other retail REITs in Singapore such as Frasers Centrepoint Trust (SGX: J69U).

Last but not least, Lendlease REIT’s Milan asset, Sky Complex, is a Grade-A Office, comprising of 3 office buildings and has excellent accessibility via the public transport system. The property is fully leased to Sky Italia, a British satellite television platform. The asset is also freehold which definitely helps its value appreciate over time. Its valuation cap rate has fallen slightly from 5.25% to 5% which is still good nonetheless. The best part about this asset is that its occupancy rate has been maintained at a high 100% thanks to Sky Italia being a very stable tenant. The asset’s WALE (9.4 years) is also very long which helps boosts the overall portfolio’s stability.

1H FY2023 Performance

After looking into Lendlease REIT’s portfolio, let’s discuss how well Lendlease REIT performed in the first half of FY2023.

Significant Boost in Revenue and NPI

| Year on Year Difference | 1H FY2023 | 1H FY2022 |

|---|---|---|

| Gross Revenue | S$101.733 million (+159.6%) | S$39.19 million |

| Net Property Income (NPI) | S$76.424 million (+157.8%) | S$29.643 million |

Lendlease REIT kicks off FY2023 with a bang, showing the impact of its latest acquisition. Having its Gross Revenue and NPI growing by 159.6% and 157.8% respectively, investors can see that the acquisition was definitely a positive one. On top of the highly accretive acquisition, the 2 existing assets had better operating performance, which ultimately resulted in a strong set of results for 1H FY2023.

Weaker Than Expected Distributable Income and DPU

| Year on Year Difference | 1H FY2023 | 1H FY2022 |

|---|---|---|

| Distributable Income | S$56.03 million (+95.9%) | S$28.602 million |

| Distribution Per Unit (DPU) | 2.45 cents (+2.1%) | 2.40 cents |

Despite the Gross Revenue and NPI growing over 150% year over year, the Distributable Income only grew by 95.9% and the overall DPU for 1H FY2023 only grew by 2.1%. The increase was much lower in comparison due to several factors such as unrealized foreign exchange gains/losses, the net change in fair value of derivatives, management fees paid in units, distribution paid to perpetual securities holders, and having an enlarged issued unit base. Despite this, it is still a good sign that the DPU and Distributable Income went up year over year.

Stabilizing Balance Sheet

| As at 31 December 2022 | As at 30 September 2022 | As at 31 December 2021 | |

|---|---|---|---|

| Aggregate Leverage | 39.2% | 39.4% | 33.5% |

| Interest Coverage | 5.5x | 6.9x | 9.7x |

| Average Cost of Debt | 2.35% | 2.24% | 0.92% |

Due to the size of the JEM acquisition, Lendlease REIT’s balance sheet did take a hit, with their aggregate leverage increasing from 33.5% in 2021 to 39.2% in 2022. Their interest coverage ratio also fell significantly from 9.7x to 5.5x. Not forgetting their average cost of debt, which went up significantly from 0.92% to 2.35% due to the high interest rate environment that we are in currently.

If we were to compare quarter over quarter, Lendlease REIT has managed to lower its aggregate leverage slightly by 2 bps but also saw its interest coverage ratio fall from 6.9x to 5.5x. Their average cost of debt also went up in comparison, from 2.24% to 2.35%. The reason why its quarter-on-quarter cost of debt went up so much is because Lendlease REIT only has approximately 61% of its debt under fixed rates. This means that they are very vulnerable to interest rate hikes in the coming quarters.

Portfolio Updates

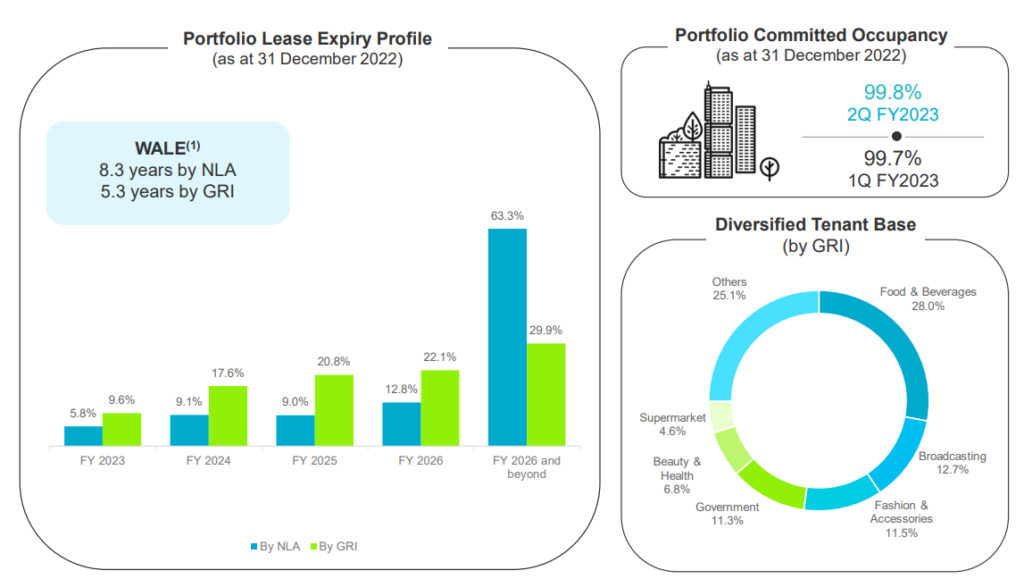

Next up, let’s look at Lendlease REIT’s overall portfolio. As of 31st December 2022, Lendlease REIT has managed to maintain a strong WALE at 8.3 years (NLA) and 5.3 years (GRI) coupled with a high portfolio occupancy of 99.8%, only falling by 0.1% year over year. It is also good to see that they have a more diversified tenant base thanks to the JEM acquisition.

Potential Growth Catalysts

After the acquisition of JEM, can Lendlease REIT still grow in the future? Let’s dive right into some of the potential growth catalysts for Lendlease REIT in FY2023 as well as the future.

Potential Pipeline Assets

Lendlease REIT has a rather large sponsor, Lendlease, which is listed on the ASX. The sponsor holds stakes in 2 fantastic assets in Singapore, namely Parkway Parade (10% interest) as well as the newly opened Paya Lebar Quarter (30% interest).

These assets are prized jewels that can be a great boost to Lendlease REIT’s portfolio, bringing about great value as well as improving diversity. Despite all this, based on Lendlease REIT’s current balance sheet, it might be wise to stay clear of acquisitions for the time being (6-12 months) and focus on lowering their debt as it could be quite a load on their financials given the rising interest rate environment.

Post Covid Recovery

As we enter 2023 with a strong start, with more countries lifting COVID-19 restrictions such as China resuming travel again, and Singapore making masks optional in most public places except for medical facilities, the overall economy could stand to gain from this recovery. Based on Lendlease REIT’s 1H FY2023 results, the management has shared that tenant sales and visitation have gone up by 5x and 2.8x year over year, surpassing pre-COVID-19 average levels. With China reopening its borders, Singapore will stand to gain from the high influx of Chinese tourists. On the commercial side of Singapore, rental across Grade A core CBD buildings went up by 0.9% to $11.7/sqft per month. Suburban office spaces like JEM will also continue to be relevant as more businesses adopt a hybrid workplace model.

Valuation v. Peers

| PB Ratio | Annualized Dividend Yield | |

|---|---|---|

| Lendlease REIT ($0.74) | 0.949x | 6.622% |

| CapitaLand Integrated Commercial Trust ($2.01) | 0.976x | 5.264% |

| Frasers Centrepoint Trust ($2.19) | 0.940x | 5.583% |

| Mapletree Pan Asia Commercial Trust ($1.76) | 0.989x | 5.5% |

As we can see from the valuation table, all the retail REITs are currently at a “cheap” valuation, with all of their PB ratios under 1x. When we compare the 4 REITs together, we find that Lendlease REIT is priced with the cheapest valuation, with the lowest PB ratio and highest annualized dividend yield as compared to its peers. On top of this, Lendlease REIT’s portfolio is significantly smaller than the other 3 REITs, which means that it has a mathematical advantage when we talk about upside potential because it has a smaller base to begin with.

Final Thoughts

Overall, I still find Lendlease REIT to be a fantastic but very undervalued REIT to buy and hold over the long term. The potential growth catalysts are definitely an added plus to its relatively fair valuation. I have had positions in Lendlease REIT in the past, having sold just after 1 year, locking in an approximate 69.2% return. Of course, the REIT has always been on my watchlist and if the valuation does become more attractive, I might start a new position again. To stay up to date with my latest portfolio and watchlist updates, check out my Premium Subscription group