With the Covid pandemic seeing a few resurgences over the past few months across several countries, could industrial REITs be the safe haven that dividend/income investors are looking for as they seek consistent and predictable cash flow in their investments? One that stood out the most would be ESR REIT (SGX: J91U) as it has recently proposed a merger with another industrial REIT, ARA LOGOS Logistics Trust. Let’s take a look at ESR REIT as well as the proposed merger and figure out if this could be a great investment to add to your portfolio.

Portfolio Overview

ESR REIT has a relatively sizable portfolio with a total of S$3.2 billion assets under management. It is good to note that 97.8% of their rental income derives from their Singapore portfolio which comprises a total of 58 properties while the remaining 2.2% comes from their 10% interest in ESR Australia Logistics Partnership in which they have a S$61.5 million equity stake in.

We can also see that ESR REIT has several key assets across Singapore such as Business Parks, High-Specs Industrials as well as assets in Major Industrial Clusters.

9M 2021 Results

Let’s dive straight into ESR REIT’s 9M 2021 results to see how well it fared year over year despite the rocky conditions brought about by the pandemic.

Consistent Growth in Gross Revenue and NPI

| Year on Year Difference | 9M 2021 | 9M 2020 |

|---|---|---|

| Gross Revenue | S$180.908 million (+6.0%) | S$170.7 million |

| Net Property Income (NPI) | S$130.817 million (+8.5%) | S$120.603 million |

ESR REIT has managed to grow its Gross Revenue and NPI by 6.0% and 8.5% respectively year over year mainly due to the absence of provision for COVID-19 rental rebates to tenants which amounted to S$4.6 million in 1H 2020. The lower property expenses also helped contribute to the higher NPI in 1H2021 which helped boost the 9M2021 results as a whole.

Outstanding Performance in Distributable Income and DPU

| Year on Year Difference | 9M 2021 | 9M 2020 |

|---|---|---|

| Core Distributable Income | S$85.4 million (+17.6%) | S$72.6 million |

| Core Distribution Per Unit (DPU) | 2.266 cents (+10.1%) | 2.059 cents |

Coupled with a higher Gross Revenue and NPI, ESR REIT achieved huge growth in its Core Distributable Income by 17.6% year over year. Despite the increase in the total number of issued shares by 3.8% to ~3.65 billion units in total, ESR REIT still achieved phenomenal growth in its core DPU by 10.1% to 2.266 cents in 9M 2021.

Rocky Balance Sheet

| As at 30 September 2021 | As at 30 June 2021 | As at 31 December 2020 | |

|---|---|---|---|

| Aggregate Leverage | 41.3% | 42.9% | 41.6% |

| Interest Coverage | 2.9x | 2.8x | 2.6x |

| Average Cost of Debt | 3.41% | 3.24% | 3.54% |

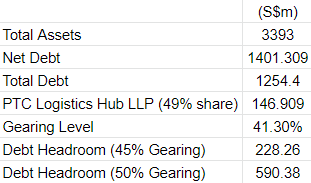

Despite the strong performance for the half, ESR REIT’s balance sheet still looks very unstable with a very high Pro-forma gearing of 41.3% after its Preferential Offering as well as its high average cost of debt at 3.41%. Although it is a good sign that the management has managed to bring it down from 3.54% 9 months ago but it is still relatively high when you take into account the current low interest-rate environment we are in. The only positive in its balance sheet is the fact that the ICR has been improving slowly from 2.6x to 2.9x over the past 9 months.

At ESR REIT’s current gearing of 41.3%, they have a debt headroom of approximately ~S$590.4m before hitting the 50% ceiling. This is calculated using the current total debt in addition to ESR REIT’s 49% share in PTC Logistics Hub LLP, amounting to a net debt of $S1401.309m. With its total assets amounting to ~S$3393m, the estimated remaining debt headroom of S$590.38m.

The debt headroom is definitely not very big and will not allow ESR REIT to make any meaningful acquisitions in the near future unless they introduce another round of equity fundraising. Perhaps it will be a good opportunity for them now to pare down their gearing before acquiring any subsequent assets.

Portfolio Updates

There have been some updates for ESR REIT’s portfolio which were mentioned in 1H 2021. Let’s take a quick look at the new changes to the portfolio.

Asset Enhancement Initiatives (AEIs)

The first AEI would be for 19 Tai Seng Avenue (“19TS”) which is expected to obtain a temporary occupation permit (“TOP”) in 3Q2021. Having already secured more than 63% committed occupancy for the asset, the new facelift will definitely help boost the asset’s value and attract higher-quality tenants moving forward. With the total CapEx amounting to ~S$7.65m, it is expected to generate an estimated yield-on-cost of 7%-9% which is great. The AEI for 19TS is expected to be completed in 4Q2021 due to the delays arising from P2(HA) in Q2021.

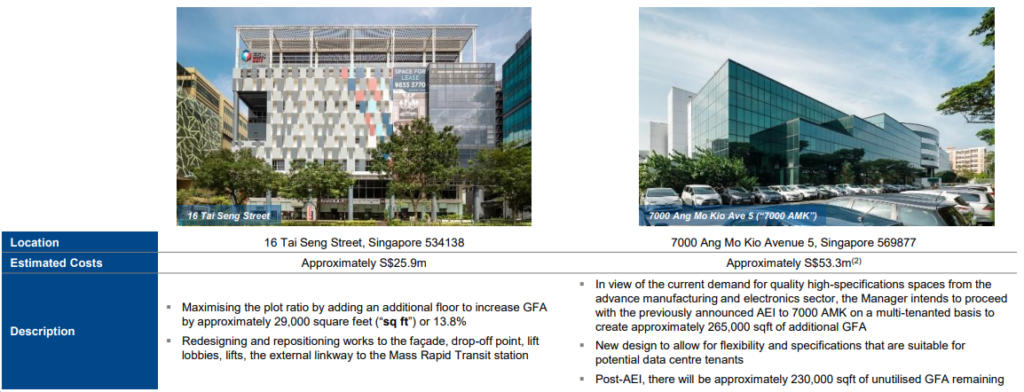

On top of that, there are 2 other AEIs that the management has already planned for. While the AEI for 16 Tai Seng Street has yet to announce when it will commence, the AEI at 7000 Ang Mo Kio Avenue 5 (“7000 AMK”) is expected to commence towards the end of October and is targeted to be completed by 3Q2023. The Scope of work includes the development of a new high-spec building with a gross floor area of approximately 265,000 sqft, atop the existing open-air car park at 7000 AMK. Designed to be suitable for both data centre operators and advanced manufacturing tenants, the fully air-conditioned new building will be fitted-out with higher power capacity and higher floor loading.

Divestments

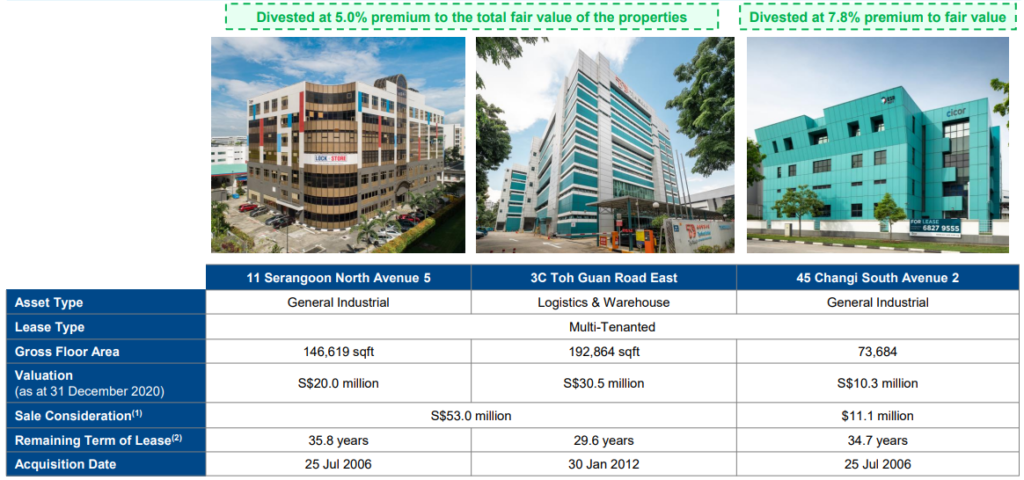

On top of the AEIs, ESR REIT has also unlocked some value through divestments in its portfolio. The first 2, 11 Serangoon North Avenue 5 and 3C Toh Guan Road East, were divested at a 5% premium to its combined fair value for the 2 properties and at a 7.1% premium to their combined total acquisition cost. ESR REIT also divested 45 Changi South Avenue 2 at a sale consideration of S$11.1m, representing a 7.8% premium to its fair value of S$10.3m.

Proposed Merger with ARA LOGOS Logistics Trust

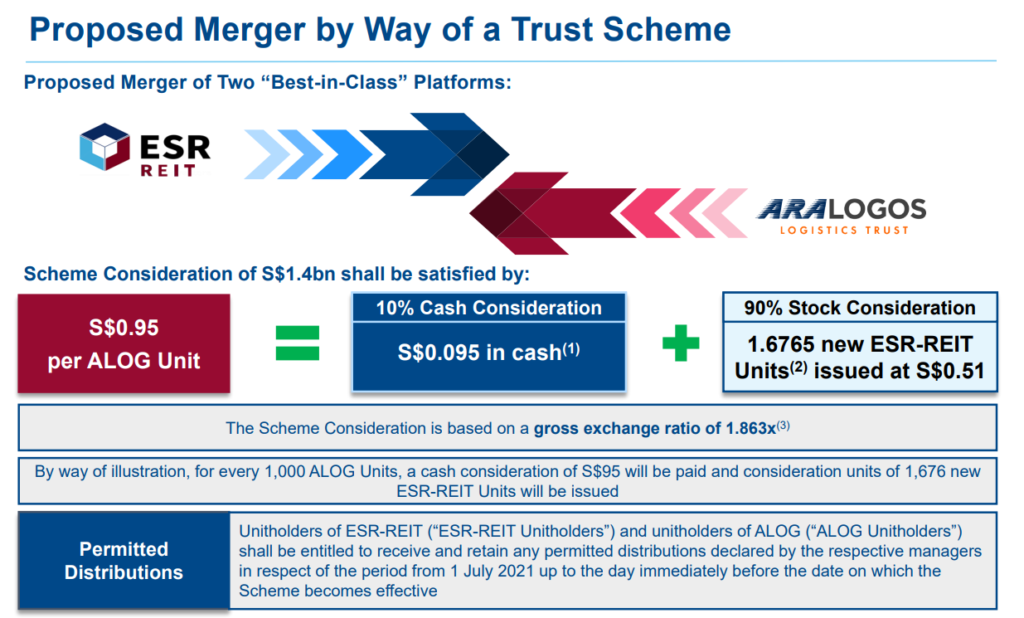

On the 15th of October 2021, a proposed merger with ARA LOGOS Logistics Trust was announced. This proposed merger will definitely impact shareholders of both REITs so let’s dive right into the details and see if the proposed merger is a good one for ESR REIT and ARA LOGOS Logistics Trust respectively.

Starting off with the proposed scheme consideration of S$1.4b for each ALOG share being satisfied through a 10% cash consideration (S$0.095 in cash) and a 90% stock consideration (1.6765 ESR REIT share issued at S$0.51). For illustration purposes, for every 1,000 shares of ALOG, you will receive a cash consideration of S$95 and 1,676 new shares in ESR REIT.

At a quick glance, this will definitely benefit ESR REIT shareholders greatly as we can see the latest closing price for ESR REIT is $0.48 while it is being priced at S$0.51 here in the scheme consideration, representing a $0.03 or 6.25% premium. Not to mention the fact that for every 1,000 ALOG shares you hold, valued at S$0.95/share, you will be receiving $95 in cash and 1,676 shares of ESR REIT, valued at $0.51/share, resulting in a total net value of $949.76 received for your $950 investment in ALOG, amounting to a near negligible loss of $0.24 through this conversion process.

Key Benefits of Merger

Reducing Portfolio Risks Through Diversification

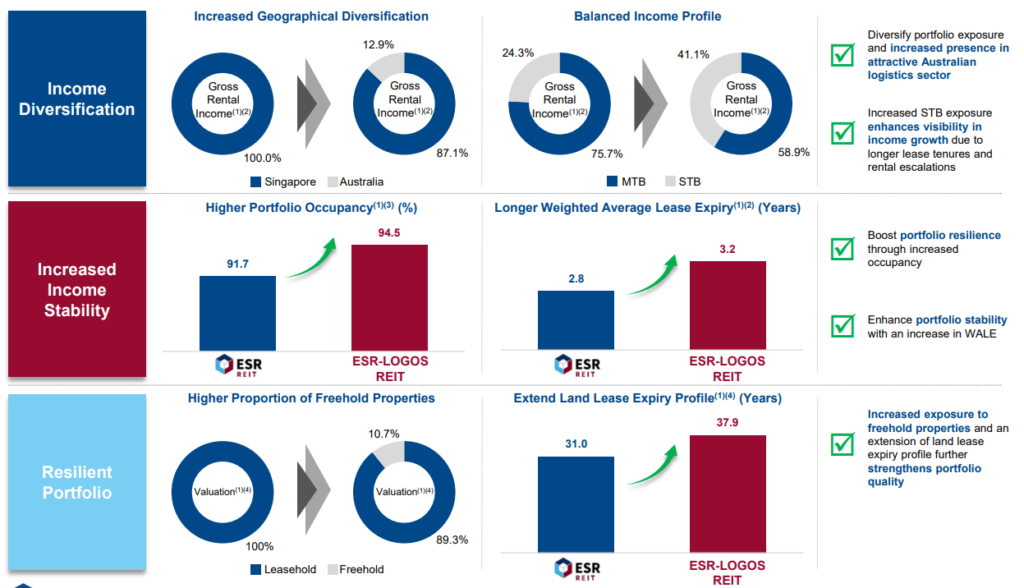

One of the key benefits for shareholders of both REITs is the fact that post-merger, the combined portfolio will be very diversified and thus lowering the overall portfolio risk. Post-merger, the overall portfolio will have its Gross Rental Income (GRI) be more diversified, having 12.9% coming from Australia while the remaining 87.1% will come from Singapore as compared to just having 100% of the GRI come from Singapore alone.

On top of that, the overall portfolio will have an increased portfolio occupancy from 91.7% to 94.5% with its Weighted Average Lease Expiry (“WALE”) increasing as well from 2.8 years to 3.2 years. In addition to this, the combined portfolio will now also have 10.7% of its assets being freehold while the remaining 89.3% is leasehold as compared to having 100% of the portfolio being leasehold.

Post-merger, there will be no single tenant that accounts for more than 4.6% of the GRI, with the top 10 tenants only accounting for 26.3% of the GRI as compared to 29.4% before the proposed merger. As the total tenant base grows from 360 to 437, with a total of 87 properties with a combined total net leasable area of 2.2m sqm, the proposed merger seems like a fantastic opportunity for both REITs to grow and expand together as a single entity.

Larger Size Opens Up More Opportunity

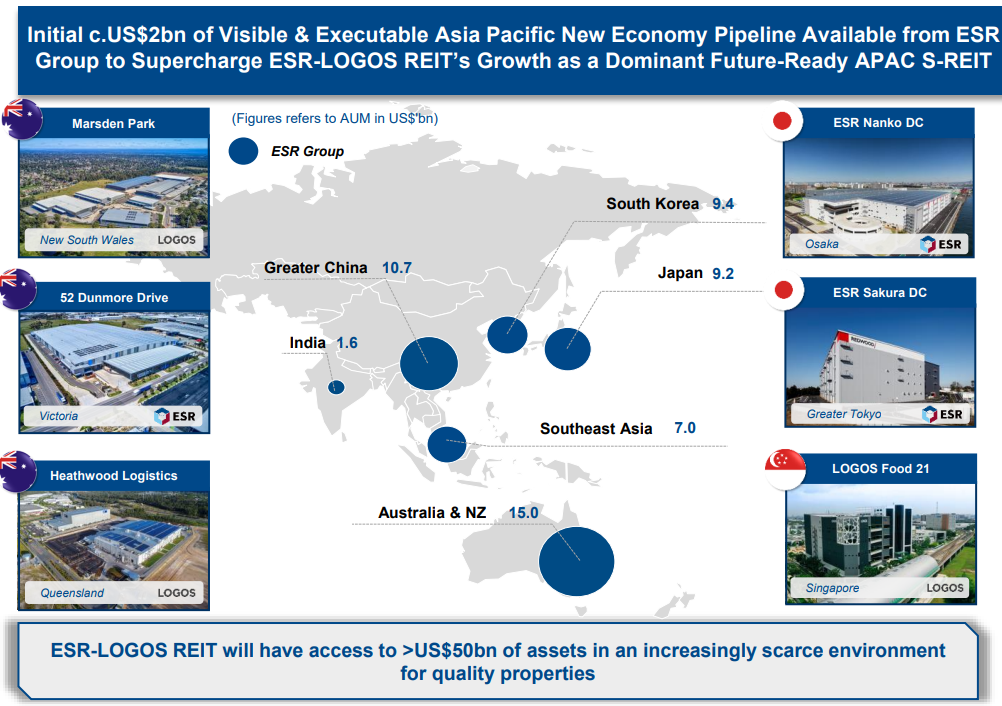

With the proposed merger, the market cap of the combined entity (ESR-LOGOS REIT) will be approximately S$3.3b. With the larger size, ESR-LOGOS REIT can bring down the average cost of debt from 3.24% to 2.84% as well as extend the Weighted Average Debt Expiry (“WADE”) from 2.6 years to 3.4 years. With a total asset size of S$5.3b, we can expect to see the gearing of ESR-LOGOS REIT be pared down significantly, thus opening up more debt headroom for future expansion plans and acquisitions.

With a larger debt headroom, it will allow ESR-LOGOS REIT to leverage on the ESR Group’s platform as they will have access to over US$50b in assets, of which an initial US$2b of pipeline assets will be readily available to accelerate ESR-LOGOS REIT’s growth plans.

Based on an estimated development headroom (up to 25% of total assets), we can expect the development headroom for ESR REIT to grow by approximately 1.6x from ~S$0.8b to ~S$1.4b post-merger.

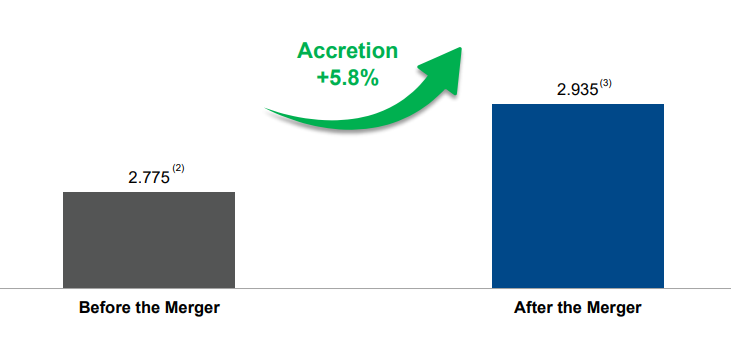

DPU Accretive for ESR REIT

One of the most important details for ESR REIT shareholders will be the post-merger DPU and if it is accretive or dilutive. Thankfully for shareholders, the merger is DPU accretive, with its DPU expected to grow by 5.8% based on an FY2020 pro forma basis.

Timeline

The proposed merger’s timeline is as follows above with the expected EGM to be held in early January 2022 for both ESR REIT and ALOG. If there are no delays and the merger goes through, the expected effective date of the scheme will be somewhere in early February 2022, with the expected date for payment of cash consideration, allotment, and issuance of considerations units, as well as the delisting of ALOG, will be during the same month as well.

Valuation v. Peers

Before we jump into my overall thoughts on ESR REIT, we will need to compare its valuation against its industry peers.

| PB Ratio | Annualized Dividend Yield | |

|---|---|---|

| ESR REIT ($0.48) | 1.21x | 5.933% |

| Aims APAC REIT ($1.45) | 1.04x | 6.552% |

| Cromwell European REIT (€2.62) | 1.04x | 6.490% |

| Sabana Shari'ah Compliant REIT ($0.43) | 0.82x | 6.884% |

As we can see, ESR REIT is currently priced with the highest premium when compared to its peers with a 1.21x PB ratio as compared to Aims APAC REIT and Cromwell European REIT which are both priced at a 1.04x PB ratio. ESR REIT also has the lowest dividend yield of 5.933% as compared to its peers which are all above 6%. In this comparison, Sabana REIT is definitely the cheapest with a PB ratio of 0.82x and a dividend yield of 6.884%.

Final Thoughts

Overall, I see great potential in ESR REIT, especially post-merger as it forms into 1 single entity, ESR-LOGOS REIT. Even without the merger, ESR REIT has seen great growth year over year thanks to the active management, introducing many AEIs as well as meaningful divestments to help improve the overall portfolio. Coupled with the merger, ESR REIT will be of a larger size and can be meaningfully compared with the bigger REITs in the industry such as Ascendas REIT, Mapletree Logistics Trust, and Mapletree Industrial Trust.

As it continues to churn out great results year over year, we can expect the REIT to grow larger over the next few years. If I were to give it a post-merger target price, I’d price it with a respectable 5% yield based on its Pro-forma FY2020 DPU (2.935cents), which will come up to a share price of 58.7cents, representing an approximate 22.3% upside from its current closing price of 48cents.

Pingback: ESR REIT Merger with ARA LOGOS Logistics Trust! Should ALOG Shareholders Vote Yes?