With the merger date drawing closer, ARA LOGOS Logistics Trust (ALOG) shareholders are still undecided on whether or not they should vote yes for the upcoming merger with ESR REIT. With ESR REIT revising their scheme consideration upwards from S$0.95 to S$0.97 per ALOG unit, it reiterates ESR-REIT’s keenness for a successful merger and confidence in the long-term merits of the Enlarged REIT. In this article, we’ll cover whether or not ALOG shareholders should take the newly revised deal or vote no for the merger.

Portfolio Overview

ARA LOGOS Logistics Trust (ALOG) is a logistics REIT with a strong portfolio of 29 assets across both Singapore and Australia. On top of this, ALOG also has stakes in 2 investment funds, 49.5% in New LAIVS Trust as well as 40% in Oxford Property Fund. These 2 newer investments were completed in April 2021, which gave them ample time to start contributing to ALOG’s revenue numbers as we can see in the next segment. In addition to these 2 investments, ALOG has also made various changes to its portfolio over FY2021, acquiring 5 new assets in Australia as well as divesting ALOG Changi DistriCentre 2 and Kidman Park.

FY2021 Results

Next, we will cover the FY2021 results of ALOG and understand how well it fared over the year after going through several portfolio changes.

Strong Growth in Gross Revenue and NPI

| Year on Year Difference | FY2021 | FY2020 |

|---|---|---|

| Gross Revenue | S$135.233 million (+15.2%) | S$117.432 million |

| Net Property Income (NPI) | S$104.889 million (+16.6%) | S$89.99 million |

As we can see, ARA LOGOS Logistics Trust (ALOG) did well in FY2021, pulling in double-digit growth in its Gross Revenue and NPI. The growth came from an increased contribution from the completed Australian portfolio acquisition back in April 2021 as well as a much stronger overall portfolio performance. The gains were slightly offset by the divestments of Kidman Park as well as ALOG Changi DistriCentre 2.

Diluted Share Base Pulls Down on DPU

| Year on Year Difference | FY2021 | FY2020 |

|---|---|---|

| Distributable Income | S$70.373 million (+19.6%) | S$58.828 million |

| Distribution Per Unit (DPU) | 5.034 cents (-4.1%) | 5.25 cents |

Despite the strong growth in Distributable Income by almost 20%, mainly attributed to ALOG’s fund investments in the New LAVIS Trust and Oxford Property Fund, the overall FY2021 DPU/share fell by 4.1% because of an enlarged share base. The diluted share base was caused by the equity fundraising which was for the maiden Australian portfolio acquisition.

From the acquisition announcement, ALOG was expecting to see a slight dip in DPU by 1.9% as well as its NAV by 2.2% based on its 1H20 numbers. Personally, I try to stay away from acquisitions that have a negative Pro-forma impact on a REITs’ financials unless there is a very strong argument for it. For ALOG’s case, even though the acquisition is good as it allows them to widen their exposure to Australia as well as diversify their overall portfolio, I don’t see it being a very “wise” acquisition.

It is important for investors to note that not every acquisition is a good opportunity for shareholders because although you might have grown in your revenue numbers and distributable income, if the overall share base was diluted heavily, your overall return (DPU/share) might be negatively impacted.

Weak Balance Sheet Post Acquisition

| As at 31 December 2021 | As at 31 December 2020 | |

|---|---|---|

| Aggregate Leverage | 39.5% | 39.0% |

| Interest Coverage | 4.7x | 4.3x |

| Average Cost of Debt | 2.77% | 3.22% |

It is also noted that post-acquisition, ALOG would expect to see a rise in its aggregate leverage by 2.5% based on its 1H20 aggregate leverage. All in all, the overall balance sheet seems weak with an aggregate average near 40%. The ICR is still manageable at 4.7x and it is great to see that they managed to pare down their cost of debt from 3.22% to 2.77%.

Just to put it into perspective, ALOG’s total debt outstanding stands at S$745.8m. This means that for every 0.01% drop in the cost of debt, ALOG effectively saves approximately S$0.07458 million. Reducing their cost of debt from 3.22% to 2.77% will effectively help them save an approximate S$3.3561 million p.a.

Overall Portfolio Stability

Despite the rather mixed results, ALOG has a fantastic portfolio in its hands. With their portfolio occupancy steadily improving from 98.5% last year to 99.0% in FY2021, coupled with a rather long WALE at 4.4 years, the portfolio looks relatively stable. They also had a 3.1% positive rental reversion for FY2021 which is an added bonus. On top of that, ALOG’s portfolio has a good balance of multi-tenanted as well as single-user leases, in a 72%-28% ratio.

Proposed Merger with ESR REIT

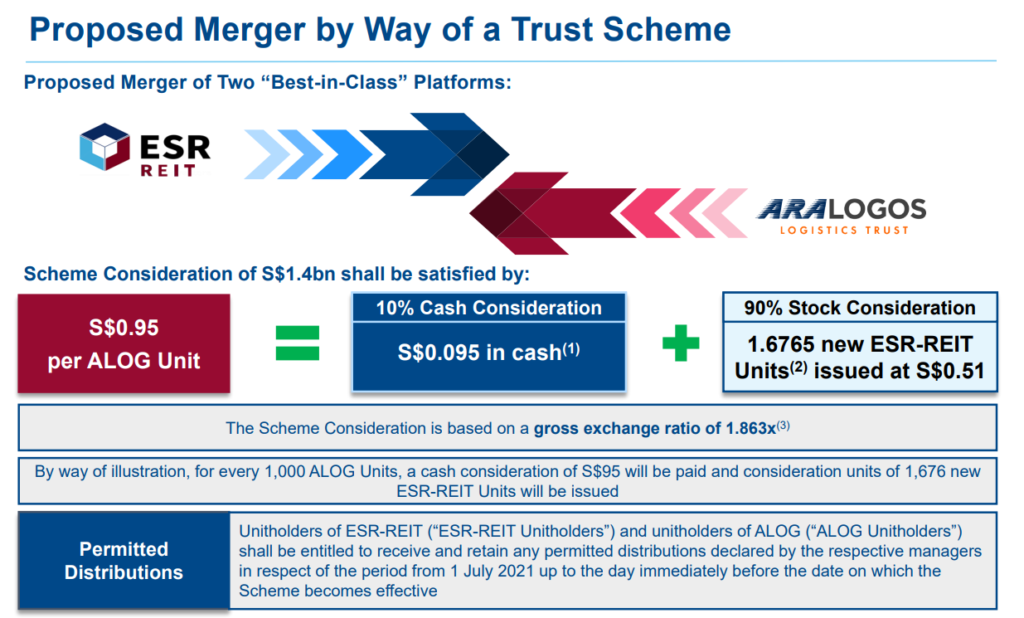

Moving into the main topic of this article, which is the proposed merger with ESR REIT. Before we discuss the pros and cons, let’s have a quick summary of what the merger is about as well as the proposed scheme consideration. On the 15th of October 2021, a proposed merger with ARA LOGOS Logistics Trust was announced and the initial scheme consideration was as such:

As we can see, the proposed scheme consideration of S$1.4b for each ALOG share being satisfied through a 10% cash consideration (S$0.095 in cash) and a 90% stock consideration (1.6765 ESR REIT share issued at S$0.51). For illustration purposes, for every 1,000 shares of ALOG, you will receive a cash consideration of S$95 and 1,676 new shares in ESR REIT.

As of 22nd January 2022, ESR REIT has since revised the scheme consideration upwards to the following:

The revision has now priced each ALOG share at S$0.97 as compared to the previous pricing of S$0.95. As for how each share will be paid out, there is a slight increase in the cash consideration, from S$0.095 to S$0.097, as well as a change in valuation per ESR REIT distributed out. Previously, for every ALOG share, a shareholder will receive 1.6765 shares of ESR REIT, priced at S$0.51 per share. As per the newly revised scheme consideration, for every ALOG share, a shareholder will now receive 1.7729 shares of ESR REIT, priced at S$0.4924 per share.

The upward revision is definitely great for ALOG shareholders because it will now imply a 1.45x P/NAV as compared to its previous 1.42x P/NAV valuation. On top of this, post-merger, ALOG is expected to see a 12.8% DPU accretion as well as a 5.3% NAV per unit accretion.

Read Also: Is ESR REIT A Good Buy Now in 2021?

Key Benefits of Merger

Before we analyze further, let’s talk about the key benefits of this merger from ALOG shareholders’ perspective.

Resolving Potential Overlapping Mandates

With ESR REIT and ALOG both having the same Sponsor (ARA) after the completion of the acquisition of ARA by ESR cayman, there could be a potential issue when it comes to overlapping mandates between the two REITs, which could potentially disrupt the growth opportunities for both. If the merger were to be completed, the new enlarged entity (ESR-LOGOS REIT) will stand to benefit from all potential pipeline assets from its sponsor. This means that ESR-LOGOS REIT will gain access to its sponsor’s huge pipeline of not only assets under management but also its development pipeline as well.

Larger Size Opens Up More Opportunity

With the proposed merger, the market cap of the combined entity (ESR-LOGOS REIT) will be approximately S$3.3b. With the larger size, ESR-LOGOS REIT can bring down the average cost of debt from x% to 2.25%. Post-merger, ALOG will see a net increase in its aggregate leverage from 39.8% to 42.1%. Despite the net increase in aggregate leverage, thanks to its huge portfolio size of S$5.4b, there is also a huge debt headroom growth from S$396m to S$815m as well as development headroom from S$0.5b to S$1.4b, thus opening up more debt headroom for future expansion plans and acquisitions.

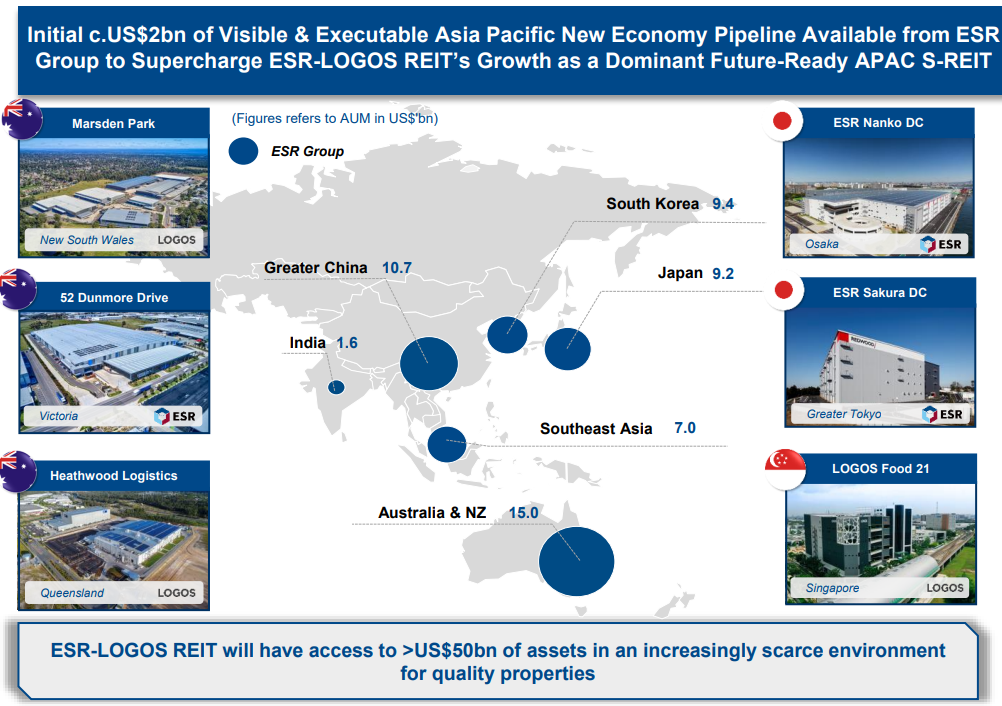

With a larger debt headroom, it will allow ESR-LOGOS REIT to leverage on the ESR Group’s platform as they will have access to over US$50b in assets, of which an initial US$2b of pipeline assets will be readily available to accelerate ESR-LOGOS REIT’s growth plans.

Timeline

The proposed merger’s timeline is as follows above with the expected EGM to be held in early January 2022 for both ESR REIT and ALOG. If there are no delays and the merger goes through, the expected effective date of the scheme will be somewhere in early February 2022, with the expected date for payment of cash consideration, allotment, and issuance of considerations units, as well as the delisting of ALOG, will be during the same month as well. It is good to note that for ALOG’s side, there must be 75.0% or more of the total number of votes cast for and against the resolution for the merger to go through.

Final Thoughts

First off, it is commendable that ALOG has grown so much in FY2021 through various acquisitions and portfolio changes. Other than the fact that its DPU did fall due to an enlarged share base, its overall performance was still strong in FY2021 and will definitely be carried forward into FY2022. With regards to the merger, it definitely doesn’t look like a good one for ALOG shareholders when we compare ALOG and ESR REIT, and here are some of the reasons why.

One key consideration is the fact that ALOG has a much longer Weighted Average Land Lease Expiry of 47.6 years as compared to ESR REIT’s 31 years. This can be seen as a losing point for ALOG as its assets will definitely outlast ESR REIT’s in terms of Land Lease Expiry, not forgetting to mention the fact that ALOG also brings freehold assets into the combined portfolio as well. In addition, ALOG will also see more negative impact on its portfolio as its WALE will drop from a stable 4.4 years to a low of 3.2 years and its portfolio occupancy will drop from a solid 99% to 94.5%. All these drawdowns on ALOG’s portfolio really show how much more superior it really is as compared to ESR REIT.

Despite all this, if the merger does fail, it could seriously impact ALOG’s growth opportunities coming from its sponsor. With both REITs being under the same sponsor, they will effectively be fighting for the same pipeline assets. Both REITs will not stand to benefit at all because a bidding war might arise whenever a potential acquisition is announced. On a smaller note as well, if the merger does fail, ALOG might have to bear some, if not all, of the costs for the merger as stated in the Question and Answer (Question 6) done by ESR REIT.

All in all, if the merger were to go through, the management will need to step up and capitalize on the various growth opportunities it has, as a way to answer to ALOG shareholders who voted yes and supported the merger. If the management fails to do so, we could see ESR-LOGOS REIT suffer a share price correction as investors lose faith and confidence in the REIT as a whole.

Pingback: REIT Posts of the Week @ 12 February 2022 | TheFinance.sg