IREIT Global recently announced the acquisition for the remaining 60% interest in the Spanish assets they acquired in December last year. The proposed acquisition seems to be pretty dilutive for shareholders. In this article, I’ll breakdown the details of the acquisition and what it means for shareholders.

The Proposed Acquisition

Overview of the Spanish Assets

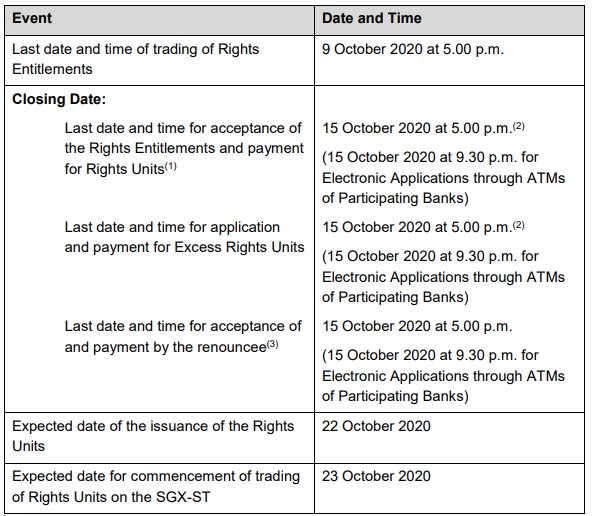

The acquisition involves 4 commercial properties in Spain, 2 in Madrid and 2 in Barcelona. All 4 properties are freehold and have an average WALE of 4.1 years. The occupancy is a little weak at 84.7%, mainly pulled down by the 2 assets in Barcelona with a occupancy of less than 85%. The acquisition will increase IREIT Global’s valuation by 13% from €630 million to €711 million.

Rationale for Acquisition

Further Expansion into Europe

IREIT Global is a Europe commercial asset focused REIT, meaning that all its key assets are in Europe. This is a great market to expand into because currently, most European countries are in near zero interest rate environments, some are even in negative interest rate territories. This allows IREIT Global to leverage up and acquire aggressively while maintaining a very low cost of debt.

As of 30 June 2020, IREIT Global’s effective cost of debt stands at 1.8%. With further acquisitions funded by debt, we can expect to see the cost of debt going closer to 1%.

High Quality Commercial Assets

The 4 freehold commercial assets are multi-tenanted and are anchored by a number of large reputable companies from diverse industries. The assets are within walking distance from public transportation stations, further enhancing their accessibility and attractiveness as an office location. They are also located in close proximity to a wide range of services such as entertainment venues, hotels and restaurants.

The overall occupancy rate is low with the passing rents below the current market rate. This brings about the potential to increase the under-rented properties nearer to market rates as well as increasing the occupancy rate through active leasing efforts. In addition, it also presents an opportunity for IREIT Global to benefit from positive rental reversions as the existing leases are renewed at a potentially higher rental rates.

Increase Resiliency and Diversification

These assets will further complement IREIT Global’s existing portfolio as the diversified blue-chip tenant base of the Spanish portfolio will help strength and diversify their portfolio. The rental income is well spread across the 4 properties, across multiple sectors and industries. The 3 largest sectors are I.T. Services (32.3%), Pharmaceutical (11.9%) and TV Studio (11.5%).

Post acquisition, the Spanish assets will contribute to 19% of IREIT Global’s total valuation while the German assets will reduce its contribution to 81% from 91% previously. Post acquisition, there will no longer be any single property that contributes to more than 30% of IREIT Global’s valuation. The largest exposure to any single city will decrease from 35% to 30% as well.

Rights Issue Details and Timeline

The rights issue units will be issued at S$0.490 per unit, representing a 32.9% discount to the last closing price of S$0.730 per unit. It is also representing a 25.2% discount to the Theoretical ex-rights price (TERP) of S$0.655 per unit. The allotment ratio will be 454 rights units for every 1000 existing units, with any fractional entitlements to be disregarded.

The sponsors (Tikehau Capital SCA, City Strategic Equity and AT Investments) have also shown support for IREIT Global by taking up any unsubscribed rights units remaining after the fulfillment of valid excess rights units applications by other shareholders.

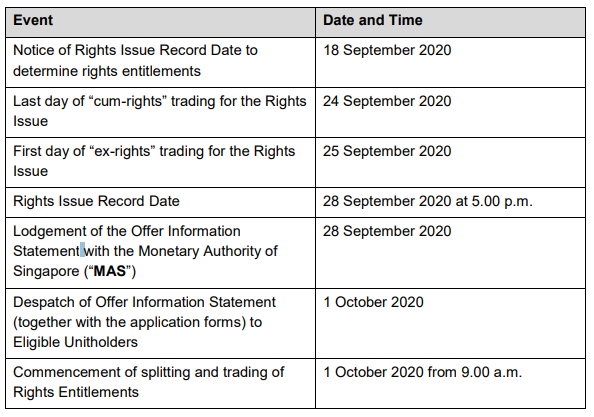

The timeline of the rights issue :

Rights Issue Proceeds

Note : The chart figures are in € millions

Based on the approximate net proceeds of €88.0 million, we can see that a little more than half is used for the actual acquisition while 36.4% is used to pay back the loan taken from the sponsor. The loan was taken during the first part of the acquisition when IREIT Global acquired the first 40% interest in the Spanish assets.

Pro-forma Impact

The below illustration was presented previously before the finalized rights issue was proposed. The illustration takes into account that the total cost of the Acquisition is to be fully financed with the Rights Issue. Approximately 281.8 million new units are issued to raise gross proceeds of approximately €90.0 million to finance the Acquisition and repay the loan.

Based on the finalized rights issue announcement, they are going to issue out 291.4 million new units to raise approximately €88.7 million. The new units will be issued out at a issue price of S$0.490 per rights unit. This means that the rights issue will be more dilutive than the above illustration as there are more units being issued at a lower valuation.

It is good to note that though the DPU and NAV will be significantly diluted, the aggregate leverage will be reduced significantly as well. This brings about more opportunities for further acquisitions if IREIT Global finds suitable assets to acquire.

What Should Shareholders Do?

If you currently hold IREIT Global, you need to ask yourself 3 questions.

How long am I planning to hold IREIT Global?

If you plan to hold IREIT Global for the long term, I believe taking part in the acquisition now could be great for you to pick up some shares at a huge discounted price. IREIT Global’s targeted market is pretty unique as compared to other Singapore Commercial REITs. If you don’t see yourself holding IREIT Global for the long term, it might be a good time to sell now and move your funds into other assets that you are more confident in.

What is my average cost now?

If your current cost now is lower than the market price, you should consider selling your stake now and buying it back post-acquisition when the share price is more depressed. If your cost is higher, you could consider subscribing for the rights in excess, to help you bring down the average cost further.

What will my average cost be post-acquisition?

Based on the issue price of $0.49/share, you are still getting a 9.43% annualized yield on cost. If your average cost is lower than the issue price then it is a no brainer to subscribe to the rights. For most of you, your cost per share will definitely be higher than the issue price. You will then need to consider what is the yield on cost for your stake post acquisition. If the yield on cost is anything less than 4%, you should consider selling your stake and not taking part in the acquisition.

The reason why I use 4% is because 4% is the risk-free coupon rate you can get in Singapore (CPF SA/MA), excluding corporate bonds or government bonds such as SSB. If the yield on cost is lower than that, then it might not make sense for you to invest in it because you are risking more for a lower yield. Of course, this is not taking into account capital appreciation which is the key difference between investing in bonds and investing in equities. If you believe the capital appreciation part is worth the low yield currently, then you should definitely consider subscribing to the rights.

The great thing about investing in REITs is that they have the ability to grow their DPU as they grow via acquisitions. Just because they are yielding 4% this year doesn’t mean they are going to yield 4% for the next 10 years. The 4% yield could grow upwards to 10% as the REIT does more accretive acquisitions, bringing in more value for shareholders.

Final Thoughts

I personally do not own any shares of IREIT Global but I am considering to take part in the rights issue and subscribing in excess. If the price is right, I will consider buying 100 shares of IREIT Global and subsequently subscribing in excess. This will allow me to lower my cost price dramatically and increase my yield on cost. I personally like IREIT Global because they target Europe assets, allowing them to access low costing debt.