If you’re looking for a way to turn your $10,000 into something more substantial, you’re in the right place. In 2024, there are plenty of opportunities for investment that can help you achieve your financial goals. But with so many options to choose from, it can be hard to know where to start. That’s where this article comes in. In this article, I’ll showcase 3 different portfolios for maximizing your returns and achieving your financial goals in the years ahead. From the safest bets to the highest growth potential, you’ll find everything you need to make your money work for you in 2024. So don’t miss out, get ahead of the game and start reading now!

What Portfolio Best Suits You?

As mentioned above, I will be showcasing 3 different portfolios. With each portfolio, I will explain in detail the respective portfolio allocations as well as the reasons why each pick fits well into the portfolio coming into 2024. It is good to note that while coming up with these portfolios, the ideal investment horizon is long-term (> 5 years). Without further ado, let’s start off with the first portfolio, the All Weather Portfolio.

Do keep in mind that the allocations provided here are just an approximation as you might not be able to achieve the exact portfolio allocation based on the asset’s price.

#1 All Weather Portfolio

The first portfolio, which is the All Weather Portfolio, is the most risk-averse portfolio in this list. It’s a portfolio that is designed to do well in all economic environments, even in a recession and during times of uncertainty, making it suitable for investors who want to achieve good returns with minimal volatility. The All Weather Portfolio was first conceptualized by the founder of Bridgewater Associates, Ray Dalio. As a local investor in Singapore, you might be wondering how to craft such a portfolio in our local context. Well, fret not as I’ve structured a sample portfolio based on the same allocation as the original All Weather Portfolio but with a Singaporean twist.

Read Also: Ray Dalio’s All Weather Portfolio 2024 (Singapore Edition)

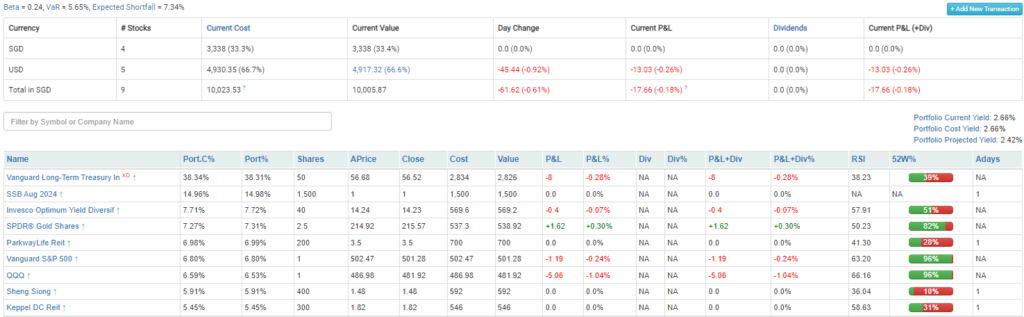

Based on StocksCafe’s technicals, we can see that the portfolio has an estimated Beta of 0.24, a Value At Risk (VaR) of 5.65%, and an Expected Shortfall of 7.34%.

The portfolio contains 9 key investments, spread across the different asset classes mentioned in the All Weather Portfolio. Firstly, for the stock allocation, we have Parkway Life REIT (6.98%), VOO (6.8%), QQQ (6.59%), Sheng Siong (5.91%), and Keppel DC REIT (5.45%), which comes up to a total of 31.73%. Next, we have ~15% in intermediate government bonds which will be our Singapore Savings Bond (SSB). We also have ~38% allocated in long-term government bonds through the Vanguard Long-Term Treasury ETF (VGLT). The remaining 14.98% is made up of a 7.27% allocation towards Gold through the SPDR Gold Shares ETF (GLD) as well as a 7.71% allocation towards Commodities through the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC).

#2 Dividend/Income Portfolio

The second portfolio, which is the Dividend/Income Portfolio is the second portfolio in this list. This portfolio is specifically built for investors who want a steady income stream from their portfolio in the form of dividends. Let’s take a look at the components in this portfolio.

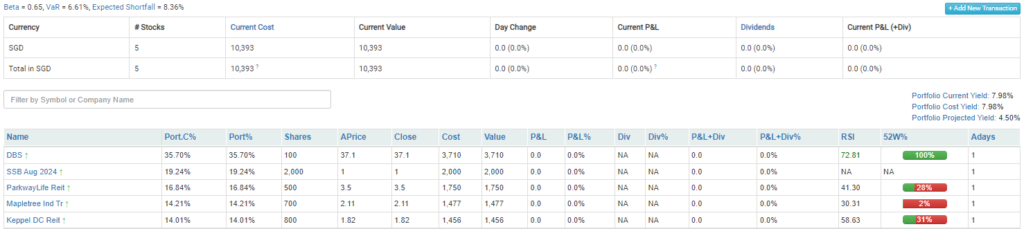

Based on StocksCafe’s technicals, we can see that the portfolio has an estimated Beta of 0.64, a Value At Risk (VaR) of 6.42% and an Expected Shortfall of 8.11%. Slightly higher than the All Weather Portfolio but still manageable in terms of risk and volatility.

As you can see from the crated portfolio above, there are only 5 components in this portfolio, targeted to split evenly at 20% but DBS will make up a larger portion as its share price is much higher and the minimum lot size is 100 shares. The overall portfolio is offering a very attractive 7.98% forward yield, with a strong likelihood of growing over time as the REITs and DBS continue to grow their dividend payout year over year.

Firstly, we allocate a position in DBS instead of UOB or OCBC as it is the strongest bank in terms of earnings as well as dividend growth potential. Even at its current valuation, based on a forward dividend of $2.16, it still offers a very attractive forward yield of 5.82%.

Next, we have 3 REITs namely, Mapletree Industrial Trust (MIT), Keppel DC REIT (KDC), and Parkway Life REIT (PLIFE). These 3 REITs have been chosen because they have shown a long track record of consistently growing their dividends year over year. On top of that, these 3 REITs are relatively stable and defensive in nature. Last but not least, we have bonds, and more specifically, liquid bonds like Singapore Savings Bond (SSB), that you can easily withdraw. This allocation is meant for spare liquidity you can use to average down positions that might have suffered a deep drop in its share price.

#3 Aggressive Growth Portfolio

Last but not least, the Aggressive Growth portfolio is designed to maximize returns but with higher volatility in comparison to the other 2 portfolios. This portfolio is only suitable for investors with a high risk appetite that is comfortable with the volatility.

Note: This portfolio is crafted with reference to my watchlist, which can be found in my Premium Subscription

Based on StocksCafe’s technicals, we can see that the portfolio has an estimated Beta of 2.04, a Value At Risk (VaR) of 35.45% and an Expected Shortfall of 43.08%. This is significantly higher than the previous 2 portfolios which shows how much risk and volatility you are taking on for higher returns.

From the portfolio, you can see 5 key components which are spread evenly with a 20% allocation each. It is also good to note that the portfolio is 100% invested in technology stocks, Firstly, we have Lemonade (NYSE: LMND), which has a strong growth potential to be a 100-bagger. Next, we have Palantir (NYSE: PLTR) and Snowflake (NYSE: SNOW), well-known tech companies that have the potential to grow upwards of 5x – 10x.

We also have Amazon (NASDAQ: AMZN), a member of the Magnificent 7 (Mag-7) who has just hit $2T in market cap as of last close. Last but not least, we have Ethereum (ETH) which has plenty of positive growth catalysts in the coming years, with the first being its ETF approval by the SEC. As you can see from the portfolio allocation, it is crafted to maximize returns, seeking returns of at least 5x to upwards of 100x over the long term.

Final Thoughts

And there you have it, 3 ways you can invest $10k in 2024, depending on your risk appetite and investment goals. To conclude, if you are risk averse and want the lowest volatility, you can go for the All Weather Portfolio. If you are looking for passive income in the form of dividends, you can reference the Dividend/Income Portfolio. Lastly, if you are seeking high returns, from 5x to upwards of 100x, you can follow the Aggressive Growth Portfolio, which references a portion of my personal watchlist.