GitLab (NASDAQ: GTLB), a leading provider of DevSecOps platforms, recently released its Q1 FY2025 earnings. The company demonstrated robust growth in key metrics, including Annual Recurring Revenue (ARR) and Dollar-Based Net Retention Rate (DBNRR), which underscore the strength of its business model and customer loyalty. In this article, we will analyze GitLab’s Q1 FY2025 performance in-depth, explore growth catalysts, and outline critical aspects for potential investors to consider.

Q1 FY2025 Earnings

GitLab reported a revenue of US$169m for Q1 FY2025, representing a 33% year-over-year increase. This substantial growth is driven by the company’s expanding customer base and the successful adoption of its comprehensive DevSecOps platform.

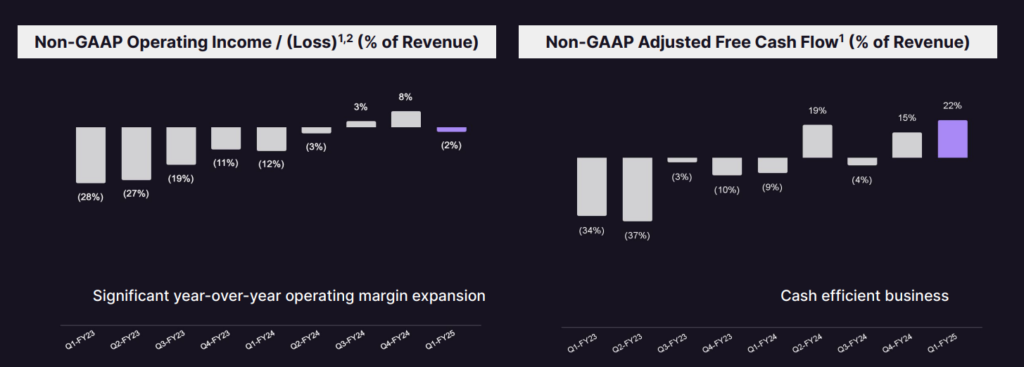

Operating Income and Free Cash Flow

Operating income is one of the critical metrics, reflecting the company’s core profitability. For Q1 FY2025, GitLab reported a significant improvement in its non-GAAP operating income, from a net loss of ~US$15m to a net loss of only ~US$3.8m in the same quarter last year. The non-GAAP operating loss margin also improved from 12% to only 2% this quarter.

Adjusted free cash flow, which represents the cash generated by the company’s operations after capital expenditures, improved markedly to ~US$37.4m, compared to a net negative of ~US$11.2m in Q1 FY2024. This increase in free cash flow underscores GitLab’s enhanced cash generation capabilities and financial health. It also showcases the huge improvement in GitLab’s net cash provided from its operating activities, which was a net negative of ~US$11m in Q1 FY2024 compared to a net positive of ~US$38.1m this quarter.

GitLab’s non-GAAP gross margin remained strong at 91% for Q1 FY2025, reflecting the high efficiency and scalability of its subscription-based business model. GitLab has maintained an average of ~90% since its Q1 FY2023 earnings. A high gross margin is indicative of the company’s ability to maintain cost control while delivering high-value services to its customers. For most SaaS-based businesses similar to GitLab, investors should expect a gross margin of at least 75%.

ARR and DBNRR

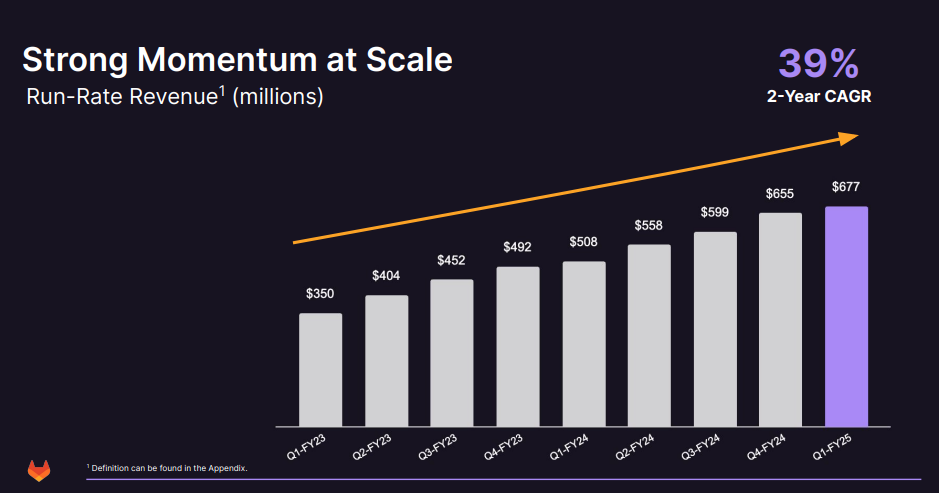

Annual Recurring Revenue (ARR), a key performance metric, reflects the total annualized value of recurring subscription contracts as of the end of the period. GitLab’s ARR has shown significant growth with a 39% 2-year CAGR, growing to US$677m, which is crucial as it provides a stable and predictable revenue stream. A contributing factor to this is the expanding customer base, which has substantially grown from 5,168 customers in Q1 FY2023 to 8,976 in Q1 FY2025. Among these customers, the percentage of customers generating more than US$100k ARR has also grown from 10.5% (545) to 11.4% (1,025).

Another key performance metric would be the Dollar-Based Net Retention Rate (DBNRR), which measures the percentage of change in ARR from existing customers over a 12-month period. GitLab reported a DBNRR of 129% for Q1 FY2025. A DBNRR above 100% indicates that existing customers are not only renewing their subscriptions but also increasing their spending, either by upgrading to higher-tier plans or adding more users. This metric highlights the company’s ability to expand within its existing customer base, a positive sign of customer satisfaction and the value it derives from GitLab’s platform.

Guidance and Future Outlook

To end Q1 FY2025 on a strong note, GitLab has increased its guidance for FY2025, projecting revenue between US$733m and US$737m, up from the previous guidance of US$725m to US$731m. For Q2 FY2025, GitLab anticipates revenue of US$176m to US$177m, which marks a 4.1% to 4.7% increase quarter-over-quarter, and 26.1% to 26.8% year-over-year. This is definitely a step down in comparison to Q1 FY2025’s revenue growth. On a brighter note, GitLab also anticipates a net positive non-GAAP operating income of US$10m to US$11m, which is a good step up from Q1’s non-GAAP operating loss.

Potential Growth Catalysts

So are there any potential growth catalysts for GitLab? Here are several factors that will help to contribute to GitLab’s positive outlook and potential for continued growth:

- Expansion of AI Capabilities: GitLab Duo, the company’s AI-driven platform, integrates AI across the software development lifecycle. New features like GitLab Duo Chat and GitLab Duo Enterprise are designed to enhance productivity and security, making the platform more attractive to customers looking to leverage AI in their DevSecOps processes.

- Strategic Partnerships: GitLab is strengthening its relationships with cloud hyperscalers such as Google Cloud and AWS. These partnerships facilitate wider adoption of GitLab’s solutions, particularly in enterprises that are already leveraging these cloud platforms.

- Acquisitions: The acquisition of Oxeye enhances GitLab’s integrated security scanning capabilities, a critical feature as security continues to be a major concern for businesses.

- Customer Base Growth: GitLab continues to increase its customer base, with significant growth in customers generating over US$100K ARR. This expansion not only boosts revenue but also establishes a solid foundation for future upselling opportunities.

Final Thoughts

GitLab’s Q1 FY2025 results reflect strong performance and robust growth in key metrics like ARR and DBNRR. The company’s enhanced guidance for FY2025 and strategic growth initiatives position it well for future success. Overall, GitLab appears well-positioned to capitalize on the growing demand for integrated DevSecOps solutions, driven by its continuous innovation and strategic partnerships.