With the continuous interest rate hikes, it is not surprising that REITs are seeing a lack of investors’ interest. As interest rates increase, the cost of debt for REITs will increase as well. This will result in a lack of growth opportunities because the cost of debt might be higher than the return on investment. As such, REITs are less incentivized to make aggressive acquisitions, which will cause the overall REITs’ performance to slow down or even stagnate. Digital Core REIT (SGX: DCRU) was not spared from this as well but, they have recently announced a possible acquisition that might help accelerate the REITs growth. Let’s dive deeper and understand what happened to this REIT and if it’s still worthy of an investment based on its current circumstance.

FY2022 Q3 Earnings

As Digital Core REIT had its IPO in December 2021, we can only compare its performance against the management’s forecasts. As we can see, the overall revenue and NPI outperformed the forecasts slightly by 1.6% and 5.7% respectively. Despite this, the distributable income missed forecasts by 3.4% due to the huge drop in distribution adjustments as compared to the forecasted amount. To better understand why the distributable income fell short of forecasts, it is important to understand what is distribution adjustments and whether or not it’s a variable cost that can fluctuate.

According to Digital Core REIT, the Distribution Adjustments comprise of the Trustee’s fees, Management fees paid in units, acquisitions costs, amortization of debt-related transaction costs, deferred tax, and adjustment for one-off fair value losses due to leasing costs on new leases. We can see that some of these are variable costs that could fluctuate from time to time such as adjustments made for one-off fair value losses or deferred tax payments. As such, it is not a big worry even though the Distributable Income fell short of the estimated forecasts given.

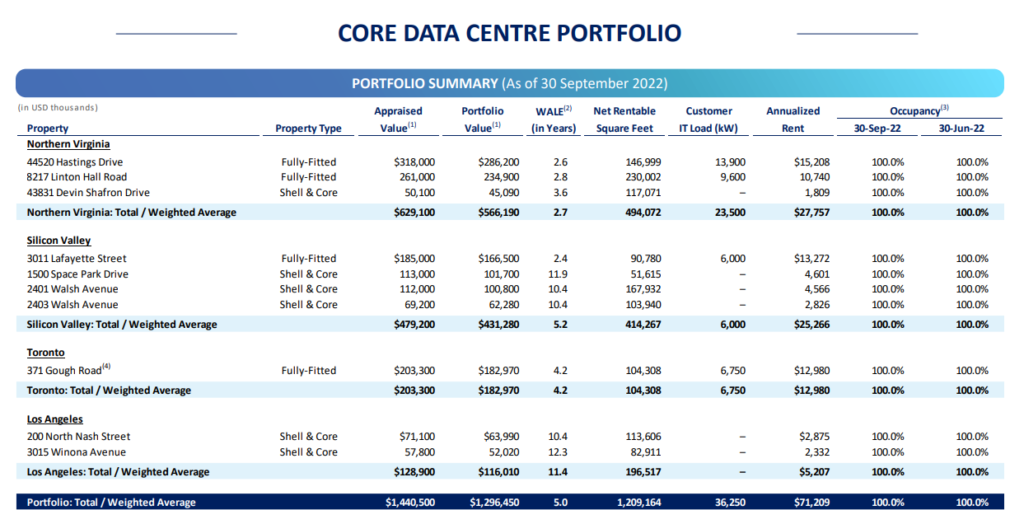

Next, we will be looking at Digital Core REIT’s overall portfolio and how it has performed thus far. From a glance, we can see that Digital Core REIT has very few customers, with its top 2 customers already contributing to 60.6% of its total portfolio’s annualized rent. This might be worrying at first but it’s good to note that the REIT only has 10 assets currently.

On top of that, we can see that its biggest contributing customer is currently renting out 2 of the Fully-Fitted DCs in Northern Virginia, with an average WALE of 2.7 years. Overall, the total portfolio has a relatively long WALE of 5 years with a current occupancy rate of 100%.

Last but not least, we will look at Digital Core REIT’s financial health and see if the REIT has any troubling issues. As we can see, the REIT has a relatively low aggregate leverage of 26.2% with a rather high average cost of debt at 3.1%. With the ever-increasing interest rates, it might be better for the REIT to increase its fixed debt allocation for the time being to counter this issue.

Proposed Acquisition

Now that we’ve looked at the FY2022 Q3 earnings, we will deep dive into the proposed acquisition that was announced on 22nd September.

Acquisition Details

The proposed acquisition features 2 exciting assets, 1 in Frankfurt, Germany, and 1 in Dallas, U.S. Both assets are 100% freehold and have a combined total of 15 customers with the top 5 customers contributing to 99% of the total annualized rent. Post-acquisition, the 2 assets will introduce a combined total of 9 new customers to Digital Core REIT’s current mix, further diversifying its portfolio and individual customer exposure.

Unorthodox Funding Structure

The really interesting or rather unorthodox part of this acquisition is the proposed funding structure that the management has come up with. They offered shareholders 2 different structures to fund this acquisition as seen below. Firstly, If they were to fund the acquisition via debt, they’d only buy 25% of the Frankfurt DC. Alternatively, if they were to fund the acquisition with an Equity Fundraising (EFR), they would buy 89.9% of the Frankfurt DC + 90% of the Dallas DC.

If the acquisition were to only be funded by debt, which means Digital Core REIT only acquires 25% of the Frankfurt DC, the DPU will increase by 2% and the aggregate leverage will increase to 33%. If the acquisition was funded via EFR, the DPU will increase by 3.1% but the aggregate leverage will increase significantly as expected from 25.7% to 37.5%.

Fundamentally, it looks like a good acquisition with both DCs being 100% freehold. The Dallas DC does seem a lot more attractive as it has a longer WALE of 15.4 years and a full 100% occupancy whereas the Frankfurt DC only has a WALE of 4.7 years and a 91% occupancy. As such, I think that funding the entire acquisition with an EFR would be more beneficial to Digital Core REIT as compared to funding the acquisition with only debt since they would only buy 25% of the weaker DC (Frankfurt DC).

Final Thoughts

I think Digital Core REIT is a fantastic DC pick next to Keppel DC REIT (SGX: AJBU) whereby they have a lot more growth potential thanks to their huge sponsor, Digital Realty. Even when the current interest rate is still increasing, Digital Core REIT is making aggressive acquisitions. So what should investors do now?

If you are already invested in Digital Core REIT, perhaps it will be wise to keep some spare cash on the side if the EFR does happen so that you can Dollar Cost Average (DCA) down on your current position. If you are not yet invested in Digital Core REIT but would like to, an EFR will be the best opportunity for you to get started.

The estimated timeline states that an EGM will be held in Mid November for shareholders to vote and decide on which funding structure they’d like the REIT to go with. The structure that receives the majority of the votes (>50%) will be approved. It is expected that the transaction will close by late November if there is no EFR.

Personally, I am looking forward to an EFR and more specifically, a rights issue. On top of this, I hope that the issued share price will be at an attractive discount to the current share price. This way, I can capitalize on the low pricing and accumulate a sizable position in Digital Core REIT as my plan for this investment is to hold it long-term and watch it grow over time. Keppel DC REIT is a great example of what a DC REIT can do. History doesn’t always repeat itself but it sure does rhyme very often.