As most Singapore REIT investors would know, Capitaland Mall Trust and Capitaland Commercial Trust (CMT and CCT) is the biggest merger investors have been waiting for in 2020. These 2 Capitaland REITs will merge and form CapitaLand Integrated Commercial Trust (CICT). Once merged, the new REIT will become APAC’s 2nd largest REIT with a market cap of S$12.7 billion, right behind Link REIT at S$23.4 billion. In this article, I’ll share with you all that you need to know about this merger between CMT and CCT.

Details of The Merger

Scheme Consideration

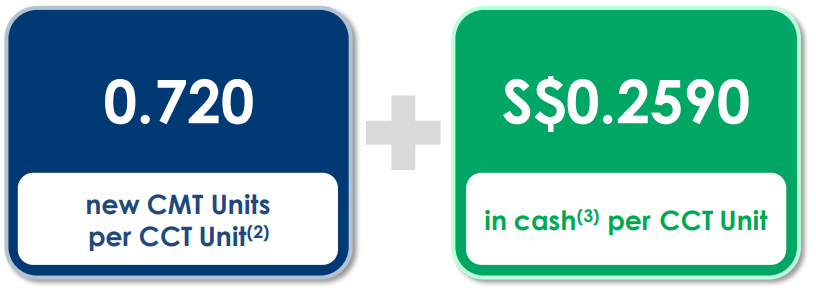

The most important thing shareholders would want to know is the details of this merger and specifically what will be the ratio of units to cash per CCT unit.

As you can see, for each CCT unit you own, you will be issued 0.72 new CMT units and a $0.259 cash portion. To put it into context, for each 100 shares of CCT you own, you will get 72 shares of CMT and $25.90. For shareholders who are wondering how to end up with even lots of CMT post merger, you will need to buy in batches of 2500 shares of CCT in order to end up with even lots. With 2500 shares of CCT, you’ll be distributed 1800 shares of CMT and $647.50 in cash.

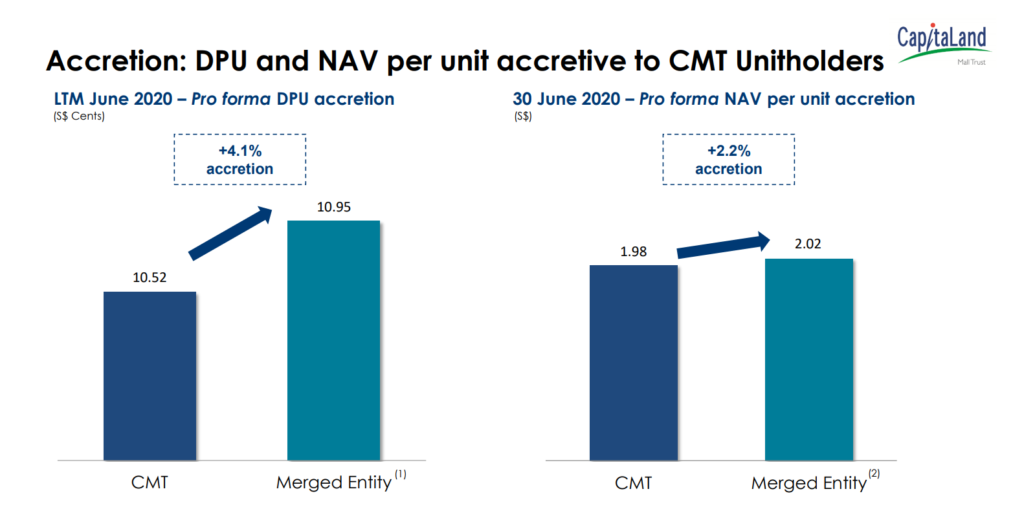

DPU and NAV Accretive for CMT Unitholders

The merger is great for CMT holders as it is both DPU and NAV accretive.

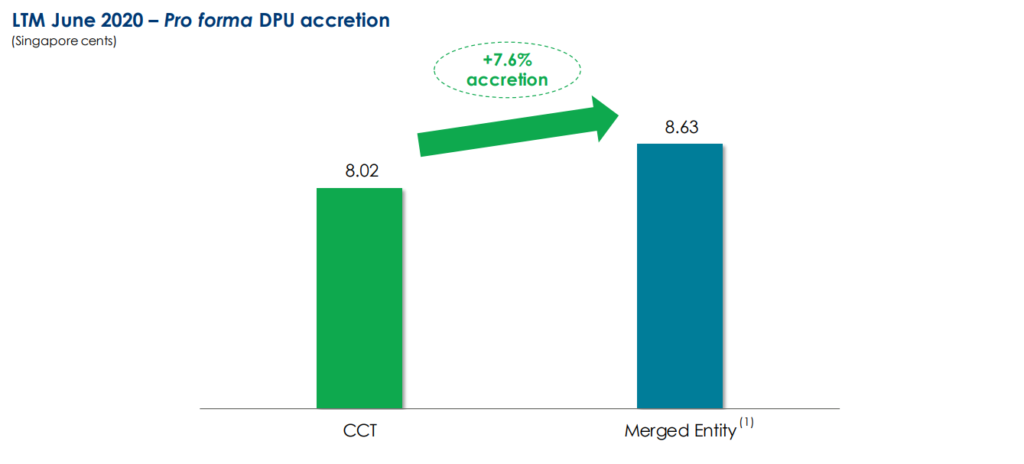

DPU Accretive for CCT Unitholders

The merger is great as well for CCT holders as it is DPU accretive. There is not much information on whether or not it is NAV accretive or dilutive for CCT holders but I believe it is not as relevant as compared to knowing that the DPU is highly accretive.

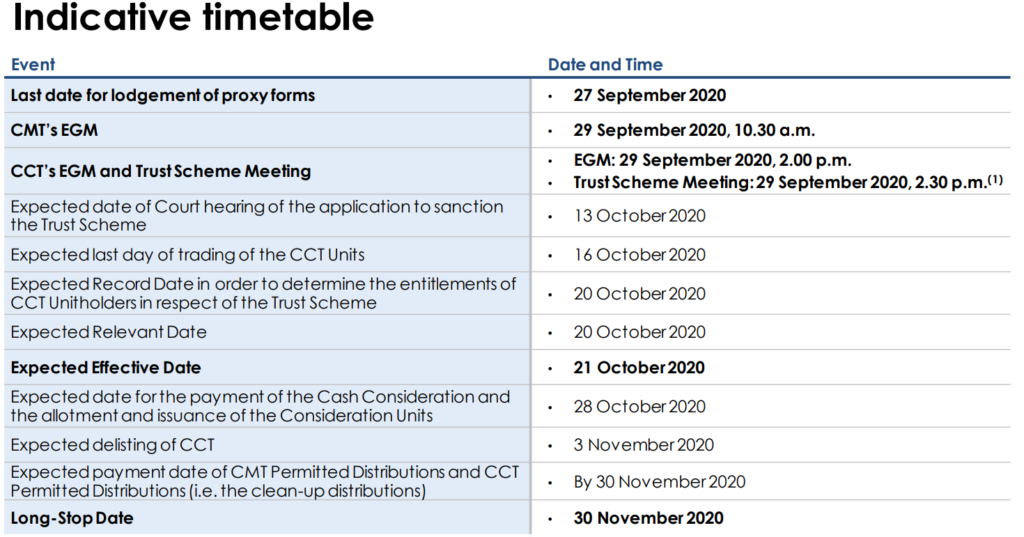

Timeline

As of the announcement made on 4th September, this is the latest and most updated timeline. The EGM will be happening at the end of the month and the merger should complete by 30th November 2020.

CapitaLand Integrated Commercial Trust (CICT)

Portfolio Overview

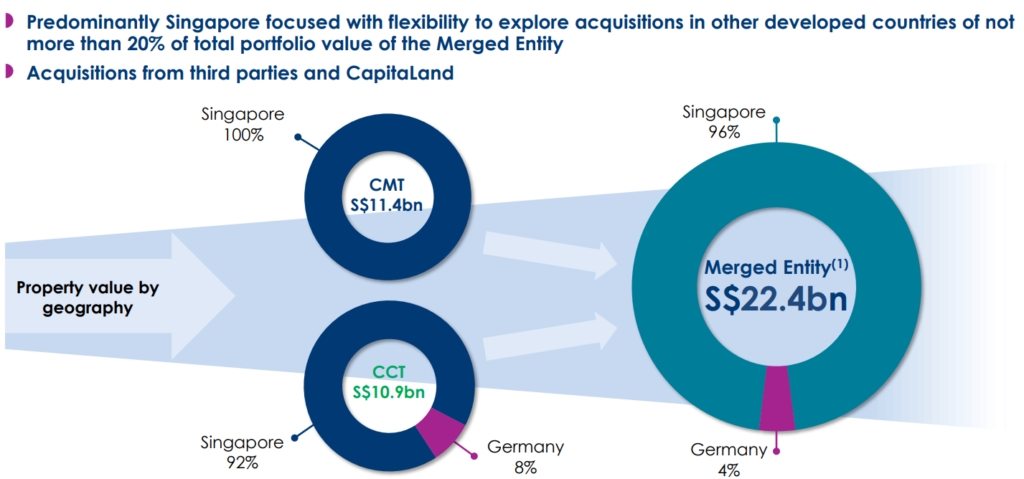

Post merger, the combined entity of CMT and CCT, CapitaLand Integrated Commercial Trust (CICT), will become the 2nd largest REIT in APAC. The REIT’s portfolio will have a total of 24 properties under its wing with a NLA of 10.4m sq ft. The total portfolio is valuated at S$22.4 billion with around 3,300 tenents. The expected NPI should come up to S$1 billion based on the combined NPI of both REITs as at June 2020 including contributions from joint ventures. The portfolio’s committed occupancy is a respectable 96.3%.

Key Benefits of This Merger

CMT and CCT shareholders must be thinking why is this merger happening and what good is there to do it other than the DPU and NAV accretion for shareholders. I’ll be sharing with you the key benefits of this merger in the following points.

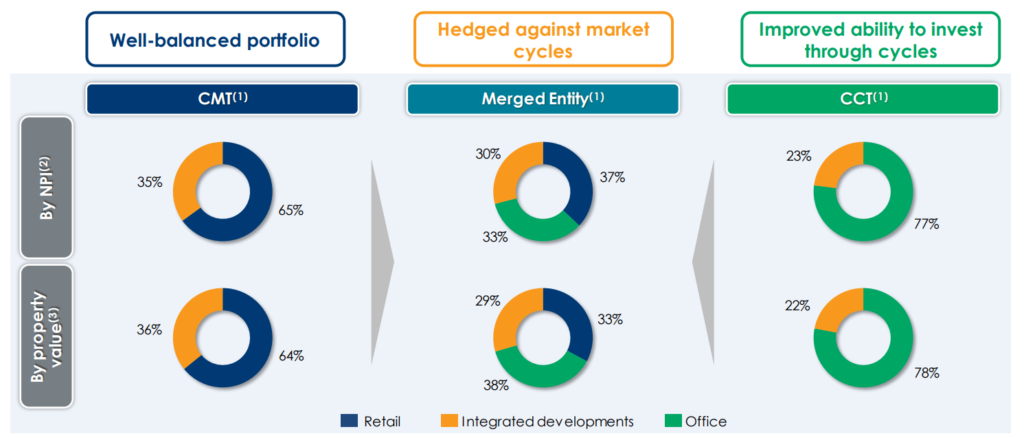

A Well-Balanced and Diversified Portfolio

Post merger, the new portfolio will be very well balanced with properties from 3 different asset classes, namely Commercial/Office, Retail and Integrated Developments. The top 10 tenants make up 20.6% of CICT’s total gross rental income for the month of June 2020 with the highest contribution coming from RC Hotels, accounting for 5.5%.

Not to mention, with a larger and more diversified portfolio, the REIT could do Asset Enhancement Initiatives (AEIs) without sacrificing the REIT’s NPI coming from key prized assets. A great example would be CMT when Funan went through an AEI for a long 27 months. The amount of income that was forgo-ed due to the AEI definitely impacted CMT’s NPI for the past 2 years to a certain extent.

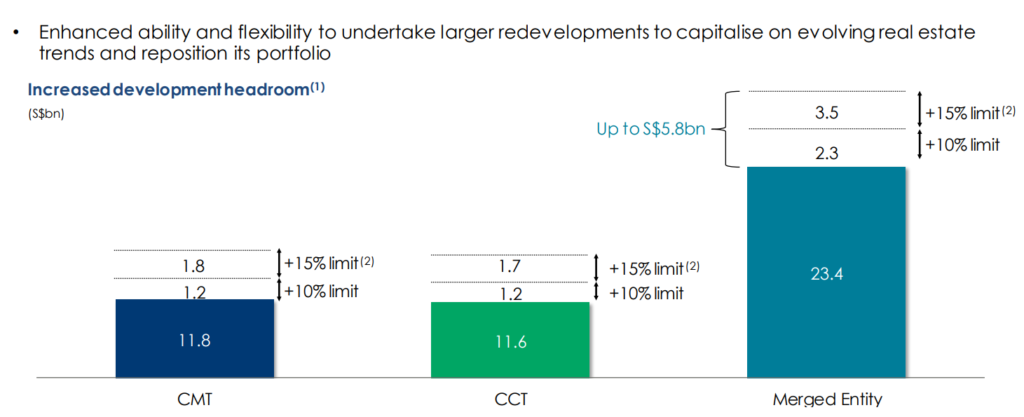

Larger Debt Headroom Available

This goes without saying that post-merger, CICT will have a larger debt headroom available which opens up many new doors that could not be opened when CMT and CCT were individual entities. A larger debt headroom not only means more acquisitions but also, the assets under CMT and CCT could see more and bigger AEIs. The biggest we’ve seen from CMT is of course their prized asset, Funan. Post-merger, I believe the large debt headroom allows for bigger AEIs that will in turn improve the quality of the assets under CICT.

Increased Pipeline Assets

As most CMT investors know, CMT did not have any more potential pipeline assets that it can acquire from its sponsor, Capitaland. As a result, this will plateau CMT’s growth potential. With the merger, this allows the merged entity, CICT, to acquire potential pipeline assets that were reserved for both CMT and CCT.

Looking at Capitaland’s properties, we can see that there are 2 potential pipeline office assets that could be acquired by CCT, 79 Robinson Road and Rocherstor Commons. As for the retail side, Capitaland does own 4 retail malls that could also be acquired by CMT, ION Orchard, Jewel, Singpost Centre and Bugis Street. From what I can see, Capitaland would not divest ION Orchard or Jewel anytime soon because these 2 are key assets that are bringing in huge value for Capitaland. As for the Singpost Centre and Bugis Street, I feel that these 2 malls don’t seem attractive enough to acquire and still be accretive for CMT holders.

Post merger, CICT has great potential to grow as it is not only limited to Singapore assets now. It now has the flexibility to also acquire malls and offices in other developed countries as well now that the mandate for the REIT does not restrict it to only Singapore assets. Now the key question that will come to mind is, what countries would they consider expanding into?

Looking at Capitaland’s portfolio of Malls, CICT will most probably look into acquiring malls in Japan. They also have malls in Vietnam and Cambodia but based on the presentation slides, they will most probably go for more developed countries in the near future. Key markets they could acquire office assets as well are Japan, South Korea, Germany and Australia. Capitaland does have a huge portfolio of China assets, malls and offices, but I believe they won’t be touched any time soon as there is already Capitaland Retail China Trust (CRCT) which is a pure China retail REIT. They could change the mandate in the future and allow CRCT to also acquire office assets.

Final Thoughts

I am a CMT shareholder since the crash in March. I have always expected the merger between CMT and CCT to come because it allows both REITs to accelerate their growth through a combined entity. I did not expect it to come so soon which is why, when the announcement came, I bought during the crash in March as the prices were way too attractive to give up. I do regret allocating a small portion to CMT back at that time but thanks to the low price, even if I average up the price now, it will still be at a low average cost.

I believe this merger will most probably be voted through because it is very beneficial for both CMT and CCT but especially CMT. CMT will benefit greatly from this acquisition as it is no longer restricted to only Singapore malls. I will continue to accumulate CMT shares as compared to CCT shares as I don’t want to deal with the odd lots and I don’t have that much capital to accumulate into this counter. CMT at its current valuation is still very cheap to me because I see CICT going to $5 in 2-3 years time.