In the ever-evolving world of electric vehicles, one name stands out above the rest: Tesla. The past year proved to be a rollercoaster ride for the EV pioneer, filled with triumphs and challenges. While facing stiffer competition from established automakers like Ford and GM, Tesla continued to break its own production and delivery records, with a whopping 1.31 million vehicles delivered in 2022 alone, which is a 40% growth year over year. However, the final quarter of the year saw some hiccups, with delivery numbers falling short of expectations and analysts expressing concern over weakening demand. Despite these challenges, Tesla managed to beat earnings expectations and increase its cash position by over $1 billion. So, what’s next for this electric giant? Let’s dive in and find out.

FY2022 Earnings

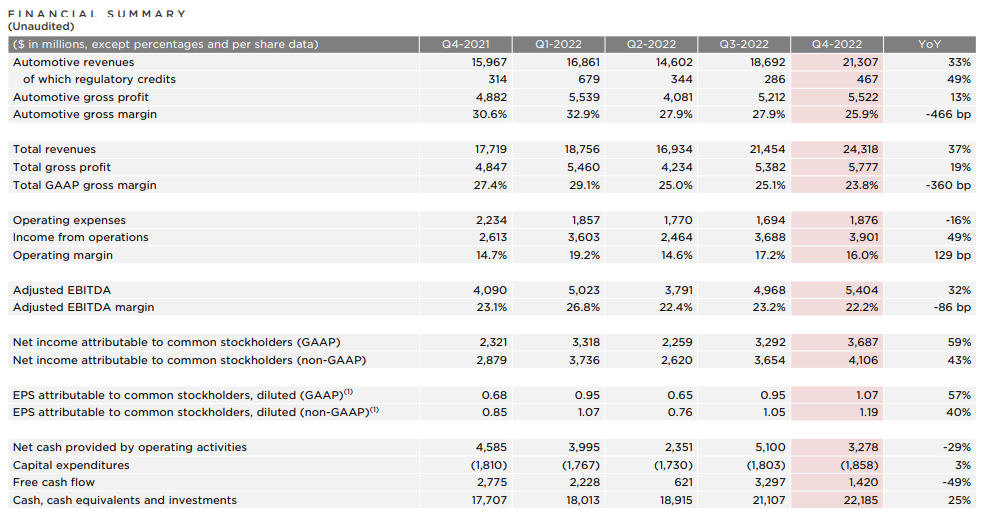

As we can see from Tesla’s FY2022 earnings above, Tesla had a remarkable year despite the ongoing economic instability marked by surging inflation and interest rates. Tesla’s automotive revenues soared by 33%, and the total revenues witnessed a rise of 37%. Additionally, the gross profit increased by 19%. Despite this impressive growth, there was a 4.66% decline in Automotive gross margin and 3.6% in total GAAP gross margin, which was a result of elevated raw material, commodity, logistics, and warranty expenses and the 4680 cell production ramp costs.

Diving deeper, we can see that Tesla’s GAAP net income and EPS increased significantly by 59% and 57% respectively, beating expectations of $1.12 per share. As we look into the company’s cash flow, we can see that Tesla saw a huge decrease of nearly 50% in its free cash flow despite its CapEx only increasing by 3% year over year.

Production and Delivery Results

Over the past 5 years, Tesla has shown remarkable growth in its production and delivery numbers. From approximately a quarter million vehicles produced and delivered in 2018 to over 1.3 million vehicles produced and delivered in 2022. This represents a compounded annual growth rate (CAGR) of 40.01% in its production and 39.86% in its deliveries. As Tesla continues to expand and build more Gigafactories, we can definitely expect this growth to continue.

Business Updates

Tesla’s ambitious plans to expand its manufacturing capabilities are already in motion. It is constructing more Gigafactories and scaling up existing ones to keep up with the surging demand for EVs. For instance, its Gigafactory in Texas, one of the world’s largest buildings by footprint, is ramping up the production of the Model Y and recently started manufacturing its highly anticipated Cybertruck. With an impressive 500-mile range and energy consumption of less than 2 kWh per mile, the Cybertruck is already a hit with over 100 orders, including one from Pepsi. Furthermore, Tesla’s new Semi is expected to further boost sales.

Tesla’s Giga Berlin facility, scheduled to start production in the near future, is expected to produce up to 500,000 vehicles annually, surpassing the capacity of the Gigafactory in China, which currently produces about 450,000 vehicles a year. Tesla is also exploring new manufacturing plants in Indonesia and Mexico to further expand its global footprint and production capacity.

In addition to EVs, Tesla is investing in energy storage solutions like the Tesla Powerwall, enabling homeowners to store energy from their solar panels. The company is also developing large-scale battery storage systems for businesses and utilities, aligning with its goal to accelerate the world’s transition to sustainable energy.

Tesla’s rumored plan to launch a new $25,000 model in 2023 could open up a whole new target market, attracting a new wave of customers to the company. Moreover, Tesla is not limiting its innovations to automotive technology. The company has recently launched a ‘Holiday’ software update for its users, allowing Tesla owners to stream games, access Apple Music, conduct Zoom calls, and remotely monitor their vehicles through the Tesla app.

Bull v Bear Case

As Tesla exits 2022 stronger than ever despite facing minor headwinds, what can investors expect in 2023 for Tesla? It is without saying that investors aren’t too happy that Elon Musk is now dividing his attention between Tesla, SpaceX, and now, Twitter. In addition to this, Tesla’s market cap took a huge hit since Elon Musk began selling large blocks of Tesla stock in April 2022 to help finance his Twitter acquisition. He initially sold $8.5 billion shares in April, another $6.9 billion in August 2022, $3.95 billion in November, and $3.6 billion in December for a total of around $22.9 billion.

So what’s next for Tesla investors? In the following sections, we’ll compare the bull and bear case for Tesla as well as share more insights on what investors should look out for moving into 2023.

Bull Case

Investing in Tesla is a thrilling prospect due to the company’s exceptional research and development capabilities and successful execution in the electric vehicle (EV) sector. The firm has made significant strides despite the chip shortage crisis, which has had a positive impact on its stock value. Experts anticipate Tesla’s revenue to increase by 29% this year and 26% in 2024, given the growing demand for EVs.

The recent stock split, coupled with the launch of the affordable Model 2, has made Tesla more accessible to individual investors, further unlocking a new segment of investors for the company. As Tesla’s production capacity increases, the company’s profit margins are expected to improve further, with the cost of production declining in both the Texas and Berlin factories.

Tesla’s adaptability to challenging macro environments, exemplified by its handling of chip shortages, demonstrates the company’s ability to tackle complex problems effectively. The recent adoption of the 10b5-1 plan, which aims to boost investor confidence, indicates that major share selling is unlikely in the near future.

Bear Case

However, there is a bear case for Tesla that cannot be ignored. While Tesla has been hailed as a pioneer in the electric vehicle (EV) industry, its long-term viability and commitment to environmentalism have been questioned in recent times.

One major concern for investors is Tesla’s high valuation, which has led some to view the company as overhyped and overpriced. Based on Tesla’s last closing price, its PE stood near 54x which is quite a high premium to pay considering the company has reached a more mature stage as compared to a few years ago. With an increasing number of EV competitors entering the market, Tesla’s growth prospects may be threatened, especially given the huge drop in stock price over the past year.

Investor confidence in the company has also been shaken by Elon Musk’s questionable behavior and public comments, which have alienated many potential customers and investors. Moreover, Tesla has been grappling with production delays, supply chain issues, and negative publicity, which have further damaged its reputation.

Additionally, Tesla has been facing regulatory scrutiny, particularly in China, which could lead to penalties and impact the company’s profitability and stock price. While Tesla is still the market leader in the EV industry, the increased competition from companies such as Ford, NIO, LUCID, and VIVIAN has raised concerns about the sustainability of Tesla’s leadership.

Taken together, these factors have led many investors to question the long-term viability of Tesla as a company. As the EV market continues to evolve, it remains to be seen whether Tesla can adapt and succeed or succumb to its inflated expectations and high valuation.

Final Thoughts

In conclusion, Tesla’s future is a subject of debate among investors, with both bullish and bearish cases having their fair share of merit. The company has faced several challenges in recent times, including production issues, supply chain disruptions, and negative publicity surrounding its CEO’s behavior. However, Tesla has shown resilience by adapting to changing market conditions and continuing to innovate in the EV sector. The recent rebound in Tesla’s stock price may be a positive sign, but it remains to be seen if the company can sustain its growth trajectory in the long run.

For investors, the decision to invest in Tesla depends on their investment horizon and risk tolerance. Long-term investors may want to wait and see how the company performs over time, while short-term investors may see the potential for quick gains due to recent market volatility. Ultimately, investors need to do their due diligence and carefully evaluate the risks and potential rewards of investing in Tesla.

In order for Tesla to meet the bullish expectations of some analysts, the company will need to address the concerns raised by skeptics and continue to execute its business plan effectively. Whether Elon Musk can steer Tesla toward continued success and growth remains to be seen, but one thing is certain: the EV market is expanding, and Tesla is well-positioned to take advantage of this trend.