With the recent correction in the stock market and high-growth tech companies taking the biggest hit, many investors are wondering if they should cut their losses short and move into greener pastures. This definitely depends on the investor’s game plan when investing, be it for the long term or short term.

In this article, I’ll be sharing with you how to analyze high-growth tech companies so you can pick the right ones for your portfolio. I’ll be using Lemonade (NYSE: LMND) as an example for this article.

1. Strong MOAT or Disruptive Factor

The first criteria to look out for is a very big qualitative factor and that is, for the company to have a very strong moat and/or a disruptive factor to it.

First off, to clarify what a moat is. An economic moat is known as a businesses’ ability to maintain competitive advantages over its competitors in order to protect its long-term profits and market share from competing firms. A strong moat allows the company to maintain its lion’s share within the market without having to cut margins to fight with its competitors.

What can be termed as a competitive moat? This could come down to a particular product/suite or even patent technology that the company owns, that is far better than its competitors’ offering.

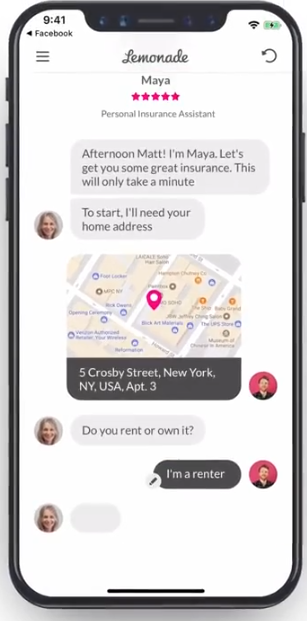

With Lemonade’s case, it has a disruptive factor that helps make its moat very strong. Lemonade, at its core, is injecting technologies such as A.I. and Machine Learning into its business. As compared to its competitors, who are more traditional insurance companies, Lemonade has managed to cut costs while also improving the overall customer experience for its customers.

If its competitors were to start digitally transforming, it will take a very long time as the companies are already well built and stabilized in their ways, and will be hard to transform it into something that could compete with Lemonade.

2. Fantastic Management

The second criteria that I look for when analyzing high-growth tech companies is management. I lookout for a management team that is very active in the company’s overall operations. As such, I will also look into the management’s past experience and how they can provide added value to the company.

For Lemonade, you can see how active as well as passionate the management team is when you watch interviews that they’ve done online. Their CEO Daniel Schreiber as well as their CFO Tim Bixby has done several interviews online, talking about Lemonade and it can all be found on Youtube.

When I invest in such a forward-looking company or industry, it is important to know that the management team is very passionate about the business as well as well versed to help bring the company to greater heights.

Lemonade’s management team has definitely proven themselves, hitting over 1 million customers in just 4 years with their main customer base being in the US. They have also transitioned into a more scalable and profitable business model over the past year which has shown some strong results in the past quarters.

3. Huge Long-Term Growth Potential

Now for the third criteria, I choose companies that have huge long-term growth potential as compared to short-term pump and dump news. I like companies that keep on growing larger and larger over the long term and can eventually 10x and even 100x.

But how do we even know if the company has huge long-term growth potential? To be able to analyze this, you will need a strong understanding of the business, its products, and the overall industry.

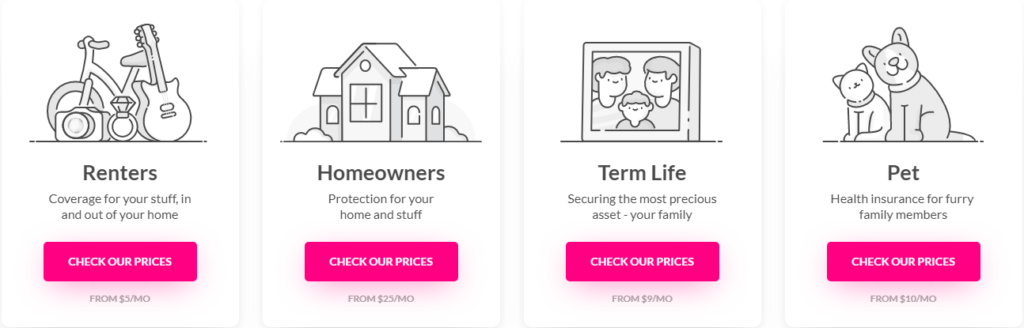

For example, in Lemonade’s case, the company currently has 4 insurance policies, with the new addition of term life. If you have your insurance and pay the premiums yearly, you will know that you have your standard term life policies, critical illness, car insurance if you own a car as well as homeowners/renters insurance. There are also many other policies that are not as popular for people to buy but there is definitely a huge market for insurance.

Now, for Lemonade’s case, they have barely touched the surface with insurance policies. Not to mention, they have not grown much geographically, with the recent expansion to France 2 quarters back. This leaves a ton of room to grow for the company as time passes and they increase their product offerings.

4. Forgo Profits To Grow Exponentially

High-growth tech companies all know that in order to accelerate the rate of growth exponentially, the company must be ready to forgo all profits and aggressively reinvest into the business. This means that they are aggressively reinvesting back into the business in key areas such as Sales & Marketing as well as Research & Development.

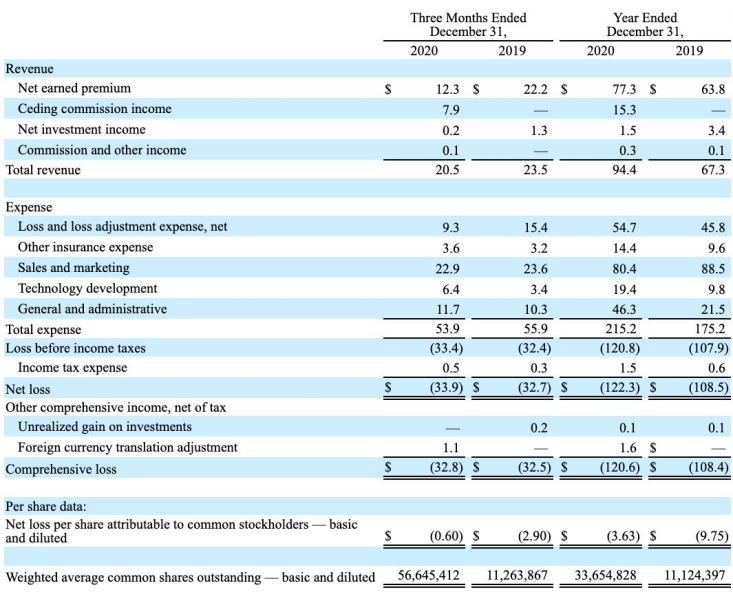

In Lemonade’s case, we can see that the Sales & Marketing segment dropped year on year which could indicate that they reduced the amount of marketing they did, which could also mean that they are less focused on customer acquisition and overall customer growth. After watching a recent interview with CFO Tim Bixby, he mentioned that Lemonade’s key focus is on growing In Force Premium per customer as compared to just growing the customer base.

This is why it is very important to not just look at numbers at face value but rather, understand and find out why the numbers are as such. The drop in marketing costs could be also due to a more efficient customer acquisition strategy whereby they are spending less for the same amount of customers being acquired. If you look at the Technology Development expense, it is still rapidly increasing, more than double the year prior. This is a very good indicator that Lemonade is still aggressively growing its technology to further improve the overall product offering.

5. Valuation

As Warren Buffett has said time and time again, “Price is what you pay, Value is what you get”. Valuation is very important when investing in high-growth tech companies because you wouldn’t want to overpay for a company that might not be able to grow as high as you think. As investors, we must always be cautious and be conservative when evaluating a company, taking on calculated risks to help us better estimate the company’s future value.

When evaluating companies, I always assign 2 values to the company, what is its value in the next 10 years to come and what is its fair value now. The former is calculated based on qualitative and quantitative analysis while the latter is calculated using fundamental and technical analysis.

For Lemonade, because it is a growth company, it is not easy to accurately determine its current fair value as you cannot use traditional methods like using PE or PB averages. Personally, a good way to determine fair value would be to look at the company’s performance with respect to its share price. If the company’s share price is the same level as it is last year, yet the company grew substantially, it could prove that the company is undervalued at the moment. You can also use Technical Analysis to identify key entry points to accumulate.

Taking a look at the chart, we can see that Lemonade could be due for a rebound as it is near a key support level and the RSI is reaching oversold regions. The MACD is pretty weak and is showing possible signs of a bullish reversal but it could be a false positive because there is no clear divergence. At its last close of $87.38, it seems like a pretty attractive price point to enter if you were to invest in Lemonade, be it for the short term or long term.

We can also see that Lemonade is near the August 2020 price level even though it has grown substantially over the past year. This could show signs of Lemonade being undervalued at the moment.

Final Thoughts

High-growth tech companies are the biggest and hottest trend right now on the market and investors are all hopping onto the train, wanting to get a piece of the delicious pie. As this trend is still relatively new, many investors are still clueless on how to analyze and evaluate these high-growth tech companies. I hope that with the help of this guide, you can better identify the strong high-growth tech companies from the weaker ones. Lemonade is definitely a very good example of what a high-growth tech company should look like and what characteristics it should have.