Keppel DC REIT (SGX: AJBU) is Singapore’s first pure Data Centre REIT but not the only one in the market now with the listing of Digital Core REIT. With the feds starting to hike interest rates, REITs are definitely under pressure as the cost of debt will start to rise over time. This will also mean that the cost of acquisition will rise over this period. In this article, let’s take a deep dive into Keppel DC REIT and analyze if it will face some headwinds in 2022 or remain stable and consistent.

Portfolio Overview

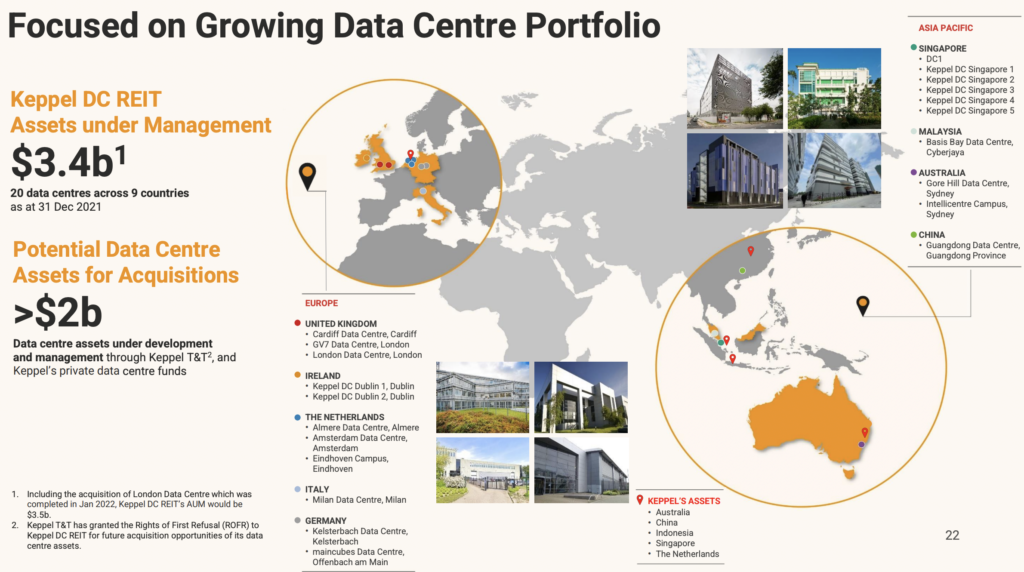

Keppel DC REIT (KDC) has managed to grow its portfolio substantially over the past few years since its IPO. Now with Assets Under Management over S$3.4b, 20 data centres spanning across 9 countries.

FY2021 Portfolio Changes

Over FY2021, Keppel DC REIT has made various changes to their portfolio. Most notably so would be the various acquisitions, investments as well as divestments made during 2H 2021. Let’s run through a quick summary of the portfolio changes for KDC in FY2021.

Maiden Acquisition in China

Released together with the 1H 2021 results was the announcement of a new acquisition, marking Keppel DC REIT’s maiden acquisition into the China market for Data Centres. The strategic acquisition of Guangdong Data Centre in Jiangmen, Guangdong Province proves to be a fantastic acquisition with a triple net lease for 15 years and is expected to be DPU accretive based on KDC’s FY2020 pro format DPU by 1.9% from 9.17 cents to 9.34 cents. The asset was purchased at RMB 635.9m or approximately S$132m, a 7.8% discount to its independent market valuation of RMB 690m or approximately S$143.2m.

Guangdong Data Centre consists of a 7-story data centre designed in accordance with the Code for Design of Data Centre Grade A GB. The asset is 1 of 6 data centres buildings to be completed in the Bluesea Intelligence Valley Mega Data Centre Campus. This acquisition also gives Keppel DC REIT the right of first refusal to acquire the remaining 5 data centres to be developed.

Read Also: 5 Important Takeaways From Keppel DC REIT 1H 2021 Results

Divestment of iSeek Data Centre

In August 2021, iseek exercised their option to purchase Keppel DC REIT’s 100% interest in the iseek Data

Centre in Brisbane for A$34.5m or approximately S$35.3m, which is 21.5% above the historical cost of the asset at IPO. The management added that the divestment was in line with KDC’s strategy to continually review and selectively consider divestments to ensure an optimal portfolio mix.

Expanding European Portfolio

Within 2H2021, Keppel DC REIT has made 2 strong acquisitions as they continue to expand their European portfolio. The first acquisition was acquiring their 3rd Data Centre in the Netherlands, a freehold property with 2 data centre buildings in De Hurk, which is the largest business park in Eindhoven, for €37.2m or approximately S$59.9m. KDC did pay a slight premium for this acquisition as the asset was valued at €35.4m or approximately S$57.1m but it is expected to be DPU accretive. On top of this, the acquisition is expected to improve KDC’s portfolio occupancy from 98.0% to 98.1% as of 30 June 2021 while the WALE remains unchanged at 6.5 years.

The second acquisition was acquiring their 2nd Data Centre in London, located in Bracknell, United Kingdom for £57.0m or approximately S$105.5m. KDC paid a fair price for the asset as it was valued at £57.0m as well. The asset is also fully leased on an existing triple-net lease on a shell and core basis to a leading telco until 2039. Similarly, this acquisition is expected to be DPU accretive for KDC. acquisition, KDC’s proportion of its shell and core data centre leases will increase from approximately 18.3% to 20.9%. This acquisition is expected to be completed in 1Q2022 and will increase KDC’s overall portfolio WALE from 7.7 years to 8.1 years.

Both acquisitions look great as KDC continues to expand its portfolio into different geographic locations. On top of that, both acquisitions are DPU accretive which is ultimately what we want as shareholders. This can help give investors ease of mind knowing that the management has shareholders’ interests in mind.

Investment in M1 Network

In November 2021, KDC announced a proposed investment of S$89.7m in M1’s network assets to help create value for shareholders. The proposed investment will go into purchasing bonds and preferred shares issued by M1 Network Private Limited. The investment is expected to provide a stable cash flow of S$11m p.a. (comprising both principal and interest) over 15 years, without assuming any operational management risks. The management added that the principal repayments from the investment may be used to pare down external borrowings, as well as fund potential acquisitions and/or capital expenditures. Post completion, the investment is expected to increase KDC’s FY2020 pro forma DPU by 3.8% from 9.17 cents to 9.519 cents.

This investment seems like a great move by the management as it helps provide a steady stream of income for KDC over the next 15 years which can be used meaningfully to either pare down debt or fund future acquisitions as mentioned. It is also important to note that KDC still maintains a huge portion of its assets under management in Data Centres which is the main investment goal for KDC.

FY2021 Results

Next, let’s take a look at how Keppel DC REIT has fared in FY2021.

Marginal Growth in Gross Revenue and NPI

| Year on Year Difference | FY2021 | FY2020 |

|---|---|---|

| Gross Revenue | S$271.065 million (+2.1%) | S$265.571 million |

| Net Property Income (NPI) | S$248.154 million (+1.6%) | S$244.166 million |

Keppel DC REIT grew their Gross Revenue and NPI marginally for FY2021 by 2.1% and 1.6% respectively. There wasn’t much meaningful growth for 2H2021 but there were a few acquisitions being announced and completed during this period. These acquisitions, along with the recent investment in M1 Network, will only start to meaningfully contribute towards their revenue numbers in FY2022. As such, we can definitely expect a much larger growth in FY2022.

Consistent Growth In Distributable Income and DPU

| Year on Year Difference | FY2021 | FY2020 |

|---|---|---|

| Distributable Income | S$171.606 million (+9.4%) | S$156.915 million |

| Distribution Per Unit (DPU) | 9.851 cents (+7.4%) | 9.17 cents |

Despite the slow growth in Gross Revenue and NPI, the overall Distributable income and DPU grew by a substantial amount in FY2021 by 9.4% and 7.4% respectively. The DPU per share for FY2021 comes up to 9.851 cents as compared to last year’s 9.17 cents. Even though Keppel DC REIT is a defensive REIT by nature due to its asset class, it is amazing how much its DPU has grown year over year. This definitely shows how much the demand for Data Centres has grown over the years as well as indicates how much it will continue to grow over the next 5-10 years as Cloud Computing continues to be a growing trend.

Rock Solid Balance Sheet

| As at 31 December 2021 | As at 31 December 2020 | |

|---|---|---|

| Aggregate Leverage | 34.6% | 36.2 |

| Interest Coverage | 10.8x | 13.3x |

| Average Cost of Debt | 1.6% | 1.6% |

Keppel DC REIT managed to pare down their overall aggregate leverage year over year to 34.6%. On top of that, thanks to the increased assets under management, Keppel DC REIT’s debt headroom has grown to ~S$0.714b and ~S$1.16b before reaching 45% and 50% respectively. The average cost of debt has been maintained and remained low at 1.6%. Although the interest coverage ratio has dropped slightly from 13.3x to 10.8x, it is still very high and strong as compared to most REITs in the market.

Overview on Portfolio Stability

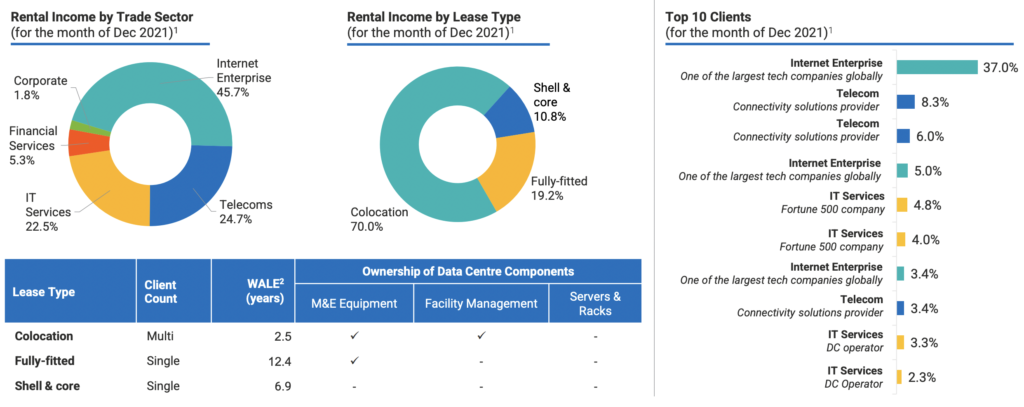

For FY2021, Keppel DC REIT has maintained a very strong portfolio that is well diversified across different trade sectors as well as lease types. It is good to note that KDC’s overall portfolio WALE stands at 7.5 years as compared to FY2020’s 6.8 years, coupled with a record high portfolio occupancy rate of 98.3%.

Just to briefly summarize the different lease types that KDC has, colocation means the equipment, space, and bandwidth are available for rental to customers. The customer only has to pay for the rental of the equipment and uses its own servers. Colocation facilities provide diverse client profile and lease expiry.

Fully-fitted lease means that Keppel DC REIT has equipped the building but the tenants have to manage the facility themselves as well as pay for the maintenance expenses. For the last lease type Shell & core, KDC simply provides the tenant with the building itself. The tenant has to uses its own servers, manage the facility themselves and cover all other expenses.

In a nutshell, fully-fitted as well as shell & core facilities provide income stability with typically longer lease terms. As such, it is good to see that KDC has been growing their concentration towards these 2 lease types from 27.3% to 30% while reducing their exposure to Colocation leases from 72.7% to 70%.

5-Year Performance

Let’s take a deeper dive into Keppel DC REIT by looking at their 5-Year Performance.

Revenue Growth

As we can see, a consistent uptrend across the past 5 years for Keppel DC REIT with all areas growing strong year over year. The Gross Revenue grew by 94.9% or at a CAGR of 14.28%. The NPI also grew at a similar rate by 98.4% or at a CAGR of 14.69%. The Distributable Income more than doubled over the past 5 years, growing by 108.5% or at a CAGR of 15.83%. Consistent NPI and Distributable Income growth is hard to achieve over such a long time period, which tells you a lot about how strong the management is.

DPU Growth

Similarly, we can see that KDC has grown its DPU consistently over the past 5 years by 41.33% or at a CAGR of 7.16%. When investing in REITs, one of the key metrics investors want to see grow over time is DPU/share. Sometimes, REITs can grow exponentially in size but end up paying out a lower DPU/share due to share dilution through equity fund raisings. Investors can end up on the losing end if acquisitions are done through poorly structured deals.

NAV Growth

Another important metric would be NAV/share growth. As we can see, KDC has also grown its NAV consistently over the past 5 years by 39.8% or at a CAGR of 6.93%. It is no doubt that achieving consistent NAV/share growth is challenging especially if the REIT has done various acquisitions funded by equity fund raisings. This definitely shows how well KDC has been doing over the past 5 years, achieving strong and consistent growth year over year.

Potential Growth Catalysts

With such a strong set of results in FY2021, a consistent set of results over the past 5 years and many positive acquisitions made, are there anymore potential growth catalysts that can help KDC grow bigger?

Acquisitions To Start Contributing

As mentioned, the few acquisitions and investments by Keppel DC REIT were transacted towards the 2H of FY2021. As such, most of them were not able to meaningfully contribute to KDC’s revenue numbers. Coming into FY2022, other than the acquisition made in the UK, the other acquisitions and investments will be properly reflected in KDC’s revenue numbers.

Potential Pipeline Assets

Thanks to Keppel DC REIT’s well-established sponsor, they have plenty of opportunities to grow through potential pipeline assets. It is mentioned in their result release that KDC has over S$2b in terms of potential assets for acquisition through Keppel T&T as well as Keppel’s private data centre funds. It is also good to note that Keppel T&T has granted KDC the Rights of First Refusal (ROFR) for future acquisition opportunities to its data centre assets.

Having a strong sponsor, on top of a huge ROFR pipeline, will help KDC secure a stable path for growth in FY2022 as they continue to expand their portfolio. Not to mention with their relatively low leverage and high debt headroom, KDC will likely continue to acquire more in FY2022.

Possible Risk Factors

Other than the potential growth catalysts, we should also look at possible risk factors that could negatively affect Keppel DC REIT in FY2022. Let’s discuss some that I’ve identified below.

Rising Interest Rates

As we all know, the FEDs are planning to start hiking interest rates in FY2022, with a target of 4 hikes with an estimated hike of 25 bps each time. REITs tend to perform weaker in times like these because the rising interest rates will result in a rising cost of debt. This will in turn, cause REITs to steer away from making acquisitions through debt as this will increase their overall cost of debt. However, some REITs are exposed to low interest rate countries such as Japan or even regions like Europe. These REITs can take advantage of the near 0 interest rate environment to continue aggressively expanding through Asset Enhancement Initiatives (AEIs) or acquisitions.

Valuation v. Peers

| PB Ratio | Annualized Dividend Yield | |

|---|---|---|

| Keppel DC REIT($2.16) | 1.66x | 4.56% |

| Ascendas REIT ($2.80) | 1.20x | 4.96% |

| Digital Core REIT ($1.15) | 1.37x | 3.63% |

| Mapletree Industrial Trust ($2.51) | 1.32x | 5.42% |

| Mapletree Logistics Trust ($1.69) | 1.19x | 5.14% |

As we can see from the comparison table above, Keppel DC REIT is the most overpriced REIT with a PB ratio of 1.66x as compared to its peers with Mapletree Logistics Trust being the cheapest with a PB of 1.19x. When we compare the annualized yield, KDC is placed near the average at 4.56% with Mapletree Industrial Trust yielding the highest at 5.42%. In this instance, we can see that KDC does seem to be overvalued at the moment when compared to its peers but you do have to account for the stability and defensive nature of the asset class in its portfolio.

Unlike most of its peers, with the exception of Digital Core REIT, KDC is a pure data centre REIT whereas the other REITs like Ascendas REIT or Mapletree Industrial Trust only hold some data centres in their portfolios. Given how defensive the asset class is, coupled with its strong growth potential, I don’t see why KDC shouldn’t be priced with a premium. Not to mention with a strong management team backing KDC, KDC is relatively attractive at this valuation as compared to its 5-year and 3-year historical average PB of 1.7x and 1.94x respectively.

Final Thoughts

All in all, Keppel DC REIT has been a treasure in my portfolio, entering my first tranche a while back at $2.42. The REIT has continued to outperform my expectations time and time again with its strong results. With the current market condition, together with the fear surrounding rising interest rates, KDC might become an attractive pick as its valuation becomes cheaper over the next few weeks.

Pingback: My Top 5 Exciting REITs To Watch in 2022

Pingback: REIT Posts of the Week @ 5 February 2022 | TheFinance.sg