Affirm (NASDAQ: AFRM) recently went public on 13th January 2021, issuing a total of 28 million Class A common stock at $49 a share. On the day of IPO, Affirm closed strong at $97.24, almost increasing by 100%. Affirm has since been on many investors’ radar as it’s the up-and-coming FinTech company to watch. As the results were released, the stock closed 7.85% lower in the post-market. Let’s take a deep dive into the results to find out why.

Phenomenal Revenue Increase

| 3M Ended December 31, 2019 | 3M Ended December 31, 2020 | 6M Ended December 31, 2019 | 6M Ended December 31, 2020 | |

|---|---|---|---|---|

| GMV | $1.3 billion | $2.1 billion (+61.5%) | $2.2 billion | $3.6 billion (+63.6%) |

| Total Revenue | $130 million | $204 million (+56.9%) | $217.9 million | $378 million (+73.5%) |

| Transaction Costs | $92.7 million | $114.1 million (+23.1%) | $155.3 million | $244.1 million (+57.2%) |

| Gross Revenue | $37.3 million | $89.9 million (+141.0%) | $62.6 million | $133.9 million (+113.9%) |

Starting off with the Revenue segment, we can see that Gross Merchandise Volume (GMV) saw a huge increase year on year for the quarter as well as the 6 months ended. The total revenue improved significantly while the transaction costs only increased slightly, allowing the overall gross revenue to increase more than 100%. We can also see that Affirm has grown remarkably as you can see the 3M 2020 revenue is almost equal to the 6M 2019.

For FinTech companies like Affirm and Square, GMV is such an important factor to take note of as it really shows you the number of transactions as well as the volume of funds being transacted in the platform.

Revenue Breakdown

Breaking down the revenue segment, we can see that the Merchant Network Revenue is the biggest contributor and has increased substantially year over year.

Rapid Active Consumers Growth

| December 31, 2019 | June 30, 2020 | December 31, 2020 | |

|---|---|---|---|

| Active Consumers | 3.0 million | 3.6 million | 4.5 million |

| Transactions per Active Consumer | 2.1 | 2.1 | 2.2 |

The second key thing for these FinTech companies to look at is the number of active consumers as well as transactions per active consumers. As we can see, Affirm grew remarkably over the past year, growing its active consumers by 20% from December 31st, 2019 to June 30th, 2020 and another 25% from then to December 31st, 2020. This represents a full 50% growth year over year.

The transactions per active consumer managed to grow by 0.1, which may seem small but it means that an additional 4.5 million transactions were made. Now that is really amazing.

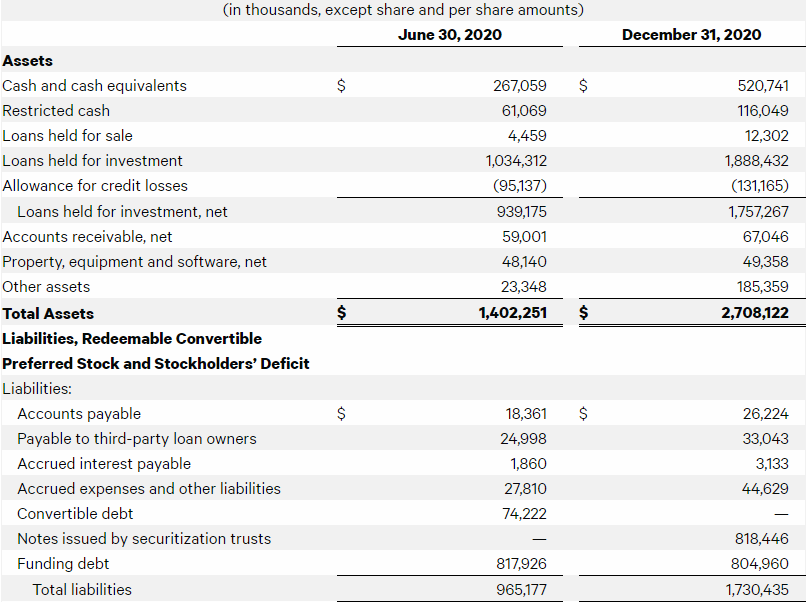

Rock Solid Balance Sheet

Moving onto the balance sheet, we can see that Affirm has a very big cash balance of $520 million. As such, Affirm’s current ratio stands at a whopping 6.58x, well above the minimum 1x which ensures that the company has sufficient liquid assets to cover all its short term liabilities and debts.

Final Thoughts

Definitely, a fantastic set of results and something investors want to see right after its strong IPO performance. The share price did dip during the post-market by about 7.85% despite such a strong set of results. This might have been caused by a few factors:

- Many Traders and Investors were buying, to sell on the good earnings report

- Investors taking profit as the share price reaches near its all-time high

- The low volume being transacted in the market

I personally feel that despite all these possible factors, I’m still going to continue accumulating Affirm for the long term. I am very confident in the management, and especially the CEO, Max Levchin, who was one of the co-founders of PayPal, he definitely knows his stuff around the FinTech space as he is one of the founding pioneers.

The growth is also very strong and is likely to continue for the next few quarters to come. As Affirm is still quite small with a market cap of $33B, it has a lot of room to grow over the next 3-5 years. I believe Affirm definitely has the ability to compete with the likes of Square if they can continue this level of growth.