With markets going on a downward trend, I tend to look for strong growth companies with healthy cash flows and net cash positions with will help them tide through these tough times without incurring debt.

After some searching, I managed to find a company that has a strong cash flow with a net cash position. It even pays you a nice 7% yield while you wait for the share price to appreciate.

Silverlake Axis Ltd (SGX:5CP)

Business Model

Silverlake Axis Ltd (SAL) provides technology and related services to the Banking, Insurance, Payments, Retail and Logistics industries. Founded in 1989, SAL has built an impeccable track record of successful core banking implementations.

Their core business involves providing the backend software to banks in South East Asia (primarily Malaysia), and providing ongoing maintenance services to the same banks. In fact, over 40% of the top 20 largest banks in South-East Asia run on Silverlake Axis’ core banking solutions, which is very impressive.

They’re listed on the SGX, but their headquarters is in Malaysia, and their earnings are reported in Malaysian Ringgit.

Financials

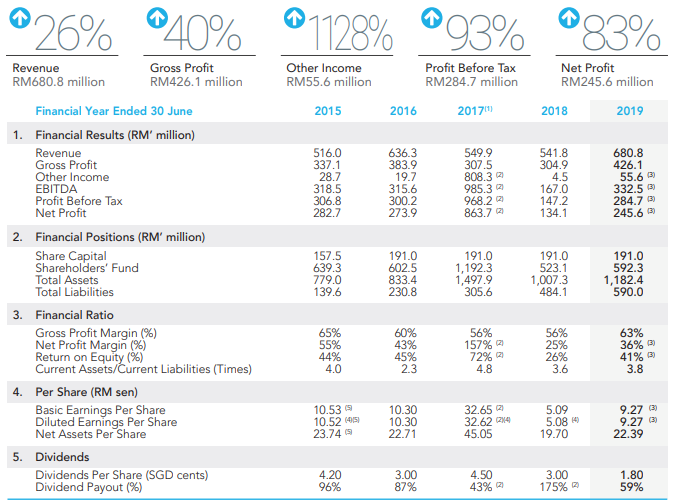

Fantastic growth in terms of their revenue and overall profit for the year, increasing by 25.66% and 83.15% respectively. EPS increased as well by 82.12%. Now let’s take a look at their operating cash flow and free cash flow !

So looking at their operating cash flow looks, it increased by 54.46% ! Now let’s calculate Free Cash Flow. If you’re not sure how, refer to this article I wrote previously where I shared how to calculate Free Cash Flow.

After some calculations, their CapEx stands at (5,532,226). So, now if you deduct the CapEx from the operating cash flows, you get ~300mil. RM. This shows that the company’s financial health is very stable.

Financial Growth History

Looking from 2015-2018, the company seems to be going on a downward trend. Only in 2019, things started to pick up slightly, though we can’t be certain if this can be sustained.

As you can see there is a huge spike in 2017. The reason is stated below.

For those who are lazy to scan through that whole chunk, here is a TLDR version

- In FY2017, they made a net gain of RM426.2 million on disposal of shares in an associate, Global InfoTech Co. Ltd. (“GIT”)

- The gains were reflected in the other income, earnings, net profit margin and return on equity ratios

- In FY2018, the group incurred a net loss of RM5.9 million from the sales of GIT shares

- If you excluded the gains and losses, FY2017’s net profit should have been RM154.9 million and FY2018’s net profit should have been, RM140 million

- Also there were special dividends handed out during both years, 2.3cents in FY2017 and 1.8cents in FY2018

This Is Not A Tech Stock

Yes they do I.T. solutions and such, but they are not gonna grow 100x like how you would assume a tech stock will grow. This isn’t the next Apple or Tesla.

Personally, from the declining financials, I can’t confidently call this a growth stock. Currently, I’d categorize it more like a Cigar-Butt Stock than your typical growth stock.

Of course, if their financials improve or at least stabilize, I might come back and take another look at it.

Buy or No Buy?

Personally I’ve taken a small position @ 0.245. Why? Lets take a look at a little check list !

- Current Ratio > 2 ✅

- Healthy FCF ✅

- Pays a good and sustainable dividend ✅

- P/E Ratio < 9 ✅

I can’t find a reason not to own this stock ! Yes, it’s not your typical dividend growth stock, or growth stock, but hey, it checked everything off my check list.

Potential Risks

Well the most obvious risk is the unstable financials. Other than that, there is also Forex risks since the company’s earnings are reported in MYR.

Closing Thoughts

There is a definite risk buying into silverlake right now, but when weighing the risks vs rewards, I’m pretty comfortable with it. The stock is almost 50% down from its recent highs.

Assuming it returns to that level in a year’s time, you will be sitting with a 100% capital gain on top of a 7% dividend gain. Position sizing is very important so I only allocated a small % for silverlake, in case anything goes wrong or if the stock takes a very long time to grow back to previous highs.