Keppel DC REIT (SGX: AJBU) is Singapore’s first and only pure Data Centre REIT as well as the most overpriced REIT, with a PB of 2.5x @ $2.98/share. Over the past week, the FY2020 results of Keppel DC REIT was released and investors are very impressed. Let’s dive right into the FY2020 results of Keppel DC REIT to find out why.

1. Strong Growth In Gross Revenue and NPI

| Year on Year Difference | FY2020 | FY2019 |

|---|---|---|

| Gross Revenue | S$265.571 million (+36.3%) | S$194.826 million |

| Net Property Income (NPI) | S$244.166 million (+37.7%) | S$177.283 million |

Jumping right into the results, Keppel DC REIT has posted yet another strong set of results, growing its Gross Revenue as well as NPI in the mid-double digits. This growth has been pretty consistent over the past few years and I’m confident that the REIT will continue to perform with similar growth in the future.

With Data Centres being the next big trend, Keppel DC REIT will continue to see a huge demand in its assets, allowing them to not only maintain high occupancy rates but also increase its rental reversion rates as time passes.

2. Phenomenal Growth In Distributable Income and DPU

| Year on Year Difference | FY2020 | FY2019 |

|---|---|---|

| Distributable Income | S$156.915 million (+38.6%) | S$113.245 million |

| Distribution Per Unit (DPU) | 9.17 cents (+20.5%) | 7.61 cents |

With strong growth in the NPI, comes phenomenal growth in Distributable Income as well as DPU. Keppel DC REIT managed to grow its Distributable Income by a whopping 38.6% and its overall DPU increased by 20.5% year on year.

This growth is really unchallenged amongst all REITs in Singapore. For a dividend growth investor like myself, Keppel DC REIT is a must-have in my portfolio. The best part about investing in REITs with this level of growth is the fact that my yield on cost will keep on growing exponentially as time passes. Based on a yield on cost of 3%, growing at a rate of 20% year over year, we can expect it to grow exponentially, to upwards of 7.4% over the next 5 years.

3. Solid and Stable Financials

| As at 31 Dec 2020 | As at 31 Dec 2019 | |

|---|---|---|

| Aggregate Leverage | 36.2% | 30.7% |

| Interest Coverage | 13.3x | 13.3x |

| Average Cost of Debt | 1.6% | 1.7% |

Moving onto the financials, we can see that the aggregate leverage has increased significantly from 30.7% to 36.2% due to the new acquisition, 100% freehold interest in Kelsterbach Data Centre. The interest coverage ratio stands strong at 13.3x which means the REIT has the ability to gear up to 50% if they want to. The average cost of debt is also relatively low at 1.6%.

4. Portfolio Stability

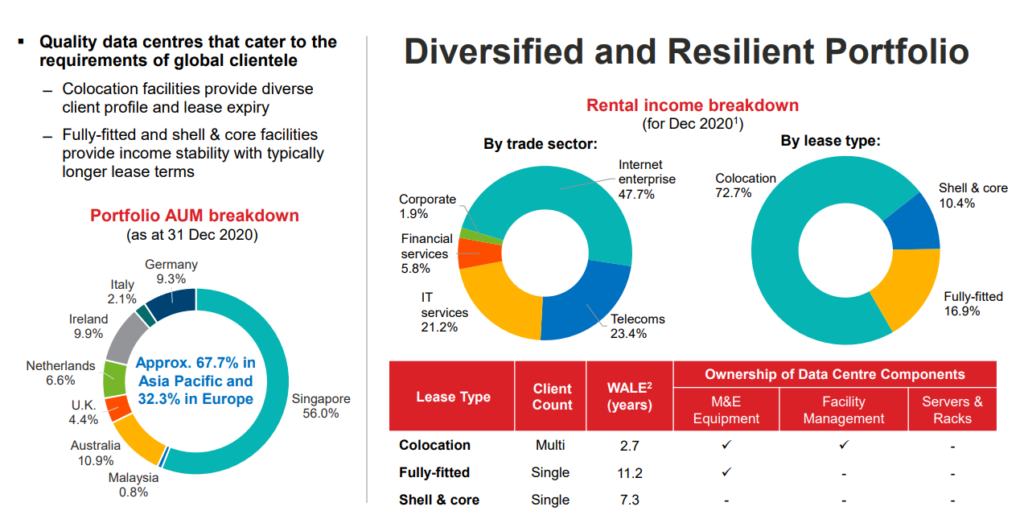

Looking at Keppel DC REIT’s portfolio, we can see that it is very resilient and stable with a long WALE of 6.8 years. The portfolio is very diversified across multiple tenants in different industries.

The total occupancy rate stands at a solid 97.8% with the majority of its leases (79.8%) expiring in 2025 and beyond. The occupancy rate improved due to 3 key factors:

- Achieved 100% occupancy at Keppel DC Singapore 5, up from 84.2% as at 30 Sep 2020

- Secured a tenant expansion at Keppel DC Singapore 1, increasing occupancy from 89.2% as at 30 Sep 2020 to 91.1% as at 31 Dec 2020

- Secured a new tenant at Keppel DC Singapore 2, increasing occupancy from 93.5% as at 30 Sep 2020 to 98.2% as at 31 Dec 2020

5. Growth Potential

As with all investments I make, I want an investment that grows over time rather than stays consistent and flat line over the next 3-5 years. Let’s take a look at some of the growth potential that Keppel DC REIT has.

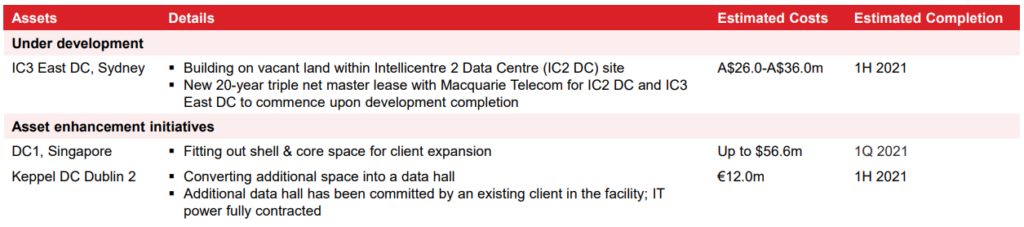

Ongoing Asset Enhancement Initiatives

As of now, Keppel DC REIT has 3 ongoing AEIs that have yet to be completed. 1 of the AEIs is estimated to be completed by 1Q 2021 while the other 2 are estimated to be completed by 1H 2021. Assuming that all 3 AEIs are completed by 1H 2021, the additional contributions will only start showing in 2H 2021.

As such, investors should take the 1H 2021 results with a pinch of salt as there will be more to come in 2H 2021. It’s always great to see management teams being proactive in improving their assets, increasing its value through AEIs rather than just doing acquisitions repeatedly, some even dilutive.

Possible Acquisitions

With the increased demand for everything to move onto the cloud, the demand for Data Centres are also increasing rapidly. Keppel DC REIT expects the European Data Centre market to grow by >40% to over US$25b by 2024 despite limited new supply. APAC Data Centre spending is also expected to surpass US$35b by 2024 to account for >35% of the global market.

As such, Keppel DC REIT needs to increase its reach and acquire more Data Centres while the trend is still growing and has yet to reach its peak. With its gearing ratio holding around 36.2% and its share price priced at such a premium, any form of equity fundraising for acquisitions will definitely be accretive for shareholders.

Final Thoughts

Without much saying, Keppel DC REIT has yet again performed way past expectations. Although the REIT’s nature is highly defensive, it has definitely performed remarkably well. Keppel DC REIT is one of the prime examples of low risk with high reward as long as you can hold on and stay the course.

Some investors will definitely argue that the yield is too low or there are better opportunities. Perhaps there are better opportunities elsewhere but, I don’t think you can find a REIT that grows at this pace anywhere in the Singapore market. Yes Keppel DC REIT is overpriced with a PB > 2 and a relatively low yield but think about its historical performance. When has Keppel DC REIT ever been “fair valued”?