Ascendas India Trust (SGX: CY6U) is not a very popular REIT amongst investors due to its assets being in India, which has a weak currency against the Singapore Dollar. Recently, the FY2020 results of Ascendas India Trust (AIT) has been released and it caused a drop in the share price afterwards. Let’s take a look into what caused the share price to drop after the release.

1. Slight Drop In Gross Revenue and NPI

| Year on Year Difference | FY2020 | FY2019 |

|---|---|---|

| Gross Revenue | S$191.7 million (-2.99%) | S$197.6 million |

| Net Property Income (NPI) | S$147.9 million (-0.47%) | S$148.6 million |

Jumping right into the revenue segment, Ascendas India Trust saw its Gross Revenue as well as its NPI drop by 2.99% and 0.47% respectively. The drop is due to the poor FX rate between SGD and INR, which is Ascendas India Trust’s main currency.

As the INR rate grew weak, this negatively affected the numbers. If we were to look at the numbers in the original currency (INR), the Gross Revenue grew by 1% while the NPI grew by 3%.

This is definitely a key risk that investors should take note of before investing in Ascendas India Trust as the currency is weakening over the past few years, which can negatively affect returns for shareholders.

2. Growth In Distributable Income and DPU

| Year on Year Difference | FY2020 | FY2019 |

|---|---|---|

| Distributable Income | S$112.6 million (+18.4%) | S$95.1 million |

| Distribution Per Unit (DPU) | 8.83 cents (+8.34%) | 8.15 cents |

Despite the slight drop in the revenue segment, the Distributable Income, as well as the DPU, grew by quite a big portion, 18% and 8% respectively. It is good to note that the Distributable Income is including the 10% of the income that is retained by the REIT. This is why there is a big difference between DPU and Distributable Income.

Although the number of units grew by 9% and a portion of the Distributable Income is being retained, the overall DPU in SGD still grew by 8%. The DPU in its base currency (INR) grew by 12% which is very remarkable as well. This shows investors how much the exchange rate affects the rate of returns when investing in REITs with assets that are primarily overseas.

3. Solid and Stable Financials

| As at 31 Dec 2020 | As at 31 Dec 2019 | |

|---|---|---|

| Aggregate Leverage | 30% | 28% |

| Interest Coverage | 4.0x | 3.6x |

| Average Cost of Debt | 5.3% | 6.3% |

Jumping into the financials part, we can see that Ascendas India Trust has always managed to keep their aggregate leverage low, 28% in 2019 and 30% in 2020. At 30%, it gives AIT a massive debt headroom of about S$1.08B before reaching the 50% gearing cap. Keeping the aggregate leverage low allows AIT to always keep their doors wide open should an opportunity arise.

The cost of debt is relatively high at 5.3% as compared to its peers because a large majority of its debts are in INR but I don’t see that as a big worry as of now. The interest coverage ratio improved to 4.0x, which allows AIT to gear up to the 50% cap if they choose to.

4. Portfolio Performance

Moving onto Portfolio Performance, we can see that Ascendas India Trust has managed to keep its portfolio occupancy very high at 94%. The occupancy rate was boosted thanks to the completion of the Endeavour building in ITPB, boosting the occupancy up from 81% to 94%. As we can see, most of its assets are performing on par with others in the same area other than ITPC.

It’s also good to see that the WALE holds well at 3.5 years and is very well spread out across the next 5 years.

5. Growth Potential

Ascendas India Trust is in a fast-growing market and it’s important that the REIT is well-positioned and ready for growth opportunities to further improve itself. Let’s dive into the potential growth catalysts that AIT has.

Strong Rental Reversion

As we can see, the FY2020 rental reversion was very strong across the portfolio with its 2nd largest asset, ITPC, growing by 28% and the 3rd largest asset, ITPH, growing by 21%. With this rate of rental reversion combined with the strong occupancy, Ascendas India Trust can continue to see strong growth in performance even without new acquisitions.

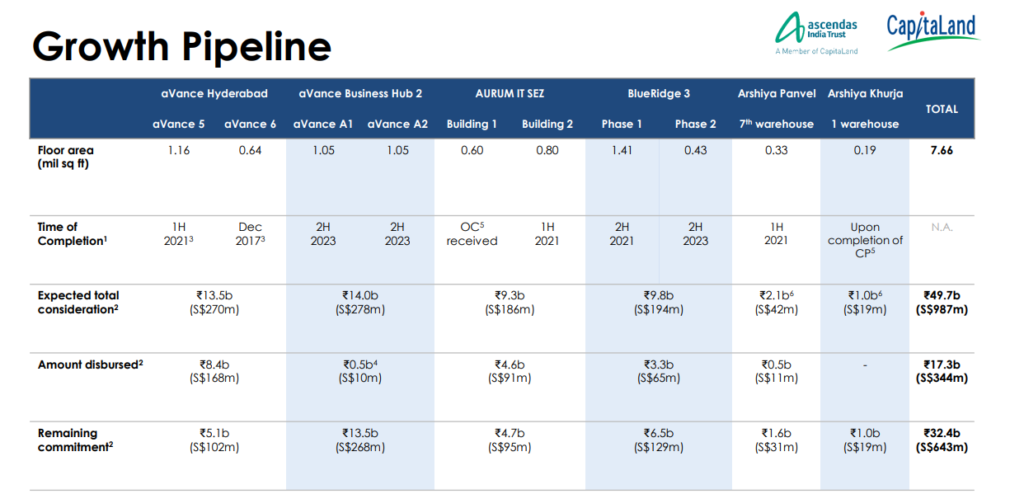

Growth Pipeline

With a debt headroom of S$1.08B, this gives Ascendas India Trust a ton of room to grow via meaningful acquisitions. With the help of its sponsor, Capitaland, as well as development pipeline opportunities, AIT has a very healthy growth pipeline over the next 3-5 years. Not to mention the 3rd party acquisition opportunities as seen in the table above, the REIT has great potential to grow 2 folds or even 3 folds over the long term.

Final Thoughts

Overall, another set of solid results by AIT. Through the FY2020 results of Ascendas India Trust, investors should start preparing for an upcoming acquisition which should kick in by 2H 2021. I also noticed that after the FY2020 result release, the share price started to tank which didn’t make sense to me. A REIT like AIT, which performed so well, should see positive movement in its share price. Of course, if the price continues to drop, I will start to accumulate because I see huge upside potential for AIT over the next 5 years.