This is the second part to a 4 part series where I share my insights and analysis on the 4 local hospitality REITs listed on the SGX. In this article, I’ll be sharing all you need to know about CDL Hospitality Trust (SGX: J85).

CDL Hospitality Trust (SGX:J85)

Property Overview

As at Mar 31st 2020, CDL Hospitality Trust owns 16 hotels and two resorts comprising a total of 5,089 rooms as well as a retail mall.

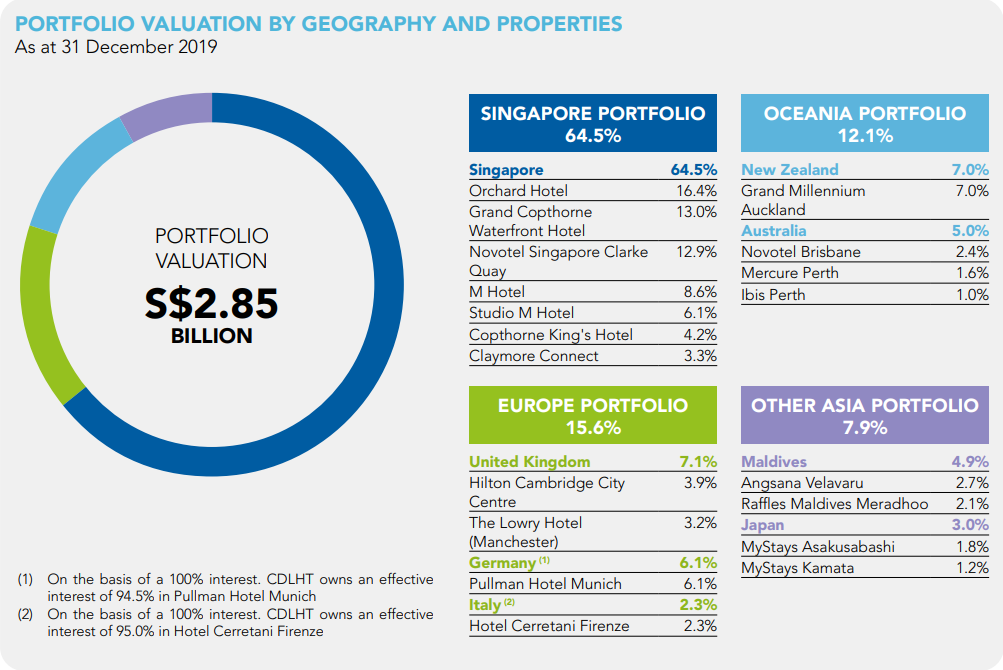

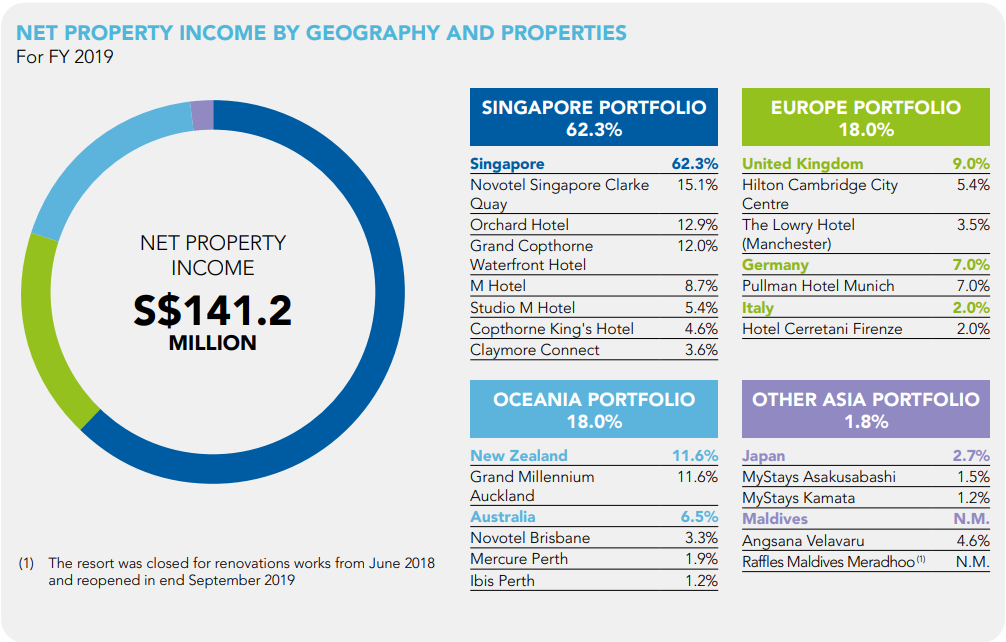

As you can see, its Singapore portfolio takes up about 64.5% of its portfolio valuation and 62.3% of its NPI. Though it is great that they have assets in other countries and regions like Europe and Oceania, the Singapore portfolio is a little too high for my liking.

Financial Ratios

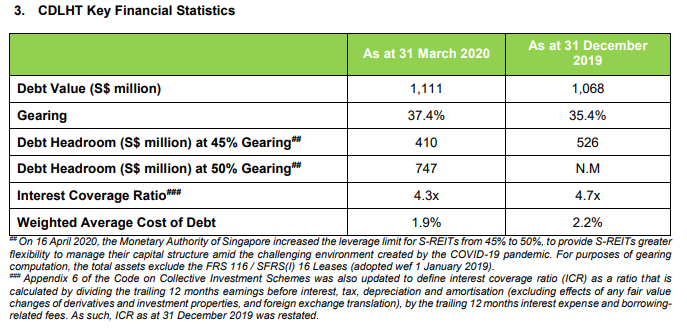

Looking at the REIT’s financials, we can see that the gearing has significantly increased from the quarter prior from 35.4% to 37.4%. As a result of the REIT taking on additional debt, it has managed to reduce their weighted average cost of debt to 1.9% as compared to 2.2% the year prior. The interest cover ratio is still healthy at 4.3x, higher than 3x, which is my optimal requirement.

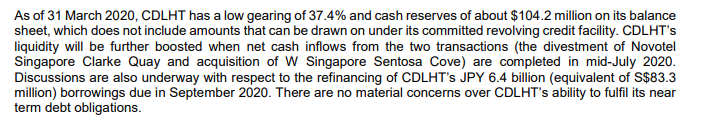

It is also good to note that CDL Hospitality Trust does have some more net cash inflows from some of their transactions that are due to complete in mid-July 2020. In addition to these net cash inflows, they are also planning to refinance the JPY 6.4 billion borrowings due in September 2020. With all these in mind, CDL Hospitality Trust’s liquidity will be further boosted up and will be reflected in the 3Q results in FY2020.

We can also see from its FY2019 annual report that the net asset value stands at $1.52/share. At $0.90/share, the PB ratio of CDL Hospitality Trust stands around 0.592. This is a huge bargain as you are only paying $0.592 per $1 of assets.

Potential Upsides

CDL Hospitality Trust has been actively initiating AEI plans for assets in several countries. There is one currently expected to complete in mid 2020.

Also, you can see that CDL Hospitality Trust has been actively initiating AEIs in the year prior as well. They enhanced their assets in Maldives and the United Kingdom.

Another potential upside for CDL Hospitality Trust is from acquiring assets from its sponsors, Millennium & Copthorne Hotels Limited (“M&C”) and City Developments Limited.

Though there is a downside to this which I will talk about in the next section.

Potential Downsides

Even though CDL Hospitality Trust has 2 sponsors which it can acquire assets from, it does not have any ROFR pipeline assets. This is a worry because this means that the REIT does not have the first right to acquire any of the assets under its sponsor. If an investor or company would like to acquire any of the assets from the sponsors, CDL Hospitality Trust cannot stop the sponsors from selling these assets away or to sell the assets to them first.

Also, there is a high chance of the REIT cutting its DPU for the coming quarters as well.

Assuming a 30% decrease in NPI and Gross Rental Revenue, and that the REIT retains about 8.28% of total distributable income for working capital, I came up with a conservative assumption of a 40% decrease in DPU from the year prior. I am also bullish on the sector’s recovery in 2H of FY21 so my forecast for FY21’s DPU is an increase of 30% from the year prior.

| @ $0.90/share | FY19 | Realistic FY20 Forecast | Realistic FY21 Forecast |

| DPU | 0.0902 | 0.05412 | 0.070356 |

| Yield | 10.02% | 6.13% | 7.82% |

Final Thoughts

I personally bought CDL Hospitality Trust @ $0.86 a few weeks back and I have encouraged some of the members of the premium subscription to do so as well. I explained to them what I explained in this article here.

In my opinion, it is still a pretty good bargain buy with the low PB ratio and relatively good yield assuming 40% decrease in total revenue. I invest for the long term so I don’t mind waiting a few years before my investments yield me 10% and up. This is not taking into account the capital appreciation that I will gain when the sector recovers and the demand for hospitality REITs increases. We should take into account the fact that CDL Hospitality Trust is still down more than 40% year to date and I believe that the downside is limited from here.