Mapletree Logistics Trust has been doing well amidst the COVID-19 pandemic due to the nature of its properties and tenants. Its share price is currently up more than 17% year to date. Let’s take a quick look at the 4 key takeaways from the Q1 results of Mapletree Logistics Trust.

1. Growth in Gross Revenue and NPI

Mapletree Logistics Trust (MLT) has grown its gross revenue as well as its NPI year on year.

This growth is mainly due to :

- Higher contributions from their existing assets

- Accretive acquisitions made in FY19/20

- Lower property expenses due to lower utilities cost, maintenance expenses and FY19/20 divestments

The increase is partially offset by rental rebates granted to tenants impacted by COVID-19 as well as the divestment of 6 properties in FY19/20.

2. Growth in DPU

MLT has also managed to grow its DPU year on year by 1% even though they had a larger unit base. This is great seeing that with COVID-19 impacting many businesses and tenants, it’s hard for REITs to even maintain their DPU, let alone increase it.

3. Healthy Financials

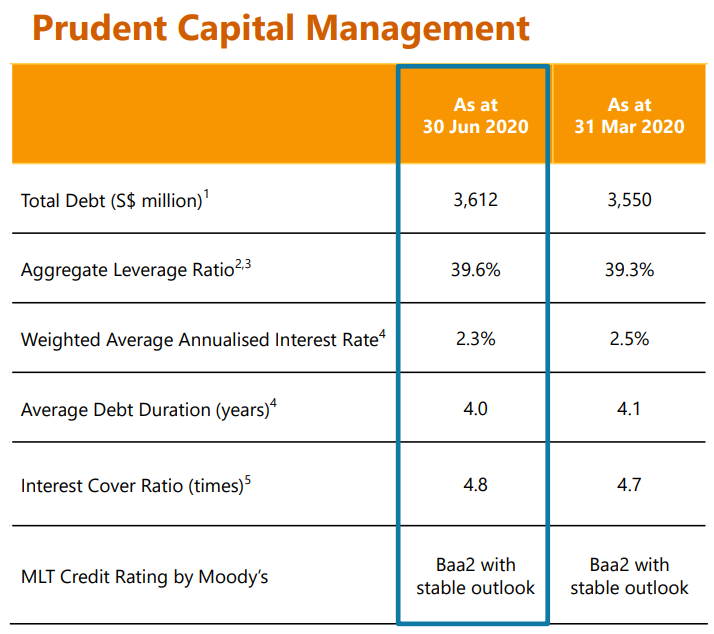

MLT’s aggregate leverage stood at 39.6%, with slightly lower weighted average borrowing cost of 2.3%.

Gearing A Little Too High For Comfort?

From their recent AGM, a shareholder asked “MLT’s current aggregate leverage ratio is at 39.3%, is there a comfortable target that the management is looking at? Will this be a constraint for MLT’s future growth?”.

Note that the AGM was before the results release, which is why the gearing stated is 39.3%

The response in short is that MLT’s gearing of 39.3% is well below MAS’s gearing limit of 50%. At MLT’s current gearing, they have a debt headroom of about S$945 million before gearing reaches 45% and S$1.95 billion till 50%. They also pointed out that have more than sufficient liquidity to meet their debt obligations in the next two financial years. It is good to note that they have stated that, they are comfortable with the current gearing level of around 40%. They will also gear up above 40% on a temporary basis if an attractive investment opportunity presents itself. If there are any sizable acquisitions, they will consider equity raising to partially fund the acquisitions so that gearing is maintained at around 40%.

In a nutshell, they have a huge debt headroom even at a gearing ratio of 39.3%. It is also good to know that should a large acquisition come, an equity fundraising (EFR) might take place which investors can take advantage of through subscribing in excess units.

4. Portfolio Rejuvenation

MLT has been actively growing and improving their portfolio with Asset Enhancement Initiatives (AEIs) and acquisitions. The redevelopment of the Mapletree Ouluo Logistics Park in Shanghai China has been completed in May 2020 and we’ll be able to see the revenue increase coming from this asset from Q2 onwards.

MLT has also made an acquisition recently on a Grade A Logistics Property in Brisbane Australia. The asset is freehold and is expected to be completed by Q3 of FY20/21. They already have a tenant on board with a 10 years lease term with annual rent escalation. The acquisition will not only help diversify MLT’s assets but also help diversify their tenant base.

Final Thoughts

Overall, the Q1 results of Mapletree Logistics Trust shows us that they are on the right track and is doing well amidst the COVID-19 pandemic. They have managed to increase their DPU year on year despite a larger unit base. With the 2 projects above contributing to MLT’s Q2 and Q3 revenue, MLT is well positioned to do great for the year.

I personally hold a very small position in MLT and have been looking for opportunities to increase my position. I’m hoping for an EFR to come soon so that I can increase my position at a discounted price. At its current price and valuation, it is way too high for me to invest in it now.