Ascendas India Trust’s 1H2020 results seem very promising especially with the huge DPU growth. I’ve covered AIT in a previous article which you can read more about here : Stock Analysis : Ascendas India Trust. Let’s take a quick look at the 1H results of Ascendas India Trust.

1. Slight Growth In Gross Revenue and NPI

| Year on Year Difference | 1st Half 2020 | 1st Half 2019 |

|---|---|---|

| Gross Revenue | S$99.0 million (+3.0%) | S$96.5 million |

| Net Property Income (NPI) | S$73.5 million (+1.0%) | S$73.1 million |

As we can see, Gross Revenue went up slightly due to positive rental revisions but it has been partially offset by lower utilities and carpark income due to the COVID-19 lockdown. The overall NPI went up by 1% due to the higher Gross Revenue. It’s good to note that the FX rate used also increased in our favor, from 51.7 INR to 52.5 INR per SGD.

2. Distributable Income and DPU Skyrocketed

| Year on Year Difference | 1st Half 2020 | 1st Half 2019 |

|---|---|---|

| Distributable Income | S$59.0 million (+36.0%) | S$43.3 million |

| Distribution Per Unit (DPU) | 4.64 cents (+24.0%) | 3.75 cents |

Ascendas India Trust increased their Distributable Income by a huge margin of 36%. This is mainly due to the higher NPI as well as interest income from investments in their pipeline assets. Keep in mind that they did retain about 10% of the distributable income as per their distribution policy which is to maintain a 90% payout ratio. All in all, the DPU still went up a remarkable 24% even though there was an enlarged unit base as compared to the year before.

It’s good to note that AIT has been able to increase its dividends for the past 7 years despite the declining exchange rate.

3. Healthy Financials

| As at 30 June 2020 | |

|---|---|

| Aggregate Leverage | 29.0% |

| Interest Coverage | 4.0x |

| Average Cost of Debt | 5.7% |

Ascendas India Trust’s balance sheet looks really great with their low gearing of 29%, giving them a huge debt headroom of about S$1bln. They also have a relatively acceptable interest coverage ratio of 4x. Their average cost of debt is pretty high at 5.7% but this is because 65% of the borrowings are in INR and the remaining 35% is in SGD. Other than the relatively high cost of debt, the overall financials of AIT is pretty healthy.

4. Potential Pipeline Acquisitions May Come Soon

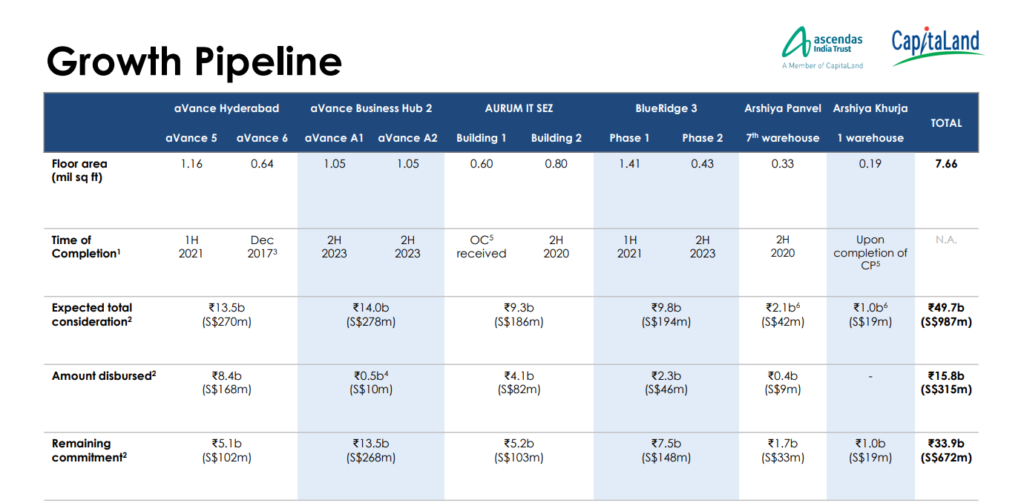

Ascendas India Trust is one of my favorite holdings and I’ll share why. They have a huge pipeline of assets that can be acquired from their sponsor, Capitaland. They also have a huge line of potential acquisitions that can be made outside of their sponsor’s scope.

They have already acquired some of these assets and are awaiting for them to be completed. When these assets are completed, they will start to contribute meaningfully to AIT’s revenue. AIT’s total lettable floor area, after all these assets are completed, will increase by 74% to a total of 22.8 million square feet. Assuming they maintain their occupancy at 98%, we can expect to see their revenue grow by at least 10% when all these assets are completed.

With their huge potential and low gearing, we can expect to see more acquisitions in the coming 6-12 months.

Final Thoughts

Overall, the 1H results of Ascendas India Trust is way better than expected. They have managed to outperform the year prior despite the COVID-19 lockdown in India. This is due to the nature of their assets, mainly business parks and warehouses.

I’ve shared about AIT a few months back about its huge potential and my view hasn’t changed. In fact, with their low gearing, I can’t wait to see what other acquisitions they will make in the coming 6-12 months.