VICOM (SGX: WJP) has seen its share price fall by over 20% over the past 12 months despite being a very defensive company and having stable earnings. VICOM seems to be poised for a good year as FY2023 saw a net influx in cars on the market which means more revenue is streaming towards VICOM. Let’s take a dive into the FY2023 results of VICOM and determine if it’s a good investment at its current share price.

1. Stable Growth in Revenue and Profits

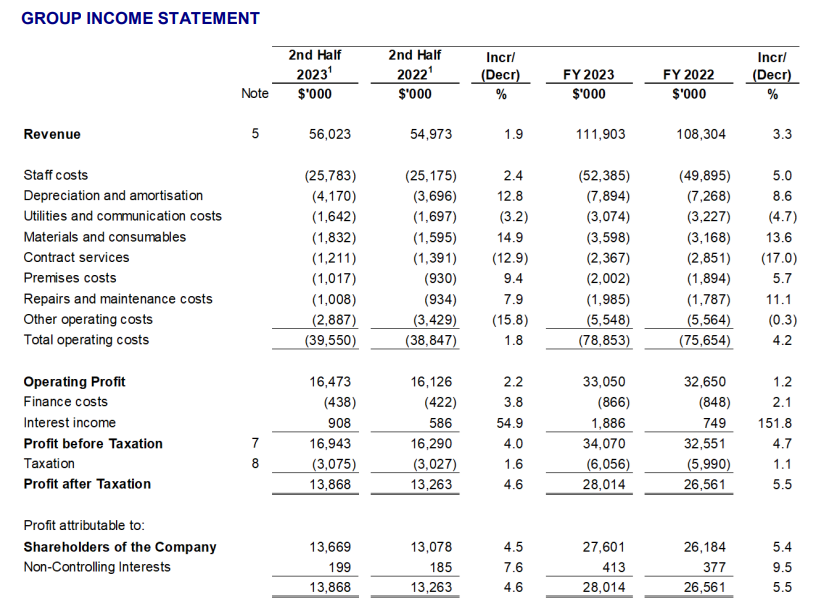

VICOM saw its revenue grow by 3.3% year over year to S$111.9m, mainly due to the 3.47% increase in revenue from car inspection and testing services. Its operating costs increased by 4.2%, mainly due to the increase in maintenance costs, as well as materials and consumables costs, which resulted in its overall operating profits only growing by 1.2% year over year. Despite this, VICOM did enjoy a net influx of interest income which helped push the net profits after tax to ~S$28m, growing by 5.5% year over year.

2. Balance Sheet Remains Stable

| As at 31 December 2023 | |

|---|---|

| Current Ratio | 2.29x |

| Quick Ratio | 2.22x |

| Net Operating Cash Flow | S$31.662 million |

VICOM’s balance sheet remains as stable as ever, with a strong current ratio of 2.29x and a quick ratio of 1.76x, which is higher than the recommended 1.2x – 2x. To recap what these 2 ratios represent, the current ratio and quick ratio are liquidity ratios that measure a company’s ability to pay its short-term debts. The key difference between these 2 ratios is the type of liquid assets used in the calculations. The current ratio takes into account all current assets, which includes inventory as well as other assets whereas the quick ratio only takes into account assets that can be easily liquidated within 90 days like liquid securities and cash.

3. Strong Dividend and NAV Growth

| Per Share (S cent) | FY2023 | FY2022 |

|---|---|---|

| Ordinary Dividend | 6.07 | 6.56 |

| Special Dividend | 2 | |

| Net Asset Value | 36.92 | 35.03 |

As we can see, VICOM distributed lower dividends in FY2023, decreasing by 0.49 cents or 7.47% year over year. This excludes the one-off special dividends of 2 cents which was distributed in FY2022. It is good to note that the decrease in dividends was actually due to the management’s decision to lower the payout ratio from 90% in FY2022 to 70% in FY2023. Over the past 5 years, VICOM has had a payout ratio ranging from 120% to 90%, inclusive of one-off special dividends. To put it into context, if VICOM were to meet the payout ratio of 90%, the dividends distributed would be ~7.002 cents which is higher than FY2022. On a brighter note, the NAV per share did grow which is good for shareholders.

4. Growth Potential

Given that VICOM is a very stable and defensive business, is there room for more growth or should investors just keep it as a cash cow that provides a steady stream of dividends? Well, the management has guided that demand for vehicle testing and related work is expected to be strong in FY2024, as the company has been appointed by the Land Transport Authority (LTA) as one of the Authorised Partners for the installation of On-Board Units (OBU) in the Electronic Road Pricing (ERP) 2.0 exercise. Demand for non-vehicle testing is also expected to increase with the anticipated recovery of the manufacturing sector and possible improvement in the overall economy.

Despite the strong guidance, profit margins will continue to be under pressure due to inflation and greater competition. It is good to note that VICOM has maintained its market share of 72%, inspecting a total of 520,895 vehicles in 2023. As VICOM is still a leading brand in the market, we can expect strong revenue growth in FY2024 given the mentioned tailwind factors.

Final Thoughts

As we can see from the FY2023 results of VICOM, it was a very mixed set of results. Even though there is growth in revenues, the dividends distributed fell year over year, which is not something investors are happy about. At its last close of S$1.45, VICOM is currently valued at a PE ratio of 18.64x and a dividend yield of 4.19%. I would deem this valuation as rather fair, with no huge potential for upside growth. Despite this, dividend investors should have some VICOM in their portfolio as its business is very defensive in nature which allows the company to provide its shareholders a very steady stream of dividends. Should the management decide to revert the payout ratio back to 90% or higher, then the yield will go up significantly, which dividend investors would be very happy about.