With the pandemic causing mass hysteria across the market in 2020, Parkway Life REIT (SGX: C2PU) stood strong due to the nature of its assets. Let’s take a quick look at the 4 important takeaways from Parkway Life REIT Q1 2021’s results as well as the future growth the REIT could potentially see in FY2021.

1. Consistent Growth In Gross Revenue and NPI

| Year on Year Difference | 1Q 2021 | 1Q 2020 |

|---|---|---|

| Gross Revenue | S$29.999 million (+0.4%) | S$29.869 million |

| Net Property Income (NPI) | S$28.029 million (+1.0%) | S$27.746 million |

Parkway Life REIT has once again, posted consistent growth in their Gross Revenue and NPI year over year by 0.4% and 1.0% respectively. Even though the number is small, it is still remarkable that they have managed to grow consistently over so many quarters.

This is why I mentioned previously that Parkway Life REIT is a very defensive REIT. The best part is, although it is very defensive, its returns are definitely on the higher end of the spectrum, offering investors a pretty attractive risk to reward if they invest in Parkway Life REIT.

2. Strong Growth In Distributable Income and DPU

| Year on Year Difference | 1Q 2021 | 1Q 2020 |

|---|---|---|

| Distributable Income | S$21.583 million (+3.0%) | S$20.951 million |

| Distributable Income Less Retained Capital | S$21.583 million (+7.4%) | S$20.101 million |

| Distribution Per Unit (DPU) | 3.57 cents (+7.4%) | 3.32 cents |

The Distributable Income segment, as well as DPU, grew much more in comparison by 3.0% and 7.4% respectively. It is good to note that Parkway Life REIT did retain some capital last year due to COVID-19 relief measures. As such, if we were to take that out of the equation, Parkway Life REIT’s Distributable Income would have increased by 7.4%.

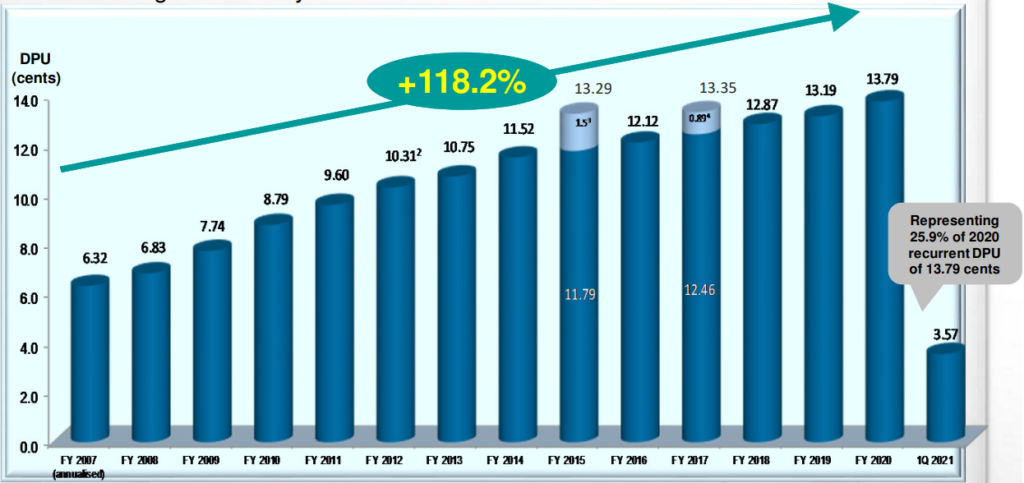

If you take a look at their long-term DPU trend, we can see that Parkway Life REIT has been consistently increasing its DPU year over year ever since its IPO.

3. Solid and Stable Financials

| As at 31 March 2021 | As at 31 December 2020 | |

|---|---|---|

| Aggregate Leverage | 37.8% | 38.5% |

| Interest Coverage | 20.9x | 18.1x |

| Average Cost of Debt | 0.55% | 0.53% |

Parkway Life REIT’s financials are steady as ever with a very strong interest coverage ratio of 20.9x, an improvement from the quarter prior at 18.1x. They also managed to pay down some of their debt, reducing their aggregate leverage from 38.5% to 37.8%.

They achieved this by issuing 6-year JPY3.3 billion (S$40.1m) 0.51% senior unsecured fixed-rate notes. The proceeds were used to repurchase existing notes that were issued at 0.58%. All in all, they did raise their average cost of debt by 0.02% but it still stood very low at 0.55%.

4. Potential Acquisition Soon?

It is good to note that with Parkway Life REIT’s current gearing of 37.8%, they have a debt headroom of S$269.7m before reaching 45% gearing and $502m before reaching 50% gearing. Not to mention the fact that they can also do an EFR (Equity Fundraising), the sky really is the limit for Parkway Life REIT.

In June 2020 during their AGM, the management asked unitholders to approve a general mandate. The general mandate allows the REIT to issue up to 20% of the units outstanding in a given year. Based on a pro-rata situation involving an equity fundraising or rights issue, the REIT could potentially issue up to 50% of its units outstanding in a calendar year.

I wrote a piece a while back talking about Parkway Life REIT and I shared 2 potential markets that the REIT could enter as it eyes for a 3rd key market to add into their portfolio. These 2 markets are Taiwan and South Korea. Check out the article to find out why I mentioned these 2 markets.

Read Also: Is Parkway Life REIT A Good Buy Now?

Final Thoughts

After looking at Parkway Life REIT Q1 2021 results, we can see that the REIT is well-positioned and very stable at the moment. There have been talks of a potential acquisition by the REIT, entering into a new developed market since last year and we can clearly see that it will be coming soon based on the management’s actions.

Investors that are currently invested should be ready for a potential EFR and to take full advantage of it because Parkway Life REIT is one of a kind, similar to Keppel DC REIT. Being the strongest healthcare REIT in Singapore and providing consistent and ever growing value to shareholders, an EFR is the best thing an investor could hope for.