With the recent release of Palantir Q1 2021 Earnings, investors didn’t seem very pleased with the results as we continue to see its share price tumble back down to near $17 a share. What could have possibly gone so wrong with the earnings release that could have upset investors so much that the share price has since come down almost 60% from an all-time high of $45. Without further delay, let’s jump right into the 4 important takeaways from Palantir Q1 2021 Earnings.

1. Phenomenal Earnings Growth

Palantir (NYSE: PLTR) started Q1 2021 strong with phenomenal earnings growth of 49%, surpassing their prior guidance of 45%. They also mentioned that based on Q1’s revenue from solely US customers, they already have an annualized revenue run rate of $800 million. Moving onto the next segment, I’ll be diving deeper into their individual revenue segments.

2. Huge Growth in Commercial and Government Revenue

Starting on the commercial side of Palantir Q1 2021’s revenue, they saw a 76% growth year over year in their duration-adjusted commercial deal value. The overall commercial revenue came up to $133 million, a 19% growth from the year prior. Despite the slower growth rate, they have managed to add 11 new commercial customers and increased their overall revenue per customer by 29% to $8.1 million and the average revenue per top 20 customers by 34% to $36.1 million.

Not forgetting the fact that commercial opportunities in the US and UK have increased by 2.5x since February 2021, Palantir is definitely off to a strong start and intends to keep it running at this pace for the rest of the year.

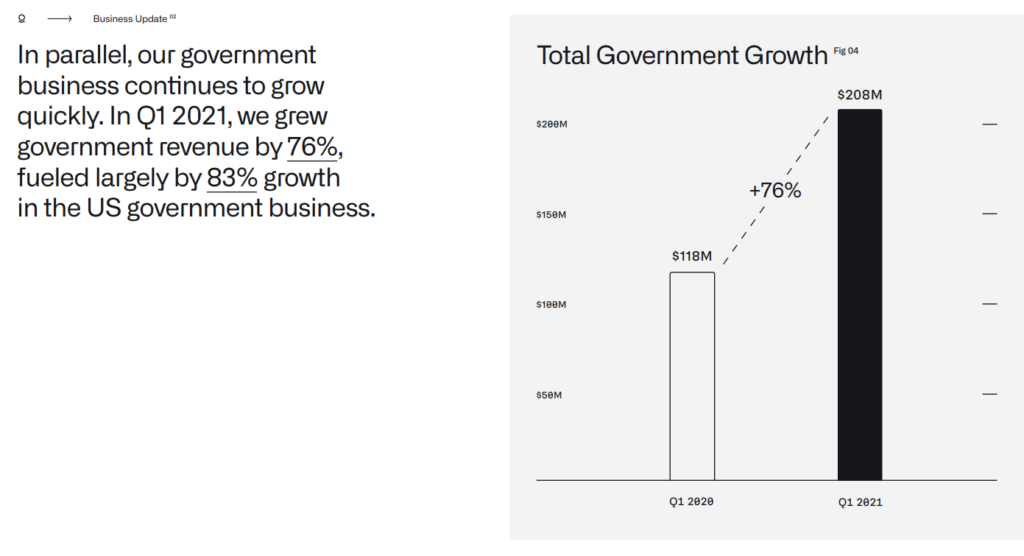

Moving onto the government side of Palantir Q1 2021’s revenue, they saw a 76% growth year on year in government revenue to $208 million. Not only that, the total US government revenue grew by an astounding 83% year over year.

Palantir ended off Q1 2021 on a strong note with $2.8 billion in total remaining deal value, marking a 40% growth year over year. They also have 15 deals worth $5 million or more, 6 of which are worth $10 million or more. They also have an average contract duration of 3.7 years and an average contract duration of commercial customers of 4.6 years.

The duration is just perfect because you wouldn’t want it to be too short as this runs the risk of companies switching providers easily as they don’t need to lock in with Palantir for a long period of time. You also wouldn’t want the contract to be too long as this takes away opportunities from Palantir to grow the contract size through increased product and service offerings that can enhance the customer’s overall experience.

3. Achieving Positive Free Cash Flow

Moving onto Free Cash Flow, an important metric that all Software as a Service (SaaS) companies look at because it tells you whether or not the business itself is profitable. Palantir has made it clear to investors that they are easily profitable now with a Positive Free Cash Flow of $151 million in Q1 2021, a $441 million growth year over year, marking a strong adjusted free cash flow margin of 44%.

4. Future Forecasts

Towards the end of the presentation, Palantir shared their future forecasts for the company and the numbers look pretty promising. They are expecting a 43% revenue growth in Q2 2021, reaching $360 million in terms of revenue with an adjusted operating margin of 23%. Not to mention the fact that they are raising the adjusted free cash flow guidance from breakeven to in excess of $150 million. This goes to show how confident Palantir is in their overall business, which many analysts and investors had doubted since their IPO, whether or not they can reach profitability.

5 Year Valuation

Palantir also mentioned that they are expecting a long-term revenue growth of over 30% for this year and the next 4 years. Thanks to their outlook on this, I’ve decided to try and valuate Palantir based on a “Conservative”, “Neutral” and “Bullish” stance. It is good to note that I’ve added in a 3% share dilution yearly as it was mentioned in the Webcast QnA portion that there will be minimal dilution moving forward for Palantir. The PS ratio that I used for each year is also standardized across the 3 stances, with it starting at a high of 60x and then slowly decreasing to 25x in FY2029 onwards.

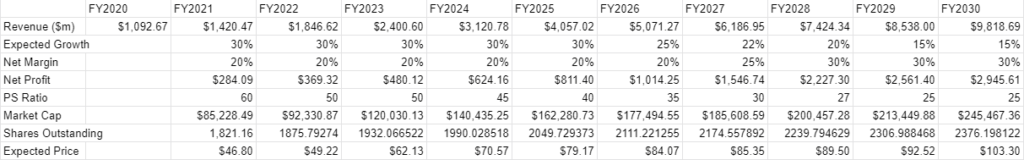

Conservative

Starting off with the conservative valuation, it assumes that Palantir only meets the minimum of their forecasts of 30% revenue growth for the first 5 years, and then sees a slow down in growth as well for the next 5 years, hitting a base of 15% from FY2029 onwards. As we can see, it also assumes that Palantir only manages to achieve a 20% net profit margin for the next 6 years and is only able to raise it to 25% in FY2027 and then hitting a plateau at 30% in FY2028 onwards. Based on these assumptions, Palantir is valued at a conservative $103.30 in FY2030.

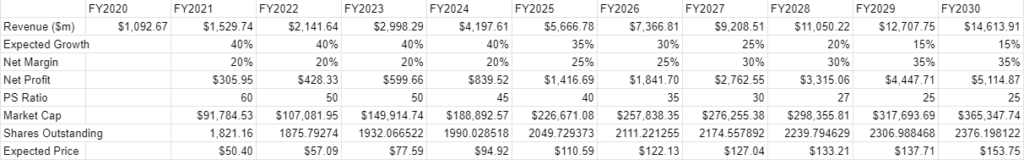

Neutral

Next up, we have the neutral stance, which assumes that Palantir is able to achieve an above expectation revenue growth of 40% for the first 5 years, and then start to see a more gradual slow down in growth for the next 5 years, hitting a base of 15% from FY2029 onwards. As we can see, it also assumes that Palantir only manages to achieve a 20% net profit margin for the next 4 years and is able to raise it slowly to 25% in FY2025 and then to 30% in FY2027 and finally hitting a plateau at 35% in FY2029 onwards. Based on these assumptions, Palantir is valued at a conservative $153.75 in FY2030.

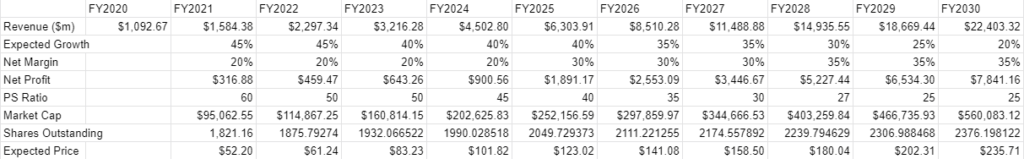

Bullish

Last but not least, we have the bullish stance, which assumes that Palantir is able to achieve a strong 45% revenue growth in the first 2 years, and then falls to 40% for the next 3 years. Palantir will then start to see a revenue growth slowdown to 35% in FY2026, dropping to 30% in FY2028, and then hitting a base of 25% in FY2029 onwards. As we can see, it also assumes that Palantir manages to achieve a 20% net profit margin for the next 4 years and is able to raise it slowly to 30% in FY2025 before plateauing at 35% in FY2028 onwards. Based on these assumptions, Palantir is valued at a very optimistic price of $235.71 in FY2030.

Potential Growth Catalysts

Palantir Starting Courses

In the Webcast QnA session on earnings day, Palantir’s management received this question, “Experience with Palantir software appears more often now on job postings. Would you consider creating courses/tutorials on how to use your software? Access to a course would give an incentive to the employees to request the software for their companies. Could you comment on that?”.

In response to this question, Palantir’s COO stated that the company is definitely growing every single day and aims to do more for the community. They plan to do so by making Foundry training available free to individual shareholders, U.S. military personnel as well as anyone that is unemployed to help reopen the economy.

Palantir Buys Bitcoin

In the Webcast QnA session on earnings day, Palantir’s management received this question, “Could you ever see Palantir having Bitcoin or any other type of cryptocurrency on its balance sheet?”.

In response to this question, Palantir’s COO stated that the company has been thinking about holding cryptocurrency in its balance sheet. With the huge $2.3 billion cash position and the company now creating positive free cash flow, it could bring increased value to shareholders as well as unlock interesting opportunities for the company.

Final Thoughts

Overall, Palantir Q1 2021 earnings release has definitely shed some light for doubtful investors and analysts that have been questioning the company’s ability to attain profitability. In such a short period of time, the company has turned free cash flow positive and has continued to see strong growth in revenue. Not only that, they have also expanded their Total Addressable Market (TAM) from just governments to now, commercial customers as well.

I have always been a strong believer in Palantir ever since its IPO, when everyone was throwing doubt at the company. I understood the products to a good extent and saw the key demand that it supplies before most investors did. Palantir is definitely on the road to achieving its long-term goal of being the “most important software company in the world”. I believe that FY2021 will be a huge turning point for the company as they continue to expand out their customer base be it, government customers or commercial customers.