Capitaland Mall Trust is a very well-known REIT amongst Singapore REIT investors. They own a large portion of retail malls in Singapore such as Bukit Panjang Plaza, Bugis, Clarke Quay, etc. The retail sector has been hit hard all around the world and Singapore was not spared. Let’s take a quick look at the 3 key takeaways from the 2Q results of Capitaland Mall Trust.

1. Drop in Gross Revenue and NPI

| Year on Year Difference | 2nd Quarter | 1st Half |

|---|---|---|

| Gross Revenue | S$114.1 million (-39.8%) | S$318.4 million (-16.7%) |

| Net Property Income (NPI) | S$68.1 million (-48.9%) | S$216.4 million (-20.8%) |

Capitaland Mall Trust, as expected, had a huge drop in Gross Revenue and NPI. The market should have priced in the poor 2Q results by now and should not be surprised at it. If you look at the 1H comparison to the year prior, the fall is not as drastic, slightly under 17% for Gross Revenue and slightly under 21% for NPI.

2. Drop in DPU

| Year on Year Difference | 2nd Quarter | 1st Half |

|---|---|---|

| Distributable Income | S$78.1 million (-27.5%) | S$109.7 million (-48.7%) |

| Distribution Per Unit (DPU) | 2.11 cents (-27.7%) | 2.96 cents (-49.0%) |

Similarly, a drop in DPU is inevitable when the Gross Revenue and NPI was expected to drop. It is good to note that Capitaland Mall Trust did retain a big portion of their Distributable Income in the first half of the year to help them tide over this challenging period.

If the retained portion was distributed back to shareholders, the DPU for 1H 2020 would be 4.35 cents. That is still a 25% drop from the year prior.

3. Healthy Financials

| As at 30 June 2020 | As at 31 March 2020 | |

|---|---|---|

| Aggregate Leverage | 34.4% | 33.3% |

| Interest Coverage | 4.3x | 4.6x |

| Average Cost of Debt | 3.1% | 3.2% |

Thankfully, every cloud has a silver lining because Capitaland Mall Trust’s financials look very healthy. With a slight increase in aggregate leverage from the quarter prior, it still stands at a conservative 34.4%, well below the maximum of 50%. The interest coverage ratio at 4.3x is way above MAS’s set minimum of 2.5x if CMT chooses to leverage up to 50%. Other than that, they have managed to drop their average cost of debt by 0.1%.

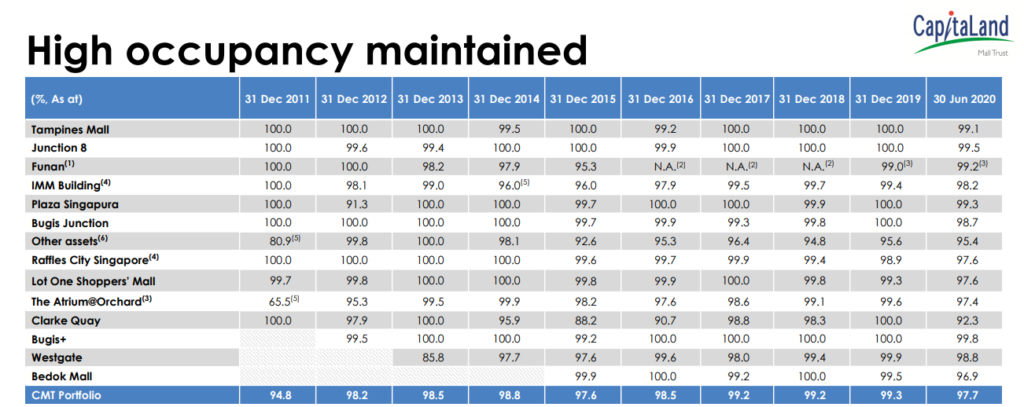

4. High Occupancy Maintained

It’s good to know that Capitaland Mall Trust has managed to maintain a high occupancy rate of 97.7%. Being able to maintain such a high occupancy can help them stabilize their cash flow from tenants.

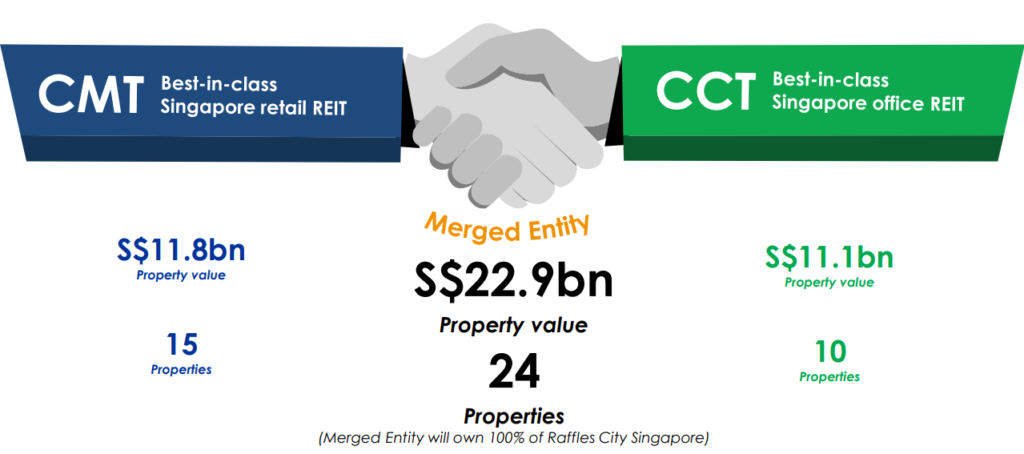

Merger With Capitaland Commercial Trust

I’m sure many people know by now that Capitaland Mall Trust and Capitaland Commercial Trust has proposed a merger. The merger was expected to take place in June 2020 but due to the COVID-19 situation, it has been pushed back till further notice. This merger does not come as a shock and has a very high likelihood of happening after everything has stabilized. This is because Capitaland Mall Trust has reached a plateau in its growth potential.

Due to the business model of CMT, which is to own a portfolio of Singapore retail malls, they do not have the ability to grow any further because there are no more malls left for acquisitions. They cannot start acquiring overseas malls such as the ones in China because Capitaland already has a REIT to pipeline these assets to, Capitaland Retail China Trust .As such, CMT has no other option but to merge with CCT. This way, they can start acquiring commercial assets as well, further enhancing their growth potential.

Buy CMT or CCT?

I personally only bought CMT because of 2 key reasons.

1. No need to deal with odd lots

To avoid odd lots, you will need to buy 2500 shares of CCT. This is too large an amount to allocate into this one REIT. I do not have that much capital on hand to deploy into CCT so I decided to buy a small amount of CMT.

2. CMT’s valuation is much more attractive

CMT, at the time of my purchase, was way more attractive than CCT. I bought CMT at $1.58/share, implying a forward yield of 5.78% and a PB of 0.786 while CCT was trading at a fairer valuation.

Final Thoughts

Overall, the 2Q results of Capitaland Mall Trust was in line with my expectations. They made the smart move of retaining capital instead of distributing it out to satisfy investors. I feel that a company should always put its own interest first before shareholders because, if the company burns all its cash flow and cash reserves just to distribute dividends to shareholders, it is unsustainable. This will hurt the company further and will hinder its ability to grow and survive this tough time.

As I’ve always mentioned, I’m a long term investor. Not collecting dividends for a year does not matter much to me if the company is fundamentally sound and making all the right decisions for their own long term growth. I urge all CMT shareholders not to panic sell but to hold tight because CMT will rebound fast when COVID-19 passes and it will go back to previous highs.