Keppel DC REIT (SGX: AJBU) is Singapore’s first and only pure data centre REIT as well as the most overpriced REIT, with a PB of 2.35x @ $2.75/share. Its share price is already up more than 32%, making it the best performing REIT year to date. Let’s take a quick look at the 3 key takeaways from the 1H results of Keppel DC REIT.

1. Huge Growth in Gross Revenue and NPI

Keppel DC REIT has managed to grow its Gross Revenue and NPI by a huge amount, 29.8% and 32.1% respectively. This is an insane growth from the year prior. This growth is achieved through the acquisitions done in 4Q 2019 (Keppel DC Singapore 4 and DC1) as well as in 1H 2020 (Kelsterbach Data Centre). These acquisitions will also further enhance their 2H 2020 results, growing the REIT’s performance for the year.

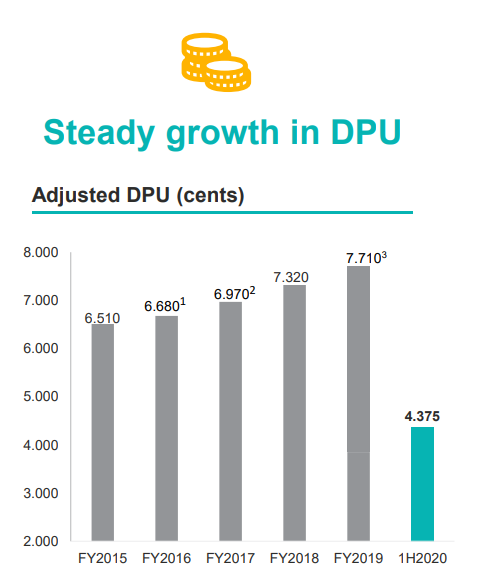

2. Phenomenal Growth in DPU

Keppel DC REIT has managed to increased their DPU year on year by a remarkable 13.6%. For a dividend growth investor like myself, KDC is a must have in my portfolio because it’s very hard to find companies that can consistently increase their dividends year on year for a long period of time.

They have consistently increased their DPU year on year since IPO and I’m confident that they have the capabilities to continue to do so even in tough times like right now.

3. Resilient Portfolio and Healthy Financials

Keppel DC REIT has maintained a high portfolio occupancy of 96.1% as well as a long portfolio WALE of 7.4 years. KDC has also maintained a very low aggregate leverage of 34.5% as well as a very high interest coverage ratio of 12.8x.

KDC’s current financial health allows them to take advantage of any potential acquisitions that may appear in the coming months without diluting shareholders through an effective fundraising (EFR).

Final Thoughts

Overall, the 1H results of Keppel DC REIT is outstanding. This REIT is a very unique REIT as it’s the only pure DC REIT in Singapore. The only REIT that can be compared to KDC is Mapletree Industrial Trust which has 39% of its portfolio in data centre properties.

Should We Buy Keppel DC REIT Now?

Let’s take a look at the valuation of Keppel DC REIT.

PB Ratio : 2.35x

PE Ratio : 27.2x

Dividend Yield : 3.18% (Assuming KDC pays the same amount of distribution in 2H 2020)

Note = Currently at its all time high price

Yes to the common investor, these valuations are insanely overpriced and only a fool would buy at its current price. Well, I’m one of the fools who bought KDC a few weeks back, as well as some of my members. I’m happy to say that us fools are sitting at a nice 13.6% profit not including the upcoming dividends which is another 1.81%.

My take is that KDC is a premium REIT. Similar to when eating steak, you can’t buy premium steak at the same price as you would with a normal steak. You have to pay a premium to buy premium quality assets. Similarly to KDC, as I’ve explained to the members of my subscription group, I don’t mind paying a premium to buy KDC because I’m investing in the company and its assets, not the share price and some valuation numbers. I’ll leave you with one wise quote, “Cheap can become….Cheaper. High can go….HIGHER”.