As Chinese Tech Stocks continue to struggle due to harsh regulations set by the Chinese Government, investors are very concerned if they should continue to hold, cut their losses or buy more as the share prices continue to dip. As a long-term investor myself, I believe that as long as the long-term fundamentals are still intact for the company, we should continue to stay invested and accumulate on dips when there is volatility or uncertainty in the market. In this article, I’ll be sharing 2 Chinese tech stocks to buy if you want to stay invested during China’s big bear market.

Note: This is a sponsored post and it’s based on my own opinions

1. Tencent Holdings Ltd. (TCEHY)

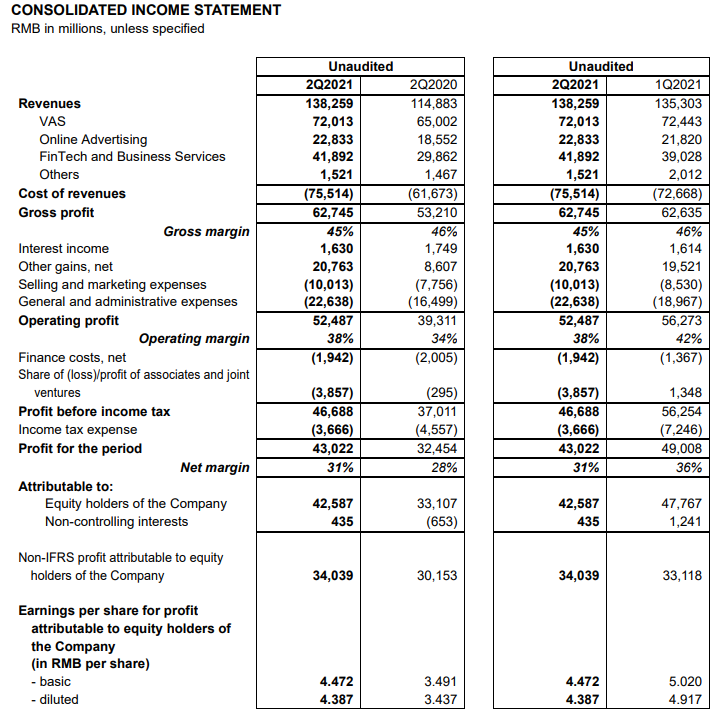

First on the list would be Tencent and this shouldn’t come as a surprise since it is one of the most well-known names when one mentions “Chinese Tech Stocks”. Just releasing its Q2 FY2021 results on 18th August, Tencent Holdings continued its strong growth with a 20% y-o-y growth in total revenues to RMB138.3 billion (~USD21.4 billion).

On top of that, their operating profits grew by 14% y-o-y to RMB42.8 billion (~USD6.6 billion) and their overall profit for the period grew by 13% y-o-y to RMB35.1 billion (~USD5.4 billion). Despite its already huge size with a market cap of USD558 billion, it is remarkable that Tencent Holdings is still able to grow at 20% y-o-y for Q2 FY2021.

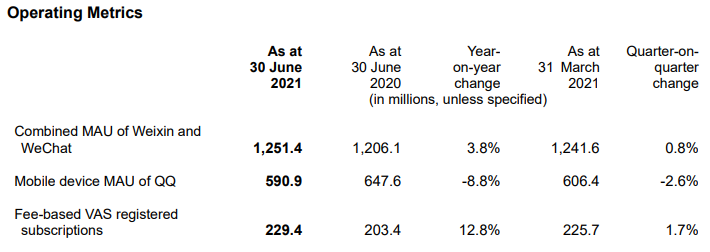

The overall business outlook for Tencent Holdings looks great moving forward with continued growth in MAU for Weixin+WeChat as well as Fee-Based VAS registered subscriptions. There is a slight drop in Mobile Device MAU of QQ when comparing the Q2 FY2021 to Q2 FY2020 by 8.8% as well as when compared to Q1 FY2021 by 2.6%. Despite the small drop in Mobile Device MAU, the overall numbers are still strong and show that despite its already huge size, there is still room to grow for Tencent Holdings.

As we can see from Tencent Holdings’ long-term share price movement from 2018 to 2021, it is actually priced near where it was in 2018. Taking into account the fact that Tencent Holdings has grown significantly in terms of its business fundamentals, we can tell that the market is grossly mispricing the company at the moment due to all the negative news surrounding Chinese tech stocks.

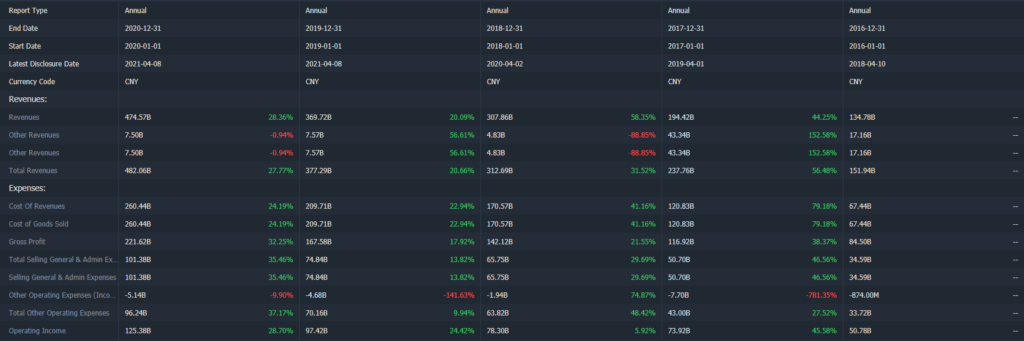

The 5-year performance for Tencent Holdings shows a very strong upward trend with its top and bottom line growing phenomenally at a CAGR of 25.98% and 23.65% respectively.

2. JD.com (JD)

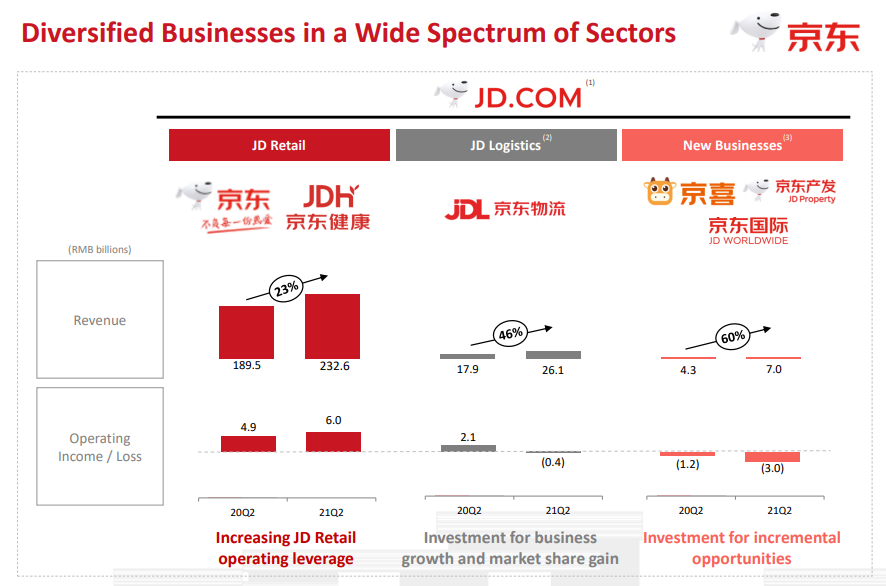

Second on the list is JD.com, another huge China technology player, dominating the e-Commerce space in China with one of the two massive B2C online retailers in China by transaction volume and revenue. JD.com has also just released its Q2 FY2021 results not too long ago, displaying outstanding growth numbers with its net revenues growing by 26% y-o-y to RMB253.8 billion (~USD39.2 billion). When we break down its net revenues segment, it can be categorized into 2 sections, Product revenues, and Services Revenue, which both can be broken down into its subsections as well.

As we can see, the net product revenues grew by 23% y-o-y while its net services revenues grew by 49% y-o-y. When diving deeper into the numbers under net product revenues, the general merchandise revenues grew by 29% y-o-y and the electronics and home appliance revenues grew by 20% y-o-y. As for the net services revenues, the marketplace and advertising services grew by 35% y-o-y while the logistics and other services grew by 72% y-o-y.

Additionally, JD.com is very diversified with its revenue streams coming from various subsidiaries in different industries. Apart from its main business with JD Retail, they also have a logistics arm, JD Logistics as well as other businesses such as JD property and JD Worldwide. On top of that, to tackle against its competitors such as Pinduoduo and Alibaba’s Juhuasuan, JD has released Jingxi to adopt a “dual-brand” strategy and target 2 separate customer groups in the market. While JD.com mainly focuses on providing high-quality, branded goods for consumers in Tier 1-2 cities, Jingxi is a social e-Commerce marketplace targeted at price-sensitive customers in smaller Tier 3-6 cities and rural areas.

As we can see from JD.com’s long term share price movement, despite it having gone up so much already, I remain very bullish on JD.com’s growth potential for the next 5 years out as there is still plenty of room to grow not just in China but on a global level as well as they continue to expand and grow their various business segments. With a market cap of USD118 billion, JD.com could see a possible 2-3x growth over the next 5 years if they continue the rate of growth they have now.

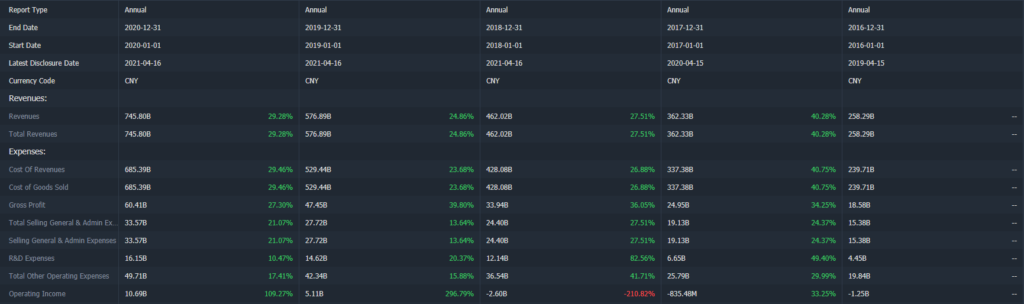

The 5-year performance for JD.com shows a very strong upward trend with its top-line growing phenomenally at a CAGR of 23.62%. On top of that, JD.com incurred a net loss of RMB3.81 billion in 2016 but has since grown and improved significantly to a net profit of RMB49.41 billion in 2020.

Final Thoughts

Closing off the article, the 2 Chinese Tech Stocks mentioned above have tremendous potential to grow over the long term and are currently grossly mispriced by the market due to negative sentiments concerning the China government and the new regulations that are being issued out. Long-term investors who still maintain a bullish stance on the overall market should keep on accumulating as the stock continues to dip.