Tesla (NASDAQ: TSLA) fell over 10% after its Q2 FY2024 earnings were released, showing a mixed bag of results, reflecting both achievements and challenges faced over the past 3 months. Could this falling knife be a good opportunity to invest or should investors be cautious and think twice before putting their money in? In this article, we’ll delve into Tesla’s Q2 FY2024 earnings and find out what caused investors and analysts to be so upset with Tesla. This analysis delves into the key financial metrics, explores growth catalysts, and provides insights into what investors should consider.

Financial Performance

Revenue

Tesla’s automotive revenue fell by 7% year-over-year (YoY) to US$19.878B. This decline was mainly attributed to lower average selling prices (ASPs) for the (S3XY) lineup and a reduction in overall deliveries. The total production numbers dropped by 14% YoY to 410,831, with delivery numbers slipping by 5% YoY to 443,956. Additionally, Tesla faced a $0.3 billion foreign exchange (FX) impact, further affecting automotive revenue.

On a positive note, energy generation and storage revenue grew by approximately 100% YoY to US$3.014B. This substantial increase helped offset the losses in automotive revenue. The surge in this segment highlights Tesla’s successful diversification strategy and growing presence in the renewable energy market. Services and other revenues grew by 21% YoY to US$2.608B, contributing to the overall revenue improvement. These segments include after-sales services, merchandise, and other business operations, showcasing Tesla’s ability to generate income beyond vehicle sales.

Overall revenue improved by 2% YoY to US$25.5B, with gross profits increasing by 1% to US$4.578B. Despite the slight uptick in performance, the total GAAP profit margin fell slightly by 0.23% to 18%, indicating a marginal decline in profitability.

Operating Expenses and Income

Operating expenses saw a significant 39% YoY increase to US$2.973B, which led to a 33% YoY drop in operating income. The operating margin fell by 3.3% to 6.3%, reflecting the impact of higher expenses on the company’s operational efficiency. The rise in operating expenses is partly attributed to a US$622 million restructuring cost, likely due to layoffs and severance packages.

Overall Profitability

Adjusted EBITDA fell by 21% YoY to US$3.674B, with net income decreasing by 45% YoY to US$1.478B on a GAAP basis and 42% YoY to US$1.812B on a non-GAAP basis. These declines indicate a challenging quarter for Tesla in terms of profitability, despite growth in certain revenue segments. Even if we were to factor out the one-off restructuring cost of US$622m, the overall net income would still be down by approximately 28.7% YoY on a GAAP basis and 22.7% YoY on a non-GAAP basis. On a brighter note, the free cash flow (FCF) improved by 34% YoY to US$1.342B. This improvement positively impacts Tesla’s cash holdings, providing the company with more flexibility for future investments and operational stability.

Growth Catalysts

With such a disappointing quarter for Tesla, are there any growth catalysts that investors can look forward to? Well, let’s delve into some of the key ones I’ve identified.

Product Line Updates

Tesla introduced new Model 3 and Model Y trims and additional paint options for the S3XY lineup in Q2. These updates aim to refresh the product line and attract more customers, potentially boosting future sales. New trims and colors can rejuvenate consumer interest, especially in a competitive market where aesthetics and model differentiation can significantly influence buying decisions. This update will unlikely cause a huge uptick in revenue but it will definitely help improve it.

Full Self-Driving (FSD) Improvements

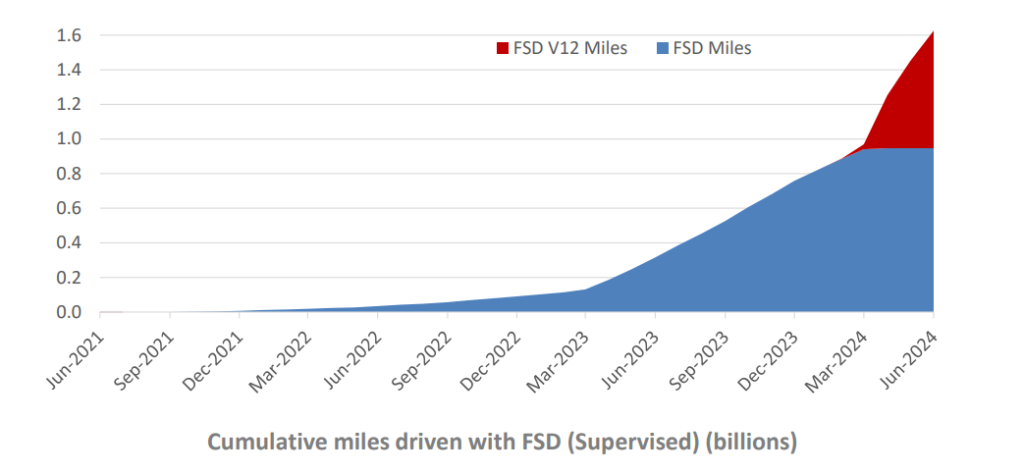

Tesla’s Full Self-Driving (FSD) system saw notable improvements, particularly in the Supervised version, which relies on eye-tracking software to monitor driver attentiveness. In Q2, Tesla focused on reducing interventions with FSD (Supervised), while improving driving comfort. They also increased the robustness of the model by adding substantially more parameters. Enhancements in FSD technology could lead to higher adoption rates and increased revenue from software sales. As Tesla refines its FSD technology, the potential for a fully autonomous driving experience becomes more tangible, which could revolutionize the automotive industry and create substantial new revenue streams.

New Vehicle Models

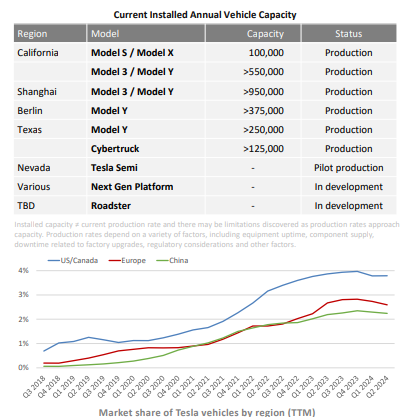

Tesla plans to introduce new, more affordable vehicle models, with production expected to start in the first half of 2025. These new models will utilize aspects of both the next-generation and current platforms, allowing for production on existing manufacturing lines. On top of this, Cybertruck production has more than tripled sequentially and remains on track to achieve profitability by the end of the year.

The introduction of affordable models could significantly expand Tesla’s market reach, which currently stands at a little under 4% in the US/Canada, ~2.5% in Europe, and a little over 2% in China, which is the most competitive region as there are many local brands such as BYD and NIO fighting aggressively for market share. If these models succeed in capturing a broader customer base, they could drive substantial revenue growth and enhance Tesla’s competitive positioning.

Robotaxi Unveiling

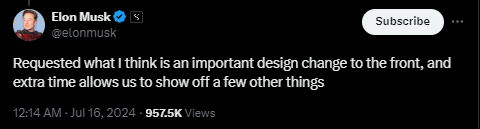

Tesla has scheduled a Robotaxi unveiling event for October 10, 2024, originally set for August 8 but postponed it in July. The reason for this sudden change was that Tesla’s CEO, Elon Musk, wrote on X that he had requested an “important design change to the front” of the vehicles, adding that it would give his team time to “show off a few other things.”

Although there has not been any confirmation of the changes mentioned, this event could generate significant interest and potentially lead to new revenue streams in autonomous transportation. The Robotaxi market holds immense potential, with autonomous ride-hailing services expected to disrupt traditional taxi and ride-sharing markets. Successful entry into this market could provide Tesla with a first-mover advantage and open up lucrative business opportunities.

Final Thoughts

Tesla’s Q2 FY2024 earnings reflect a mix of achievements and challenges. While the decline in automotive revenue and increased operating expenses have impacted profitability, the growth in energy generation and storage revenue, services, and free cash flow provide positive indicators for the future. The introduction of new vehicle models, improvements in FSD technology, and upcoming Robotaxi unveiling highlight Tesla’s ongoing innovation and potential for growth.

However, investors should remain cautious, considering the volatility in profitability and external factors such as FX impacts. Overall, Tesla’s strategic initiatives and diversification efforts position it well for long-term success, despite the short-term challenges faced in this quarter. Any short-term weakness in share price should be a good time to invest for long-term Tesla bulls.