Introduction :

UMS Holdings specializes in manufacturing high precision front-end semiconductor components and perform complex electromechanical assembly and final testing services. Included in their core business is the production of modular and integration systems for original semiconductor equipment manufacturers. Aside from semiconductor industry, they also cater to other industries including in electronic, machine tools, aerospace and oil & gas industries.

Financials :

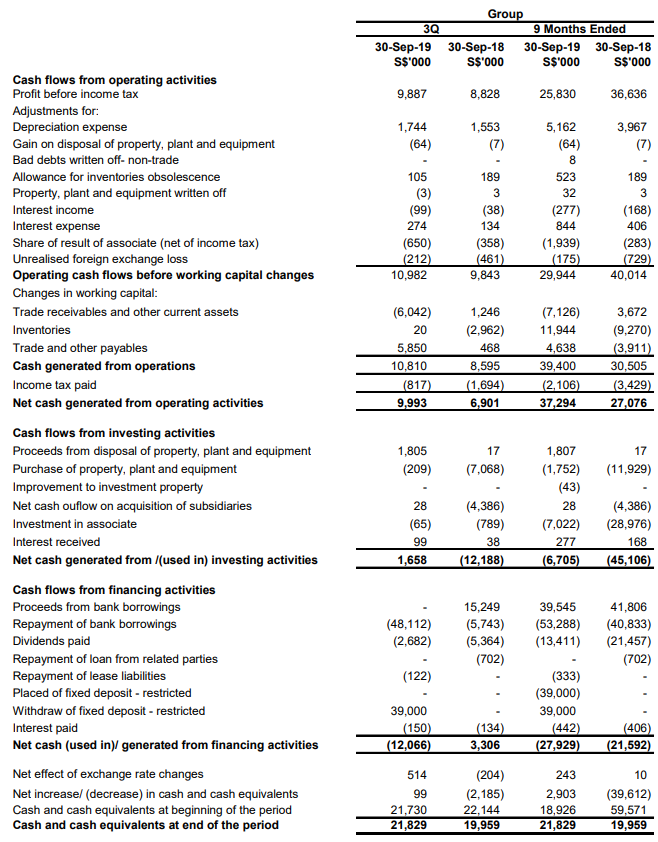

From the images below, revenue and overall profit increased for 3Q19 but decreased for the 9M19. Sharp increases in areas such as, finance expenses, depreciation expenses caused the results to be as such but I feel that these things can be reduced and should not be a worrying matter for investors. Overall revenue and profit for the period still went up which is the most important factor. There is also an increase in FCF, 37.7% y-o-y for the 9M19 and 44.8% for the 3Q19.

Ratios :

Current Ratio : 3.356

Quick Ratio : 1.431

Yield : ~3.55% ( Assuming same payout of $0.035 @ 0.985/share )

Dividend Payout : ~ 55.38% (From stockscafe)

NAV/Share : $0.4465/share

Personal Thoughts and Positions :

What I like about UMS Holdings is the healthy FCF. It is one of the first things I look for in a stock when I first look through the company’s financial statements. Current and Quick ratios both being above 1 is also important. I personally will soon take a position in this stock. I already missed the first short spike for this stock and I hope I don’t miss the second one!! Looking to enter around $0.97 – $1.

You can take a look at my portfolio updates to see my current positions !