The upcoming Snowflake IPO is the most anticipated tech IPO of the year. Investors should decide in advance how much are they willing to pay as Snowflake will definitely test the upper limits of what it means to have a stretched valuation. The company has definitely attracted a ton of attention after Berkshire Hathaway announced that it will take part in the IPO as well. Today, I attempt to breakdown Snowflake as a company to help you better understand all that you need to know before investing in them.

Who is Snowflake?

Snowflake was founded in 2012 by 3 recognized experts on data management technologies, Benoit Dageville, Thierry Cruanes and Marcin Zukowski with the goal of “breaking data silos” at organizations. They identified some of the key limitations that we have with the existing technologies that we use and created a cloud-based data warehouse platform that was easy to use, fast and flexible.

The company is run by Frank Slootman as CEO and Chairman and Michael Scarpelli as CFO. It is worth noting that the dynamic duo held these roles at ServiceNow, taking it from a $90-million-revenue private business to a successful IPO, generating almost $1.5 billion in revenue and having a market cap of over $12 billion.

Besides ServiceNow, Kevin Slootman accompanied by Michael Scarpelli led a small company called Data Domain to both a successful IPO and an eventual acquisition by EMC. This dynamic duo has a serious track record of successful IPOs in the technology sector, so we can only expect good things from this one.

Other relevant executive members include Benoit Dageville as President of Products and co-founder, Thierry Cruanes as CTO and co-founder, and Christopher W. Degnan in the important role of Chief Revenue Officer.

Key Investors Involved

The company is mostly owned by Sutter Hill Ventures (20.3%), ICONIQ Strategic Partners (14.8%) and Redpoint Ventures (13.8%). The main executives hold almost 15% of the company (pre-IPO), with the CEO having 5.9% for himself, hence the management interests seem to be in line with those of the shareholders.

Some of the other key investors include Salesforce Ventures, Dragoneer Investment Group and the most recent, Berkshire Hathaway. This definitely captured the attention of retail investors as Snowflake isn’t the type of company Berkshire Hathaway usually invests in.

Business Model

For those who are not proficient or don’t know much about the cloud industry, Snowflake essentially offers a cloud platform for various use cases such as data storage, data analysis, application hosting and many others. Snowflake itself does not own any databases or physical servers but rather, they leverage on AWS/Azure/GCP to run their platform.

Instead of licensing use rights, Snowflake actually uses a utilization model that is based on consumption whereby you essentially buy credits and you consume those.

You might be wondering, “Since Snowflake uses AWS/Azure/GCP to run their platform, why don’t I just bypass Snowflake and run it with these providers instead?”. To answer this question, I’ll be comparing Snowflake to each of these cloud providers with the appropriate services that they have.

Snowflake vs. BigQuery (GCP)

In this comparison, we’ll be comparing Snowflake to GCP’s BigQuery, which is a data warehouse service. Prior research and more in-depth information can be found here : Stichdata.com.

Architecture

Snowflake’s architecture keeps compute, storage, and cloud services separate to optimize their independent performances while with BigQuery, a serverless data warehouse, you don’t have to think about the architecture as the platform manages all resources and automates scalability and availability, so you don’t have to make any decisions about necessary CPU or storage levels.

Verdict : Tie

Performance

Thanks to their ability to auto-scale, both Snowflake and BigQuery perform well under various load levels. If you run benchmarks using your own data, you’ll likely find that both platforms can handle most companies’ workloads with excellent performance.

Verdict : Tie

Pricing

Snowflake uses a time-based pricing model for compute resources, in which users are charged based on a per-second basis for execution time, but not charged for the amount of data scanned during computation. Snowflake offers five pricing plans with additional features tied to each ascending level of price, so you can select the plan that best fits your business needs. The pricing plans are determined based on volume and type of data, geographical region, and cloud platform.

As for BigQuery, they only have 2 pricing options, an on-demand model and a flat rate option. The on-demand model uses a query-based pricing model for compute resources. Users are charged for the amount of data their queries scan at a rate of $5/TB of data processed. As for the flat rate option, it lets customers purchase dedicated resources for query processing rather than pay for individual queries. The annual flat rate plan starts at $1,700/month with 100 commitment slots.

It is also good to note that GCP charges for data storage at a rate lower than that of Snowflake: $20/TB vs $23/TB per month.

If a customer stores an average of 4TB’s worth of data and runs a loading task every night for 2 hours, on Snowflake, that would cost $214 while on BigQuery, that would cost $84.57

Verdict : BigQuery Wins

Data protection

Snowflake has two key facilities for data protection: Time Travel and Fail-safe. Snowflake charges storage fees for the historical data maintained for both Time Travel and Fail-safe though they don’t specify the rates they charge.

With Time Travel, when data is modified, Snowflake preserves the state of the data before the update. Time Travel’s standard retention period is 1 day, but the Enterprise plan allows customers to specify a period of up to 90 days. You can apply Time Travel to databases, schemas as well as tables.

As for Fail-safe, it provides a 7 day period after the Time Travel retention period ends during which Snowflake can recover historical data. You must ask Snowflake to do the recovery; the feature is intended to be a way for Snowflake to recover data that may have been lost or damaged due to extreme operational failures.

BigQuery maintains a complete 7 day history of changes against its tables. Administrators can revert changes without having to request a recovery from backups.

Verdict : BigQuery Wins

Conclusion

Overall, Snowflake is almost on par with BigQuery in terms architecture, performance and security but BigQuery still wins as they have a more affordable pricing plan and do not charge for Data Protection. In a consumer’s pov, BigQuery might be the better option to go for but as an investor, you might want to invest in Snowflake because they are charging more for their services as compared to BigQuery, giving them more possible revenue streams.

Snowflake vs. Redshift (AWS)

In this comparison, we’ll be comparing Snowflake to AWS’s Redshift, which is also another data warehouse service. Prior research and more in-depth information can be found here : Stichdata.com

Performance

Both Snowflake and Redshift leverage columnar storage and massively parallel processing (MPP) for simultaneous computation, enabling advanced analytics and saving significant time on sizable jobs.

Snowflake attributes its performance to a unique architecture that supports structured and semi-structured data. It keeps compute, storage, and cloud services separate to optimize their independent performance. Concurrency scaling has always been a feature of Snowflake’s platform, but Redshift has recently introduced their own concurrency scaling feature, along with machine learning, to compete with Snowflake’s throughput capabilities.

Verdict : Tie

Pricing

Both Snowflake and Redshift offer on-demand pricing but the pricing plans have different features associated to each. Snowflake separates compute usage from storage in their pricing structure, while Redshift bundles the two together. Redshift offers users a dedicated daily amount of concurrency scaling, charging by the second once usage exceeds it.

Redshift boasts the potential for deep discounts over the long term if you commit to a 1 or 3 year contract, and offers the option to pay an hourly rate (by type and nodes in each cluster) or by the quantity of bytes scanned (a feature called Spectrum). Snowflake offers five pricing plans with additional features tied to each ascending level of price, so you can select the plan that best fits your business needs. The pricing plans are determined based on volume and type of data, geographical region, and cloud platform.

Using the previous example, If a customer stores an average of 4TB’s worth of data and runs a loading task every night for 2 hours, on Snowflake, that would cost $214 while on Redshift, that would cost $280.80.

Verdict : Snowflake Wins

Security

While Redshift addresses security and compliance in a comprehensive fashion, Snowflake takes a nuanced approach.

Redshift’s end-to-end encryption can be tailored to fit your security requirements. Additionally, you can isolate your network within a virtual private cloud (VPC) and link it to your existing IT infrastructure via VPN. Integration with AWS CloudTrail provides auditing to help you meet compliance requirements.

Snowflake boasts always-on encryption, along with VPC/VPN network isolating options, but a key differentiation from Redshift is that Snowflake’s scope of security and compliance options grows more robust depending on which edition of the product you opt for.

Verdict : Tie

Conclusion

Overall, Snowflake and Redshift is almost on par in terms of performance and security but Snowflake takes the win thanks to its cheaper pricing plan. From a business’s perspective, I would go for Snowflake as its pricing model gives me the flexibility to scale up in the future. From a normal user’s perspective, I would go for Snowflake as well for its low cost and high performance in comparison with AWS’s Redshift.

Snowflake vs. Synapse (Azure)

In this comparison, we’ll be comparing Snowflake to Microsoft Azure’s Synapse, a limitless analytics service that does data warehousing and Big Data analytics.

Flexibility

The key difference between Snowflake and Synapse is that Synapse is built for Microsoft Azure services so if your company is already using Azure services, it would be better to use Synapse. The advantage of using Snowflake is that you can run it on either AWS/Azure/GCP, allowing you to have cross-cloud flexibility. Some companies might opt for Snowflake because they have applications and services running across different cloud providers.

Conclusion

There isn’t much to compare as I don’t have enough information to compare the performances of both services. For companies that run a full Microsoft stack, it might be easier to just work with Synapse as it is easier to integrate. For companies that have multiple cloud providers, it will be better to use Snowflake as you are not locked in with any one cloud provider.

Customer Base

Snowflake has been aggressively acquiring customers to accelerate its growth. As of July 31, 2020, Snowflake has 3,117 customers, increasing from 1,547 customers a year ago. Customers included seven of the Fortune 10 and 146 of the Fortune 500, based on the 2020 Fortune 500 list, and those customers contributed approximately 4% and 26% of their revenue for the six months ended July 31, 2020, respectively.

As their customers experience the benefits of their platform, they typically expand their usage significantly, as evidenced by the net revenue retention rate, which was 158% as of July 31, 2020. The number of customers that contributed more than $1 million in trailing 12-month product revenue increased from 22 to 56 as of July 31, 2019 and 2020, respectively.

Financials

Income Statement

| Year on Year Difference | Six Months Ended July 31, 2020 | Six Months Ended July 31, 2019 |

|---|---|---|

| Revenue | $241.96 million (+132.56%) | $104.044 million |

| Gross Profit | $148.957 million (+189.25%) | $51.498 million |

| Sales and Marketing Expense | $190.54 million (+38.61%) | $137.465 million |

| Research and Development Expense | $69.811 million (+46.10%) | $47.782 million |

| Operating Loss | $174.086 million (-4.79%) | $182.844 million |

| Net Loss | $171.278 million (-3.36%) | $177.224 million |

For the 6 months ended July 31, Snowflake had a remarkable 132.56% increase in Revenue and 189.25% increase in gross profit. The company also incurred a net loss of $171 million, $6 million lower than the year before. The net loss was actually incurred because of the company aggressively growing its business, thus the increase in operating expenses such as Sales and Marketing as well as Research and Development.

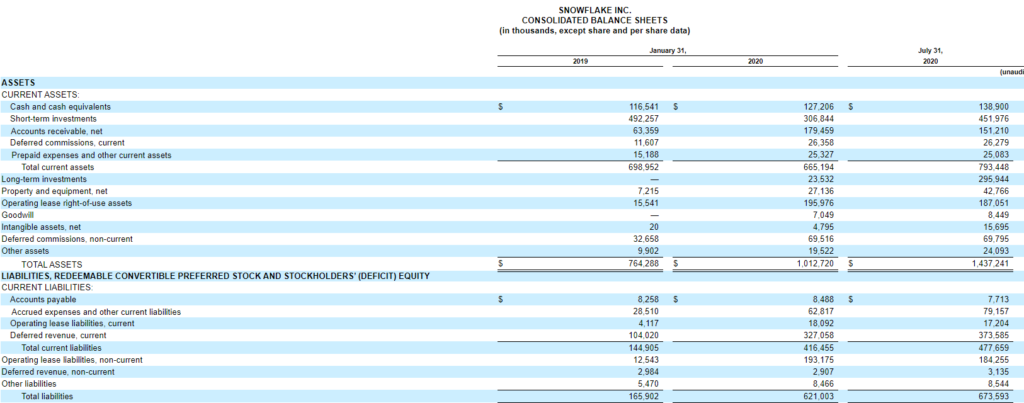

Balance Sheet

As of July 31, 2020, the company has $886.82 million in cash, cash equivalents and short-term and long-term investments. It is also good to note that the company has a deferred revenue current liability which increased from $104.02 million in 2019 to $373.585 million in 2020. Other than that, the company does not have much debt and has sufficient cash to tide over any near term expenses.

Financial Ratios

| As of July 31 2020 | |

|---|---|

| P/S Ratio | 56.7x |

| Current Ratio | 1.66x |

| Rule of 40 | 61% |

| Net Revenue Retention (NRR) | 158% |

As we can see, based on a market cap or enterprise value of $22.8 billion, Snowflake’s Price/Sales ratio stands at a higher multiple of 56.7x as compared to its SaaS peers such as Datadog at 48.96x, Atlassian at 25.07x and Salesforce at 11.26x.

We can also see that when using the rule of 40, Snowflake not only beats the requirement but also outperforms it by a significant amount at 61%. Its Net Revenue Retention (NRR) also stands strong at 158%.

IPO Details and Proceeds

The full IPO prospectus can be found here.

The Snowflake IPO intends to sell 28 million shares of Class A common stock at a midpoint price of $80.00 per share for gross proceeds of approximately $2.24 billion, not including the sale of customary underwriter options. This means that the company will be trading at a market cap of around $22.8 billion. A concurrent private placement is expected to sell an additional $500 million to Salesforce and Berkshire Hathaway.

The principal purposes of this offering are to increase the company’s capitalization and financial flexibility and create a public market for their Class A common stock. Based on the prospectus, there was no specified uses for the net proceeds of the IPO. However, they currently intend to use the net proceeds for general corporate purposes, including working capital, operating expenses, and capital expenditures.

They may also use a portion of the net proceeds to acquire complementary businesses, products, services, or technologies. They may also invest the net proceeds that are not used as described above in investment-grade, interest-bearing instruments. Based on my prediction, I believe the $2.7 billion total proceed from the Snowflake IPO will go towards growing the company via acquisitions so as to increase their market share.

Final Thoughts

Other than the points I’ve shared above, I really like Snowflake for 1 key reason. Flexibility. As a business, you can use Snowflake as an in-between layer for all your applications and data storage as compared to having multiple services running on AWS/Azure/GCP. With Snowflake, you can have everything centralized into 1 platform which helps you save time and cost. It is far better to hire 1 engineer to maintain the Snowflake environment than to hire 2-3 engineers to maintain the different services you have across the different cloud providers.

With Snowflake, you can also have cross-cloud compatibility so you won’t be locked in with any one cloud provider. This is Snowflake’s biggest MOAT and is the main reason why I’m investing in the Snowflake IPO. Snowflake isn’t just another data warehouse as a service but rather, it is a cross-cloud platform that offers much more than just storing data. Snowflake allows enterprise users especially, to leverage on their platform and use it as a bargaining tool so that they can arbitrage between the several cloud providers and this can help them save millions.

I am planning on investing into the Snowflake IPO on the first day it lists on the market and will continue to monitor its performance, accumulating on every dip if possible. Snowflake, in my eyes, is a potential 100 bagger in the making.

Best View i have ever seen !